Rising Demand in Construction Sector

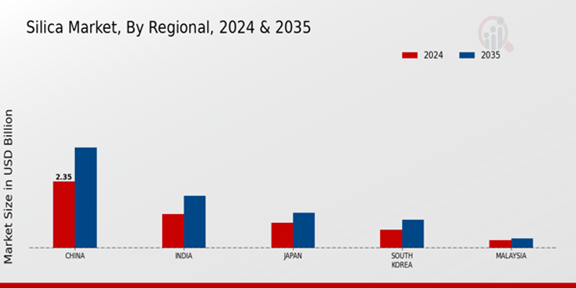

The Global APAC Silica Market Industry experiences a notable surge in demand driven by the construction sector. With infrastructure projects proliferating across the region, silica is increasingly utilized in concrete, glass, and ceramics. For instance, the construction industry in Asia Pacific is projected to contribute significantly to the market, with a valuation of approximately 235.94 USD Billion in 2024. This growth is anticipated to be fueled by urbanization and government initiatives aimed at enhancing infrastructure, thereby propelling the demand for silica products.

Diverse Applications Across Industries

The versatility of silica across various industries is a key driver for the Global APAC Silica Market Industry. Silica finds applications in sectors such as construction, automotive, electronics, and healthcare, among others. This broad applicability ensures a steady demand for silica products, as industries seek materials that enhance performance and durability. For instance, the automotive sector increasingly utilizes silica in tires and coatings, which contributes to overall market growth. The diverse applications of silica are likely to sustain its relevance and demand in the market.

Technological Advancements in Silica Production

Technological innovations in silica production processes are transforming the Global APAC Silica Market Industry. Advanced extraction and processing techniques enhance the quality and efficiency of silica, making it more appealing to various industries. For example, the introduction of eco-friendly production methods not only reduces environmental impact but also meets the increasing regulatory standards across the region. As a result, manufacturers are likely to experience improved profit margins and market competitiveness, potentially leading to a market valuation of 541.32 USD Billion by 2035.

Growth in Electronics and Semiconductor Industries

The Global APAC Silica Market Industry is significantly influenced by the burgeoning electronics and semiconductor sectors. Silica is a critical component in the production of semiconductors, which are essential for various electronic devices. The rapid expansion of technology-driven markets, particularly in countries like China and South Korea, is expected to bolster silica demand. As the electronics industry continues to evolve, the market could witness a compound annual growth rate of 7.84% from 2025 to 2035, reflecting the increasing reliance on silica in high-tech applications.

Environmental Regulations and Sustainability Initiatives

Increasing environmental regulations and sustainability initiatives are shaping the Global APAC Silica Market Industry. Governments across the region are implementing stringent policies aimed at reducing carbon footprints and promoting sustainable practices. This trend compels silica manufacturers to adopt greener production methods and develop eco-friendly products. Consequently, companies that align with these regulations may gain a competitive edge, as consumers and industries alike gravitate towards sustainable options. This shift could further enhance market growth and stability in the coming years.

Leave a Comment