Summary Overview

Fasteners Market Overview:

The demand from sectors like manufacturing, construction, automotive, and aerospace is propelling the steady expansion of the worldwide fasteners market. Fasteners utilized in many different applications, including bolts, screws, nuts, washers, and rivets, are widely available in this market. Our paper provides a thorough examination of procurement trends, emphasizing cost-cutting measures and the use of digital tools to enhance operational and procurement processes.

Going forward, controlling material costs, guaranteeing scalability, upholding high product standards, and incorporating fasteners into current production systems will be major procurement difficulties. To secure long-term market competitiveness and optimize fastener sourcing, digital procurement solutions and strategic sourcing are essential. Businesses are using market information to increase operational efficiency as global demand keeps rising.

-

Market Size: The global Fasteners market is projected to reach USD 139.65 billion by 2035, growing at a CAGR of approximately 4.17% from 2025 to 2035.

-

Sector Contributions: Growth In the market is driven by:

-

Manufacturing and Supply Chain Optimization: To increase operational efficiency and optimize production workflows, there is a growing need for real-time data and process integration in manufacturing and supply chain optimization.

-

Growth in Retail and E-Commerce: The use of more sophisticated tools to improve business operations, such as demand forecasting, inventory control, and customer relationship management (CRM). -

Technological Developments: By facilitating automation, improved product quality, and predictive analytics, the use of AI and machine learning is increasing the output of fasteners.

-

Innovations: The emergence of modular fastener solutions enables businesses to select and include just the precise components they require, resulting in reduced expenses and streamlined procedures.

-

Investment Trends: To lower infrastructure costs, increase remote access, and boost production flexibility, businesses are investing in cloud-based technologies.

-

Regional Insights: Due to their robust digital infrastructure and growing use of cloud technologies in manufacturing, Asia Pacific and North America continue to be significant contributors to the fasteners industry.

Key Trends and Sustainability Outlook:

-

Cloud Integration: The increasing use of cloud technologies in the manufacturing of fasteners provides scalability, cost-effectiveness, and improved data accessibility.

-

Advanced Technologies: The integration of artificial intelligence (AI), the Internet of Things (IoT), and blockchain technology is enhancing decision-making, automation, and transparency in the production and transportation of fasteners.

-

Focus on Sustainability: By facilitating better tracking and reporting, fastener solutions assist businesses achieve sustainability goals and enable effective resource management.

-

Customization Trends: Fasteners designed to meet the needs of industries, such as healthcare, automotive, and construction, are becoming more and more in demand.

-

Data-Driven Insights: Businesses in the fasteners market can better estimate demand, optimize inventory, and track key performance indicators for more informed decision-making and effective operations by utilizing sophisticated analytics which benefit the data driven market needs.

Growth Drivers:

-

Digital Transformation: Digital technologies are being adopted by the fasteners sector more and more to increase productivity and optimize supply chain management and manufacturing processes.

-

Demand for Process Automation: Automating repetitive operations in the manufacture of fasteners is becoming more and more popular to reduce operational bottlenecks and boost productivity.

-

Scalability Needs: To ensure seamless integration and sustained high performance as production needs change, fastener makers are searching for solutions that can grow with their company.

-

Regulatory Compliance: By automating reporting and precisely monitoring materials and production processes, the sector is utilizing technology to guarantee adherence to pertinent requirements. -

Globalization: Fasteners are becoming more and more in demand, especially for systems that facilitate worldwide operations, like those that handle several currencies, multiple languages, and compliance with international compliance standards to benefit the ongoing market.

Overview of Market Intelligence Services for the Fasteners Market:

High implementation costs and the demand for customization in the fastener business are two major problems that have been noted by recent assessments. Market intelligence studies help businesses find cost-cutting tactics, improve supplier management, and increase implementation success by offering insightful information on procurement opportunities. These insights also support efficient cost management, high-quality operations, and adherence to industry standards.

Procurement Intelligence for Fasteners: Category Management and Strategic Sourcing

Businesses are using expenditure analysis and vendor performance review to optimize procurement procedures to stay competitive in the fasteners market. Strategic sourcing and efficient category management are essential for reducing procurement costs and guaranteeing a consistent supply of high-quality fasteners. By utilizing actionable market intelligence, businesses can refine procurement strategies and negotiate favourable terms for their fastener needs.

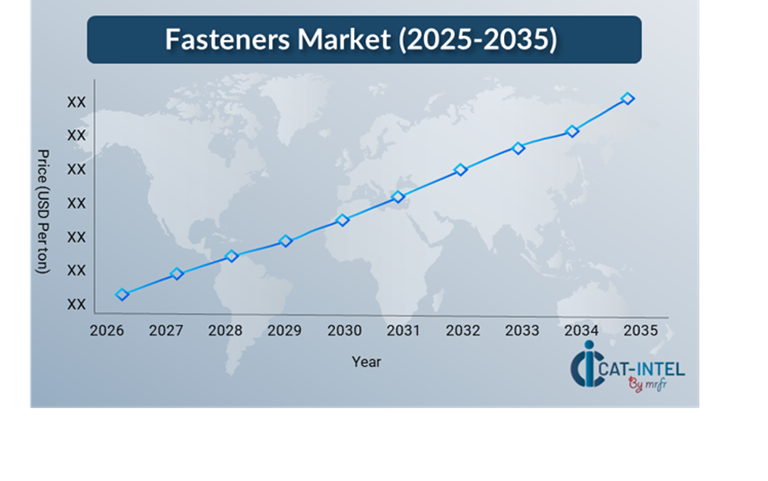

Pricing Outlook for Fasteners: Spend Analysis

Due to several reasons, the fastener pricing outlook is anticipated to be somewhat changeable. Technological developments, the need for specialized solutions, regional pricing variations, and a greater emphasis on quality control are some of the main factors causing these swings. Fastener costs may also rise because of the increasing use of AI and IoT in manufacturing, as well as increased worries about data security and legal compliance in the market and need to be considered for pricing outlook.

Graph shows general upward trend pricing for Fasteners and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Businesses must improve supplier relationships, streamline procurement procedures, and take modular fastener solutions into account to efficiently control costs. Cost efficiency can be increased by utilizing digital solutions for effective contract administration, price forecasting using data analytics, and market tracking.Important tactics for reducing the cost of fastener procurement include forming alliances with reliable fastener suppliers, negotiating long-term agreements, and looking into opportunities for bulk purchases. Despite these obstacles, the fastener sector will need to retain cost effectiveness and operational excellence by concentrating on scalability, integrating production seamlessly, and utilizing innovative manufacturing.

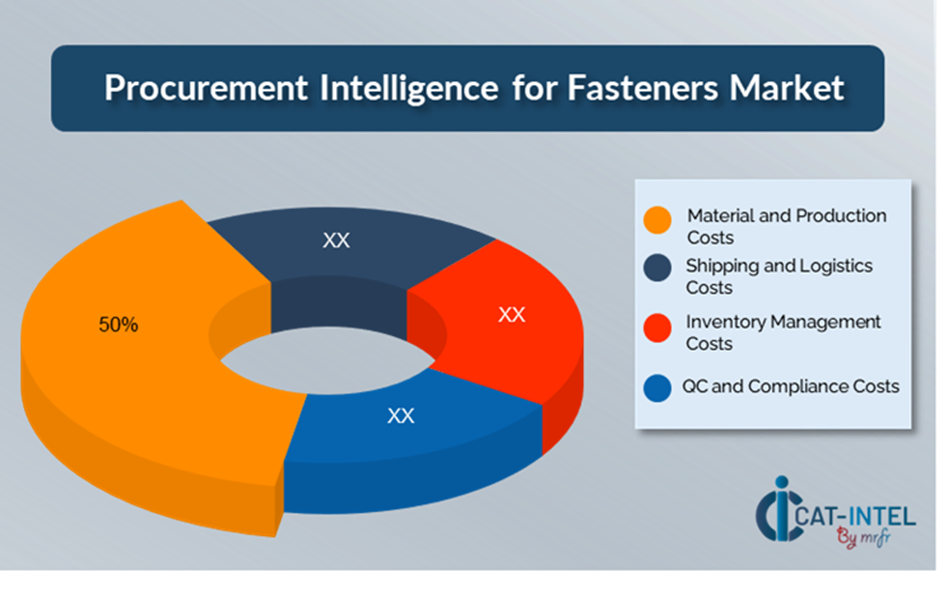

Cost Breakdown for Fasteners: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Material and Production Costs: (50%)

-

Description: The price of fasteners is mostly determined by the cost of manufacturing techniques, such as casting and machining and raw materials, such as steel and aluminium. -

Trends: Automation and technology lower manufacturing costs and increase efficiency, while sustainability drives up material costs.

- Shipping and Logistics Costs: (XX%)

- Inventory Management Costs: (XX%)

- Quality Control and Compliance Costs: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

Significant cost savings and improved operational performance can result from streamlining procurement procedures and employing successful negotiating techniques in the fasteners market. Better pricing, volume-based discounts, and bundled service packages can be obtained by establishing long-term relationships with reliable fastener suppliers, particularly those who provide scalable and configurable solutions. Purchasing in bulk and signing multi-year contracts can help you get better deals and guard against price hikes in the future for cutting off on the cost over negotiations.

Additional advantages of working with suppliers who prioritize innovation and scalability include access to cutting-edge manufacturing technology, AI-driven solutions, and modular product designs, all of which contribute to reduced long-term production costs. Transparency is increased, surplus inventory is decreased, and ideal stock levels are guaranteed by using digital tools such as usage analytics and contract management systems. Adopting a multi-vendor strategy and diversifying supplier sources can increase negotiating leverage, lower supply chain risks, and lessen reliance on a single provider.

Supply and Demand Overview for Fasteners: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The advent of digital transformation initiatives in sectors like manufacturing, construction, and automotive is propelling the fasteners market's steady expansion. Global economic variables, industry-specific demands, and technology advancements all have an impact on market supply and demand.Demand Factors:

-

Initiatives for Digital Transformation: The need for sophisticated fastener solutions is being driven by the growing requirement for automation and centralized data management in a variety of industries.

-

Cloud Adoption: The need for adaptable, subscription-based fastener management is being driven by the move to cloud-based solutions.

-

Industry-Specific Needs: Industries such as healthcare and automotive need fasteners that are appropriate for their operational needs and adhere to stringent regulatory standards.

-

Integration Demand: As a result of industry changes, there is an increasing demand for fasteners that integrate readily with other corporate software and Internet of Things devices.

Supply Factors:

-

Technological Innovations: Advances in digital manufacturing, AI, and machine learning are enhancing fastener selections and escalating supplier competitiveness.

-

Vendor Variety: Customers have more options thanks to the growing number of fastener suppliers, which range from smaller industry players to specialized manufacturers.

-

Global Economic Influences: The price and accessibility of fasteners around the world are impacted by variables such as labour costs, exchange rates, and the rate at which technology is adopted in various geographical areas. -

Scalability and Flexibility: Modern fastener solutions are becoming more modular, enabling suppliers to serve businesses of all sizes and operational complexities.

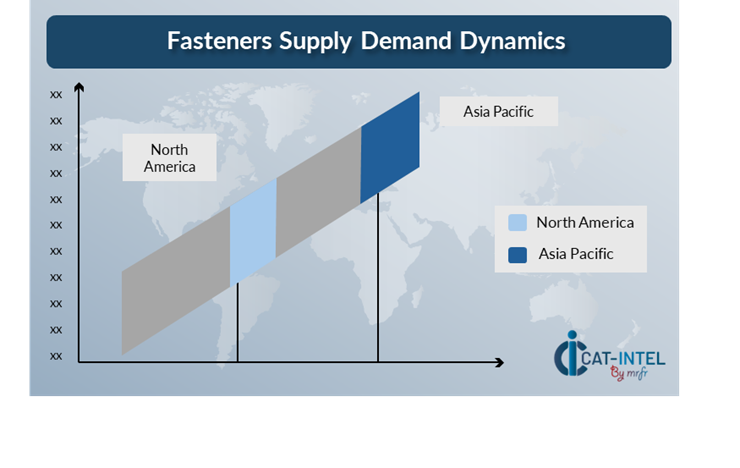

Regional Demand-Supply Outlook: Fasteners

The Image shows growing demand for Fasteners in both Asia Pacific and North America, with potential price increases and increased competition.

Asia Pacific: Dominance in the Fasteners Market

Asia Pacific, particularly China, is a dominant force in the global Fasteners market due to several key factors:

-

Strong Manufacturing Base: Countries such as China, India, and Japan have a well-established manufacturing industry that produces a wide range of fasteners for many industries. -

Low Labor Costs: The region's affordable labour allows for cost-effective fastener production, making them competitively priced around the world. -

High Industrial Demand: Automotive, construction, and electronics industries are rapidly developing, resulting in high demand for fasteners. -

Advanced Technology: Implementing automation and precision engineering improves manufacturing efficiency, quality, and innovation in fastener design. -

Strategic Trade Location: The region's strategic location and robust shipping infrastructure allow for easy global distribution of fasteners.

Asia Pacific remains a key hub for Fasteners Price Drivers Innovation and Growth.

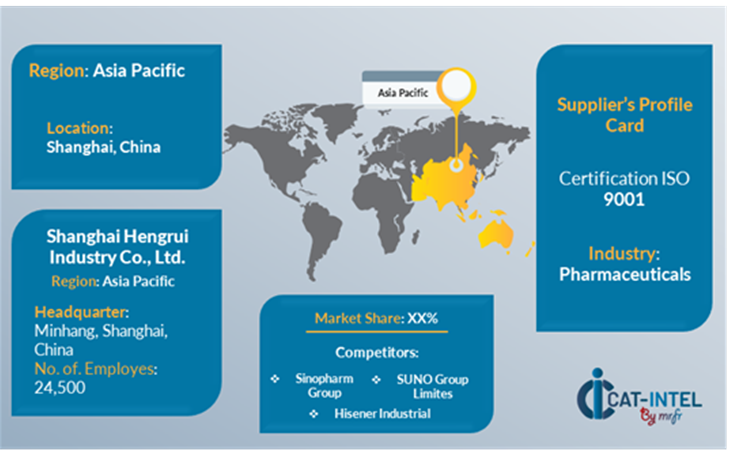

Supplier Landscape: Supplier Negotiations and Strategies

Global leaders and local producers who influence market trends are part of the competitive and varied supplier landscape of the fasteners market. These vendors have an impact on important factors like service quality, product customization, and pricing strategies. Smaller, specialist suppliers concentrate on specialized markets or distinctive features like high-performance materials and customized designs, whereas big, well-established corporations control the market by providing a broad range of fasteners.Key technological regions are covered by the fastener supplier ecosystem, which includes both significant international players and creative local suppliers catering to industrial demands. Fastener suppliers are developing their products by incorporating state-of-the-art technology, optimizing production procedures, and providing flexible pricing models to satisfy the changing demands of the market as companies place a greater emphasis on digital transformation and increasing operational efficiency.

Key suppliers in the Fasteners Market include:

- Shanghai Hengrui Industry Co., Ltd.

- Stanley Black & Decker

- Fastenal Company

- Nucor Corporation

- Thyssenkrupp AG

- Bosch Group

- Sundram Fasteners Limited

- Würth Group

- ITW (Illinois Tool Works)

- Makita Corporation

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The market for fasteners is expanding significantly as more companies, particularly in emerging regions, use cutting-edge technology to improve productivity, streamline processes, and better manage resources. |

Cloud Adoption |

The requirement for scalability, cost-effectiveness, and remote access is driving a growing trend toward cloud-based fastener solutions, especially as hybrid work models gain traction in fastener-dependent industries |

Product Innovation |

By combining real-time data processing, AI-powered analytics, and industry-specific designs, fastener makers are advancing to meet the specialized fastening requirements of industries like manufacturing, construction, and automotive. |

Technological Advancements |

Fastener production skills are being improved by technologies including robotic process automation (RPA), machine learning, and IoT integration. These technologies also generate predictive insights and automate repetitive tasks to increase productivity |

Global Trade Dynamics |

Fastener market trends are being impacted by changes in regional economic policies, trade restrictions, and compliance standards, especially for multinational corporations that source from various locations and manage intricate supply chains. |

|

Fasteners Attribute/Metric |

Details |

Market Sizing |

The global Fasteners market is projected to reach USD 139.65 billion by 2035, growing at a CAGR of approximately 4.17% from 2025 to 2035.

|

Fasteners Technology Adoption Rate |

Approximately 60% of companies worldwide have implemented sophisticated fastening solutions, with a notable trend toward intelligent, cloud-based platforms for improved manufacturing process scalability and flexibility. |

Top Fasteners Industry Strategies for 2025 |

Adopting modular solutions for customizable production, integrating AI and machine learning for predictive analytics in manufacturing, putting sustainability first, and utilizing mobile technologies for better accessibility and tracking are some of the key strategies for the fastener market. |

Fasteners Process Automation |

Routine functions like inventory tracking, quality control, and compliance reporting are now automated in about 50% of fastener manufacturing processes. |

Fasteners Process Challenges |

Rising material costs, supply chain interruptions, reliance on suppliers, and the requirement for continuous investment in technology and equipment updates are some of the major issues facing the fastener sector. |

Key Suppliers |

Leading Suppliers of the fasteners include Stanley Black & Decker, Fastenal Company and Nucor Corporation

|

Key Regions Covered |

Prominent regions for Fasteners adoption include Asia Pacific, North America and Europe, with significant demand in manufacturing and machine learning. |

Market Drivers and Trends |

The requirement for real-time operational insights, the growing use of cloud-based solutions, the growing demand for centralized data management, and the integration of cutting-edge technologies like IoT and AI are all factors propelling the fasteners market's growth. |