Summary Overview

Data Center Hosting and Storage Market Overview - Australia

The Data Center Hosting and Storage market in Australia is experiencing significant growth, driven by an increasing demand for cloud-based services, data storage, and digital transformation initiatives. With advancements in technology and growing reliance on data-driven solutions across various industries, the market is poised for expansion. Companies in Australia are increasingly adopting data center hosting services to support their digital infrastructure needs, boost operational efficiency, and enhance cybersecurity measures.

Our report provides an in-depth analysis of emerging procurement trends in the Australian data center hosting and storage market. It highlights opportunities for cost savings through strategic sourcing, cloud storage solutions, and energy-efficient technologies. Additionally, the report addresses potential challenges in the supply chain and emphasizes the importance of digital procurement tools in optimizing procurement strategies, ensuring the seamless operation of data centers, and managing associated risks. With competition intensifying, Australian businesses are leveraging market intelligence and procurement analytics to streamline their supply chain and improve overall cost efficiency.

The outlook for the Data Center Hosting and Storage market in Australia is highly positive, with key trends and projections indicating substantial growth through 2032:

-

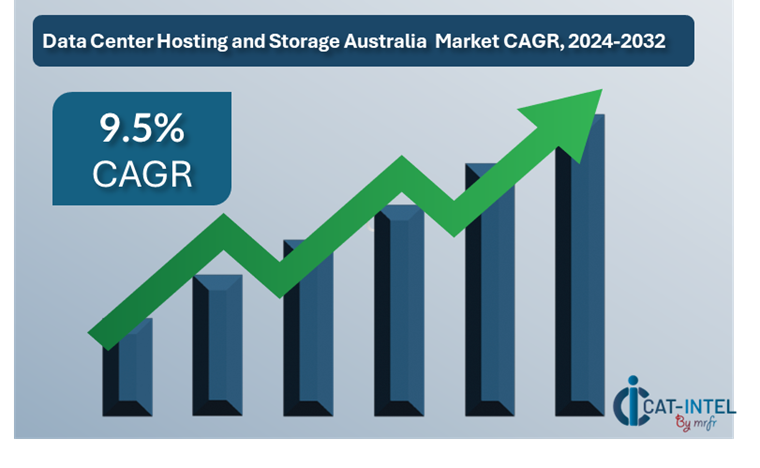

Market Size: The Australian data center hosting and storage market is expected to reach approximately USD 4.3 billion by 2032, reflecting a compound annual growth rate (CAGR) of about 9.5% from 2024 to 2032.

Growth Drivers:

-

Cloud Adoption: The rise in demand for cloud-based solutions, driven by businesses migrating their IT infrastructure to the cloud, is significantly contributing to market growth. Australian businesses, including SMEs, are increasingly adopting cloud hosting and storage services to improve operational efficiency. -

Data Sovereignty and Security: With data protection and privacy concerns becoming more pronounced, the demand for data centers in Australia is on the rise. Local data storage solutions ensure compliance with Australian data sovereignty regulations, making them highly attractive to businesses concerned about data security. -

Digital Transformation: The adoption of digital technologies and the increasing need for high-performance computing have driven demand for advanced data center services, including high-capacity storage, disaster recovery solutions, and AI-powered cloud hosting. -

Cybersecurity Needs: As cyber threats continue to evolve, businesses are investing in secure data center hosting and storage solutions to ensure robust data protection measures are in place. Secure hosting services are essential for mitigating risks associated with data breaches and other cybersecurity challenges.

Sector Contributions:

-

IT and Telecommunications: The IT sector's need for hosting solutions and cloud storage services remains the primary driver of growth. As more companies in Australia adopt hybrid cloud models, demand for both private and public data center hosting services increases. -

Government and Public Sector: Government agencies in Australia are increasingly moving their IT services to hosted solutions to improve scalability and reduce costs. Data sovereignty laws in Australia have further boosted demand for local hosting and storage services. -

Financial Services and Healthcare: Data centers provide mission-critical infrastructure for industries like finance and healthcare, where data security and availability are crucial. These sectors require high levels of uptime and regulatory compliance, further driving demand for reliable data hosting and storage solutions.

Technological Transformation and Innovations:

-

Energy-Efficient Data Centers: Increasing focus on sustainability is driving the development of energy-efficient data centers in Australia. Technologies such as liquid cooling, renewable energy sources, and energy-efficient storage systems are gaining traction in the market. -

AI and Automation: AI-driven solutions are increasingly being integrated into data center operations, enabling better resource management, predictive maintenance, and cost optimization. -

Edge Computing: The rise of edge computing is transforming the way data is stored and processed. Businesses are increasingly deploying data centers closer to end users, which is reducing latency and improving service delivery.

Key Trends and Sustainability Outlook:

-

Sustainability Initiatives: Data center providers in Australia are increasingly adopting sustainable practices, including using renewable energy sources like solar and wind to power data centers. Energy efficiency and carbon reduction targets are driving the development of more eco-friendly data center infrastructures. -

Health and Safety: As the demand for data storage and processing increases, so does the need for physical security and safety measures in data centers. This trend is pushing companies to invest in robust infrastructure to protect against environmental hazards, cyber threats, and physical intrusions. -

Data Compliance and Regulatory Outlook: With stringent data protection laws, Australian data centers are focused on ensuring compliance with both local and international data security standards, such as the Australian Privacy Principles (APP) and GDPR.

Overview of Market Intelligence Services for the Data Center Hosting and Storage Market in Australia

Recent analysis indicates that the Data Center Hosting and Storage market in Australia is currently facing fluctuations in pricing due to rising operational costs, increased demand for data storage, and infrastructure upgrades. These challenges are compounded by energy consumption concerns and evolving regulatory requirements. To navigate these complexities, market reports offer detailed cost forecasts and procurement strategies that assist stakeholders in optimizing their purchasing decisions. By leveraging insights from these reports, data center providers, and buyers can better manage cost volatility while ensuring access to high-quality hosting and storage solutions.

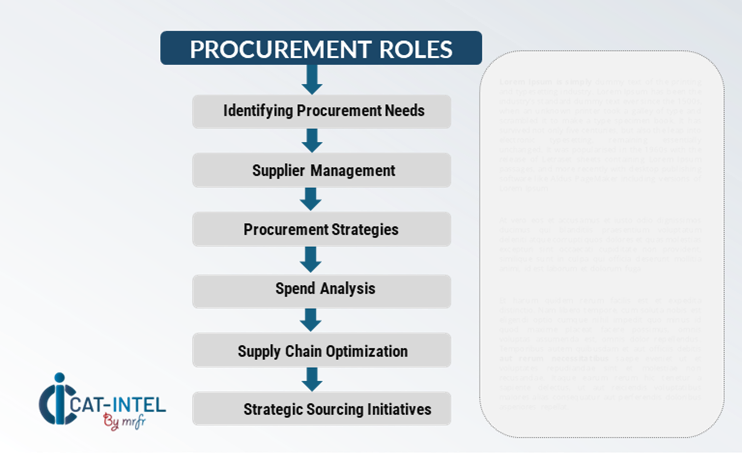

Procurement Intelligence for Data Center Hosting and Storage Market in Australia: Category Management and Strategic Sourcing

To remain competitive in the Australian Data Center Hosting and Storage market, companies are adopting advanced procurement strategies. Strategic sourcing, supported by spend analysis solutions and supplier performance management, is becoming crucial in managing vendor relationships and optimizing costs. Procurement category management is essential for ensuring timely availability of high-quality hosting services while meeting the growing demand for data storage solutions.

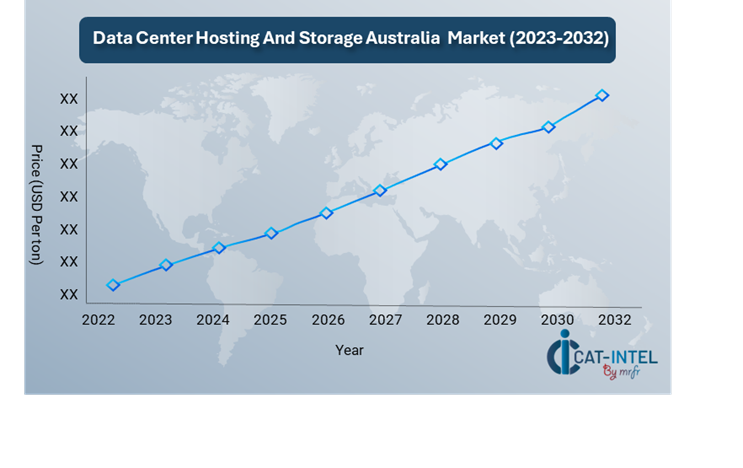

Pricing Outlook for Data Center Hosting and Storage Market in Australia: Spend Analysis

The Data Center Hosting and Storage market in Australia is currently navigating a complex pricing landscape characterized by fluctuating costs driven by factors such as increasing demand for data storage, rising operational expenses, and infrastructure investments. This dynamic environment reflects the ongoing changes in both technological advancements and consumer preferences.

Line chart illustrating the pricing outlook for the data center hosting and storage industry from 2024 to 2032. The chart shows the projected price trends, with prices gradually increasing over the years.

Our advanced analysis indicates a steady growth trajectory in data center hosting and storage prices driven by several key factors, including:

-

Rising Operational Costs: Increased expenses associated with energy consumption, cooling systems, and sustainable infrastructure are impacting overall pricing. -

Surge in Demand: A growing preference for cloud-based services, big data analytics, and digital transformation initiatives is boosting demand for data center services globally. -

Infrastructure Investments: Expanding markets in Asia and Europe are creating competitive pricing pressures, contributing to price volatility. -

Regulatory Compliance: Evolving data protection and privacy regulations are influencing operational costs and pricing structures.

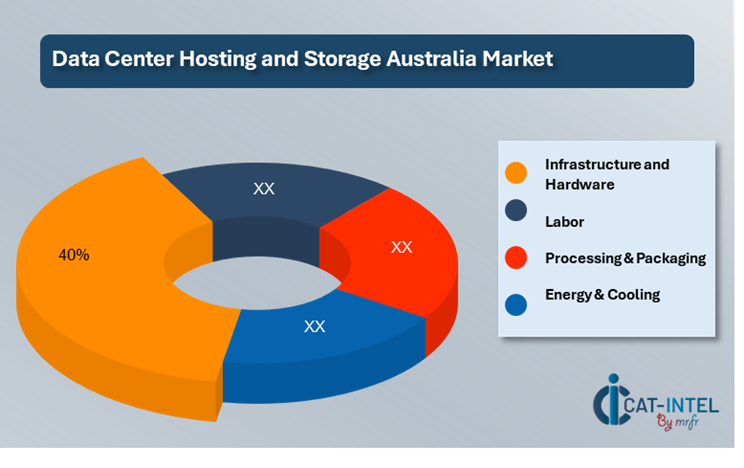

Cost Breakdown for the Data Center Hosting and Storage Market in Australia: Cost Saving Opportunities

- Infrastructure and Hardware (40%)

-

Description: Includes the cost of physical servers, networking equipment, and data center facilities. This category also covers expenses related to the construction or leasing of data center space. -

Trends: Infrastructure costs are rising due to increasing demand for high-performance computing, energy-efficient equipment, and secure storage solutions. The demand for multi-cloud environments and colocation services is driving significant investment in infrastructure. However, technological advancements such as the adoption of edge computing are enabling companies to reduce costs over time by optimizing hardware usage and improving efficiency.

- Labor (XX%)

- Processing & Packaging (XX%)

- Energy & Cooling (XX%)

Cost saving opportunity: Negotiation Lever and Purchasing Negotiation Strategies

In the Data Center Hosting and Storage market in Australia, cost-saving opportunities include collaborative purchasing for bulk discounts, investing in energy-efficient infrastructure, and adopting hybrid or multi-cloud solutions to reduce on-site costs. Outsourcing IT functions and optimizing data storage through techniques like deduplication and compression further lowers expenses. Negotiating better service level agreements (SLAs) and consolidating suppliers can also lead to more favourable pricing. Leveraging technological innovations like AI-driven workload management and automation can enhance efficiency and reduce operational costs, helping companies remain competitive.

Supply and Demand Overview of the Data Center Hosting and Storage Market in Australia: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The data center hosting and storage market in Australia is experiencing rapid growth driven by the increasing demand for cloud services, digital transformation, and data-driven solutions across various industries. As organizations generate more data, the need for scalable, secure, and cost-efficient data storage solutions intensifies.

Demand Factors:

-

Cloud Adoption: The shift towards cloud-based solutions is driving demand for data hosting and storage services, particularly in industries such as finance, healthcare, and e-commerce. -

Digital Transformation: Businesses are increasingly adopting digital technologies, generating a significant increase in data volumes and requiring robust data storage capabilities. -

Big Data and IoT: The rise of big data analytics and the Internet of Things (IoT) is creating an exponential need for storage solutions to manage and process large amounts of data. -

Regulatory Compliance: Stricter data privacy and regulatory requirements are prompting organizations to seek reliable data hosting solutions that ensure compliance.

Supply Factors:

-

Data Center Infrastructure: Australia’s robust data center infrastructure, particularly in major cities like Sydney and Melbourne, offers a reliable supply of hosting services. -

Technological Advancements: Innovations in server hardware, software, and energy-efficient technologies enhance the capacity and efficiency of data centers, supporting growing demand. -

Colocation Services: Increased availability of colocation services allows businesses to scale their storage needs without building their own infrastructure, boosting supply in the market. -

Competition: The competitive landscape, with major players like Equinix, NEXTDC, and others, drives service improvements, cost reductions, and diversification of offerings, ensuring supply stability and meeting demand.

Regional Demand-Supply Outlook: Data Center Hosting and Storage Market in Australia

The demand for data center hosting and storage services in Australia is steadily growing due to increased reliance on cloud services, digital transformation, and data storage solutions across various sectors. The Australian market is poised to experience expansion as organizations seek scalable, reliable, and secure data management solutions.

Australia: A Key Player in the Data Center Hosting and Storage Market

-

Leading Providers: Major players in Australia, such as NEXTDC and Equinix, dominate the data center hosting sector, offering robust, high-performance facilities with industry-leading services. -

Strong Export Market: Australia's data center providers are increasingly catering to international markets, with a focus on the Asia-Pacific region, where demand for cloud and data storage services is growing rapidly. -

Innovation in Infrastructure: Advanced data center designs and energy-efficient technologies are being integrated to meet the increasing demand for reliable and sustainable hosting solutions. -

Focus on Sustainability: Australian data center providers are adopting renewable energy solutions and energy-efficient infrastructure to meet sustainability goals, helping reduce operational costs and improve environmental impact. -

Consumer Trends: The growing need for digital transformation, cloud storage, and big data analytics across industries such as finance, healthcare, and government are driving demand for data hosting and storage services in Australia.

Sydney (Australia) remains a key hub Data Center Hosting and Storage market and its growth

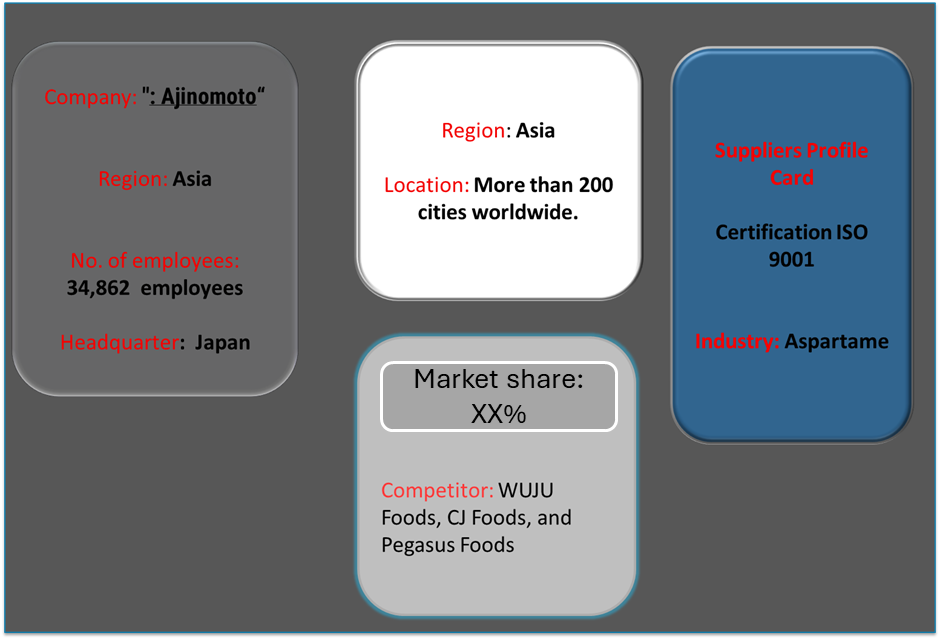

Supplier Landscape: Supplier Negotiations and Strategies – Data Center Hosting and Storage Australia Market

The data center hosting and storage market in Australia is supported by a diverse and competitive supplier landscape, comprising global and regional players who provide the essential infrastructure, technology, and services required to build and operate data centers. These suppliers play a critical role in ensuring the efficiency, reliability, and security of data storage services across various sectors such as finance, healthcare, and government.

Key suppliers in the Australian data center hosting and storage market provide critical components such as cloud services, servers, storage hardware, cooling systems, power supply systems, and network equipment. They also contribute to innovations in energy efficiency, sustainability, and security protocols, which are becoming increasingly important for data centers in the region.

Some of the key suppliers in the Data Center Hosting and Storage market in Australia include:

- NEXTDC

- Equinix

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud

- Digital Realty

- Schneider Electric

- Rittal

- Vertiv

- HP Enterprise

Key Development: Procurement Category significant development

Procurement Category |

Significant Development |

Cloud Services |

Increased adoption of cloud services by businesses, driving demand for scalable, cost-effective storage solutions. |

Energy Efficiency |

Implementation of energy-efficient systems and sustainable practices to reduce operational costs and environmental impact. |

Security & Compliance |

Strengthened focus on cybersecurity and compliance with data privacy regulations, ensuring secure data storage. |

Infrastructure & Hardware |

Rising demand for advanced server technologies, storage hardware, and high-performance networking equipment. |

Automation & AI |

Integration of automation and AI technologies to enhance operational efficiency and optimize resource allocation. |

Cooling & Power Supply |

Development of innovative cooling and power solutions to reduce energy consumption and improve data center sustainability. |

Edge Computing |

Expansion of edge computing solutions to improve latency and support local data processing for specific industries. |

Procurement Attribute/Metric |

Details |

Market Sizing |

The data center hosting and storage market in Australia is projected to grow from USD 1.1 billion in 2024 to USD 4.3 billion by 2032, with a CAGR of 9.5% during the forecast period. |

Adoption of Cloud Services |

There is an increasing shift towards cloud-based storage solutions due to the demand for scalability, security, and cost-efficiency, particularly in industries like finance, healthcare, and retail. |

Top Strategies for 2024 |

Focus on sustainable energy solutions, enhancing data security measures, and expanding partnerships with global cloud providers to drive innovation. |

Automation in Data Centers |

Over 50% of Australian data centers are adopting AI and machine learning technologies to improve data management, optimize storage, and enhance performance. |

Procurement Challenges |

Key challenges include ensuring cybersecurity in multi-cloud environments, managing energy consumption, and addressing compliance with evolving regulations in data storage. |

Key Suppliers |

Major players include Next DC, Equinix, Digital Realty, and Vocus Group, focusing on providing scalable and secure data center solutions across Australia. |

Key Regions Covered |

Major markets include New South Wales, Victoria, and Queensland, with a growing demand from industries such as finance, education, and government sectors. |

Market Drivers and Trends |

The market is driven by increasing digital transformation, the rise of cloud computing, high demand for data security, and the need for compliance with regulatory standards. |