Summary Overview

Glass Bottles Europe Market Overview

The global glass bottle market in Europe is steadily expanding, driven by rising demand in a variety of industries, including food and beverage, pharmaceuticals, cosmetics, and chemicals. This industry encompasses a wide range of glass bottle types, including custom-designed bottles, standard containers, and environmentally friendly packaging options. Our paper provides an in-depth analysis of procurement patterns, with an emphasis on cost optimization measures and the implementation of sustainable practices to improve operational efficiency in the glass bottle supply chain.

Key future procurement concerns include managing production costs, assuring sustainable raw material sourcing, complying with environmental standards, and incorporating innovative technologies into manufacturing processes. Digital procurement tools and strategic sourcing are critical for improving procurement operations and remaining competitive in the market.

-

Market Size The global Glass Bottles Europe market is projected to reach USD 30 billion by 2025, growing at a CAGR of approximately 3.30% from 2025 to 2035.

-

Sector Contributions Growth in the market is driven by -

Manufacturing and Supply Chain Optimization The demand for glass bottles in Europe is being pushed by the need for more efficient manufacturing processes and supply chain management.

-

Retail and E-Commerce Growth As e-commerce continues to grow, firms must develop new packaging solutions to fulfil consumer demand. Glass bottles are increasingly being utilized for premium items in industries such as beverages, cosmetics, and pharmaceuticals, driven by a need for appealing, sustainable packaging.

-

Technological transformation Production technology advancements include automation and AI-powered systems that improve glass bottle manufacture, increase production capacity, and reduce waste. These innovations enable predictive analytics, which improves supply chain and inventory management.

-

Innovations Glass bottles provide a recyclable, sustainable alternative to plastics, contributing to the growing trend of eco-friendly packaging solutions. The development of lightweight glass bottles and eco-friendly manufacturing procedures is lowering costs and environmental effect.

-

Investment Initiatives Companies are spending extensively in sustainable practices, such as energy-efficient production techniques, recycled materials, and eco-friendly designs, to meet consumer demand for ecologically responsible packaging.

-

Regional insights Northern Europe is still a big market for glass bottles due to strict environmental restrictions and consumer desire for sustainability.

Key Trends and Sustainability Outlook

-

Sustainability Focus Growing demand for eco-friendly glass bottles is being driven by customer preferences for recyclable and sustainable packaging. Manufacturers are implementing more energy-efficient techniques and recycled glass to lessen environmental effect and meet regulatory requirements.

-

Advanced Packaging Features The use of smart technologies like QR codes, NFC (Near Field Communication), and IoT sensors in glass bottles improves traceability, transparency, and consumer involvement. These advances increase brand tracking and sustainability reporting.

-

Customization Trends There is an increasing demand for personalized glass bottles, with manufacturers providing specialized solutions for many industries, particularly the food, beverage, and luxury sectors. Brands are investing in distinctive designs to increase product appeal and differentiation in competitive markets.

-

Focus on productivity and Automation Glass bottle makers are increasingly using automated production techniques to increase productivity, decrease waste, and lower production costs. Automation in moulding, packing, and quality control is used to satisfy high-volume demands.

-

Data-Driven Production Insights Advanced data analytics are being used to improve manufacturing operations, demand forecasting, and supply chain management. By examining production and sales data, producers may better predict market trends and modify production accordingly.

Growth Drivers

-

Sustainability and Environmental Regulations An increased emphasis on recycling and eco-friendly packaging techniques is driving the glass bottle market in Europe. Stricter environmental restrictions are prompting businesses to invest in eco-friendly glass production technologies.

-

Shift to Premium Packaging As consumer demand for premium packaging in the food, beverage, and cosmetics industries grows, glass bottles are considered as a high-end packaging option.

-

Customization and Innovation Manufacturers are inventing and providing highly customizable glass packaging alternatives, notably for the beverage industry, to fulfil unique client and branding needs.

-

Global Trade and Export Opportunities As European manufacturers expand their exports to international markets, there is a greater demand for glass bottles that can meet multi-market requirements such as compliance with international packaging regulations, multi-language labelling, and diverse product specifications.

-

Consumer Preferences for Transparency and Quality European consumers are seeking greater transparency regarding product sustainability and source. Glass bottles, as a premium and recyclable packaging solution, correspond to these evolving customer demands.

Overview of Market Intelligence Services for the Glass Bottles Europe Market

Recent evaluations have highlighted numerous important difficulties in the glass bottle business, including increased production costs, inefficiencies in the supply chain, and a need for packaging innovation. Market intelligence studies provide useful insights into procurement prospects, allowing businesses to optimize their sourcing strategy, find cost-cutting methods, and streamline supplier management to improve overall operational efficiency. These insights also contribute to industry standard compliance, product quality, and cost-effective manufacturing and logistics management methods.

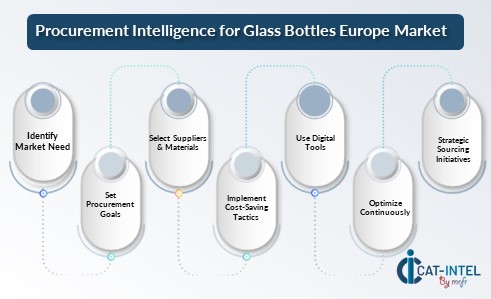

Procurement Intelligence for Glass Bottles Europe Category Management and Strategic Sourcing

To preserve a competitive advantage in the glass bottle industry, businesses are streamlining procurement procedures through spend monitoring and supplier performance tracking. Effective category management and strategic sourcing are critical for lowering procurement costs while maintaining a steady supply of high-quality glass packaging solutions. Businesses may improve their procurement strategies, negotiate better terms with suppliers, and ensure a consistent supply of quality glass bottles that fulfil both regulatory and sustainability standards by employing actionable market knowledge.

Pricing Outlook for Glass Bottles Europe Spend Analysis

The pricing prognosis for glass bottles is projected to remain moderately dynamic, with potential fluctuations influenced by several major factors. These include advancements in manufacturing technology, rising demand for environmentally friendly packaging solutions, volatility in raw material prices, and regional pricing differences. Furthermore, the expanding adoption of eco-friendly methods, as well as the growing emphasis on quality and environmental efficiency.

Graph shows general upward trend pricing for Glass Bottles Europe and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, improve supplier management, and implement novel packaging solutions are crucial for cost reduction in the glass bottle industry. Leveraging digital solutions for market monitoring, price forecasting via analytics, and effective contract administration can help businesses improve cost efficiency and reduce price swings.

Building long-term partnerships with dependable suppliers and constantly evaluating their performance can help assure consistent quality while lowering costs over time. Partnering with suppliers who prioritize sustainable sourcing and considering bulk purchasing or multi-year contracts can assist secure competitive pricing and mitigate against price fluctuation. Despite these hurdles, focusing on sustainable production methods, guaranteeing dependable supply chain management, and implementing strategic procurement processes will be critical to preserving cost-effectiveness and attaining sustainability goals.

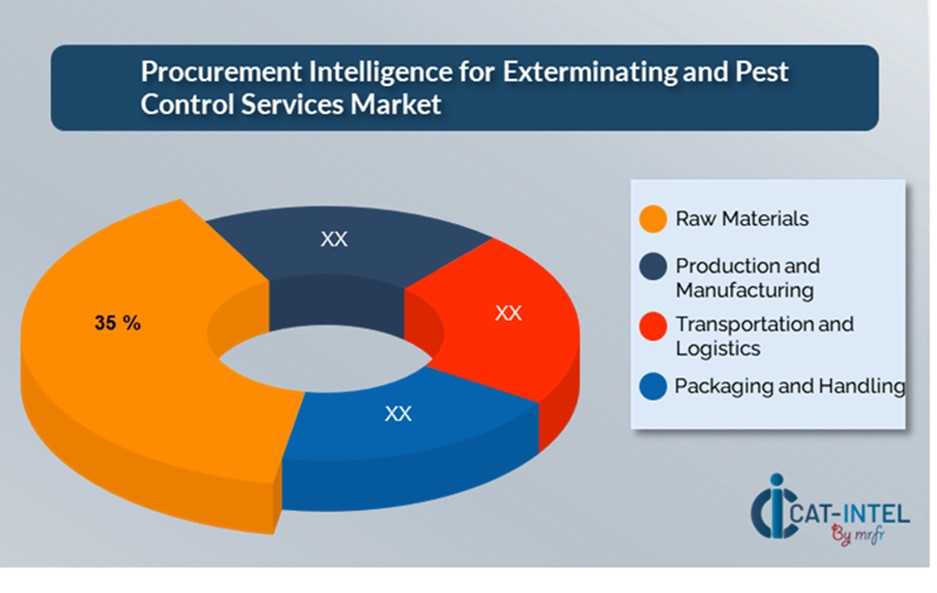

Cost Breakdown for Glass Bottles Europe Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Raw Materials (35%)

-

Description Silica sand, soda ash, limestone, and recycled glass (cullet) are the key raw materials used in the creation of glass bottles. These elements are mixed and melted at high temperatures to create glass.

-

Trends An important development in the glass bottle business is the rising use of recycled glass (cullet), which not only cuts raw material costs but also lowers energy usage throughout the manufacturing process.

- Production and Manufacturing (XX%)

- Transportation and Logistics (XX%)

- Packaging and Handling (XX%)

Cost-Saving Opportunities Negotiation Levers and Purchasing Negotiation Strategies

In Europe's glass bottle sector, streamlining procurement processes and implementing strategic bargaining strategies can result in significant cost savings and increased operational efficiency. Long-term relationships with suppliers, particularly those that provide sustainable and creative solutions, can result in improved price structures and attractive terms, such as volume-based discounts and bundled service packages. Multi-year contracts and subscription-based arrangements offer chances to negotiate reduced rates while mitigating price rises over time.

Collaborating with suppliers who prioritize sustainability, innovation, and scalability provides additional benefits, such as access to modern technology, eco-friendly materials, and production efficiency, which reduce long-term operational expenses. Implementing digital procurement technologies like contract management systems and usage analytics improves transparency, reduces overordering, and maximizes material utilization. Diversifying supplier options and implementing multi-supplier solutions can help to reduce reliance on a single provider, manage risks such as supply chain disruptions, and increase negotiation leverage. This technique promotes a more robust and cost-effective buying strategy in the highly competitive European glass bottle industry.

Supply and Demand Overview for Glass Bottles Europe Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The glass bottle market in Europe is expanding steadily, driven by rising demand for sustainable packaging solutions in industries such as food and beverage, cosmetics, and pharmaceuticals. Technological breakthroughs, environmental legislation, and changing consumer preferences all have an impact on supply and demand dynamics.

Demand Factors

-

Sustainability Initiatives As consumers' preferences for eco-friendly packaging grow, glass bottles are in high demand as a sustainable alternative to plastic and other materials.

-

Regulatory Pressures Increasing environmental laws, such as single-use plastic bags and extended producer responsibility programs are encouraging firms to use more sustainable packaging solutions.

-

Industry-Specific Requirements Food and beverage, pharmaceutical, and cosmetics industries demand packaging solutions that meet specific regulatory criteria while also ensuring product safety and quality.

-

Customization Trends The market is being shaped by an increasing demand for bespoke glass bottle designs to suit branding requirements and promote product distinctiveness.

Supply factors

-

Technological Advancements Innovations in glass manufacturing technologies, including as lightweighting and automated production lines, are increasing efficiency and product offers, boosting supplier competitiveness.

-

Vendor Ecosystem The rise of both large-scale glass manufacturers and specialized, niche producers offer a broad range of options for clients.

-

Raw Material Availability and Costs The availability and cost of raw materials such as silica sand and soda ash affect glass bottle production costs, influencing total price and supply chain stability.

-

Customization and Scalability The growing need for customizable and scalable glass bottle solutions, driven by small-to-medium businesses and huge worldwide brands, has pushed suppliers to provide more flexible and tailored manufacturing capabilities.

Regional Demand-Supply Outlook Glass Bottles Europe

The Image shows growing demand for Glass Bottles in both Northern Europe and Southern Europe, with potential price increases and increased Competition

Northern Europe Dominance in the Glass Bottles Europe Market

Northern Europe, particularly the United Kingdom, is a dominant force in the Glass Bottles Europe market due to several key factors

-

Strong Sustainability Focus Northern European countries prioritize environmental sustainability, implementing tight recycling rules and regulations.

-

Advanced Manufacturing Capabilities Northern Europe boasts some of the most advanced glass manufacturing processes, allowing for the efficient production of high-quality glass bottles.

-

Established Supply Chain Infrastructure The region has well-developed logistics and supply chain infrastructure, allowing for effective distribution and availability of glass bottles throughout Europe and beyond.

-

High consumer demand for premium packaging Northern European consumers are increasingly looking for high-quality and premium packaging, particularly for beverages, luxury items, and medications regulatory.

-

Regulatory Support Northern European governments foster innovation in packaging and recycling through incentives, research funding, and legislation that promote eco-friendly alternatives.

Northern Europe Remains a key hub Glass Bottles Europe Price Drivers Innovation and Growth.

Supplier Landscape Supplier Negotiations and Strategies

The supplier landscape in the European glass bottle market is equally broad and competitive, with a mix of global and regional competitors. These suppliers have a significant impact on pricing strategies and manufacturing capacities. Large-scale glass manufacturers dominate the market, offering a diverse range of standardized glass bottle solutions, while smaller, niche competitors focus on new designs, sustainable materials, or specialized industry requirements such as premium packaging or eco-friendly alternatives.

The glass bottle supplier ecosystem in Europe includes both established worldwide manufacturers and local, innovative businesses that serve to industry-specific needs such as the food and beverage, pharmaceutical, and cosmetics industries. As businesses prioritize sustainability and eco-friendly practices, glass bottle suppliers are focusing on incorporating advanced manufacturing techniques, providing recyclable and lightweight options, and improving customization capabilities to meet the increasing demand for differentiated and sustainable packaging. To remain competitive, suppliers are implementing digital technologies to expedite production processes, boost efficiency, and provide flexibility in production.

Key Suppliers of Glass Bottles market in Europe include

- Encirc

- Ardagh Group

- Owens–Illinois (O-I)

- Vitro

- Gerresheimer

- Saint Gobain

- Rexam (formerly called Ball Corporation

- Zignago Vetro

- Vidrala

- Saverglass

Key Developments Procurement Category Significant Development

Significant Development |

Description |

Market Growth |

The European glass bottle market is expanding rapidly, propelled by increased demand for sustainable and high-quality packaging solutions in industries such as food & beverage, cosmetics, and pharmaceuticals. |

Cloud Adoption |

There is a noticeable shift toward sustainable glass bottle production, motivated by the need to reduce environmental effect and comply with stricter recycling and packaging rules. This movement is also spurred by the increased preference among consumers and businesses for packaging options that encourage recyclability and lower carbon footprints. |

Product Innovation |

Manufacturers are increasing their product offers by embracing technologies such as lightweight glass bottles, innovative manufacturing techniques, and customizable designs. These innovations serve industries that value both functionality and aesthetic appeal. |

Technological Advancements |

Glass bottle producers are benefiting from sophisticated technologies like automation, AI, and IoT to improve production efficiency. |

Global Trade Dynamics |

Global trade dynamics affect multinational enterprises' procurement, production, and distribution of glass bottles, requiring adaptive and compliant manufacturing processes. |

Customization Trends |

Customized glass bottles are becoming increasingly popular in areas such as luxury goods, pharmaceuticals, and high-end beverages. Suppliers are responding to this trend by offering custom designs, colour variations, and sizes, as well as flexible manufacturing runs that accommodate smaller or more customized orders. |

Glass Bottles Europe Attribute/Metric |

Details |

Market Sizing |

The global Glass Bottles Europe market is projected to reach USD 30 billion by 2025, growing at a CAGR of approximately 3.30% from 2025 to 2035.

|

Glass Bottles Europe Technology Adoption Rate |

Approximately 60% of firms in Europe have embraced sustainable and creative packaging solutions, with a strong preference for glass bottles due to their eco-friendliness and customer demand for recyclable, premium packaging options.

|

Top Glass Bottles Europe Industry Strategies for 2025 |

Key tactics in the glass bottle industry include using sustainable materials (such as recycled glass or eco-friendly coatings), increasing branded customization choices, and investing in production technologies to increase efficiency. The emphasis on lowering carbon footprints and providing lightweight, energy-efficient glass bottles is also gaining popularity.

|

Glass Bottles Europe Process Automation |

Automation is used in around 50-55% of glass bottle manufacturing processes, particularly for quality control, inventory management, and production line efficiency.

|

Glass Bottles Europe Process Challenges |

Major issues in the glass bottle industry include expensive raw material costs (such as silica sand and soda ash), energy-intensive manufacturing methods, and environmental concerns about waste and recycling. Resistance to implementing more sustainable practices in some sectors, as well as regulatory compliance difficulties, can be a challenge.

|

Key Suppliers |

Large-scale producers such as Encirc, Ardagh Group and Owens–Illinois (O-I) are among the European glass bottle market's leading providers, as are regional businesses that provide specialized and environmentally friendly glass bottle solutions.

|

Key Regions Covered |

Glass bottles are widely used in Europe, Northern and Southern, particularly in the food and beverage, cosmetics, and pharmaceutical industries. |

Market Drivers and Trends |

The glass bottle market is expanding due to the growing need for sustainable packaging solutions, increased acceptance of recycled materials, customer preference for luxury packaging, and advances in manufacturing technology. Lightweighting, lowering carbon footprints, and adopting circular economy concepts (recycling and reuse) are all having a big impact on the market.

|