Summary Overview

DTC E-Commerce Market Overview

The European DTC (Direct-to-Consumer) e-commerce industry is experiencing significant growth, fuelled by increasing consumer preference for online shopping and the convenience of direct brand interactions. This market encompasses various sectors, including fashion, beauty, electronics, and home goods. Our report offers an in-depth analysis of procurement trends, emphasizing cost optimization strategies and the adoption of digital tools to enhance operational efficiency and customer experience.

Key challenges in procurement include managing fluctuating shipping costs, ensuring inventory accuracy, and addressing evolving consumer demands. Digital procurement platforms and advanced logistics solutions are essential for optimizing supply chains and maintaining competitiveness in the rapidly expanding e-commerce landscape. As the market continues to grow, businesses are leveraging market intelligence to improve efficiency, enhance customer satisfaction, and minimize risks.

The European DTC e-commerce market is expected to sustain robust growth through 2032, with key highlights including:

-

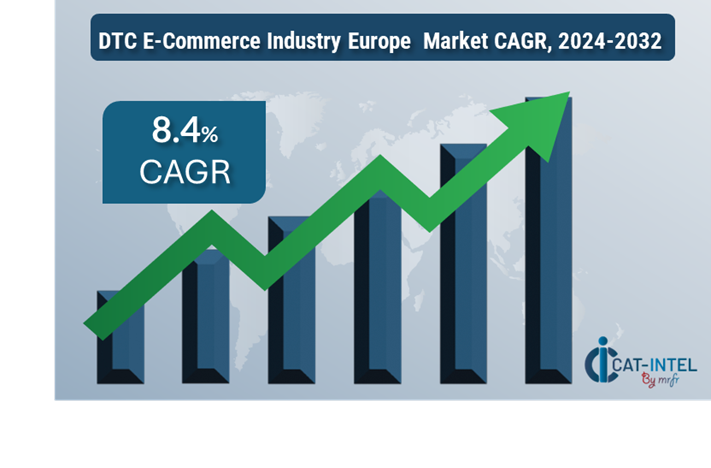

Market Size: The European DTC e-commerce market is projected to reach USD 7.2 billion by 2032, growing at a CAGR of approximately 8.4% from 2024 to 2032.

-

Sector Contributions: Growth in the market is driven by: -

Consumer Behaviour Shifts: Increased preference for online shopping and personalized customer experiences. -

Technological Integration: Advancements in AI-powered customer support, personalized marketing, and real-time inventory management systems. -

Innovations: Creative solutions like personalized product recommendations and AR-powered virtual try-ons are improving customer engagement and purchase experiences. -

Investment Initiatives: Companies are investing in advanced e-commerce platforms, automated fulfilment centres, and scalable cloud technologies to enhance operational capabilities and customization options. -

Regional Insights: Europe remains a significant contributor due to its mature e-commerce infrastructure, high internet penetration, and increasing focus on sustainable packaging and delivery solutions.

Key Trends and Sustainability Outlook:

-

Enhanced Digital Integration: Adoption of advanced e-commerce platforms, AI-driven insights, and automated marketing tools to enhance the customer journey. -

Focus on Sustainability: Increased adoption of sustainable packaging, eco-friendly products, and carbon-neutral shipping options to meet consumer and regulatory demands. -

Omnichannel Strategies: Integration of online and offline channels to provide seamless shopping experiences. -

Data-Driven Operations: Leveraging data analytics for inventory forecasting, customer behavior analysis, and marketing optimization. -

Customization and Personalization: Growing demand for tailored products and experiences to meet specific consumer preferences.

Growth Drivers:

-

Rising E-Commerce Penetration: Growing internet access and smartphone usage are driving demand for online shopping across Europe. -

Sustainability Awareness: Consumers are increasingly choosing brands that prioritize sustainable practices, fuelling demand for eco-friendly products. -

Advancements in Logistics: Improvements in last-mile delivery and fulfilment solutions are enhancing operational efficiency. -

Regulatory Standards: Compliance with European data protection regulations (e.g., GDPR) and sustainability mandates is shaping procurement practices. -

Digital Marketing Innovation: Increased adoption of performance-driven marketing strategies to attract and retain customers.

Overview of Market Intelligence Services for the DTC E-Commerce Market:

Recent analyses highlight challenges such as fluctuating logistics costs, the complexity of maintaining inventory accuracy, and the need for compliance with data protection regulations. Market intelligence reports offer actionable insights into procurement opportunities, enabling businesses to optimize supplier relationships, streamline logistics, and reduce operational costs. These reports also help companies maintain compliance with European standards while delivering high-quality customer experiences.

Procurement Intelligence for DTC E-Commerce: Category Management and Strategic Sourcing:

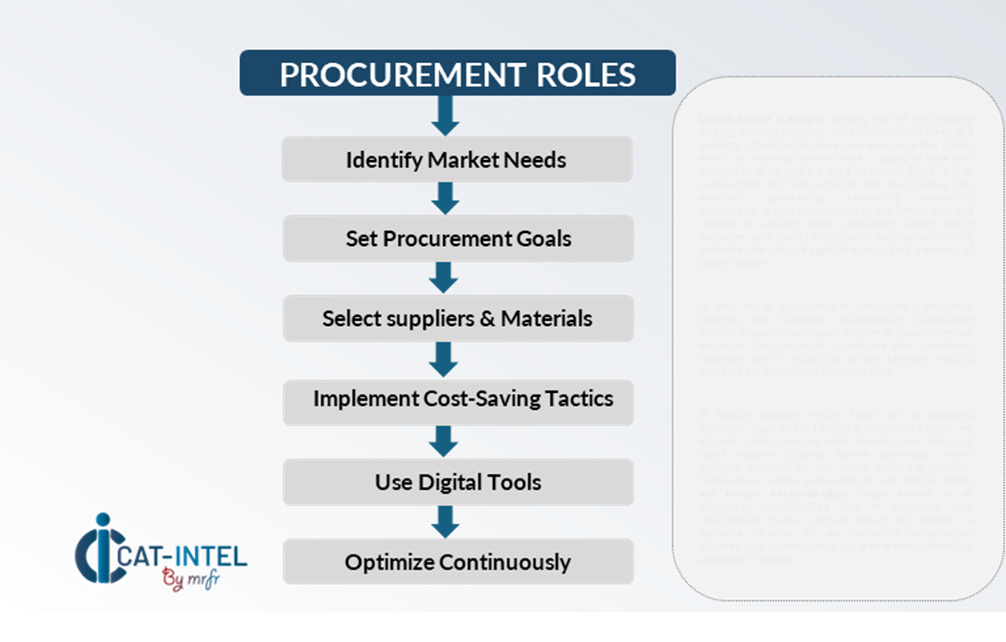

To remain competitive in the European DTC e-commerce industry, businesses are refining procurement processes by employing spend analysis, optimizing supplier relationships, and leveraging advanced logistics solutions. Effective category management and strategic sourcing are critical for minimizing costs while ensuring product quality and timely delivery. By utilizing actionable market intelligence, companies can enhance procurement strategies, secure favourable terms with suppliers, and meet evolving customer expectations.

Pricing Outlook for the DTC E-Commerce Industry in Europe: Spend Analysis

The pricing outlook for the DTC e-commerce industry in Europe is projected to remain moderately stable, influenced by several dynamic factors. Key contributors include changes in logistics costs, evolving customer expectations, and stringent regulatory standards, such as GDPR and sustainability mandates. The increasing demand for personalized and eco-friendly products, such as sustainable packaging and carbon-neutral shipping, is also driving upward price pressures.

Graph shows general upward trend pricing for DTC E commerce and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement processes, strengthen supplier relationships, and invest in innovative digital tools are critical for controlling costs. Leveraging analytics for market monitoring, price forecasting, and efficient inventory management can further enhance cost efficiency.

Establishing strategic partnerships with reliable suppliers, negotiating favourable contract terms, and adopting advanced technological solutions are essential strategies for managing pricing in this competitive market. Despite challenges, maintaining service quality, aligning with sustainability initiatives, and integrating advanced logistics systems will be vital for sustaining cost-effectiveness.

Cost Breakdown for the DTC E-Commerce Industry in Europe: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Logistics and Shipping (30%)

- Description: A significant portion of costs in the DTC e-commerce industry is attributed to logistics, including last-mile delivery, warehousing, and returns management. These costs are heavily influenced by transportation rates, fuel prices, and infrastructure capabilities.

- Trends: Companies are implementing strategies such as partnering with regional logistics providers, adopting automation in fulfilment centres, and offering flexible delivery options to optimize costs. The shift toward sustainable shipping solutions, like electric vehicle fleets and carbon offset programs, is adding value but may slightly increase expenditures.

- Technology and Digital Tools (XX%)

- Marketing and Customer Acquisition (XX%)

- Sustainability Initiatives (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the DTC e-commerce industry in Europe, optimizing procurement strategies and leveraging effective negotiation tactics can result in significant cost savings and operational improvements. Establishing long-term partnerships with logistics providers, particularly in key regions, can secure better pricing and terms, including volume-based discounts and reduced service charges. Forward contracts and bulk service agreements also help lock in competitive rates and mitigate cost volatility.

Collaborating with service providers focused on innovation and sustainability provides additional benefits, such as improved efficiency and access to eco-friendly solutions like green delivery options. Implementing digital tools for supply chain optimization, such as real-time tracking, inventory management systems, and predictive demand analytics, enhances efficiency, reduces errors, and minimizes costs. Diversifying service networks and adopting multi-partner strategies can mitigate risks associated with supply chain disruptions or regulatory changes, offering greater leverage during negotiations.

Supply and Demand Overview for DTC E-Commerce: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The European DTC e-commerce industry is experiencing robust growth, driven by increasing consumer demand for online shopping and personalized customer experiences. The balance of supply and demand is influenced by factors such as infrastructure development, regulatory standards, and digital adoption.

Demand Factors:

-

Consumer Expectations: The growing demand for faster delivery, personalized services, and seamless online experiences is pushing e-commerce platforms to optimize their operations. -

Sustainability Goals: Increased focus on sustainable practices is driving demand for eco-friendly packaging, carbon-neutral shipping, and energy-efficient technologies. -

Technological Advancements: The adoption of AI-driven personalization, automated customer service, and real-time inventory management is shaping consumer expectations and supplier capabilities. -

E-Commerce Growth: Rising internet penetration and mobile commerce adoption are contributing to a surge in demand for streamlined and efficient online platforms.

Supply Factors:

-

Digital Infrastructure: The availability of advanced e-commerce platforms and cloud-based technologies is ensuring a steady supply of services to meet growing demands. -

Logistics Innovations: Automation in fulfilment centres, electric vehicle fleets, and efficient route optimization tools are enhancing supply chain reliability. -

Regulatory Compliance: Adherence to stringent European data protection and sustainability regulations influences the supply of compliant platforms and services. -

Operational Efficiency: Investments in AI, big data, and machine learning tools are helping suppliers streamline operations and shorten delivery times.

Regional Demand-Supply Outlook: DTC E-Commerce

The Image shows growing demand for DTC E commerce Europe in both England and France, with potential price increases and increased Competition.

Europe: Dominance in the DTC E-Commerce Market

Europe, particularly Western Europe England, France, is a dominant player in the global DTC e-commerce market due to several factors:

-

High Digital Adoption: Countries such as Germany, the UK, and France lead in digital infrastructure, supporting seamless e-commerce operations. -

Sustainability Leadership: Europe’s strong focus on green initiatives drives innovations in eco-friendly packaging, energy-efficient data centres, and carbon-neutral delivery options. -

Consumer Sophistication: European consumers demand high-quality, personalized, and transparent e-commerce experiences, influencing service enhancements. -

Technological Advancements: Investments in AI-driven analytics, real-time tracking, and automated fulfilment systems ensure efficient supply chain operations. -

Regulatory Standards: Europe’s comprehensive regulatory framework, including GDPR and sustainability laws, drives consistent service quality and innovation.

Europe Remains a key hub DTC E commerce Industry Europe price drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the DTC e-commerce industry in Europe is diverse and highly competitive, comprising a mix of global and regional players that influence critical aspects such as pricing, technological innovation, and service quality. Established service providers dominate the market by offering comprehensive solutions for logistics, digital platforms, and customer experience, while niche providers focus on specialized services, such as AI-driven personalization and eco-friendly delivery options.

The supplier ecosystem across Europe includes major players and emerging service providers catering to a wide range of operational and strategic requirements. As DTC e-commerce continues to expand, suppliers are investing in advanced technologies, enhancing fulfilment capabilities, and aligning with sustainability goals to deliver efficient, innovative, and customer-centric solutions.

Key Suppliers in the DTC E-Commerce Market Include:

- DHL Supply Chain

- Hermes Europe

- Zalando Logistics

- Amazon Web Services (AWS)

- Shopify Europe

- DPD Group

- Meta Pack

- Klarna

- BigCommerce Europe

- FedEx Europe

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The DTC e-commerce sector in Europe is experiencing strong growth, fueled by increased consumer demand for online shopping, particularly in the fashion, electronics, and beauty sectors. Emerging markets are contributing to this expansion as digital penetration increases. |

Sustainability Focus |

There is a growing emphasis on sustainable practices, with DTC brands increasingly adopting eco-friendly packaging, carbon-neutral delivery options, and promoting circular business models to reduce environmental impact. |

Product Innovation |

E-commerce businesses are diversifying their offerings, integrating personalized shopping experiences, and providing exclusive products or limited-edition items that cater to niche consumer demands. |

Technological Advancements |

Advancements in AI, machine learning, and automation are enhancing personalization, optimizing inventory management, and improving logistics, making DTC operations more efficient and customer-centric. |

Global Trade Dynamics |

Changes in international trade policies, supply chain disruptions, and varying tariffs across regions are influencing product availability, pricing, and shipping timelines in the DTC e-commerce sector. |

Customization Trends |

There is an increasing demand for tailored shopping experiences, including personalized product recommendations, customized delivery options, and flexible return policies, which cater to specific consumer preferences. |

DTC E Commerce Industry Europe Attribute/Metric |

Details |

Market Sizing |

The European DTC e-commerce market is projected to reach USD 7.2 billion by 2032, growing at a CAGR of approximately 8.4% from 2024 to 2032. |

E-Commerce Technology Adoption Rate |

About 60% of DTC e-commerce businesses in Europe are leveraging advanced technologies like AI-driven personalization, automated logistics, and data analytics to enhance customer experience and operational efficiency. |

Top DTC E-Commerce Industry Strategies for 2024 |

Key strategies include enhancing customer personalization, adopting sustainable practices, improving last-mile delivery solutions, and expanding omni-channel experiences to cater to evolving consumer preferences. |

E-Commerce Process Automation |

Around 50% of DTC e-commerce companies have implemented process automation in areas like inventory management, customer service, and order fulfillment to boost efficiency and reduce costs. |

E-Commerce Process Challenges |

Main challenges include navigating supply chain disruptions, managing rising logistics costs, dealing with fluctuating consumer demand, and ensuring data privacy and security. |

Key Suppliers |

Leading suppliers in the European DTC e-commerce space include Shopify, BigCommerce, and Stripe, offering diverse solutions for online stores, payment processing, and logistics. |

Key Regions Covered |

Prominent regions in the European DTC e-commerce market include Western Europe, particularly the UK, Germany, and France, with significant demand from retail, fashion, and electronics industries. |

Market Drivers and Trends |

Growth is driven by the surge in online shopping, the increasing adoption of mobile commerce, the shift toward sustainable packaging and carbon-neutral shipping, and the demand for personalized and seamless shopping experiences. |