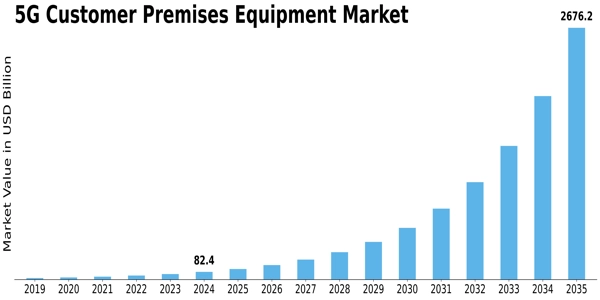

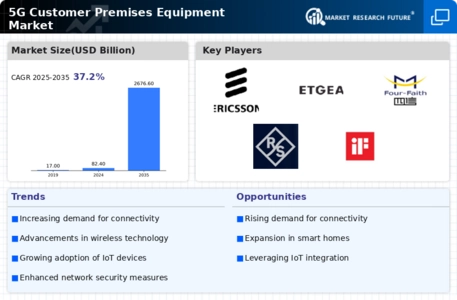

5g Customer Premises Equipment Size

5G Customer Premises Equipment Market Growth Projections and Opportunities

The need for edge computing is going up after the COVID-19 pandemic because there's a big focus on making communication better. Many people are now working from home, and online healthcare is getting more popular. This means we need a special kind of network that is very secure and can connect quickly. Telecom companies are likely to benefit from this because it's cheaper for them to add more abilities to their networks than to build big data centers. This cost advantage will help them do bigger data center projects in the future. Edge computing has become a technology that's made for specific uses, with tools and designs made for certain situations. Next-gen CDNs, network functions, 5G virtualization, and game streaming are some of the situations where edge computing is expected to become very important in the coming years. This is the start of a world where edge computing is available to a lot of people.

The global Edge Computing Market is split into different parts based on technology, how it's set up, what it's made of, how it's used, and where in the world it is. In terms of technology, Fog Computing is the biggest part with a market value of USD 5,228.4 million in 2021, and it's expected to grow a lot in the coming years. When it comes to how it's set up, On-Premise is the biggest part with a market value of USD 5,090.5 million in 2021, and it's expected to grow a lot too. In terms of the cloud, the Public part is the biggest with a market value of USD 2,207.3 million in 2021, and it's expected to grow a lot as well. The different parts that make up edge computing, like Hardware, Software/Solutions, and Services, all play important roles. For Hardware, Processors/CPUs are the biggest part with a market value of USD 1,130.7 million in 2021, and it's expected to grow a lot too. In terms of how it's used, the Industrial Internet of Things (IIoT) is the biggest part with a market value of USD 2,089.6 million in 2021, and it's expected to grow a lot in the future.

Leave a Comment