- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

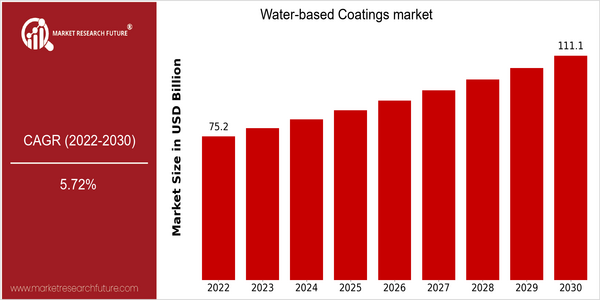

| Year | Value |

|---|---|

| 2022 | USD 75.2 Billion |

| 2030 | USD 111.1 Billion |

| CAGR (2022-2030) | 5.72 % |

Note – Market size depicts the revenue generated over the financial year

The water-repellent coatings market is expected to reach $77.8 billion by 2022 and is anticipated to reach $111.1 billion by 2030, growing at a CAGR of 5.72% during the forecast period. The growth in this market reflects the growing demand for low VOC (volatile organic compounds) products, owing to the increasing demand for regulatory compliance and the growing demand for low VOC products by consumers. Water-repellent coatings have a long history in the building, construction, and automobile industries. As these industries are expected to continue to adopt more sustainable practices, the adoption of water-repellent coatings is expected to grow significantly. There are many factors that are driving this market, including the advancements in formulation technology, which is enhancing the performance characteristics of water-based coatings, such as adhesion and tensile strength. Also, the rise in the number of consumers who are more conscious about the environment is compelling manufacturers to focus on developing water-based products. The major players in this market, such as PPG Industries, AkzoNobel, and Sherwin-Williams, are investing in strategic alliances and product launches to strengthen their product portfolios and gain a larger market share. The growing investments in R&D for high-performance water-based coatings, for example, are a clear indication of the commitment of the industry to meet the changing needs of the market.

Regional Market Size

Regional Deep Dive

The market for water-based paints is growing strongly in all regions, primarily because of rising demand from end-use industries such as construction, automobiles, and consumer goods. The market in each region has its own characteristics, which are influenced by local regulations, economic conditions, and cultural preferences. The trend toward eco-friendly products is especially strong, with manufacturers introducing innovations to meet increasingly strict VOC regulations and consumers’ preference for safer, non-toxic products.

Europe

- The European Union's Green Deal aims to make Europe climate-neutral by 2050, which is driving demand for water-based coatings as part of a broader push for sustainable construction and manufacturing practices.

- Innovations in bio-based raw materials for water-based coatings are being spearheaded by companies like BASF and AkzoNobel, enhancing the performance and sustainability of these products.

Asia Pacific

- China's rapid urbanization and infrastructure development are significantly boosting the demand for water-based coatings in construction, with local companies like Nippon Paint leading the charge in innovation.

- Regulatory changes in countries like India are promoting the use of water-based coatings to reduce air pollution, encouraging manufacturers to adapt their offerings to meet these new standards.

Latin America

- Brazil's National Policy on Solid Waste is encouraging the use of water-based coatings to minimize environmental impact, prompting local manufacturers to innovate and adapt their product lines.

- The growing construction sector in Mexico is driving demand for water-based coatings, with companies like Comex investing in research and development to create high-performance, sustainable products.

North America

- The U.S. Environmental Protection Agency (EPA) has implemented stricter regulations on VOC emissions, prompting manufacturers to invest in advanced water-based coating technologies that comply with these standards.

- Major companies like PPG Industries and Sherwin-Williams are expanding their product lines to include more sustainable water-based coatings, reflecting a growing consumer preference for environmentally friendly options.

Middle East And Africa

- The UAE's Vision 2021 initiative emphasizes sustainability and environmental protection, leading to increased adoption of water-based coatings in construction and automotive sectors.

- Local manufacturers are collaborating with international firms to enhance their product offerings, as seen in partnerships between companies like Jotun and regional distributors to promote eco-friendly solutions.

Did You Know?

“Water-based coatings can reduce VOC emissions by up to 90% compared to traditional solvent-based coatings, making them a preferred choice for environmentally conscious consumers and industries.” — Environmental Protection Agency (EPA)

Segmental Market Size

Water-based coatings are a vital part of the overall market for paints and are growing strongly in response to increasing environmental regulations and the demand for sustainable products. The stricter VOC regulations encourage manufacturers to use eco-friendly solutions, and consumers are increasingly interested in low-emission products that are in line with sustainable development. In this respect, PPG Industries and Sherwin-Williams are among the leading companies that are responding to this trend by implementing water-based technology in their product lines. In the meantime, the development of water-based coatings has reached a mature stage, and water-based coatings are widely used in various industries, such as the automotive industry, construction industry and furniture industry. Among the examples of the use of water-based paints in the automobile industry are the Ford group and other manufacturers that are shifting to water-based paints in order to comply with the regulations. The main applications are indoor and outdoor paints, industrial paints and wood finishes. However, the trend towards a more sustainable society and the stricter regulations on emissions also contribute to the growth of water-based paints. Moreover, the technological development of water-based paints has been able to improve the performance and application of the products, which makes water-based paints more competitive.

Future Outlook

From 2022 to 2030, the water-based paints market is expected to grow at a CAGR of 5.72%. This growth will be driven mainly by the increasing demand for sustainable and eco-friendly coatings from the automotive, construction, and consumer goods industries. As regulations become stricter, manufacturers are increasingly shifting to water-based formulations in order to meet the stringent VOC (volatile organic compounds) limits, thereby increasing their market penetration and application rates in both developed and developing economies. Further developments in the formulation of water-based paints will also play an important role in shaping the market. The enhanced adhesion properties, faster drying times, and higher resistance of water-based paints are making them more attractive to end users. The growing trend for self-help and the rise in e-commerce will also increase the demand for water-based paints in the consumer goods industry. The shift towards more sustainable alternatives will have a positive effect on the market for water-based paints.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 75.2 billion |

| Growth Rate | 5.72% (2022-2030) |

Water-based coatings Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.