Anti Corrosion Lubricant Market Share

Anti Corrosion Lubricant Market Research Report Information By Type (Mineral Oil, Semi-Synthetic Oil, and Fully Synthetic Oil), By Application (Aerospace, Defense, Industrial, Electronic, and Others), And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2035

Market Summary

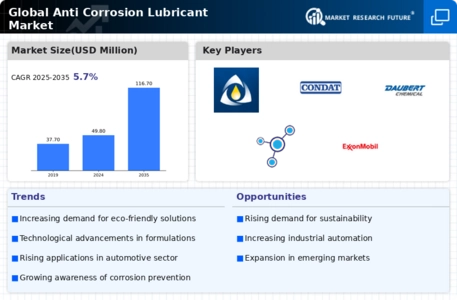

The Global Anti Corrosion Lubricant Market is projected to grow significantly from 49.76 USD Million in 2024 to 91.58 USD Million by 2035.

Key Market Trends & Highlights

Global Anti Corrosion Lubricant Key Trends and Highlights

- The market is expected to experience a compound annual growth rate (CAGR) of 8.05 percent from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 116.7 USD Million, indicating robust growth potential.

- in 2024, the market is valued at 49.76 USD Million, showcasing a solid foundation for future expansion.

- Growing adoption of advanced anti corrosion technologies due to increasing industrial applications is a major market driver.

Market Size & Forecast

| 2024 Market Size | 49.76 (USD Million) |

| 2035 Market Size | 91.58 (USD Million) |

| CAGR (2025-2035) | 5.70% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

Afton Chemical, Ashburn Chemical Technologies, Condat, Cor-Pro Systems, Cortec, Daubert Chemical, DuPont, Eureka Chemical, Exxon Mobil, FUCHS Group

Market Trends

Growing emphasis on infrastructure development and the expansion of industrial activities is driving the market growth

Market CAGR for anti-corrosion lubricants is being driven by the rising emphasis on infrastructure development and the expansion of industrial activities. As nations invest significantly in building and upgrading infrastructure, there is a parallel surge in the deployment of heavy machinery and equipment across construction, transportation, and manufacturing sectors. These assets are often exposed to harsh environmental conditions, including moisture, salt, and other corrosive elements, making them susceptible to corrosion-induced deterioration.

Anti-corrosion lubricants play a crucial role in this scenario by forming protective layers on metal surfaces, thereby preventing corrosion and mitigating wear and tear. This preservation of machinery is essential for maintaining operational efficiency and reducing downtime, factors that are paramount in industrial settings where uninterrupted production is critical. Additionally, the expansion of industrial activities translates to a higher demand for specialized lubricants capable of withstanding diverse and challenging operating conditions. In the construction sector, for instance, where heavy machinery operates in varied environments, anti-corrosion lubricants are indispensable in safeguarding equipment exposed to abrasive materials and fluctuating weather conditions.

Similarly, in the transportation industry, vehicles face corrosion threats from road salts and environmental factors, necessitating the use of anti-corrosion lubricants to ensure the longevity of critical components.

Moreover, the increasing complexity of industrial processes underscores the need for reliable and durable lubrication solutions. Anti-corrosion lubricants not only protect against corrosion but also contribute to overall operational efficiency by reducing friction and minimizing wear on moving parts. This becomes particularly significant as industries strive for optimal performance and cost-effectiveness in their operations. As industries worldwide undergo continuous expansion and modernization, the demand for anti-corrosion lubricants is further amplified. The evolving landscape of manufacturing, with the integration of advanced technologies and materials, intensifies the necessity for lubrication solutions that can address the specific challenges posed by newer industrial processes.

The emphasis on infrastructure development and the expansion of industrial activities fuels the anti-corrosion lubricant market by creating a heightened requirement for protective solutions that can safeguard machinery and equipment, ensuring their longevity and optimal performance in the face of increasingly demanding operational environments. Thus driving the anti-corrosion lubricant market revenue.

CRC Industries unveiled SILICONE LUBE HD in 2023; it's a cutting-edge anti-corrosion lubricant that offers exceptional defense against rust and corrosion in challenging conditions. This product has high-performance lubrication and improved durability.

The WD-40 Company introduced the WD-40 Specialist Long-Term Corrosion Inhibitor in 2023. This product is ideal for industrial and automotive applications because it is designed to prevent rust and corrosion over a long period of time.

The increasing emphasis on sustainability and environmental regulations is driving innovation in the anti-corrosion lubricant sector, as manufacturers seek to develop eco-friendly formulations that meet stringent compliance standards.

U.S. Environmental Protection Agency

Anti Corrosion Lubricant Market Market Drivers

Market Trends and Projections

The Global Anti Corrosion Lubricant Market Industry is poised for substantial growth, with projections indicating a market size of 49.8 USD Million in 2024 and an anticipated increase to 116.7 USD Million by 2035. The compound annual growth rate of 8.05% from 2025 to 2035 suggests a dynamic market landscape driven by various factors, including technological advancements, regulatory compliance, and sector-specific demands. These trends highlight the evolving nature of the industry and the importance of anti-corrosion lubricants in maintaining equipment integrity and operational efficiency across diverse applications.

Expansion of Oil and Gas Sector

The expansion of the oil and gas sector is a significant driver for the Global Anti Corrosion Lubricant Market Industry. As exploration and production activities increase, the need for effective corrosion protection in pipelines and equipment becomes paramount. The harsh environments encountered in this sector necessitate the use of specialized lubricants that can withstand extreme conditions. This demand is expected to contribute to the market's growth, with projections indicating a robust increase in revenue as companies invest in corrosion prevention strategies to protect their assets.

Increasing Regulatory Compliance

The Global Anti Corrosion Lubricant Market Industry is also shaped by the increasing regulatory compliance requirements across various sectors. Governments worldwide are implementing stricter regulations regarding the use of hazardous materials, pushing manufacturers to adopt safer alternatives. This shift is driving the demand for anti-corrosion lubricants that comply with environmental standards while providing effective protection. As industries adapt to these regulations, the market is expected to see a steady increase in demand, reflecting a broader commitment to sustainability and safety in manufacturing processes.

Growth in Industrial Applications

The Global Anti Corrosion Lubricant Market Industry is significantly influenced by the growth in industrial applications, particularly in manufacturing and heavy machinery. Industries such as construction and mining require lubricants that can prevent rust and corrosion, thereby extending equipment life and reducing maintenance costs. The increasing investment in infrastructure projects globally is likely to bolster the demand for these lubricants. As industries expand, the market is expected to grow, with projections indicating a rise to 116.7 USD Million by 2035. This growth is indicative of the critical role that anti-corrosion lubricants play in maintaining operational efficiency and safety in industrial settings.

Rising Demand from Automotive Sector

The Global Anti Corrosion Lubricant Market Industry is experiencing heightened demand from the automotive sector, which is increasingly focused on enhancing vehicle longevity and performance. As manufacturers strive to meet stringent regulations regarding emissions and fuel efficiency, the use of anti-corrosion lubricants becomes essential. In 2024, the market is projected to reach 49.8 USD Million, driven by the need for protective solutions that can withstand harsh environmental conditions. This trend is likely to continue, as the automotive industry anticipates a compound annual growth rate of 8.05% from 2025 to 2035, indicating a robust future for anti-corrosion lubricants in vehicle applications.

Technological Advancements in Lubricant Formulations

Innovations in lubricant formulations are a key driver of the Global Anti Corrosion Lubricant Market Industry. Advances in technology have led to the development of high-performance lubricants that offer superior protection against corrosion while being environmentally friendly. These formulations often incorporate advanced additives that enhance performance under extreme conditions. As industries increasingly prioritize sustainability, the demand for eco-friendly anti-corrosion lubricants is likely to rise. This trend not only aligns with global environmental goals but also positions manufacturers to capture a larger market share as they adapt to changing consumer preferences.

Market Segment Insights

Anti Corrosion Lubricant Type Insights

The global Anti Corrosion Lubricant market segmentation, based on type, includes Mineral Oil, Semi-Synthetic Oil, and Fully Synthetic Oil. The mineral oil segment dominated the market, accounting for the largest market revenue due to their widespread availability, cost-effectiveness, and versatile applications. These lubricants, derived from petroleum, offer excellent anti-corrosive properties and high lubricity, making them suitable for various industrial machinery and equipment. The simplicity of their production process and the abundance of raw materials contribute to their competitive pricing, appealing to a broad range of industries, including manufacturing, construction, and transportation.

The well-established performance record of mineral oil-based lubricants in preventing corrosion and reducing friction further solidifies their dominance in the market. Synthetic oil is experiencing the fastest growth in the anti-corrosion lubricant market as it has a longer lifespan than other types, requires less frequent reapplication, and reduces maintenance costs.

Anti-Corrosion Lubricant Application Insights

The global anti-corrosion lubricant market segmentation, based on application, includes Aerospace, Defense, Industrial, Electronic, and Others. The industrial category dominates the market due to the extensive use of machinery and equipment in manufacturing, processing, and other industrial processes. The harsh operating environments, including exposure to moisture, chemicals, and varying temperatures, make industrial equipment highly susceptible to corrosion. Anti-corrosion lubricants play a critical role in protecting metal surfaces, reducing friction, and preventing wear and tear in these settings, ensuring prolonged equipment life and enhanced operational efficiency.

The diverse range of industrial machinery, from heavy manufacturing equipment to precision instruments, creates a robust demand for specialized anti-corrosion lubricants tailored to meet the unique challenges of each application.

Figure 1: Anti Corrosion Lubricant Market, by Application, 2022 & 2032 (USD Billion)

Source: The Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Get more detailed insights about Anti Corrosion Lubricant Market Research Report — Global Forecast till 2032

Regional Insights

By region, the study gives market insights into the North America, Europe, Asia-Pacific, and the Rest of the World. The North American Anti Corrosion Lubricant market area dominates this market due to the region's extensive industrial infrastructure and widespread use of machinery across various sectors. The stringent regulatory environment emphasizing equipment maintenance, coupled with a high awareness of corrosion prevention measures, propels the demand for anti-corrosion lubricants.

Further, the prime countries studied in the market report are The US, Canada, Germany, France, the UK, Italy, Spain, Japan, China, India, Australia, South Korea, and Brazil.

Figure 2: ANTI CORROSION LUBRICANT MARKET SHARE BY REGION 2022 (USD Billion)

Source: The Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe's Anti Corrosion Lubricant market accounts for the second-largest market share due to the region's robust manufacturing sector, stringent environmental regulations, and a strong emphasis on maintaining machinery integrity. Further, the German anti-corrosion lubricant market held the largest market share, and the UK anti-corrosion lubricant market was the fastest-growing market in European region.

The Asia-Pacific Anti Corrosion Lubricant Market is expected to rise at the fastest CAGR from the year 2023 to 2032. This is due to the rapid industrialization, increasing manufacturing activities, and a surge in infrastructure development. Moreover, China’s anti-corrosion lubricant market held the largest market share, and the Indian anti-corrosion lubricant market was the fastest-growing market in Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in the research and development in order to expand their product lines, which will help the Anti Corrosion Lubricant market grow even more. Market players are also undertaking a variety of strategic activities to spread their global footprint, with important market developments including mergers and acquisitions, new product launches, contractual agreements, higher investments, and collaboration with other organizations. To spread and survive in a more competitive and rising market climate, Anti Corrosion Lubricant industry must offer cost-effective items.

Manufacturing locally to minimize the operational costs is one of the key business tactics used by the manufacturers in the global Anti Corrosion Lubricant industry to benefit the clients and increase the market sector. In recent years, the Anti Corrosion Lubricant industry has offered some of the most significant advantages to several industries. Major players in the Anti Corrosion Lubricant market, including Afton Chemical, Ashburn Chemical Technologies, Condat, Cor-Pro Systems, Cortec, Daubert Chemical, DuPont, Eureka Chemical, Exxon Mobil, FUCHS Group, and others, are trying to increase market demand by investing in the research and development operations.

ExxonMobil Corporation, the largest publicly traded multinational oil and gas companies, is renowned for its extensive presence and influence in the global energy sector. Founded through the merger of Exxon Corporation and Mobil Corporation, the company boasts a rich history dating back to the late 19th century. ExxonMobil is a key player in various aspects of the energy industry, including the exploration, production, refining, and marketing of a wide range of energy products. In October 2023, ExxonMobil Corporation partnered with Boeing Company to develop and market next-generation anti-corrosion lubricants specifically designed for the aerospace industry.

This partnership aims to optimize the performance and lifespan of aircraft components while reducing maintenance costs.

Henkel AG & Co. KGaA is a multinational chemical and consumer goods company headquartered in Düsseldorf, Germany. Founded in 1876, Henkel has evolved into a global leader in the adhesive technologies, beauty care, and laundry and home care industries. The company's diverse product portfolio includes well-known brands such as Persil, Schwarzkopf, and Loctite, catering to consumers, industries, and craftsmen worldwide. Henkel operates in three business units: Adhesive Technologies, Beauty Care, and Laundry & Home Care. With a strong commitment to sustainability and innovation, Henkel focuses on developing solutions that meet the evolving needs of its customers while promoting environmental responsibility.

In September 2023, Henkel AG & Co. KGaA collaborated with Siemens AG to develop a range of environmentally friendly anti-corrosion lubricants for industrial applications. This partnership focuses on creating sustainable solutions that comply with environmental regulations and reduce environmental impact.

Key Companies in the Anti Corrosion Lubricant Market market include

Industry Developments

August 2023: Fuchs Petrolub SE partnered with Fraunhofer Institute for Manufacturing Technology and the Applied Materials Research (IFAM) to conduct joint research and development on advanced anti-corrosion lubricants for high-temperature applications. This collaboration aims to overcome the challenges associated with corrosion in demanding environments.

July 2023: The US-based specialty chemicals company ChemTreat Inc. acquired EcoChem International Inc., a Canadian company specializing in environmentally friendly anti-corrosion lubricants. This acquisition expands ChemTreat's portfolio of sustainable solutions and strengthens its presence in the North American market.

June 2023: The Japanese chemical manufacturer Nippon Steel & Sumitomo Metal Corporation (NSSMC) acquired a majority stake in the Swedish anti-corrosion lubricant company Cortec Corporation. This acquisition provides NSSMC with access to advanced anti-corrosion technology and strengthens its global reach.

Future Outlook

Anti Corrosion Lubricant Market Future Outlook

The Global Anti Corrosion Lubricant Market is poised for growth at 5.70% CAGR from 2025 to 2035, driven by industrial expansion, technological advancements, and increasing environmental regulations.

New opportunities lie in:

- Develop bio-based anti-corrosion lubricants to meet sustainability demands.

- Invest in R&D for advanced formulations enhancing performance in extreme conditions.

- Expand distribution networks in emerging markets to capture new customer segments.

By 2035, the market is expected to exhibit robust growth, reflecting evolving industry needs and innovation.

Market Segmentation

Anti Corrosion Lubricant Type Outlook

- Mineral Oil

- Semi-Synthetic Oil

- Fully Synthetic Oil

Anti Corrosion Lubricant Regional Outlook

- US

- Canada

Anti Corrosion Lubricant Application Outlook

- Aerospace

- Defense

- Industrial

- Electronic

- Others

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 49.76 Million |

| Market Size 2035 | 91.58 (Value (USD Million)) |

| Compound Annual Growth Rate (CAGR) | 5.70% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, The Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Application, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, Germany, France, UK, Italy, Spain, Japan, China, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Afton Chemical, Ashburn Chemical Technologies, Condat, Cor-Pro Systems, Cortec, Daubert Chemical, DuPont, Eureka Chemical, Exxon Mobil, FUCHS Group |

| Key Market Opportunities | · Focus on asset management and equipment maintenance strategies. |

| Key Market Dynamics | · Increased emphasis on infrastructure development and the expansion of industrial activities. |

| Market Size 2025 | 52.60 (Value (USD Million)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Anti Corrosion Lubricant market?

The global Anti Corrosion Lubricant market size was valued at Significant value in 2023.

What is the growth rate of the Anti Corrosion Lubricant market?

The global market is foreseen to rise at a CAGR of 5.70% during the forecast period, 2024-2032.

Which region held the biggest market share in the Anti Corrosion Lubricant market?

North America had the biggest share in the global market

Who are the prime players in the Anti Corrosion Lubricant market?

The prime players in the market are Afton Chemical, Ashburn Chemical Technologies, Condat, Cor-Pro Systems, Cortec, Daubert Chemical, DuPont, Eureka Chemical, Exxon Mobil, FUCHS Group.

Which type led the Anti Corrosion Lubricant market?

The mineral oil category dominated the market in 2023.

Which application held the largest market revenue share in the Anti Corrosion Lubricant market?

The industrial had largest share in the global market.

-

Table of Contents

-

Executive Summary

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumptions

- Limitations

-

Research Methodology

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value Chain Analysis

-

Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

GLOBAL ANTI CORROSION LUBRICANT MARKET, BY TYPE

- Overview

- Mineral Oil

- Semi-Synthetic Oil

- Fully Synthetic Oil

-

GLOBAL ANTI CORROSION LUBRICANT MARKET, BY APPLICATION

- Overview

- Aerospace

- Defense

- Industrial

- Electronic

- Others

-

GLOBAL ANTI CORROSION LUBRICANT MARKET, BY REGION

- Overview

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market Share Analysis

- Major Growth Strategy in the Global Anti Corrosion Lubricant Market,

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Global Anti Corrosion Lubricant Market,

-

Key developments and Growth Strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales & Operating Income, 2022

- Major Players R&D Expenditure. 2022

-

COMPANY PROFILES

-

Afton Chemical

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Ashburn Chemical Technologies

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Condat

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Cor-Pro Systems

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Cortec

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Daubert Chemical

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

DuPont

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Eureka Chemical

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Exxon Mobil

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

FUCHS Group

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Afton Chemical

-

APPENDIX

- References

- Related Reports

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 GLOBAL ANTI CORROSION LUBRICANT MARKET, SYNOPSIS, 2018-2032

- TABLE 2 GLOBAL ANTI CORROSION LUBRICANT MARKET, ESTIMATES & FORECAST, 2018-2032 (USD BILLION)

- TABLE 3 GLOBAL ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 4 GLOBAL ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 5 NORTH AMERICA: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 6 NORTH AMERICA: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 7 US: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 8 US: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 9 CANADA: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 10 CANADA: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 1 EUROPE: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 2 EUROPE: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 3 GERMANY: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 4 GERMANY: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 5 FRANCE: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 6 FRANCE: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 7 ITALY: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 8 ITALY: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 9 SPAIN: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 10 SPAIN: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 11 UK: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 12 UK: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 13 REST OF EUROPE: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 14 REST OF EUROPE: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 15 ASIA-PACIFIC: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 16 ASIA-PACIFIC: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 17 JAPAN: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 18 JAPAN: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 19 CHINA: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 20 CHINA: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 21 INDIA: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 22 INDIA: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 23 AUSTRALIA: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 24 AUSTRALIA: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 25 SOUTH KOREA: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 26 SOUTH KOREA: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 27 REST OF ASIA-PACIFIC: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 28 REST OF ASIA-PACIFIC: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 29 REST OF THE WORLD: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 30 REST OF THE WORLD: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 31 MIDDLE EAST: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 32 MIDDLE EAST: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 33 AFRICA: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 34 AFRICA: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION)

- TABLE 35 LATIN AMERICA: ANTI CORROSION LUBRICANT MARKET, BY TYPE, 2018-2032 (USD BILLION)

- TABLE 36 LATIN AMERICA: ANTI CORROSION LUBRICANT MARKET, BY APPLICATION, 2018-2032 (USD BILLION) LIST OF FIGURES

- FIGURE 1 RESEARCH PROCESS

- FIGURE 2 MARKET STRUCTURE FOR THE GLOBAL ANTI CORROSION LUBRICANT MARKET

- FIGURE 3 MARKET DYNAMICS FOR THE GLOBAL ANTI CORROSION LUBRICANT MARKET

- FIGURE 4 GLOBAL ANTI CORROSION LUBRICANT MARKET, SHARE (%), BY TYPE, 2022

- FIGURE 5 GLOBAL ANTI CORROSION LUBRICANT MARKET, SHARE (%), BY APPLICATION, 2022

- FIGURE 6 GLOBAL ANTI CORROSION LUBRICANT MARKET, SHARE (%), BY REGION, 2022

- FIGURE 7 NORTH AMERICA: ANTI CORROSION LUBRICANT MARKET, SHARE (%), BY REGION, 2022

- FIGURE 8 EUROPE: ANTI CORROSION LUBRICANT MARKET, SHARE (%), BY REGION, 2022

- FIGURE 9 ASIA-PACIFIC: ANTI CORROSION LUBRICANT MARKET, SHARE (%), BY REGION, 2022

- FIGURE 10 REST OF THE WORLD: ANTI CORROSION LUBRICANT MARKET, SHARE (%), BY REGION, 2022

- FIGURE 11 GLOBAL ANTI CORROSION LUBRICANT MARKET: COMPANY SHARE ANALYSIS, 2022 (%)

- FIGURE 12 AFTON CHEMICAL: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 13 AFTON CHEMICAL: SWOT ANALYSIS

- FIGURE 14 ASHBURN CHEMICAL TECHNOLOGIES: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 15 ASHBURN CHEMICAL TECHNOLOGIES: SWOT ANALYSIS

- FIGURE 16 CONDAT: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 17 CONDAT: SWOT ANALYSIS

- FIGURE 18 COR-PRO SYSTEMS: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 19 COR-PRO SYSTEMS: SWOT ANALYSIS

- FIGURE 20 CORTEC: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 21 CORTEC: SWOT ANALYSIS

- FIGURE 22 DAUBERT CHEMICAL: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 23 DAUBERT CHEMICAL: SWOT ANALYSIS

- FIGURE 24 DUPONT: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 25 DUPONT: SWOT ANALYSIS

- FIGURE 26 EUREKA CHEMICAL: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 27 EUREKA CHEMICAL: SWOT ANALYSIS

- FIGURE 28 EXXON MOBIL: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 29 EXXON MOBIL: SWOT ANALYSIS

- FIGURE 30 FUCHS GROUP: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 31 FUCHS GROUP: SWOT ANALYSIS

Anti Corrosion Lubricant Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment