Summary Overview

Gearboxes and Crushers Market Overview:

The global gearbox and crusher market is steadily expanding, driven by rising demand in industries such as manufacturing, construction, mining, and automotive. This market comprises a wide range of solutions, including industrial gearboxes, crushers for diverse materials, and custom-built systems. Our research includes a complete examination of procurement trends, focusing on cost-cutting techniques and the use of sophisticated technology to improve procurement and operational procedures.

Key future procurement difficulties include managing high starting costs, assuring scalability for a wide range of applications, sustaining dependability under intensive usage, and integrating gearboxes and crushers into current production systems. Digital procurement tools and strategic sourcing are crucial for increasing the use of these technologies and guaranteeing long-term competitiveness. As global demand continues to climb, businesses are using market intelligence to better operational efficiency, reduce downtime, and mitigate risks, particularly in sectors like mining, construction, and heavy manufacturing.

-

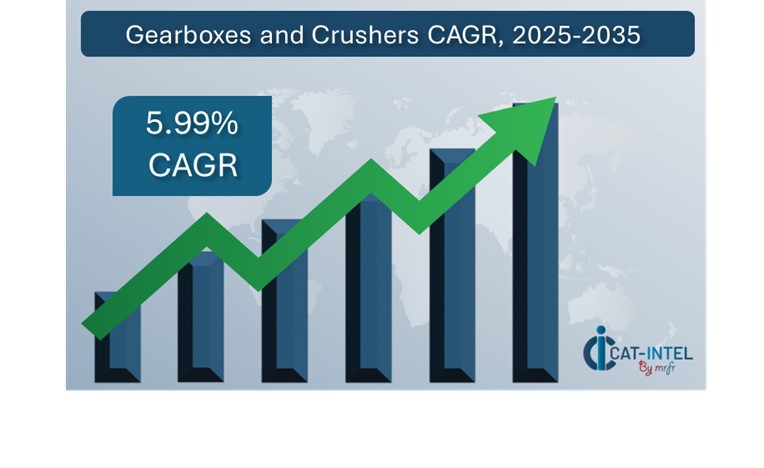

Market Size: The global Gearboxes and Crushers market is projected to reach USD 17.85 billion by 2035, growing at a CAGR of approximately 4.89% from 2025 to 203

Growth Rate: 4.89%

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: The growing need for real-time data and smooth process integration is increasing demand for improved gearboxes and crushers in manufacturing and mining operations.

-

Construction and Mining Growth: Rapid infrastructure construction and mining activities are driving up demand for high-performance gearboxes and crushers. Technological Transformation:

-

Technological Transformation: Predictive analytics and automation are now being used to boost system performance, lower maintenance costs, and extend the life of these crucial components.

-

Innovations: Businesses can choose specific features and functionalities that are adapted to their business, resulting in significant cost savings and increased adaptability.

-

Investment initiatives: Companies are investing extensively in energy-efficient and cloud-connected gearbox and crusher systems, with the goal of decreasing maintenance costs and enabling remote monitoring.

-

Regional insights: Asia Pacific and North America continue to be key contributors to the worldwide gearbox and crusher market, owing to their established infrastructure and rapid adoption of cutting-edge technology.

Key Trends and Sustainability Outlook:

-

Cloud Integration: Cloud technologies are increasingly being integrated into gearbox and crusher systems to improve scalability, real-time monitoring, and data access. Cloud-based systems make it easier to monitor performance, predict errors, and optimize operations remotely.

-

Advanced Features: The use of IoT, AI, and automated maintenance in gearboxes and crushers is transforming operations. These solutions enable real-time insights, automation, and enhanced decision-making, resulting in increased efficiency and lower operational costs.

-

Focus on Sustainability: Sustainable aims are becoming increasingly important in the use of energy-efficient gearboxes and crushers. Companies are focused on reducing carbon footprints and energy consumption through advanced design and operational tracking tools.

-

Customization Trends: The demand for industry-specific gearboxes and crushers is increasing. Solutions designed for industries such as construction, mining, and heavy manufacturing are increasingly in demand to address distinct operational issues.

-

Data-Driven Insights: Advanced analytics and monitoring systems are now built into gearboxes and crushers, allowing organizations to estimate wear and tear, optimize performance, and measure key operational data.

Growth Drivers:

-

Digital Transformation: The increased reliance on digital technology is encouraging the development of smart, connected gearboxes and crushers, which offer improved monitoring, proactive upkeep, and automation.

-

Demand for Process Automation: As businesses seek to streamline their processes, there is a growing need for automated gearboxes and crushers that may eliminate human error, improve precision, and boost production.

-

Scalability Requirements: Businesses are increasingly investing in scalable gearboxes and crushers that can expand with their needs. Modular systems enable firms to add or modify functionality as needed, resulting in long-term efficiency.

-

Regulatory Compliance: With increasing requirements in mining, construction, and manufacturing, businesses need gearboxes and crushers that can help them meet environmental and safety standards while delivering optimal performance.

-

Globalization: The worldwide nature of industries like mining and construction necessitates gearboxes and crushers that can handle a wide range of operational conditions, from multilingual support to international standard compliance.

Overview of Market Intelligence Services for the Gearboxes and Crushers Market:

Recent evaluations have identified important issues in the gearbox and crusher markets, such as high capital investment prices and the necessity for customized solutions matched to specific operational requirements. Market intelligence studies provide useful insights into procurement prospects, allowing businesses to identify cost-cutting methods, enhance supplier relationships, and increase the overall success of equipment installations. These insights also ensure conformity to industry norms, allowing for high-quality operational performance while successfully managing expenses.

Procurement Intelligence for Gearboxes and Crushers: Category Management and Strategic Sourcing

To remain competitive in the gearbox and crusher markets, businesses are improving their procurement procedures through spend analysis and supplier performance monitoring. Effective category oversight and strategic sourcing are critical for lowering procurement costs and maintaining a consistent supply of long-lasting, efficient gearboxes and crushers. Businesses can optimize their buying by utilizing market intelligence strategies and negotiate favourable terms for these crucial assets, leading to long-term operational efficiency and cost control.

Pricing Outlook for Gearboxes and Crushers: Spend Analysis

The pricing prognosis for gearboxes and crushers is projected to be moderately dynamic, with fluctuations caused by a variety of factors. Technological improvements, demand for energy-efficient solutions, the requirement for customization, and regional pricing variances are all important drivers. Furthermore, the increased adoption of smart technologies such as IoT and AI, along with a greater emphasis on environmental compliance, is putting upward pressure on prices for these critical pieces of industrial equipment.

Graph shows general upward trend pricing for Gearboxes and Crushers and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic

Efforts to streamline procurement procedures, improve vendor management, and implement modular solutions are critical to cost control in the gearbox and crusher sector. Leveraging digital technologies for market monitoring, pricing forecasting using analytics, and effective contract administration can assist save costs and maintain smooth operations.

Partnering with dependable suppliers, negotiating long-term contracts, and investigating flexible pricing methods are critical techniques for effectively managing gearbox and crusher expenses. Despite these hurdles, prioritizing scalability, assuring efficient performance, and implementing energy-saving technologies will be critical to sustaining cost-effectiveness and operational excellence.

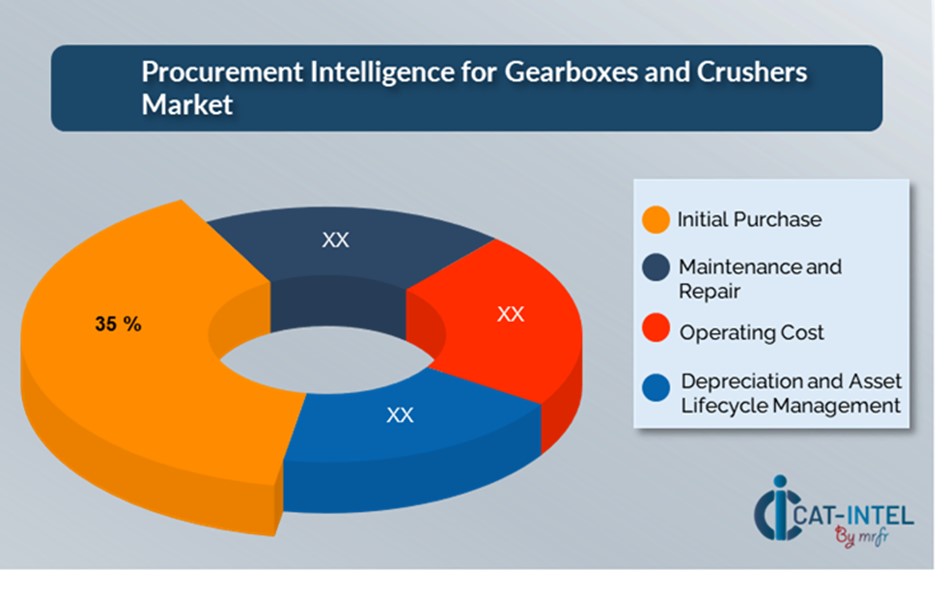

Cost Breakdown for Gearboxes and Crushers: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Initial Purchase: (35%)

-

Description: The initial purchase cost refers to the initial investment required to acquire gearboxes and crushers, which includes the cost of the equipment, installation fees, and any associated charges such as shipping or modification.

-

Trend: Advanced, high-efficiency gearboxes and crushers are becoming more expensive to purchase, particularly with the integration of automation, IoT, and AI technologies for improved performance.

- Maintenance and Repair: (XX%)

- Operating Costs: (XX%)

- Depreciation and Asset Lifecycle Management: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the gearbox and crusher industry, streamlining procurement processes and using strategic negotiation strategies can result in significant cost savings and increased operational efficiency. Long-term partnerships with dependable suppliers, particularly those who provide energy-efficient and high-performance equipment, can result in more attractive price structures and terms, such as volume-based discounts and packaged service packages. Exploring subscription-based or a performance-based pricing structures can help you save money up front while also mitigating future price hikes.

Collaboration with suppliers who value innovation and scalability provides additional benefits, such as access to smart technologies, predictive maintenance solutions, and modular components that save long-term operational expenses. Implementing digital procurement solutions like contract management systems and usage analytics improves transparency, reduces overspending, and maximizes equipment utilization. Businesses that diversify their suppliers and implement a multi-vendor strategy can reduce reliance on a single source, eliminate risks such as supply delays or service failures, and increase negotiation leverage.

Supply and Demand Overview for Gearboxes and Crushers: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The market for gearboxes and crushers is expanding steadily, owing to increased industrialization and technical improvements in areas such as mining, building, and manufacturing. Automation breakthroughs, environmental laws, and changing global economic situations all have an impact on supply and demand.

Demand Factors:

-

Trends in Industrial Automation: Growing automation requirements in industries such as mining and construction are increasing demand for improved gearboxes and crushers that increase operating efficiency.

-

Movement Toward Energy: Efficient Solutions: As companies strive to minimize energy consumption and expenses, there is a growing demand for energy-efficient, high-performance gearboxes and crushers.

-

Industry-Specific Requirements: Industries like mining and construction require specific solutions that are tailored to the rigorous operational environments and regulatory standards.

-

Integration with IoT and Smart Technologies: There is a growing demand for equipment that seamlessly connects with IoT devices, enabling real-time data analysis and predictive maintenance.

Supply Factors:

-

Technological Advancements: Advancements in smart manufacturing, AI, and machine learning improve gearbox and crusher designs, leading to increased efficiency and reliability.

-

Vendor Ecosystem: The market sees an increasing number of suppliers, ranging from huge multinational corporations to specialized, niche firms, offering a wide range of products for various industries.

-

Global Economic Factors: Material cost fluctuations, trade rules, and global demand for industrial equipment all have an impact on the price and availability of gearboxes and crushers.

-

Scalability and Flexibility: There is an ever-growing need for modular, scalable systems that can accommodate organizations of all sizes, assuring equipment adaptability and long-term cost-effectiveness.

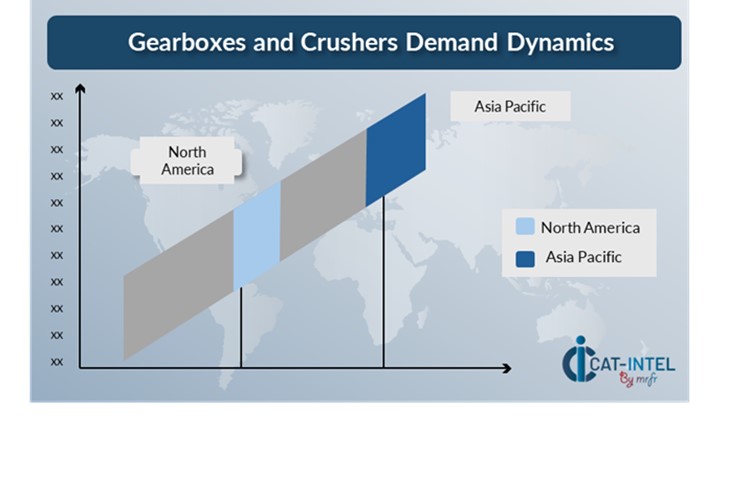

Regional Demand-Supply Outlook: Gearboxes and Crushers

The Image shows growing demand for Gearboxes and Crushers in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Gearboxes and Crushers

Asia Pacific, particularly China, is a dominant force in the global Gearboxes and Crushers market due to several key factors:

-

Strong Manufacturing and Industrial Growth: The rapidly expanding industries of construction, mining, automotive, and energy are driving demand for heavy machinery, particularly gearboxes and crushers.

-

Cost-Effective Production: The region's lower labour and material costs allow manufacturers to create gearboxes and crushers at a more competitive price.

-

Rapid Infrastructure Development: Many countries in Asia Pacific are embarking on huge infrastructure projects, particularly in construction and mining. With rising demand for raw materials and development projects, there is a greater requirement for crushers and gearboxes to aid in extraction and material handling.

-

Technological Advancements and Innovation: Asian manufacturers are among the first to embrace and integrate new technology into their gearbox and crusher products. Innovations such as automation, IoT integration, and AI-driven monitoring systems are making equipment more efficient, reliable, and cost-effective. -

Export Hub for Global Markets: Asia Pacific, especially China, is a major manufacturing hub and exporter of industrial equipment.

Asia Pacific remains a key hub Gearboxes and Crushers Price Drivers Innovation and Growth

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the gearboxes and crushers market is both diversified and competitive, with global leaders and specialized regional companies affecting critical elements such as price tactics, product innovation, and service quality. Large multinational corporations dominate the market with extensive product offerings that span a wide range of industries, from mining and construction to production. These providers provide high-performance gearboxes and crushers that are scalable and long-lasting, meeting even the most rigorous operational requirements.

Smaller, regional suppliers specialize in highly specialized items or serve certain industries, such as renewable energy, agriculture, or small-scale manufacturing. These providers frequently provide customized solutions targeted to local market needs and incorporate cutting-edge technology such as AI for predictive maintenance and IoT for real-time data collection. Leading suppliers in the market are increasingly focused on digital transformation and operational efficiency, advancing automation and smart capabilities in gearboxes and crushers. Innovations like IoT connectivity, AI integration for predictive maintenance, and energy-efficient designs are becoming key differentiators.

Key Suppliers in the Gearboxes and Crushers market include:

- Komatsu Ltd.

- Siemens AG

- ABB Ltd.

- FLSmidth & Co.

- Metso Outotec

- Sandvik AB

- Eaton Corporation

- Doosan Infracore

- Terex Corporation

- The Weir Group

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

As industrial processes grow, businesses invest in innovative equipment to boost operational efficiency, reduce downtime, and handle more complicated tasks. |

Cloud Adoption |

The gearboxes and crushers sector is increasingly using cloud-based solutions for scalability, cost-efficiency, and remote monitoring. Cloud-based tools for maintenance tracking, predictive analytics, and remote diagnostics are changing the way firms operate and maintain equipment. |

Product Innovation |

Gearbox and crusher manufacturers are using modern technologies like AI-driven monitoring and real-time data processing to enhance operating efficiency. |

Technological Advancements |

Technological breakthroughs like machine learning, IoT integration, and RPA are being integrated into gearboxes and crushers to improve predictive maintenance, performance analytics, and equipment efficiency. |

Global Trade Dynamics |

Global trade dynamics, including altering rules, compliance requirements, and fluctuating tariffs, have a considerable impact on the gearbox and crusher business. Companies in global sectors must adjust to these developments, which impact supply chain logistics, equipment pricing, and market expansion strategies. |

Customization Trends |

Modular systems and interaction with third-party tools and software enable greater flexibility and customization, which is especially useful in industries with specialized demands such as mining, cement manufacturing, and renewable energy. |

Gearboxes and Crushers Attribute/Metric |

Details |

Market Sizing |

The global Gearboxes and Crushers market is projected to reach USD 17.85 billion by 2035, growing at a CAGR of approximately 4.89% from 2025 to 2035.

|

Gearboxes and Crushers Technology Adoption Rate |

The global adoption for gearbox and crusher technologies, is gradually expanding to about 65%, with growing need for automation, efficiency, and performance enhancements. Transitioning to cloud-based equipment monitoring and diagnostics for remote management, predictive maintenance. |

Top Gearboxes and Crushers Industry Strategies for 2025 |

In 2025, key industry strategies for the gearboxes and crushers market include integrating AI and machine learning for predictive maintenance and failure analysis, streamlining operations with modular equipment, prioritizing energy efficiency, and implementing IoT systems for real-time monitoring and data collection. |

Gearboxes and Crushers Process Automation |

Approximately 50% of organizations are incorporating automated systems into their equipment to improve operational efficiency and reduce downtime. |

Gearboxes and Crushers Process Challenges |

The gearbox and crusher industry faces challenges such as high capital investment costs, resistance to technology adoption, data integration with legacy systems, and the need for continuous equipment updates to keep up with technological advancements.

|

Key Suppliers |

Leading suppliers in the gearbox and crusher business include Komatsu Ltd., Siemens AG and ABB Ltd. These companies provide a variety of solutions for industries like construction, mining, and manufacturing.

|

Key Regions Covered |

Key regions for gearbox and crusher adoption are Asia Pacific and North America. Demand is also high in emerging markets, where industrial automation and operational efficiency are top goals.

|

Market Drivers and Trends |

The gearboxes and crushers market are growing due to increased industrialization, automation needs, and adoption of cloud-based monitoring systems to enable real-time data analysis and predictive maintenance.

|