- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

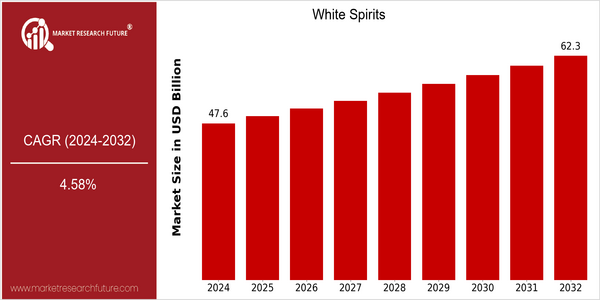

| Year | Value |

|---|---|

| 2024 | USD 47.59 Billion |

| 2032 | USD 62.26 Billion |

| CAGR (2024-2032) | 4.58 % |

Note – Market size depicts the revenue generated over the financial year

White spirits are a steady growth market. The current market size is estimated to reach $47,591 million in 2024, which is expected to rise to $ 62,261,000 in 2032. The CAGR of this market is 4.58%. The rise in the popularity of premium and artisanal spirits and the popularity of mixology and cocktail culture are the main reasons for this growth. In addition, the growing popularity of white spirits in emerging economies due to changes in lifestyle and rising incomes also supports the expansion of the market. Technological innovations in production processes and the development of new marketing strategies also contribute to the growth of the market. In addition, the companies have been investing in sustainable development and diversification of products to meet the needs of consumers. Diageo, Pernod Ricard and Bacardi have been launching new products and establishing strategic alliances to strengthen their positions in the market. Diageo, for example, has launched a new line of premium vodkas, while Bacardi has been developing its rum portfolio.

Regional Market Size

Regional Deep Dive

The market for white spirits is characterised by the wide range of products on offer, including vodka, gin, and tequila, each of which has its own distinctive cultural significance and regional consumption patterns. In North America, the trend towards premiumisation and craft spirits is gaining momentum, while Europe has a rich heritage of distillation methods. In the Asia-Pacific region, the market is expanding rapidly as consumers’ disposable incomes rise and their preferences change towards western-style beverages. In the Middle East and Africa, cultural and regulatory factors are causing the market to be shaped by a complex combination of factors, while in Latin America, the popularity of local products such as tequila and mezcal is on the rise as they gain in global recognition. In summary, the market is shaped by a combination of evolving consumer tastes, product innovation, and regulatory developments that vary significantly from region to region.

Europe

- The European Union has implemented stricter regulations on labeling and production standards for spirits, which has led to increased transparency and quality assurance in the market.

- Countries like the UK and France are seeing a rise in gin consumption, with brands such as Tanqueray and Hendrick's launching new flavors to attract younger consumers.

Asia Pacific

- The rise of social media and influencer marketing has significantly impacted the promotion of white spirits, with brands like Smirnoff leveraging platforms like Instagram to reach younger audiences.

- China's growing middle class is driving demand for premium vodka and gin, prompting international brands to tailor their offerings to local tastes and preferences.

Latin America

- The resurgence of interest in tequila and mezcal has led to the establishment of several new distilleries in Mexico, with brands like Casamigos gaining international acclaim.

- Regulatory support for local spirits production is increasing, with initiatives aimed at promoting traditional distillation methods and protecting indigenous brands.

North America

- The craft cocktail movement has gained significant traction, with companies like Diageo and Pernod Ricard investing in local distilleries to cater to the demand for artisanal spirits.

- Regulatory changes in several states have made it easier for small producers to enter the market, fostering innovation and competition among brands.

Middle East And Africa

- In the UAE, the government has relaxed regulations on alcohol sales, leading to a surge in the availability of white spirits in retail and hospitality sectors.

- Cultural shifts in countries like South Africa are leading to increased acceptance of white spirits, with local brands like Three Ships Whisky gaining popularity among consumers.

Did You Know?

“Did you know that vodka is the most consumed spirit in the world, with Russia and Poland being the largest consumers per capita?” — International Spirits and Beverage Association

Segmental Market Size

Vodka, gin and tequila are the products of the White Spirits category, which is an important part of the overall spirits market, which is growing steadily. There are a number of factors that are driving this growth, such as the growing popularity of craft and premium spirits, the growing popularity of cocktails and the rise of mixology. The desire for low-calorie products also increases the demand for white spirits, which are often seen as lighter alternatives to dark spirits. The white spirits category is now in a mature phase of development, with brands like Pernod Ricard and Diageo leading the market. In regions like North America and Europe, new products and marketing strategies are constantly being launched that keep the consumers interested. The main consumers of white spirits are bars, restaurants and private consumers, and the most common application is the preparation of cocktails. There are a number of trends that are driving growth, such as the focus on sustainability and the rise of e-commerce. Technological trends such as digital marketing and social media are reshaping the relationship between consumers and brands.

Future Outlook

The spirits market is expected to grow significantly from 2024 to 2032, from $47,594,000,000 to $67,262,800,000. The compound annual growth rate (CAGR) for the period is 4.5%. The growth is due to the growing popularity of premium and craft spirits and the growing popularity of mixology and the preparation of cocktails at home. White spirits will also become more popular as consumers become more adventurous in their drinking habits. White spirits penetration in both on-premise and off-premise channels is expected to rise, potentially reaching 30% of the total spirits market in 2032, up from about 25% in 2024. The growth is also driven by technological advances in the distillation process that enhance the flavour profiles and quality of the products and consumers’ evolving preferences for healthier and lower-calorie options. Also, changes in regulations governing the production and sale of alcoholic beverages in different regions will open up new opportunities. Furthermore, emerging trends such as the use of sustainable production and packaging practices and the increasing importance of e-commerce platforms for the distribution of alcohol will further alter the competitive landscape. As the market develops, the brands that focus on innovation and sustainability are expected to capture a larger share of the growing customer base, thereby securing the white spirits market’s position as a dynamic segment of the alcoholic beverages industry.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 4.58% (2023-2030) |

White Spirits Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.