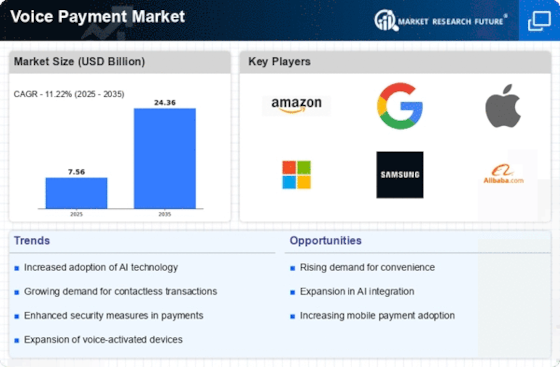

Expansion of E-commerce Platforms

The rapid expansion of e-commerce platforms is driving the Voice Payment Market significantly. As online shopping becomes more prevalent, consumers are increasingly seeking efficient payment methods that streamline their purchasing experience. Voice payments offer a hands-free solution that aligns with the growing trend of convenience in e-commerce. Recent statistics indicate that e-commerce sales are expected to surpass USD 6 trillion by 2024, which could lead to a corresponding increase in voice payment adoption. This trend suggests that businesses are likely to integrate voice payment options into their platforms to cater to consumer preferences. The convergence of e-commerce and voice technology may create new opportunities for merchants, enhancing customer engagement and potentially increasing sales through improved transaction efficiency.

Increased Focus on User Experience

An increased focus on user experience is emerging as a critical driver in the Voice Payment Market. Companies are recognizing the importance of creating intuitive and user-friendly interfaces that facilitate seamless voice transactions. This emphasis on user experience is likely to enhance customer satisfaction and loyalty, as consumers are more inclined to adopt payment methods that are easy to use. Recent surveys suggest that over 70% of consumers prioritize user experience when selecting payment options, indicating a strong correlation between user-friendly designs and market adoption. As businesses strive to differentiate themselves in a competitive landscape, the Voice Payment Market may witness innovations aimed at improving the overall user experience. This trend suggests that companies investing in user-centric designs are likely to gain a competitive edge, fostering growth within the voice payment sector.

Rising Demand for Contactless Payments

The rising demand for contactless payments is a notable driver within the Voice Payment Market. As consumers increasingly prioritize safety and convenience, contactless payment methods, including voice payments, are gaining traction. This trend is reflected in the growing number of merchants adopting contactless solutions, with a reported increase of over 30% in contactless transactions in recent years. The Voice Payment Market stands to benefit from this shift, as voice-enabled transactions provide a secure and efficient alternative to traditional payment methods. Furthermore, the convenience of voice payments aligns with consumer expectations for quick and hassle-free transactions. As the demand for contactless solutions continues to rise, the Voice Payment Market is likely to experience substantial growth, driven by both consumer preferences and technological advancements.

Integration with Artificial Intelligence

The integration of artificial intelligence technologies into the Voice Payment Market appears to be a pivotal driver. AI enhances voice recognition accuracy, enabling seamless transactions through natural language processing. This technological advancement is likely to improve user experience, as consumers increasingly prefer voice commands for convenience. According to recent data, the AI market is projected to reach USD 190 billion by 2025, which may further bolster the Voice Payment Market. As AI continues to evolve, its applications in voice payments could lead to more personalized services, thereby attracting a broader customer base. The synergy between AI and voice payment systems suggests a promising trajectory for growth, as businesses seek to leverage these innovations to enhance operational efficiency and customer satisfaction.

Advancements in Voice Recognition Technology

Advancements in voice recognition technology are significantly influencing the Voice Payment Market. Enhanced algorithms and machine learning capabilities are improving the accuracy and reliability of voice recognition systems, making them more appealing for payment processing. As these technologies evolve, they are likely to reduce errors in transaction processing, thereby increasing consumer trust in voice payments. Recent studies indicate that the voice recognition market is projected to reach USD 27 billion by 2026, suggesting a robust growth trajectory that could positively impact the Voice Payment Market. The continuous improvement in voice recognition capabilities may lead to wider adoption among consumers, as they seek more efficient and user-friendly payment solutions. This trend indicates a promising future for voice payment systems, as they become increasingly integrated into everyday transactions.

Leave a Comment