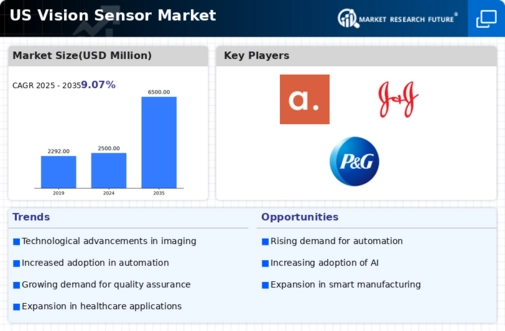

The competitive landscape of the US Vision Sensor Market is characterized by rapid technological advancements and a growing demand for automation across various industries, including manufacturing, healthcare, and transportation. Companies in this sector are emphasizing innovation and efficiency, striving to deliver high-quality vision sensor solutions that cater to specific application requirements. The increasing integration of artificial intelligence and machine learning with vision sensors is shaping the market dynamics, propelling competition as firms develop sophisticated imaging technologies. Stakeholders are keenly observing trends such as enhanced resolution, improved processing speeds, and expanded functionalities, as these factors significantly influence market positioning.

The competitive insights point to a vibrant ecosystem where collaborations and strategic alliances are becoming paramount for companies aiming to enhance product offerings and expand into new markets.

Acquisition has made notable strides within the US Vision Sensor Market by strategically positioning itself through a series of significant mergers and partnerships. This company has focused on augmenting its portfolio by integrating advanced vision sensor technologies that enhance its operational capabilities. The strength of Acquisition lies in its ability to bring together complementary technologies and expertise, which not only fortifies its market presence but also provides it with a competitive edge. The firm’s acquisition-driven strategy has facilitated a rapid expansion of its product line, allowing it to address diverse customer needs effectively.

By leveraging the strengths and synergies from acquired entities, Acquisition is poised to deliver innovative solutions that enhance performance and reliability in vision sensing applications across various sectors.

National Instruments has established itself as a prominent player in the US Vision Sensor Market, known for its commitment to providing high-quality measurement and automation solutions. The company’s key product offerings include sophisticated vision systems that integrate seamlessly with its extensive software platform, enabling users to develop complex imaging applications with ease. National Instruments is recognized for its robust market presence and reputation for reliability and high-performance standards. The company's strengths lie in its innovative approach to developing versatile vision sensor technologies and its ability to adapt to changing customer demands in the US market.

Additionally, National Instruments has pursued strategic mergers and collaborations to enhance its capabilities and broaden its technological footprint, ensuring that it remains at the forefront of the vision sensor sector. Its proactive approach to integrating cutting-edge technology positions it well to meet the evolving challenges and opportunities within the US Vision Sensor Market.