Asia Pacific Plant Based Food Products Size

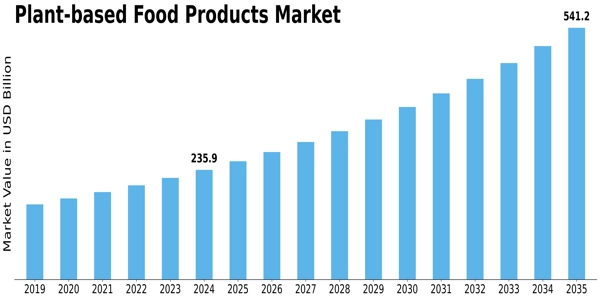

Asia Pacific Plant-based Food Products Market Growth Projections and Opportunities

The Asia Pacific plant-based food products market is influenced by several key factors that shape its growth, trends, and consumer demand. One significant factor is the increasing awareness of health and sustainability among consumers in the region. As people become more conscious of the environmental impact of their food choices and the health benefits of plant-based diets, there's a growing demand for plant-based food products. These products, which are derived from plants such as fruits, vegetables, grains, legumes, and nuts, offer a sustainable and ethical alternative to animal-derived foods, resonating with consumers seeking healthier and more environmentally friendly options.

Changing dietary preferences and cultural influences also play a crucial role in driving the Asia Pacific plant-based food products market. While traditional Asian diets have long featured plant-based ingredients as staples, modern lifestyles and Western influences have led to an increase in meat and dairy consumption in some parts of the region. However, as consumers become more health-conscious and concerned about animal welfare, there's a renewed interest in plant-based eating. Additionally, cultural practices such as vegetarianism and Buddhism contribute to the popularity of plant-based food products in certain countries, further driving market demand.

The influence of convenience and urbanization is another significant market factor in the Asia Pacific region. As urban populations grow and lifestyles become more hectic, there's a greater demand for convenient and ready-to-eat plant-based food options. Plant-based alternatives to traditional meat and dairy products, such as plant-based burgers, dairy-free milk, and vegan convenience meals, cater to the needs of busy consumers looking for quick and easy meal solutions. Moreover, the rise of e-commerce and food delivery services further facilitates access to plant-based food products, making them more accessible to a wider audience of consumers across the region.

Marketing and branding strategies play a crucial role in shaping consumer perceptions and driving demand in the Asia Pacific plant-based food products market. Companies invest in creative packaging, branding, and promotional campaigns to differentiate their products and attract consumers' attention. Labels and certifications indicating that products are vegan, vegetarian, or plant-based help consumers identify and choose products that align with their dietary preferences and values. Additionally, engaging consumers through social media, influencer marketing, and educational campaigns helps raise awareness about the benefits of plant-based eating and encourages trial and adoption of plant-based food products.

Government regulations and policies also impact the Asia Pacific plant-based food products market. Regulatory bodies set guidelines for labeling, food safety, and product standards to ensure consumer protection and transparency in the food industry. Compliance with these regulations is essential for plant-based food manufacturers to maintain product quality, safety, and consumer trust. Additionally, government initiatives promoting sustainable agriculture and environmental conservation may incentivize the production and consumption of plant-based foods, further driving market growth in the region.

Competitive dynamics and market trends drive innovation and product differentiation in the Asia Pacific plant-based food products market. With an increasing number of players entering the market, competition is intensifying, leading to a greater variety of plant-based product offerings and flavors. Companies differentiate themselves by offering unique formulations, premium ingredients, and innovative packaging designs that stand out on store shelves and appeal to discerning consumers. Moreover, innovation in plant-based protein sources, such as pea protein, soy protein, and jackfruit, contributes to product diversification and market competitiveness.

Consumer behavior and preferences continue to evolve, shaping the dynamics of the Asia Pacific plant-based food products market. While some consumers prioritize health and sustainability, others prioritize taste, convenience, and affordability in their food choices. Understanding these preferences and market trends is essential for plant-based food manufacturers and retailers to develop targeted marketing strategies, product offerings, and distribution channels that resonate with their target audience. Consumer education initiatives highlighting the health benefits, environmental impact, and culinary versatility of plant-based foods help increase awareness and drive demand in the Asia Pacific market.

Leave a Comment