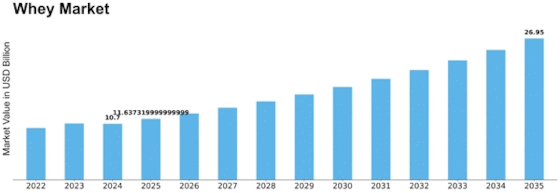

Whey Size

Whey Market Growth Projections and Opportunities

The whey market is influenced by several key factors that shape its dynamics and growth trajectory. Firstly, the growing demand for protein-rich foods and beverages is a significant driver of the whey market. Whey protein is valued for its high nutritional value, containing all essential amino acids necessary for muscle growth, repair, and overall health. As consumers become more health-conscious and prioritize protein intake for various reasons such as weight management, sports nutrition, and muscle building, the demand for whey protein products continues to rise.

Moreover, the increasing popularity of sports and fitness activities contributes to the growth of the whey market. Athletes, bodybuilders, and fitness enthusiasts often use whey protein supplements to support their training goals and enhance muscle recovery. Whey protein's rapid absorption and high bioavailability make it a preferred choice for post-workout nutrition, driving demand for whey-based sports nutrition products such as protein powders, bars, and shakes.

Additionally, the rising prevalence of lifestyle-related health conditions such as obesity, diabetes, and metabolic disorders fuels the demand for functional and fortified foods and beverages. Whey protein is increasingly incorporated into a variety of functional food and beverage products marketed for their health benefits, including weight management, satiety, and blood sugar control. This trend is expected to drive further growth in the whey market as consumers seek out products that support their health and wellness goals.

Furthermore, advancements in food technology and ingredient innovation contribute to the expansion of the whey market. Manufacturers are developing new formulations and applications for whey protein, allowing for its inclusion in a wider range of food and beverage products. Whey protein isolates, concentrates, and hydrolysates are utilized in various formulations to enhance texture, flavor, and nutritional profile, leading to increased consumer acceptance and market penetration.

Moreover, demographic factors such as population growth, urbanization, and changing dietary habits impact the whey market. As populations grow and become more urbanized, there's an increasing demand for convenient and nutritious food and beverage options. Whey protein products offer a convenient and versatile source of protein that appeals to busy consumers seeking on-the-go nutrition solutions, driving market demand.

Additionally, economic factors such as disposable income levels and consumer spending patterns influence the whey market. Higher disposable incomes enable consumers to afford premium-priced whey protein products and supplements, driving sales in the whey market. Moreover, the rise of e-commerce and online retail channels provides consumers with greater accessibility to a wide range of whey protein products, further boosting market growth.

Furthermore, regulatory factors and industry standards play a crucial role in shaping the whey market. Compliance with food safety regulations and quality standards ensures the safety and integrity of whey protein products, fostering consumer trust and confidence. Moreover, regulatory approvals and labeling requirements for health claims and nutritional content influence product positioning and marketing strategies, affecting consumer perceptions and purchasing decisions.

Leave a Comment