Integration of Advanced Technologies

The Vehicle Camera Market is experiencing a notable shift due to the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the functionality of vehicle cameras, enabling features like real-time object detection and lane departure warnings. As a result, the demand for high-resolution cameras is increasing, with the market projected to reach USD 10 billion by 2026. This growth is driven by the need for improved safety and efficiency in transportation. Furthermore, the incorporation of 360-degree cameras and night vision capabilities is becoming more prevalent, suggesting a trend towards comprehensive surveillance systems in vehicles. This technological evolution not only enhances driver awareness but also contributes to the overall safety of road users, thereby propelling the Vehicle Camera Market forward.

Regulatory Influence on Safety Standards

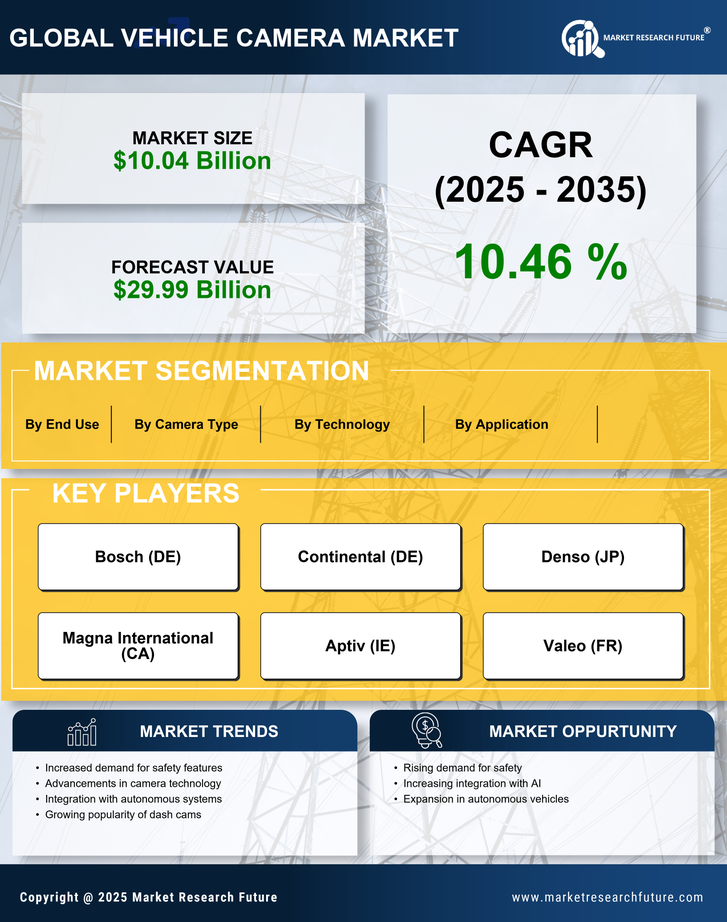

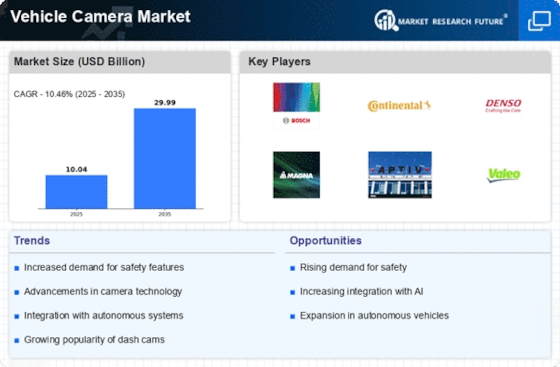

The Vehicle Camera Market is significantly influenced by stringent regulatory frameworks aimed at enhancing road safety. Governments across various regions are implementing regulations that mandate the installation of advanced driver-assistance systems (ADAS), which often include vehicle cameras. For instance, the European Union has proposed regulations requiring all new vehicles to be equipped with rear-view cameras by 2022. Such regulations are expected to drive the market, as manufacturers strive to comply with these safety standards. The increasing emphasis on reducing road accidents and fatalities is likely to further bolster the demand for vehicle cameras. As a result, the Vehicle Camera Market is poised for growth, with an anticipated compound annual growth rate (CAGR) of 10% over the next five years, reflecting the critical role of regulatory influence in shaping market dynamics.

Rise of Autonomous and Electric Vehicles

The Vehicle Camera Market is witnessing a surge in demand due to the rise of autonomous and electric vehicles. As automakers invest heavily in developing self-driving technology, the need for sophisticated camera systems becomes paramount. These vehicles rely on an array of cameras to navigate and interpret their surroundings, making them integral to the functionality of autonomous systems. The market for vehicle cameras is projected to grow at a CAGR of 12% through 2027, driven by this trend. Additionally, electric vehicles often incorporate advanced camera systems for features such as parking assistance and collision avoidance. This convergence of electric and autonomous technologies is likely to create new opportunities within the Vehicle Camera Market, as manufacturers seek to innovate and enhance the capabilities of their camera systems.

Consumer Demand for Enhanced Safety Features

The Vehicle Camera Market is propelled by increasing consumer demand for enhanced safety features in vehicles. As awareness of road safety rises, consumers are actively seeking vehicles equipped with advanced safety technologies, including vehicle cameras. This trend is reflected in market data, which indicates that approximately 70% of consumers prioritize safety features when purchasing a vehicle. Consequently, automakers are responding by integrating more camera systems into their designs, thereby expanding the Vehicle Camera Market. The growing popularity of features such as blind-spot monitoring and rear cross-traffic alerts underscores this demand. Furthermore, as consumers become more educated about the benefits of vehicle cameras, the market is expected to experience sustained growth, with projections indicating a potential market size of USD 8 billion by 2025.

Technological Advancements in Camera Systems

The Vehicle Camera Market is significantly driven by technological advancements in camera systems. Innovations such as high-definition imaging, improved sensor technology, and enhanced connectivity options are transforming the capabilities of vehicle cameras. These advancements enable features like adaptive cruise control and automatic emergency braking, which are increasingly sought after by consumers. The market is expected to grow substantially, with estimates suggesting a value of USD 9 billion by 2026. Moreover, the development of compact and lightweight camera systems is facilitating their integration into a wider range of vehicles, including smaller models. This trend indicates a shift towards more versatile applications of vehicle cameras, thereby expanding the potential customer base within the Vehicle Camera Market. As technology continues to evolve, the demand for advanced camera systems is likely to remain robust.