Vehicle Analytics Market Summary

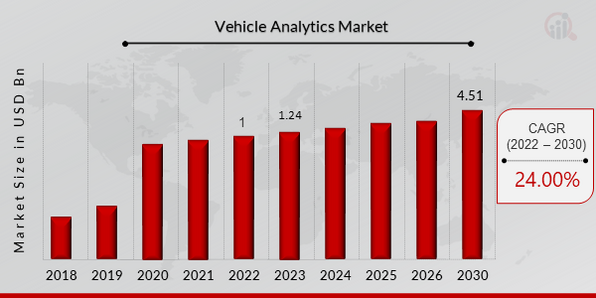

As per Market Research Future Analysis, the Global Vehicle Analytics Market was valued at USD 1 billion in 2022 and is projected to reach USD 4.51 billion by 2030, growing at a CAGR of 24.00% from 2023 to 2030. The market is driven by the integration of vehicle telematics data with analytics, predictive maintenance applications, and the increasing digitalization in the automotive sector. The demand for predictive maintenance is particularly significant, as it enhances vehicle reliability and safety by addressing potential faults before they occur. The North American region is expected to dominate the market due to the high acceptance of connected cars, while the Asia-Pacific region is anticipated to exhibit the fastest growth rate during the forecast period.

Key Market Trends & Highlights

Key trends driving the Vehicle Analytics Market include advancements in predictive maintenance and the rise of connected vehicles.

- Vehicle Analytics Market Size in 2022: USD 1 billion; projected to reach USD 4.51 billion by 2030.

- CAGR during 2023-2030: 24.00%; driven by predictive maintenance and digitalization.

- Predictive maintenance segment expected to dominate, improving vehicle reliability and performance.

- North America to hold the largest market share, with Asia-Pacific growing at the fastest rate.

Market Size & Forecast

2022 Market Size: USD 1 billion

2023 Market Size: USD 1.24 billion

2030 Market Size: USD 4.51 billion

CAGR (2023-2030): 24.00%

Largest Regional Market: North America.

Major Players

Key players include SAP SE, Genetec, Microsoft Corporation, IBM Corporation, CloudMade, Intelligent Mechatronic Systems, Harman International Industries Inc., Teletrac Navman, Inseego, Agnik LLC, and Automotive Rentals (ARI).

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Vehicle Analytics Market Trends

Predictive Maintenance is boosting the market growth

As automakers are constantly assessing the performance of the vehicle part in real-time through sensors, it unlocks the opportunity for a predictive maintenance approach. Data can be pulled out from most vehicles of a given year and model, and that information can be compared with warranty repair trends using predictive Maintenance. These trending issues are carefully observed and addressed, limiting the fallout from large-scale recalls, minimizing unnecessary wrench time, and potentially saving lives. Moreover, vehicle breakdowns are one of the significant causes of road accidents.

These breakdowns often occur due to human negligence in the timely service and Maintenance of vehicles. Predictive analytics solutions inform the owner about the potential maintenance requirement before a study can occur. Data collected from the various sensors fitted in a car assists in carrying out predictive maintenance tasks. Cognitive predictive Maintenance makes holistic, real-time, and deep insights possible. Also, every aspect of a manufacturer's processes can be connected through IoT, leading to smart and efficient decision-making.

According to Appinventiv, the global 5G Internet of Things (IoT) endpoint Market CAGR is forecast to grow significantly in the connected car segment, from 0.4 million in 2020 to 19.1 million units in the current year. The 5G IoT installed base is forecast to grow to around 49 million this year.

Additionally, Digitization is pivotal in the automotive industry as it delivers detailed information about speed, distance, emissions, resource usage, driving behavior, and fuel consumption. This, coupled with the rising sales of vehicles worldwide, represents one of the key factors stimulating the Market's growth. The increasing congestion on city streets and sidewalks has resulted in numerous safety challenges, such as distracted pedestrians and rising bicyclists. Besides this, the vehicle analytics market revenue is also compelled by the increasing utilization of these solutions to keep naval, aircraft, and ground vehicles online and avoid costly last-minute repairs.

Vehicle Analytics Market Segment Insights:

Vehicle Analytics Component Insights

Based on Components, the Vehicle Analytics Market segmentation includes software services, professional services, deployment & integration, support & maintenance, and consulting services. The software services segment dominated the market because automobile manufacturers and transportation service providers increasingly use vehicle analytics software platforms to improve their product and service offerings. The vehicle analytics software platforms segment is expected to account for more than 74 percent of the Market by 2030.

Genetec (Canada)

Genetec announced the launch of its new vehicle analytics platform, which integrates AI-driven insights to enhance traffic management and safety. This platform aims to provide real-time data on vehicle movements and behaviors.

Microsoft Corporation (U.S.)

Microsoft introduced enhancements to its Azure IoT platform, specifically tailored for vehicle analytics. The new features include advanced predictive maintenance tools that leverage machine learning to forecast vehicle issues before they occur.

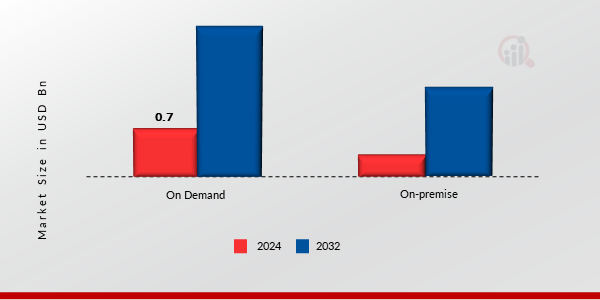

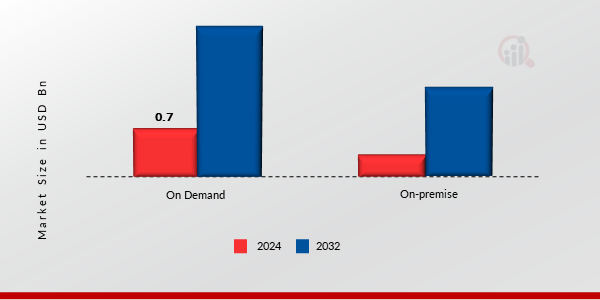

Vehicle Analytics Deployment Insights

The Vehicle Analytics Market segmentation is based on deployment includes on-demand, on Premise. The on-demand category dominated the Market. On-demand services are less expensive than on–premises as they require a data center to store the data. Moreover, the cloud provides access to data from anywhere, unlike on-premises. Rapid growth in the adoption of cloud deployment is expected to propel the on-demand segment growth.

IBM Corporation (U.S.)

IBM unveiled a partnership with several automotive manufacturers to implement its Watson AI for automotive analytics. This collaboration aims to improve vehicle performance monitoring and customer experience through data-driven insights.

Figure 1: Vehicle Analytics Market, by Deployment, 2024 & 2030 (USD billion)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Vehicle Analytics Application Insights

Based on the application, the Vehicle Analytics Market data includes predictive maintenance, traffic management, warranty analytics, infotainment, usage-based insurance, road charging, dealer performance analysis, safety & security management, and driver & user behavior analysis. The predictive maintenance segment dominated the market. Predictive maintenance uses advanced analytics to identify and address possible vehicle faults and breakdowns before they occur. It also optimizes end-to-end servicing operations resulting in an overall improvement in vehicle reliability and performance.

The safety and security management segment is used in today's vehicles are reliably delivers consistent performance over time without any system failures. Increased traffic accidents and worries about distracted driving are presenting possibilities for the growing use of car analytics in driver behavior analysis. By the end of 2030, the driver behavior analysis application segment is expected to occupy one-fourth of the global Market in revenue. The driver and user behavior analysis segment of IoT-connected vehicle insights provides microservices that users can use to gain valuable insights into driving behavior and vehicle usage patterns.

The driver behavior component retrieves driver-related data from connected car devices recorded by the vehicle data hub (VDH).

Vehicle Analytics End User Insights

Based on end users, the global vehicle analytics industry includes travel & hospitality, service providers, automotive dealers, fleet owners, insurers, etc. Travel & hospitality has emerged as the leading segment efficiency, making them more relevant to current demand. The insurer is fastest – growing segment with a CAGR of 29.0% during the forecast period. The growing adoption of usage–based insurance UBI in developed countries is expected to fuel the segment growth. Moreover, increasing penetration of connected vehicles in underdeveloped and developing countries is expected to provide insurers with revenue and expansion opportunities.

The service providers segment is also expected to hold the second–largest market share. An increasing number of service providers and expanding service portfolios drive segment growth.

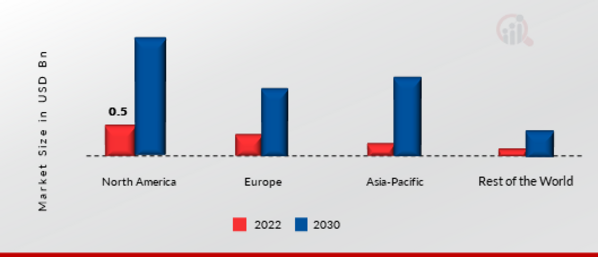

Vehicle Analytics Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American vehicle analytics market area will dominate this Market due to the strong acceptance rate of connected cars, and e-mobility is propelling the market growth will boost the market growth in this Region.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Vehicle Analytics Market Share by Region 2022 (%)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Europe's vehicle analytics market accounts for the second-largest market share due to the rapidly increased innovative business models that can be generated by combining vehicle telematics data and analytic insights into customer and business data. Further, the German vehicle analytics market held the largest market share, and the UK vehicle analytics market was the fastest-growing Market in the European Region.

The Asia-Pacific vehicle analytics market is expected to grow at the fastest CAGR from 2023 to 2030. This is due to the development in the aviation and defense industry. Moreover, China’s vehicle analytics market held the largest market share, and the Indian vehicle analytics market was the fastest-growing in Asia-Pacific.

Vehicle Analytics Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the vehicle analytics market, grow even more. Market participants are also undertaking various strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. The vehicle analytics industry must offer cost-effective items to expand and survive in a more competitive and rising market climate.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the global vehicle analytics industry to benefit clients and increase the market sector. In recent years, the vehicle analytics industry has offered defense some of the most significant advantages.

Major players in the vehicle analytics market, including SAP SE (Germany), Genetec (Canada), Microsoft Corporation (U.S.), IBM Corporation (U.S.), CloudMade (Ukraine), Intelligent Mechatronic Systems (Canada), Harman International Industries Inc. (U.S.), Teletrac Navman (U.S.), Inseego (U.S.), Agnik LLC (U.S.), Inquiry (U.S.), Automotive Rentals (ARI) (U.S.) and others are attempting to increase market demand by investing in research and development operations.

The International Business Machines Corporation, nicknamed Big Blue, is an American multinational technology corporation headquartered in Armonk, New York, and is present in over 175 countries. IBM services include Cloud, Mobile, Cognitive, Security, Research, Watson, Analytics, Consulting, Commerce, Experience Design, Internet of Things, Technology support, Industry solutions, Systems services, Resiliency services, Financing, and IT infrastructure. IBM announced the software's new version, 4.0. IoT connected vehicle insights private is connected vehicle software that aims to improve the in-car experience by extending cognitive computing capabilities to connected automobiles.

Modern vehicles are mobile data centers with onboard sensors and computers that can collect and retrieve vehicle data in near-real time. IoT-connected vehicle insights private allow the company to access, manage, and analyze large amounts of data from connected vehicles.

Bayerische Motoren Werke AG, abbreviated as BMW, is a German multinational manufacturer of luxury vehicles and motorcycles headquartered in Munich, Bavaria. The corporation was founded in 1916 as a manufacturer of aircraft engines, which it produced from 1917 until 1918 and from 1933 to 1945. In 2022, the BMW Group sold nearly 2.4 million passenger vehicles and more than 202,000 motorcycles worldwide. The profit before tax in the financial year 2022 was € 23.5 billion on revenues amounting to € 142.6 billion.

As of 31 December 2022, the BMW Group had 149,475 employees. BMW partnered with Amazon Web Services (AWS) to develop software to collect and analyze data generated by connected vehicles. The data collection would expedite the development of features to enhance software life cycle management.

Key Companies in the vehicle analytics market include

- SAP SE (Germany)

- Genetec (Canada)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- CloudMade (Ukraine)

- Intelligent Mechatronic Systems (Canada)

- Harman International Industries Inc. (U.S.)

- Teletrac Navman (U.S.)

- Inseego (U.S.)

- Agnik LLC (U.S.)

- Inquiron (U.S.)

- Automotive Rentals (ARI) (U.S.)

Vehicle Analytics Market Developments

-

Q2 2024: Renault launches vehicle analytics platform for commercial fleets Renault announced the launch of a new vehicle analytics platform designed for commercial fleet operators, offering real-time data insights on vehicle health, driver behavior, and predictive maintenance to optimize fleet efficiency.

-

Q2 2024: Otonomo merges with Wejo to create leading vehicle data analytics company Otonomo and Wejo, two major players in connected vehicle data analytics, completed a merger to form a combined entity focused on delivering advanced analytics solutions to automakers and mobility service providers.

-

Q3 2024: Bosch acquires startup DeepMotion to enhance vehicle analytics capabilities Bosch announced the acquisition of DeepMotion, a U.S.-based AI analytics startup, to strengthen its vehicle analytics offerings, particularly in predictive maintenance and driver safety applications.

-

Q3 2024: Continental and Microsoft partner to deliver cloud-based vehicle analytics Continental AG entered a strategic partnership with Microsoft to co-develop a cloud-based vehicle analytics platform, enabling automakers to access real-time data for fleet management and advanced driver assistance systems.

-

Q4 2024: Geotab secures major contract with UK government for fleet analytics Geotab won a multi-year contract to provide vehicle analytics and telematics solutions for the UK government's public sector fleet, supporting efficiency and sustainability initiatives.

-

Q4 2024: General Motors launches OnStar Vehicle Insights Pro for enterprise fleets General Motors expanded its OnStar Vehicle Insights platform with a new 'Pro' version, offering enhanced analytics, AI-driven maintenance alerts, and integration with third-party fleet management tools.

-

Q1 2025: Nauto raises $50 million to expand AI-powered vehicle analytics platform Nauto, a provider of AI-based vehicle analytics for commercial fleets, announced a $50 million funding round to accelerate product development and expand into new international markets.

-

Q1 2025: Toyota launches new data analytics center in Singapore Toyota opened a dedicated vehicle data analytics center in Singapore to support its Asia-Pacific operations, focusing on connected vehicle services and predictive analytics for mobility solutions.

-

Q2 2025: SAP launches next-generation vehicle analytics suite for OEMs SAP introduced a new suite of vehicle analytics tools aimed at automotive OEMs, featuring real-time data integration, predictive maintenance, and advanced driver behavior analysis.

-

Q2 2025: Valeo and AWS announce partnership for scalable vehicle analytics Valeo partnered with Amazon Web Services to develop scalable vehicle analytics solutions, leveraging AWS cloud infrastructure to deliver real-time insights for automakers and fleet operators.

-

Q2 2025: Geotab opens new European analytics hub in Berlin Geotab inaugurated a new analytics hub in Berlin to enhance its vehicle data processing capabilities and support the growing demand for fleet analytics across Europe.

-

Q3 2025: HERE Technologies acquires CarData to boost vehicle analytics portfolio HERE Technologies completed the acquisition of CarData, a telematics and analytics company, to expand its vehicle analytics offerings for OEMs and mobility service providers.

Vehicle Analytics Market Segmentation:

Vehicle Analytics By Component Outlook

- Software Services

- Professional Services

- Deployment & Integration

- Support & Maintenance

- Consulting Services

Vehicle Analytics By Deployment Outlook

Vehicle Analytics By Application Outlook

- Predictive Maintenance

- Traffic Management

- Warranty Analytics

- Infotainment

- Usage Based Insurance

- Road Charging

- Dealer Performance Analysis

- Safety & Security Management

- Driver & User Behavior Analysis

- UAV based

Vehicle Analytics By End User Outlook

- Travel & Hospitality

- Service Providers

- Automotive Dealers

- Fleet Owners

- Insurers

- Others

- Commercial

Vehicle Analytics Regional Outlook

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

| Attribute/Metric |

Details |

| Market Size 2022 |

USD 1 billion |

| Market Size 2023 |

USD 1.24 billion |

| Market Size 2030 |

USD 4.51 billion |

| Compound Annual Growth Rate (CAGR) |

24.00% (2023-2030) |

| Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Historical Data |

2019- 2021 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

By Component, By Deployment, By Application, By End User, and Region |

| Geographies Covered |

North America, Europe, AsiaPacific, and the Rest of the World |

| Countries Covered |

The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

SAP SE (Germany),Genetec (Canada), Microsoft Corporation (U.S.), IBM Corporation (U.S.),CloudMade (Ukraine), Intelligent Mechatronic Systems (Canada), Harman International Industries Inc. (U.S.),Teletrac Navman (U.S.),Inseego (U.S.),Agnik LLC (U.S.),Inquiry (U.S.), Automotive Rentals (ARI) (U.S.) |

| Key Market Opportunities |

Increasing implementation of advanced technologies |

| Key Market Dynamics |

Predictive Maintenance Warranty Analytics Digitalization |

Vehicle Analytics Market Highlights:

Frequently Asked Questions (FAQ):

The global vehicle analytics market size was valued at USD 1 Billion in 2022.

The global market is projected to grow at a CAGR of 24.00% during the forecast period, 2023-2030.

North America had the largest share of the global market

The key players in the Market are SAP SE (Germany), Genetec (Canada), Microsoft Corporation (U.S.), IBM Corporation (U.S.), CloudMade (Ukraine), Intelligent Mechatronic Systems (Canada), Harman International Industries Inc. (U.S.), Teletrac Navman (U.S.), Inseego (U.S.), Agnik LLC (U.S.), Inquiry (U.S.), Automotive Rentals (ARI) (U.S.).

The software services vehicle analytics category dominated the market in 2022.

The on-demand base had the largest share of the global market.