Rising Geriatric Population

The demographic shift towards an aging population in the US is a critical driver for the wound closure-devices market. Older adults are more susceptible to chronic wounds, such as pressure ulcers and diabetic foot ulcers, due to age-related factors like reduced skin elasticity and comorbidities. According to the US Census Bureau, the population aged 65 and older is projected to reach 95 million by 2060, which will likely increase the demand for effective wound management solutions. This demographic trend necessitates the development of advanced wound closure devices that can address the unique challenges faced by elderly patients. As healthcare systems adapt to cater to this growing population, the wound closure-devices market is expected to expand, driven by the need for innovative and effective solutions tailored to the geriatric demographic.

Advancements in Biomaterials

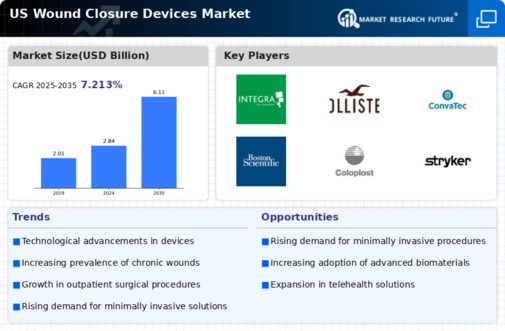

Innovations in biomaterials are significantly influencing the wound closure-devices market. The development of advanced materials, such as hydrogels, bioactive dressings, and smart wound closure devices, enhances healing processes and improves patient outcomes. These materials are designed to provide optimal moisture levels, promote cell growth, and reduce infection risks. The US market for advanced wound care products, which includes these innovative biomaterials, is projected to grow at a CAGR of around 6% through 2027. As healthcare providers increasingly recognize the benefits of these advanced materials, the demand for wound closure devices that incorporate them is likely to rise. This trend indicates a shift towards more effective and patient-friendly wound management solutions, thereby propelling the growth of the wound closure-devices market.

Increased Focus on Infection Control

The heightened awareness of infection control in healthcare settings is a significant driver for the wound closure-devices market. With the rise of antibiotic-resistant infections, healthcare providers are prioritizing strategies to minimize infection risks associated with wound care. This focus has led to the development of advanced wound closure devices that incorporate antimicrobial properties and enhanced barrier functions. The US wound care market is projected to reach approximately $20 billion by 2025, reflecting the growing emphasis on infection prevention. As hospitals and clinics implement stricter infection control protocols, the demand for innovative wound closure solutions that align with these standards is expected to increase. Consequently, the wound closure-devices market is likely to benefit from this trend, as healthcare providers seek effective solutions to enhance patient safety.

Growing Awareness of Wound Care Management

The increasing awareness of proper wound care management among healthcare professionals and patients is driving the wound closure-devices market. Educational initiatives and training programs are being implemented to improve knowledge about effective wound care practices. This heightened awareness is leading to better patient outcomes and a reduction in complications associated with improper wound management. As a result, healthcare providers are more inclined to invest in advanced wound closure devices that ensure optimal healing. The US market for wound care products is anticipated to grow significantly, with a focus on educating both providers and patients about the importance of effective wound management. This trend suggests that the wound closure-devices market will continue to expand as awareness and education around wound care practices improve.

Increasing Demand for Minimally Invasive Procedures

The wound closure-devices market experiences a notable surge in demand due to the growing preference for minimally invasive surgical techniques. These procedures are associated with reduced recovery times, lower infection rates, and less postoperative pain. As healthcare providers increasingly adopt these methods, the market for wound closure devices is projected to expand significantly. In the US, the minimally invasive surgery market is expected to reach approximately $50 billion by 2026, indicating a robust growth trajectory. This trend is likely to drive innovation in wound closure technologies, as manufacturers strive to develop devices that cater to the specific needs of minimally invasive procedures. Consequently, the wound closure-devices market is poised to benefit from this shift towards less invasive surgical options, enhancing patient outcomes and satisfaction.