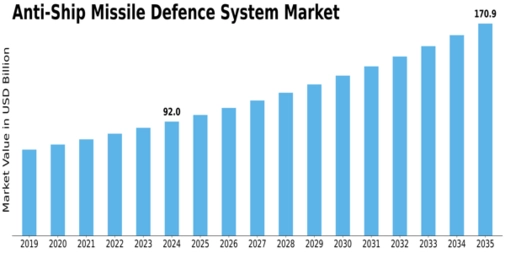

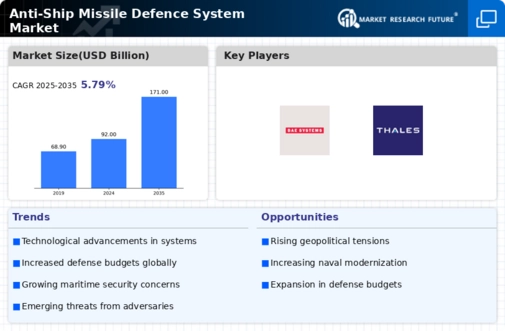

Anti Ship Missile Defence System Size

Anti-Ship Missile Defence System Market Growth Projections and Opportunities

The anti-ship missile defense system market overview is influenced by several key market factors that shape its dynamics and growth trajectory. These factors encompass a range of elements, including technological advancements, geopolitical tensions, defense budgets, and market competition.

Technological advancements play a crucial role in driving the anti-ship missile defense system market. As defense technology evolves, there is a continuous push for more sophisticated and effective defense systems capable of countering evolving threats posed by modern anti-ship missiles. Advancements in radar systems, missile interception technologies, and electronic warfare capabilities drive innovation within the market, influencing the development and deployment of new defense systems.

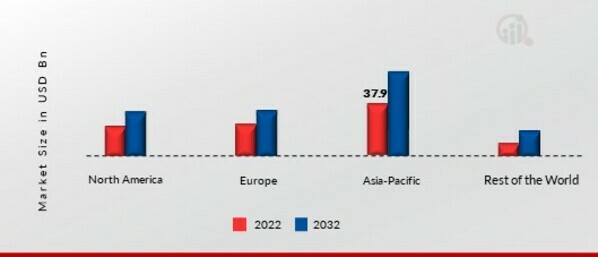

Geopolitical tensions and regional conflicts also significantly impact the anti-ship missile defense system market. Heightened maritime security concerns, territorial disputes, and the proliferation of anti-access/area denial (A2/AD) strategies drive nations to invest in advanced anti-ship missile defense capabilities to protect their naval assets and maintain strategic dominance in contested regions. As geopolitical tensions ebb and flow, governments reassess their defense priorities, leading to fluctuations in procurement and investment patterns within the market.

Defense budgets and spending allocations are fundamental determinants of the anti-ship missile defense system market's growth and expansion. Government defense budgets influence procurement decisions, research and development initiatives, and the overall pace of technological innovation within the market. Increases in defense spending, driven by security imperatives or geopolitical developments, can stimulate demand for anti-ship missile defense systems, while budget constraints may constrain market growth or lead to delays in procurement programs.

Market competition among defense contractors and manufacturers also shapes the landscape of the anti-ship missile defense system market. As companies vie for government contracts and international sales opportunities, there is continuous pressure to deliver cost-effective solutions that meet stringent performance requirements. Competitive dynamics drive investment in research and development, product innovation, and strategic partnerships aimed at gaining a competitive edge and capturing market share.

Furthermore, evolving threat landscapes and emerging technologies influence the demand for anti-ship missile defense systems. The proliferation of advanced anti-ship missiles, including hypersonic and stealthy variants, presents new challenges that drive the development of next-generation defense capabilities. Emerging technologies such as directed energy weapons, autonomous systems, and artificial intelligence are also increasingly integrated into anti-ship missile defense systems, shaping the future trajectory of the market.

Leave a Comment