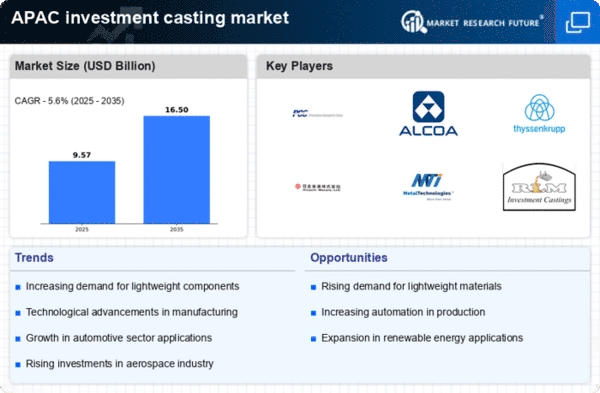

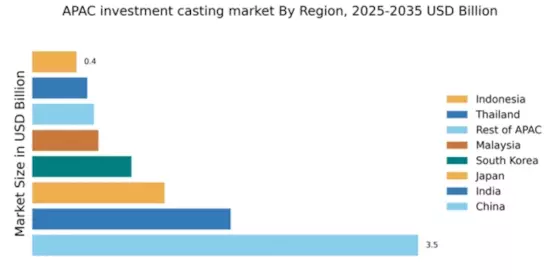

China : Unmatched Growth and Demand Trends

Key markets in China include Jiangsu, Guangdong, and Zhejiang provinces, which are home to numerous foundries and casting facilities. The competitive landscape features major players like Precision Castparts Corp and Alcoa Corporation, alongside local firms. The business environment is characterized by a mix of state-owned and private enterprises, fostering innovation and competition. Sector-specific applications are prevalent in automotive, aerospace, and machinery, with a growing emphasis on sustainable practices and materials.

India : Rapid Growth in Manufacturing Sector

Key cities such as Pune, Chennai, and Ahmedabad are pivotal in India's investment casting landscape, hosting several foundries and manufacturing units. The competitive environment features both domestic and international players, including Thyssenkrupp AG and Hitachi Metals Ltd. Local market dynamics are influenced by a skilled workforce and increasing adoption of advanced technologies. The automotive and aerospace industries are significant consumers, driving innovation and quality improvements in casting processes.

Japan : Precision and Quality at Forefront

Key markets in Japan include Aichi, Osaka, and Tokyo, where major players like Hitachi Metals Ltd dominate the landscape. The competitive environment is marked by a focus on quality and technological superiority, with local firms investing heavily in R&D. The business environment is stable, supported by a skilled workforce and advanced manufacturing technologies. Sector-specific applications are prevalent in automotive, electronics, and industrial machinery, emphasizing precision and reliability in casting processes.

South Korea : Strong Demand from Electronics Sector

Key cities such as Seoul, Incheon, and Busan are central to South Korea's investment casting market, hosting numerous foundries and manufacturing facilities. The competitive landscape features major players like Metal Technologies Inc and RLM Industries Inc, alongside local firms. The business environment is dynamic, characterized by a focus on innovation and quality. Sector-specific applications are prevalent in electronics, automotive, and machinery, with a growing emphasis on advanced materials and technologies.

Malaysia : Strategic Location and Development Initiatives

Key markets in Malaysia include Selangor, Penang, and Johor, where several foundries and manufacturing units are located. The competitive landscape features both local and international players, with a focus on quality and innovation. The business environment is conducive to growth, supported by a skilled workforce and government incentives. Sector-specific applications are prevalent in automotive, aerospace, and electronics, driving advancements in casting technologies and processes.

Thailand : Diverse Applications and Market Growth

Key markets in Thailand include Chonburi, Rayong, and Bangkok, where numerous foundries and manufacturing facilities are located. The competitive landscape features both local and international players, with a focus on quality and innovation. The business environment is dynamic, supported by a skilled workforce and government incentives. Sector-specific applications are prevalent in automotive, machinery, and electronics, driving advancements in casting technologies and processes.

Indonesia : Investment Casting Gaining Traction

Key markets in Indonesia include Java, Sumatra, and Bali, where several foundries and manufacturing units are located. The competitive landscape features both local and international players, with a focus on quality and innovation. The business environment is evolving, supported by a skilled workforce and government incentives. Sector-specific applications are prevalent in automotive, machinery, and electronics, driving advancements in casting technologies and processes.

Rest of APAC : Varied Growth Across Sub-regions

Key markets in the Rest of APAC include Vietnam, Philippines, and Singapore, where investment casting is gaining traction. The competitive landscape features a mix of local and international players, each adapting to unique market conditions. The business environment is influenced by varying regulatory frameworks and economic conditions. Sector-specific applications are emerging in automotive, electronics, and machinery, highlighting the need for innovation and quality in casting processes.