Market Analysis

In-depth Analysis of APAC Steel Market Industry Landscape

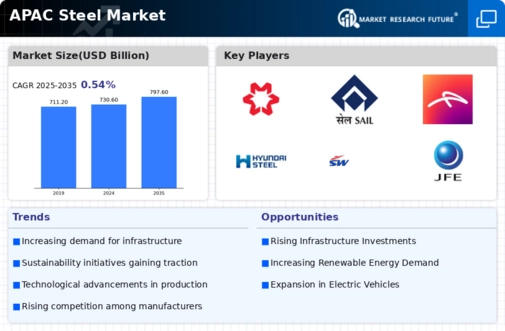

The Asia-Pacific (APAC) Steel Market is changing rapidly due to rapid urbanization, industrialization, foundation improvement, and global exchange factors. An crucial element for development, manufacturing, and other businesses, steel contributes to APAC's economic growth. China and India's rapid urbanization and infrastructure growth are major drivers. High-rises, scaffolds, and transportation foundations drive steel demand and market growth.

APAC Steel Market components are being shaped by mechanical advances. Electric bend warmers, continuous projection, and high-level computerization improve steel production efficiency, environmental impact, and product quality. Steel manufactures become more serious and market-dynamic as they adopt these improvements.

The serious situation affects market aspects, with many steel makers and producers competing in APAC. Both domestic and international firms compete for market share. Qualitative, cost-viable, and manageable product separation increases market intensity. Innovative, energy-efficient, and environmentally responsible companies succeed.

World exchange and international factors affect the APAC Steel Market. APAC nations' production and product activities are affected by global steel prices, currency rates, and demand. Exchange pressures and import/export norms can affect market factors by affecting steel product movement across borders. Steelmakers in APAC must consider these global factors and adapt to market changes.

Administrative factors also shape the APAC Steel Market. State-run authorities enforce steel production, environmental management, and security regulations. Steel manufacturers must follow these standards to ensure product quality, environmental compliance, and a good reputation. The firm' ability to adapt and follow new rules affects market factors as administrative systems evolve.

Financial conditions and foundation projects also affect the APAC Steel Market. Financial development, industrialization, and government-driven framework projects boost steel demand. China and India are investing heavily in infrastructure, including transportation, energy, and urban projects, increasing steel demand. Loan rates, growth, and money exchange rates also affect the steel market.

Customer preferences in development, car, and assembly contribute to the APAC Steel Market. Customers want steel products with excellent stiffness, consumption resistance, and versatility. Steel companies must provide customization options like grades and finishes to satisfy customers' diverse tastes.

The APAC Steel Market is being affected by sustainability and natural factors. The awareness of environmental change and natural effects is driving low-carbon steel production. To meet maintainability goals, steelmakers are investing in cleaner technologies, reusing practices, and energy-efficient cycles. As shoppers grow more environmentally aware, appropriate behaviors become market factors.

Leave a Comment