Advanced Material Market Share

Advanced Material Market Research Report Information By Product Type (Polymers, Metal & Alloys, Glasses, Composites and Ceramics), By Application (Medical Devices, Automotive, Aerospace, Electricals & Electronics, Industrial, Power and Others) And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2035

Market Summary

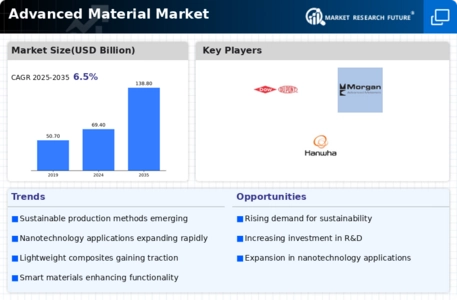

As per Market Research Future Analysis, the Global Advanced Material Market was valued at USD 69.41 Billion in 2024 and is projected to grow to USD 138.78 Billion by 2035, with a CAGR of 6.50% from 2025 to 2035. The market is driven by the increasing demand for durable and eco-friendly products, advancements in technologies like nanotechnology, and significant growth in the aerospace and automotive sectors. The aerospace industry is particularly focused on lightweight materials such as carbon fiber composites, while the automotive sector is seeing a rise in the use of advanced materials for electric vehicles (EVs). The ceramics segment leads the market, offering high-performance alternatives to traditional materials. North America holds the largest market share, followed by Europe and the Asia-Pacific region, which is expected to grow at the fastest rate.

Key Market Trends & Highlights

Key trends driving the advanced material market include technological advancements and sector-specific demands.

- Market Size in 2024: USD 69.41 Billion; projected to reach USD 138.78 Billion by 2035.

- CAGR from 2025 to 2035: 6.50%; driven by aerospace and automotive sectors.

- Aerospace sector demand for carbon fiber composites is increasing; Boeing 787 Dreamliner is 50% carbon fiber by weight.

- Ceramics segment dominates the market; used extensively in medical devices and other applications.

Market Size & Forecast

| 2024 Market Size | USD 69.41 Billion |

| 2035 Market Size | USD 138.78 Billion |

| CAGR (2025-2035) | 6.50% |

| Largest Regional Market Share in 2024 | North America. |

Major Players

Key players include 3M Company, Momentive Performance Materials Inc., BASF SE, DowDuPont Inc., Morgan Advanced Materials, Hanwha Group, PyroGenesis Canada Inc., Cytech Products Inc., Akzo Nobel N.V., and Hexcel Corporation.

Market Trends

Growing adoption in the aerospace industry is driving the market growth

One of the important sectors for the market for advanced materials is the aircraft industry. During the projection period, there will be a significant increase in the demand for these materials from the aerospace industry. The aerospace sector is continuously looking for materials that are both lightweight and robust enough to sustain difficult flight conditions. Demand for innovative materials will be further fueled by the growing usage of carbon fiber composites in the manufacture of airplanes. In order to lighten and strengthen airplanes, the aerospace industry is using carbon fiber composites, which are lightweight materials.

For instance, the Boeing 787 Dreamliner, which made its debut in 2011, is 50% carbon fiber composites by weight, making it substantially lighter and more fuel-efficient than earlier generations of airplanes. The demand for more environmentally friendly, operating-cost-saving, fuel-efficient aircraft that can satisfy increasingly strict environmental requirements is what propels the market. Because of this, it is anticipated that there will be a continued high demand for innovative materials in the aerospace sector in the years to come.

The usage of innovative materials in the automotive sector is being driven by the increasing demand for electric cars (EVs). For instance, lithium ions are used to store and release energy in rechargeable lithium-ion batteries. Due to their high energy density, small size, and speedy recharging, these batteries are being employed in EVs more and more. In addition, they outlast conventional lead-acid batteries and are environmentally beneficial. Furthermore, lightweight materials like composites and aluminum alloys are developed using innovative technologies and employed in electric vehicles.

The car's range can be extended by using these materials to lighten the vehicle and increase energy efficiency. In the body and chassis of EVs, for instance, carbon fiber reinforced polymer (CFRP), a lightweight and high-strength composite material, is utilized to reduce weight and boost performance.

The primary driving forces behind the market for advanced materials are an increase in R&D efforts across numerous countries and a rise in industrialisation on a scale. Demand for advanced materials is being driven by the quick adoption of these materials in the automotive, aerospace, healthcare, and other industries. According to analysts, during the anticipated time, these cutting-edge materials will displace the use of metal and plastic. End consumers are transitioning to the usage of innovative materials as a result of the development of ceramics and composites that have increased strength, resistance to abrasion, and light weight.

The majority of ceramics are used in medical devices, and as the breadth of the healthcare sector expands, so will the demand for ceramics. Thus, driving the advanced material market revenue.

In July 2024, Arvind Ltd, a company renowned for its denim and apparel brands, intends to enhance its advanced materials division by implementing inventive textile applications in sectors including defense, aerospace, and other infrastructure segments. During the fiscal year 2024, all the entities within the advanced material segment were merged into a distinct corporation called Advanced Material Ltd. This consolidation was done with the aim of enhancing concentration and expanding the business. The purpose of the move is to assist them in addressing the necessary actions for expansion in that particular area, as well as seizing new prospects.

This will not only be cost-effective but will also guarantee clear and accurate reporting of their advancements. The division's capacities were increased, and additional divisions, including defense, were incorporated, creating opportunities for future expansion. The increase in Human Protection sales was primarily due to a larger market share in important customer accounts and improved performance in the Middle East region. In FY24, the textile industry experienced a decline, specifically in the company's revenue from garmenting. This can be attributed to reduced demand for denim items and lower realization.

The Global Advanced Material Market is poised for transformative growth, driven by innovations in nanotechnology and sustainable practices that are reshaping industries from aerospace to electronics.

U.S. Department of Energy

Advanced Material Market Market Drivers

Market Growth Projections

The Global Advanced Material Market Industry is poised for substantial growth, with projections indicating a market value of 69.4 USD Billion in 2024 and an anticipated increase to 138.8 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 6.5% from 2025 to 2035, reflecting the increasing adoption of advanced materials across various sectors. The market dynamics are influenced by factors such as technological advancements, rising environmental regulations, and expanding applications, all contributing to a robust outlook for the industry.

Rising Environmental Regulations

The Global Advanced Material Market Industry is increasingly influenced by stringent environmental regulations aimed at reducing carbon footprints and promoting sustainability. Governments worldwide are implementing policies that encourage the use of eco-friendly materials and processes. For example, regulations mandating the reduction of hazardous substances in manufacturing are driving the adoption of advanced materials that comply with these standards. This shift not only aligns with global sustainability goals but also opens new market opportunities for manufacturers who can innovate responsibly. Consequently, the industry's growth trajectory remains positive as it adapts to these regulatory landscapes.

Growing Demand for Lightweight Materials

The Global Advanced Material Market Industry experiences a notable surge in demand for lightweight materials, particularly in the automotive and aerospace sectors. As manufacturers strive to enhance fuel efficiency and reduce emissions, materials such as carbon fiber and aluminum alloys are increasingly favored. For instance, the automotive sector is projected to utilize advanced composites to achieve weight reductions of up to 30 percent in vehicles. This trend is expected to contribute to the market's growth, with the industry valued at 69.4 USD Billion in 2024, indicating a robust shift towards sustainable manufacturing practices.

Technological Advancements in Material Science

Technological innovations play a pivotal role in shaping the Global Advanced Material Market Industry. Breakthroughs in nanotechnology and 3D printing are revolutionizing material properties and applications. For example, the development of nanomaterials allows for enhanced strength-to-weight ratios, making them suitable for various applications, including electronics and medical devices. Additionally, advancements in additive manufacturing enable the production of complex geometries that were previously unattainable. These innovations not only expand the range of applications but also drive market growth, with expectations of reaching 138.8 USD Billion by 2035.

Expanding Applications Across Various Industries

The versatility of advanced materials is a significant driver for the Global Advanced Material Market Industry, as they find applications across diverse sectors such as electronics, healthcare, and construction. For instance, advanced ceramics are increasingly utilized in medical implants due to their biocompatibility and durability. Similarly, smart materials are gaining traction in electronics, enabling the development of responsive devices. This broad applicability enhances market potential, as industries seek materials that offer improved performance and functionality. The ongoing expansion of applications is expected to sustain market growth, reinforcing the industry's relevance in a rapidly evolving technological landscape.

Increased Investment in Research and Development

Investment in research and development is a critical driver for the Global Advanced Material Market Industry. Governments and private entities are allocating substantial resources to explore new materials and improve existing ones. For instance, initiatives aimed at developing sustainable materials and recycling technologies are gaining traction. This focus on innovation is likely to yield new products that meet evolving consumer demands and regulatory standards. As a result, the industry is projected to grow at a CAGR of 6.5% from 2025 to 2035, reflecting the importance of R&D in maintaining competitive advantage.

Market Segment Insights

Advanced Material Product Type Insights

The advanced material market segmentation, based on product type includes Polymers, Metal & Alloys, Glasses, Composites and Ceramics. The ceramics segment dominated the market. Advanced ceramics offer a high-performance, cost-effective alternative to traditional materials like glass, metals, and plastics. These materials include alumina, aluminum nitride, zirconia, silicon nitride, silicon carbide, and titania-based materials, each having their own unique properties. When selecting a material, physical characteristics like hardness, wear resistance, strength, corrosion resistance, and thermal stability are taken into account.

Figure 1: Advanced Material Market, by Product Type, 2022 & 2032 (USD Billion)Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Advanced Material Application Insights

The advanced material market segmentation, based on application, includes Medical Devices, Automotive, Aerospace, Electricals & Electronics, Industrial, Power and Others. The automotive category generated the most income. The automotive industry is currently dealing with escalating expectations for improvements in fuel efficiency and pollution control. Therefore, there is a lot of interest in the use of cutting-edge materials like improved high-strength steels, non-ferrous alloys (aluminum and titanium), and a range of composites (carbon fiber and metal matrix) to manufacture lightweight cars. The market for innovative materials will expand as a result of the rising demand for lightweight cars.

Get more detailed insights about Advanced Material Market Research Report - Global Forecast by 2034

Regional Insights

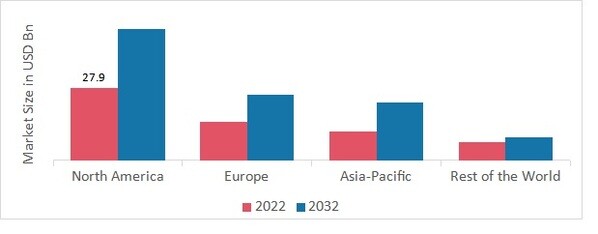

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American advanced material market area will dominate this market because of the building industry's strong growth and the significant presence of major automakers in nations like the United States and Canada. Additionally, it is anticipated that the presence of businesses that produce equipment for renewable energy sources will boost this industry.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: ADVANCED MATERIAL MARKET SHARE BY REGION 2022 (USD Billion) Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe advanced material market accounts for the second-largest market share because of the ease with which mineral resources may be accessed, the rapid uptake of cutting-edge technology, and the growth of investments in the automobile and aerospace industries. The demand for novel materials is also being stimulated by the use of finished items in industries like automotive, electronics, and others. Further, the German advanced material market held the largest market share, and the UK advanced material market was the fastest growing market in the European region

The Asia-Pacific Advanced Material Market is expected to grow at the fastest CAGR from 2023 to 2032 because major economies like China, India, and Japan may contain large producers. Additionally, it is anticipated that product demand for energy applications would increase as consumer knowledge of renewable energy sources increases. Moreover, China’s advanced material market held the largest market share, and the Indian advanced material market was the fastest growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the advanced material market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, advanced material industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the advanced material industry to benefit clients and increase the market sector. In recent years, the advanced material industry has offered some of the most significant advantages to medicine. Major players in the advanced material market are attempting to increase market demand by investing in research and development operations includes 3M Company, Momentive Performance Materials Inc., BASF SE, DowDuPont Inc., Morgan Advanced Materials, Hanwha Group, PyroGenesis Canada Inc., Cytech Products Inc., Akzo Nobel N.V. and Hexcel Corporation.

Explosives, machinery, trading, and defense products are all produced and offered by Hanwha Corp (Hanwha). Among its machinery items are plant and other machinery products, machine tools, powertrain, solar products, factory automation, and aerospace equipment. The business provides a lifestyle platform via which it runs its luxury hotel operations, as well as the construction and management of commercial complexes. Its products are employed in livestock products, aerospace items, rockets, fuses, grenades, fireworks, and subsea equipment.

A diversified corporation is Morgan Advanced Materials Plc (Morgan). The business develops, produces, and sells technical ceramics, braze alloys, thermal ceramics, fire protection products, seals and bearings, speciality graphite, electrical carbon, molten metal systems, composites, and military systems. It also designs, manufactures, and markets braze alloys. Engineered coatings, ceramic cores, laser products, wax injection goods, extruded products, mass spectrometry components, and zirconia products are a few of the technological ceramics it offers.

Key Companies in the Advanced Material Market market include

Industry Developments

June 2021: For usage in automotive and consumer goods applications, Arkema has introduced a new line of bio-based thermoplastic elastomers that can lower the carbon footprint of finished goods.

December 2020: In order to create new lithium-ion battery electrolyte solutions that are safer, more effective, and have a longer life cycle, Mitsubishi Chemical Corporation and Ube Industries have partnered.

December 2020: For the plastics industry, Evonik Industries has introduced a new array of high-performance additives that can enhance the mechanical, thermal, and electrical qualities of plastics.

January 2020: The advanced-ballistic protection division of 3M has been successfully sold to Avon Rubber p.l.c. for a sum of $91 million

In March 2024, Grasim Industries Limited, the main company of the Aditya Birla Group, officially opened the expansion project at Vilayat, Gujarat for its Chemical business. This project increased the capacity of Epoxy resins and formulation by 123,000 tonnes, resulting in a total capacity of 246,000 tonnes per year for Advanced Materials. The expansion is a pivotal moment for the Advanced Material business to solidify its position as a major contender in the global epoxy materials market, propelled by ambitious growth objectives.

The upgraded facility seeks to set new standards in operational efficiency by incorporating cutting-edge safety protocols and sustainable practices, such as adopting solvent-free technology, reducing water consumption and waste generation, and prioritizing the use of renewable energy sources.

Future Outlook

Advanced Material Market Future Outlook

The Global Advanced Material Market is projected to grow at a 6.50% CAGR from 2025 to 2035, driven by technological advancements, increasing demand for lightweight materials, and sustainability initiatives.

New opportunities lie in:

- Invest in R&D for bio-based advanced materials to meet sustainability goals.

- Develop smart materials for applications in healthcare and electronics.

- Expand into emerging markets with tailored advanced material solutions.

By 2035, the market is expected to achieve substantial growth, reflecting evolving industry needs and technological innovations.

Market Segmentation

Advanced Material Regional Outlook (USD Billion, 2018-2032)

- US

- Canada

- Mexico

Advanced Material Application Outlook (USD Billion, 2018-2032)

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

Advanced Material Product Type Outlook (USD Billion, 2018-2032)

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2035 | 138.78 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 6.50% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2020- 2023 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product Type, Application, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | 3M Company, Momentive Performance Materials Inc., BASF SE, DowDuPont Inc., Morgan Advanced Materials, Hanwha Group, PyroGenesis Canada Inc., Cytech Products Inc., Akzo Nobel N.V. and Hexcel Corporation |

| Key Market Opportunities | Rising demand for sophisticated materials in the automotive and consumer goods sector is opening up new business prospects |

| Key Market Dynamics | Rapid industrialization and significant R&D expenditures are the primary market drivers for advanced materials Increasing demand in the aerospace sector will improve market prospects |

| Market Size 2024 | 69.41 (Value (USD Billion)) |

| Market Size 2025 | 73.92 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the advanced material market?

The advanced material market size was valued at USD 61.2 Billion in 2022.

What is the growth rate of the advanced material market?

Advanced Material Market is projected to register a CAGR of 6.5% from 2025-2035

Which region held the largest market share in the advanced material market?

North America had the largest share in the market

Who are the key players in the advanced material market?

The key players in the market are 3M Company, Momentive Performance Materials Inc., BASF SE, DowDuPont Inc., Morgan Advanced Materials, Hanwha Group, PyroGenesis Canada Inc., Cytech Products Inc., Akzo Nobel N.V. and Hexcel Corporation.

Which product type led the advanced material market?

The ceramics category dominated the market in 2022.

Which application had the largest market share in the advanced material market?

The automotive category had the largest share in the market.

-

Table of Contents SECTION I: Executive Summary AND KEY HIGHLIGHTS

-

EXECUTIVE'S HANDBOOK

- Market Overview

- Key Findings

- Market Segmentation

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook SECTION II: SCOPING, METHODOLOGY AND MARKET STRUCTURE

-

Market Introduction

- Definition

- Report Segmentation & Scope

- Why do you need this report? - Report Objective

-

Market structure and classification

- Market structure By Product Type

- Market structure By Application

- Market structure By Region

-

Research Methodology

- Overview

-

Data flow

- Data Mining & Condensation

- Sources (Associations, Organizations, Magazines, Paid Databases)

-

Data acquisition

- Purchased Databases

- Sources (Associations, Organizations, Magazines, Paid Databases)

-

Secondary sources

- Secondary research data flow

-

Primary research

- Primary research data flow

- Primary research: Number of interviews conducted

- Primary research: Regional coverage

-

Approaches for market size estimation

- Consumption net trade approach

- Revenue analysis approach

- Data forecasting

-

Data Modeling

- Micro-Economic factor analysis

- Data Modeling

- Data forecasting

-

Team and Analyst Contribution

- Research, consulting and Quality check

- Analyst hours SECTION III: QUALITATIVE ANALYSIS

-

MARKET DYNAMICS

- Introduction

- Market trends and growth affecting factors

-

Growth Parameters Mapped - Drivers

- Increasing demand in aerospace industry

- Rapid industrialization and significant R&D efforts

- Sustainability & Environmental Regulations

- Energy Transition & Renewable Integration

-

Growth Inhibitors Mapped - Restraints

- High production costs

- Standardization & Certification Issues

-

Market Opportunities Mapped

- Rising demand for sophisticated materials in the automotive and consumer goods sector

- Next-Gen Electronics & Photonics

- Smart Infrastructure & Construction

- Circular Economy & Recycling Technologies

- Impact analysis of Russia-Ukraine War

- Impact of Trump 2.0

-

TRADE WAR IMPACT ON MARKET FACTOR ANALYSIS

-

Supply chain Analysis

- Participants

-

Porter's Five Forces Model

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

- Technological Advancements

-

Regulatory Framework

- Government Policies

- Certification and Standards

- Broad Level Gap Analysis

-

R&D Update

- Current Scenario

- Future Roadmap

- Challenges

- Novel Applications

- Key Developments

- Adjacent Market Analysis

- PESTLE Analysis SECTION IV: QUANTITATIVE ANALYSIS

-

Supply chain Analysis

-

GLOBAL ADVANCED MATERIAL MARKET, BY PRODUCT TYPE (VALUE & VOLUME)

- Introduction

-

Polymers

- Global Advanced Material Market Size: Market Estimates and Forecast, By Polymers, 2019-2034

-

Metal & Alloys

- Global Advanced Material Market Size: Market Estimates and Forecast, By Metal & Alloys, 2019-2034

-

Glasses

- Global Advanced Material Market Size: Market Estimates and Forecast, By Glasses, 2019-2034

-

Composites

- Global Advanced Material Market Size: Market Estimates and Forecast, By Composites, 2019-2034

-

Ceramics

- Global Advanced Material Market Size: Market Estimates and Forecast, By Ceramics, 2019-2034

-

Others

- Global Advanced Material Market Size: Market Estimates and Forecast, By Others, 2019-2034 7. GLOBAL ADVANCED MATERIAL MARKET, BY APPLICATION (VALUE & VOLUME)

- Introduction

-

Aerospace

- Global Advanced Material Market Size: Market Estimates and Forecast, By Aerospace, 2019-2034

-

Automotive

- Global Advanced Material Market Size: Market Estimates and Forecast, By Automotive, 2019-2034

-

Medical Devices

- Global Advanced Material Market Size: Market Estimates and Forecast, By Medical Devices, 2019-2034

-

Electricals & Electronics

- Global Advanced Material Market Size: Market Estimates and Forecast, By Electricals & Electronics, 2019-2034

-

Industrial

- Global Advanced Material Market Size: Market Estimates and Forecast, By Industrial, 2019-2034

-

Power

- Global Advanced Material Market Size: Market Estimates and Forecast, By Power, 2019-2034

-

Others

- Global Advanced Material Market Size: Market Estimates and Forecast, By Others, 2019-2034 8. GLOBAL ADVANCED MATERIAL MARKET, BY REGION (VALUE & VOLUME)

- Introduction

-

North America

- North America Advanced Material Market Size: Market Estimates and Forecast, By Product Type ,2019-2034

- North America Advanced Material Market Size: Market Estimates and Forecast, By Application,2019-2034

- US

- Canada

- Mexico

-

Europe

- Europe Advanced Material Market Size: Market Estimates and Forecast, By Product Type ,2019-2034

- Europe Advanced Material Market Size: Market Estimates and Forecast, By Application,2019-2034

- Germany

- UK

- France

- Italy

- Rest of Europe

-

APAC

- APAC Advanced Material Market Size: Market Estimates and Forecast, By Product Type ,2019-2034

- APAC Advanced Material Market Size: Market Estimates and Forecast, By Application,2019-2034

- China

- India

- Japan

- South Korea

- Australia

- Rest of APAC

-

South America

- South America Advanced Material Market Size: Market Estimates and Forecast, By Product Type ,2019-2034

- South America Advanced Material Market Size: Market Estimates and Forecast, By Application,2019-2034

- Brazil

- Argentina

- Rest of South America

-

MEA

- MEA Advanced Material Market Size: Market Estimates and Forecast, By Product Type ,2019-2034

- MEA Advanced Material Market Size: Market Estimates and Forecast, By Application,2019-2034

- GCC Countries

- South Africa

- Rest of MEA

-

Competitive Landscape

- Introduction

- Market share analysis 2024

- Competitor Dashboard

- Comparative analysis: Key players financial

-

Key developments growth strategies

- Product Development

- Merger and Acquisition 10. COMPANY PROFILES

-

3M

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- BASF SE

- Momentive Performance Materials Inc.

- DowDuPont Inc.

- Morgan Advanced Materials

- Hanwha Group

- PyroGenesis Canada Inc.

- Cytech Products Inc.

- Akzo Nobel N.V.

- Hexcel Corporation

- Others

-

FREQUENTLY ASKED QUESTIONS (FAQ’S)

- FAQ's

- Data Citations

- Client Partners

- Disclaimer NOTE:

-

This table of content is tentative and subject to change as the research progresses.

-

In the Competitive Analysis section, only the top companies are profiled. Each company will be profiled based on the Market Overview, Financials, Product Portfolio, Business Strategies, and Recent Developments parameters.

-

Please note: The financial details of the company cannot be provided if the information is not available in the public domain and or from reliable sources

-

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1. LIST OF ASSUMPTIONS

- TABLE 2. NORTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY COUNTRY, 2019-2034 (USD BILLION)

- TABLE 3. NORTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY COUNTRY, 2019-2034 (KILOTON)

- TABLE 4. NORTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 5. NORTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 6. NORTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 7. NORTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 8. US ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 9. US ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 10. US ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 11. US ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 12. CANADA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 13. CANADA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 14. CANADA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 15. CANADA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 16. MEXICO ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 17. MEXICO ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 18. MEXICO ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 19. MEXICO ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 20. EUROPE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY COUNTRY, 2019-2034 (USD BILLION)

- TABLE 21. EUROPE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY COUNTRY, 2019-2034 (KILOTON)

- TABLE 22. EUROPE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 23. EUROPE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 24. EUROPE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 25. EUROPE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 26. GERMANY ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 27. GERMANY ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 28. GERMANY ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 29. GERMANY ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 30. UK ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 31. UK ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 32. UK ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 33. UK ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 34. FRANCE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 35. FRANCE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 36. FRANCE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 37. FRANCE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 38. SPAIN ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 39. SPAIN ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 40. SPAIN ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 41. SPAIN ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 42. ITALY ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 43. ITALY ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 44. ITALY ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 45. ITALY ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 46. RUSSIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 47. RUSSIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 48. RUSSIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 49. RUSSIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 50. REST OF EUROPE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 51. REST OF EUROPE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 52. REST OF EUROPE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 53. REST OF EUROPE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 54. APAC ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY COUNTRY, 2019-2034 (USD BILLION)

- TABLE 55. APAC ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY COUNTRY, 2019-2034 (KILOTON)

- TABLE 56. APAC ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 57. APAC ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 58. APAC ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 59. APAC ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 60. CHINA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 61. CHINA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 62. CHINA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 63. CHINA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 64. INDIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 65. INDIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 66. INDIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 67. INDIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 68. JAPAN ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 69. JAPAN ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 70. JAPAN ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 71. JAPAN ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 72. AUSTRALIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 73. AUSTRALIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 74. AUSTRALIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 75. AUSTRALIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 76. INDONESIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 77. INDONESIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 78. INDONESIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 79. INDONESIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 80. REST OF APAC ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 81. REST OF APAC ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 82. REST OF APAC ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 83. REST OF APAC ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 84. SOUTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY COUNTRY, 2019-2034 (USD BILLION)

- TABLE 85. SOUTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY COUNTRY, 2019-2034 (KILOTON)

- TABLE 86. SOUTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 87. SOUTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 88. SOUTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 89. SOUTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 90. BRAZIL ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 91. BRAZIL ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 92. BRAZIL ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 93. BRAZIL ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 94. ARGENTINA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 95. ARGENTINA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 96. ARGENTINA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 97. ARGENTINA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 98. REST OF SOUTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 99. REST OF SOUTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 100. REST OF SOUTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 101. REST OF SOUTH AMERICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 102. MEA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY COUNTRY, 2019-2034 (USD BILLION)

- TABLE 103. MEA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY COUNTRY, 2019-2034 (KILOTON)

- TABLE 104. MEA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 105. MEA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 106. MEA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 107. MEA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 108. SAUDI ARABIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 109. SAUDI ARABIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 110. SAUDI ARABIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 111. SAUDI ARABIA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 112. UAE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 113. UAE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 114. UAE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 115. UAE ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 116. TURKEY ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 117. TURKEY ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 118. TURKEY ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 119. TURKEY ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 120. SOUTH AFRICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 121. SOUTH AFRICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 122. SOUTH AFRICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 123. SOUTH AFRICA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 124. REST OF MEA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (USD BILLION)

- TABLE 125. REST OF MEA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2034 (KILOTON)

- TABLE 126. REST OF MEA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (USD BILLION)

- TABLE 127. REST OF MEA ADVANCED MATERIAL MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2034 (KILOTON)

- TABLE 128. PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

- TABLE 129. ACQUISITION/PARTNERSHIP LIST OF FIGURES

- FIGURE 1. MARKET SYNOPSIS

- FIGURE 2. RESEARCH PROCESS OF MRFR

- FIGURE 3. DROC ANALYSIS OF GLOBAL ADVANCED MATERIAL MARKET, 2019-2034

- FIGURE 4. DRIVERS IMPACT ANALYSIS: GLOBAL ADVANCED MATERIAL MARKET

- FIGURE 5. RESTRAINTS IMPACT ANALYSIS: GLOBAL ADVANCED MATERIAL MARKET

- FIGURE 6. SUPPLY CHAIN: GLOBAL ADVANCED MATERIAL MARKET

- FIGURE 7. MARKET ATTRACTIVENESS ANALYSIS: GLOBAL ADVANCED MATERIAL MARKET

- FIGURE 8. GLOBAL ADVANCED MATERIAL MARKET ANALYSIS BY PRODUCT TYPE (% SHARE)

- FIGURE 9. GLOBAL ADVANCED MATERIAL MARKET ANALYSIS BY PRODUCT TYPE (USD BILLION)

- FIGURE 10. GLOBAL ADVANCED MATERIAL MARKET ANALYSIS BY PRODUCT TYPE (KILOTON)

- FIGURE 11. GLOBAL ADVANCED MATERIAL MARKET ANALYSIS BY APPLICATION (% SHARE)

- FIGURE 12. GLOBAL ADVANCED MATERIAL MARKET ANALYSIS BY APPLICATION (USD BILLION)

- FIGURE 13. GLOBAL ADVANCED MATERIAL MARKET ANALYSIS BY APPLICATION (KILOTON)

- FIGURE 14. GLOBAL ADVANCED MATERIAL MARKET ANALYSIS BY REGION (% SHARE)

- FIGURE 15. GLOBAL ADVANCED MATERIAL MARKET ANALYSIS BY REGION (USD BILLION)

- FIGURE 16. GLOBAL ADVANCED MATERIAL MARKET ANALYSIS BY REGION (KILOTON)

- FIGURE 17. GLOBAL ADVANCED MATERIAL MARKET: MARKET STRUCTURE

- FIGURE 18. NORTH AMERICA ADVANCED MATERIAL MARKET SIZE & MARKET SHARE BY COUNTRY (2025 VS 2034)

- FIGURE 19. EUROPE ADVANCED MATERIAL MARKET SIZE & MARKET SHARE BY COUNTRY (2025 VS 2034)

- FIGURE 20. ASIA-PACIFIC ADVANCED MATERIAL MARKET SIZE & MARKET SHARE BY COUNTRY (2025 VS 2034)

- FIGURE 21. SOUTH AMERICA ADVANCED MATERIAL MARKET SIZE & MARKET SHARE BY COUNTRY (2025 VS 2034)

- FIGURE 22. MIDDLE EAST & AFRICA ADVANCED MATERIAL MARKET SIZE & MARKET SHARE BY COUNTRY (2025 VS 2034)

Advanced Material Market Segmentation

Advanced Material Product Type Outlook (USD Billion, 2018-2032)

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

Advanced Material Application Outlook (USD Billion, 2018-2032)

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

Advanced Material Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

- North America Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- North America Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

US Outlook (USD Billion, 2018-2032)

- US Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- US Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

CANADA Outlook (USD Billion, 2018-2032)

- CANADA Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- CANADA Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

- North America Advanced Material by Product Type

Europe Outlook (USD Billion, 2018-2032)

- Europe Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- Europe Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

Germany Outlook (USD Billion, 2018-2032)

- Germany Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- Germany Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

France Outlook (USD Billion, 2018-2032)

- France Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- France Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

UK Outlook (USD Billion, 2018-2032)

- UK Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- UK Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

ITALY Outlook (USD Billion, 2018-2032)

- ITALY Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- ITALY Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

SPAIN Outlook (USD Billion, 2018-2032)

- Spain Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- Spain Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

Rest Of Europe Outlook (USD Billion, 2018-2032)

- Rest Of Europe Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- REST OF EUROPE Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

- Europe Advanced Material by Product Type

Asia-Pacific Outlook (USD Billion, 2018-2032)

- Asia-Pacific Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- Asia-Pacific Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

China Outlook (USD Billion, 2018-2032)

- China Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- China Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

Japan Outlook (USD Billion, 2018-2032)

- Japan Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- Japan Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

India Outlook (USD Billion, 2018-2032)

- India Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- India Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

Australia Outlook (USD Billion, 2018-2032)

- Australia Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- Australia Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

- Rest of Asia-Pacific Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- Rest of Asia-Pacific Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

- Asia-Pacific Advanced Material by Product Type

Rest of the World Outlook (USD Billion, 2018-2032)

- Rest of the World Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- Rest of the World Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

Middle East Outlook (USD Billion, 2018-2032)

- Middle East Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- Middle East Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

Africa Outlook (USD Billion, 2018-2032)

- Africa Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- Africa Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

Latin America Outlook (USD Billion, 2018-2032)

- Latin America Advanced Material by Product Type

- Polymers

- Metal & Alloys

- Glasses

- Composites

- Ceramics

- Latin America Advanced Material by Application

- Medical Devices

- Automotive

- Aerospace

- Electricals & Electronics

- Industrial

- Power

- Others

- Rest of the World Advanced Material by Product Type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment