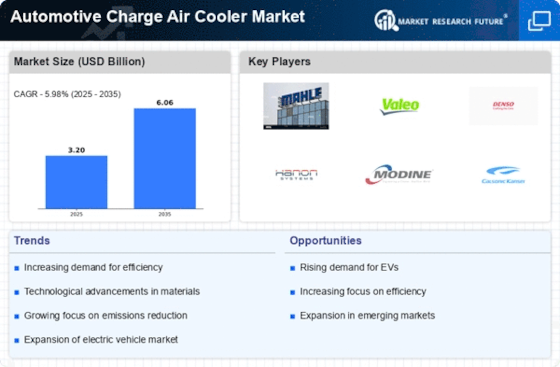

TABLE OF CONTENT\r\n1. EXECUTIVE SUMMARY\r\n1.1. MARKET ATTRACTIVENESS ANALYSIS\r\n1.1.1. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE\r\n1.1.2. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE\r\n1.1.3. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN\r\n1.1.4. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE\r\n1.1.5. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL\r\n1.1.6. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL\r\n1.1.7. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY REGION\r\n2. MARKET INTRODUCTION\r\n2.1. DEFINITION\r\n2.2. SCOPE OF THE STUDY\r\n2.3. MARKET STRUCTURE\r\n3. RESEARCH METHODOLOGY\r\n3.1. RESEARCH PROCESS\r\n3.2. PRIMARY RESEARCH\r\n3.3. SECONDARY RESEARCH\r\n3.4. MARKET SIZE ESTIMATION\r\n3.5. TOP-DOWN AND BOTTOM UP APPROACH\r\n3.6. FORECAST MODEL\r\n3.7. LIST OF ASSUMPTION\r\n4. MARKET DYNAMICS\r\n4.1. INTRODUCTION\r\n4.2. DRIVERS\r\n4.2.1. INCREASING SALES OF CNG VEHICLES\r\n4.2.2. GROWING ADOPTION OF TURBOCHARGERS\r\n4.2.3. DRIVER IMPACT ANALYSIS\r\n4.3. RESTRAINT\r\n4.3.1. INCREASING ADOPTION OF ELECTRIC VEHICLES\r\n4.3.2. RESTARINT IMPACT ANALYSIS\r\n4.4. OPPORTUNITIES\r\n4.4.1. INTRODUCTION OF HIGH-PERFORMANCE ENGINES\r\n4.4.2. INCREASED SPENDING ON NEW VEHICLE PURCHASING\r\n4.5. COVID-IMPACT ANALYSIS\r\n4.5.1. ECONOMIC IMPACT ON AUTOMOTIVE INDUSTRY\r\n4.5.2. IMPACT ON AUTOMOTIVE PRODUCTION\r\n4.5.3. IMPACT ON IN-VEHICLE AI ROBOT MARKET\r\n4.5.3.1. IMPACT ON SUPPLY CHAIN\r\n4.5.3.2. CASH FLOW CONSTRAINTS\r\n4.5.4. IMPACT ON WORLD TRADE\r\n5. MARKET FACTOR ANALYSIS\r\n5.1. PORTER’S FIVE FORCES MODEL\r\n5.1.1. THREAT OF NEW ENTRANTS\r\n5.1.2. BARGAINING POWER OF SUPPLIERS\r\n5.1.3. THREAT OF SUBSTITUTES\r\n5.1.4. BARGAINING POWER OF BUYERS\r\n5.1.5. INTENSITY OF RIVALRY\r\n5.2. SUPPLY CHAIN ANALYSIS\r\n5.2.1. DESIGN & DEVELOPMENT\r\n5.2.2. COMPONENT SUPPLY\r\n5.2.3. MANUFACTURE/ASSEMBLY\r\n5.2.4. END USE\r\n5.3. REGULATORY ANALYSIS, BY REGION\r\n5.3.1. NORTH AMERICA\r\n5.3.2. EUROPE\r\n5.3.3. ASIA PACIFIC\r\n5.3.4. MIDDLE EAST & AFRICA\r\n5.3.5. SOUTH AMERICA\r\n5.4. PRICING TREND, BY REGION, 2024-2032 (USD/UNIT)\r\n6. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE\r\n6.1. AIR-COOLED CHARGE AIR COOLER\r\n6.2. LIQUID-COOLED CHARGE AIR COOLER\r\n7. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE\r\n7.1. GASOLINE ENGINE\r\n7.2. DIESEL ENGINE\r\n8. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN\r\n8.1. FIN & TUBE\r\n8.2. BAR & PLATE\r\n9. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE\r\n9.1. PASSENGER CARS\r\n9.2. COMMERCIAL VEHICLES\r\n10. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL\r\n10.1. ALUMINIUM\r\n10.2. STAINLESS STEEL\r\n10.3. COPPER\r\n10.4. OTHER\r\n11. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL\r\n11.1. OEM\r\n11.2. AFTERMARKET\r\n12. GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY REGION\r\n12.1. OVERVIEW\r\n12.2. NORTH AMERICA\r\n12.2.1. NORTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY COUNTRY, 2024-2032 (USD MILLION)\r\n12.2.2. NORTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.2.3. NORTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.2.4. NORTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.2.5. NORTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.2.6. NORTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.2.7. NORTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.2.8. US\r\n12.2.8.1. US AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.2.8.2. US AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.2.8.3. US AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.2.8.4. US AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.2.8.5. US AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.2.8.6. US AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.2.9. CANADA\r\n12.2.9.1. CANADA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.2.9.2. CANADA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.2.9.3. CANADA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.2.9.4. CANADA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.2.9.5. CANADA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.2.9.6. CANADA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.2.10. MEXICO\r\n12.2.10.1. MEXICO AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.2.10.2. MEXICO AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.2.10.3. MEXICO AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.2.10.4. MEXICO AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.2.10.5. MEXICO AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.2.10.6. MEXICO AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.3. EUROPE\r\n12.3.1. EUROPE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY COUNTRY, 2024-2032 (USD MILLION)\r\n12.3.2. EUROPE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.3.3. EUROPE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.3.4. EUROPE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.3.5. EUROPE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.3.6. EUROPE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.3.7. EUROPE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.3.8. GERMANY\r\n12.3.8.1. GERMANY AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.3.8.2. GERMANY AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.3.8.3. GERMANY AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.3.8.4. GERMANY AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.3.8.5. GERMANY AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.3.8.6. GERMANY AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.3.9. UK\r\n12.3.9.1. UK AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.3.9.2. UK AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.3.9.3. UK AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.3.9.4. UK AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.3.9.5. UK AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.3.9.6. UK AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.3.10. FRANCE\r\n12.3.10.1. FRANCE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.3.10.2. FRANCE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.3.10.3. FRANCE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.3.10.4. FRANCE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.3.10.5. FRANCE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.3.10.6. FRANCE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.3.11. SPAIN\r\n12.3.11.1. SPAIN AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.3.11.2. SPAIN AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.3.11.3. SPAIN AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.3.11.4. SPAIN AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.3.11.5. SPAIN AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.3.11.6. SPAIN AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.3.12. ITALY\r\n12.3.12.1. ITALY AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.3.12.2. ITALY AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.3.12.3. ITALY AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.3.12.4. ITALY AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.3.12.5. ITALY AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.3.12.6. ITALY AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.3.13. REST OF EUROPE\r\n12.3.13.1. REST OF EUROPE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.3.13.2. REST OF EUROPE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.3.13.3. REST OF EUROPE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.3.13.4. REST OF EUROPE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.3.13.5. REST OF EUROPE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.3.13.6. REST OF EUROPE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.4. ASIA-PACIFIC\r\n12.4.1. ASIA-PACIFIC AUTOMOTIVE CHARGE AIR COOLER MARKET, BY COUNTRY, 2024-2032 (USD MILLION)\r\n12.4.2. ASIA-PACIFIC AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.4.3. ASIA-PACIFIC AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.4.4. ASIA-PACIFIC AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.4.5. ASIA-PACIFIC AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.4.6. ASIA-PACIFIC AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.4.7. ASIA-PACIFIC AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.4.8. CHINA\r\n12.4.8.1. CHINA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.4.8.2. CHINA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.4.8.3. CHINA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.4.8.4. CHINA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.4.8.5. CHINA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.4.8.6. CHINA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.4.9. INDIA\r\n12.4.9.1. INDIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.4.9.2. INDIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.4.9.3. INDIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.4.9.4. INDIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.4.9.5. INDIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.4.9.6. INDIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.4.10. JAPAN\r\n12.4.10.1. JAPAN AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.4.10.2. JAPAN AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.4.10.3. JAPAN AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.4.10.4. JAPAN AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.4.10.5. FRANCE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.4.10.6. JAPAN AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.4.11. AUSTRALIA\r\n12.4.11.1. AUSTRALIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.4.11.2. AUSTRALIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.4.11.3. AUSTRALIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.4.11.4. AUSTRALIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.4.11.5. AUSTRALIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.4.11.6. AUSTRALIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.4.12. SOUTH KOREA\r\n12.4.12.1. SOUTH KOREA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.4.12.2. SOUTH KOREA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.4.12.3. SOUTH KOREA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.4.12.4. SOUTH KOREA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.4.12.5. SOUTH KOREA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.4.12.6. SOUTH KOREA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.4.13. REST OF ASIA-PACIFIC\r\n12.4.13.1. REST OF ASIA-PACIFIC AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.4.13.2. REST OF ASIA-PACIFIC AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.4.13.3. REST OF ASIA-PACIFIC AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.4.13.4. REST OF ASIA-PACIFIC AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.4.13.5. REST OF ASIA-PACIFIC AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.4.13.6. REST OF ASIA-PACIFIC AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.5. MIDDLE EAST & AFRICA\r\n12.5.1. MIDDLE EAST & AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY COUNTRY, 2024-2032 (USD MILLION)\r\n12.5.2. MIDDLE EAST & AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.5.3. MIDDLE EAST & AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.5.4. MIDDLE EAST & AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.5.5. MIDDLE EAST & AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.5.6. MIDDLE EAST & AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.5.7. MIDDLE EAST & AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.5.8. SAUDI ARABIA\r\n12.5.8.1. SAUDI ARABIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.5.8.2. SAUDI ARABIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.5.8.3. SAUDI ARABIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.5.8.4. SAUDI ARABIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.5.8.5. SAUDI ARABIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.5.8.6. SAUDI ARABIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.5.9. UAE\r\n12.5.9.1. UAE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.5.9.2. UAE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.5.9.3. UAE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.5.9.4. UAE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.5.9.5. UAE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.5.9.6. UAE AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.5.10. SOUTH AFRICA\r\n12.5.10.1. SOUTH AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.5.10.2. SOUTH AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.5.10.3. SOUTH AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.5.10.4. SOUTH AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.5.10.5. SOUTH AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.5.10.6. SOUTH AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.5.11. REST OF MIDDLE EAST & AFRICA\r\n12.5.11.1. REST OF MIDDLE EAST & AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.5.11.2. REST OF MIDDLE EAST & AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.5.11.3. REST OF MIDDLE EAST & AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.5.11.4. REST OF MIDDLE EAST & AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.5.11.5. REST OF MIDDLE EAST & AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.5.11.6. REST OF MIDDLE EAST & AFRICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.6. SOUTH AMERICA\r\n12.6.1. SOUTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY COUNTRY, 2024-2032 (USD MILLION)\r\n12.6.2. SOUTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.6.3. SOUTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.6.4. SOUTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.6.5. SOUTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.6.6. SOUTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.6.7. SOUTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.6.8. ARGENTINA\r\n12.6.8.1. ARGENTINA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.6.8.2. ARGENTINA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.6.8.3. ARGENTINA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.6.8.4. SAUDI ARABIA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.6.8.5. ARGENTINA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.6.8.6. ARGENTINA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.6.9. BRAZIL\r\n12.6.9.1. BRAZIL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.6.9.2. BRAZIL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.6.9.3. BRAZIL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.6.9.4. BRAZIL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.6.9.5. BRAZIL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.6.9.6. BRAZIL AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n12.6.10. REST OF SOUTH AMERICA\r\n12.6.10.1. REST OF SOUTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE, 2024-2032 (USD MILLION)\r\n12.6.10.2. REST OF SOUTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY ENGINE TYPE, 2024-2032 (USD MILLION)\r\n12.6.10.3. REST OF SOUTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN, 2024-2032 (USD MILLION)\r\n12.6.10.4. REST OF SOUTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2024-2032 (USD MILLION)\r\n12.6.10.5. REST OF SOUTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL, 2024-2032 (USD MILLION)\r\n12.6.10.6. REST OF SOUTH AMERICA AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL, 2024-2032 (USD MILLION)\r\n \r\n13. CUSTOMIZATION PACKAGE\r\n13.1. ARTIFICIAL INTELLIGENCE IN AUTOMOTIVE INDUSTRY\r\n13.2. DRIVERLESS CARS\r\n13.3. ENGINE COOLING SYSTEMS\r\n13.4. POWERTRAIN CONTROL UNITS\r\n \r\n14. COMPETITIVE LANDSCAPE\r\n14.1. COMPETITIVE OVERVIEW\r\n14.2. MARKET SHARE ANALYSIS, BY REGION\r\n14.2.1. GLOBAL MAJOR PLAYERS MARKET SHARE ANALYSIS\r\n14.3. COMPETITIVE BENCHMARKING\r\n14.4. KEY DEVELOPMENTS IN THE GLOBAL AUTOMOTIVE CHARGE AIR COOLER MARKET\r\n14.4.1. KEY DEVELOPMENTS: MERGERS & ACQUISITIONS\r\n14.4.2. KEY DEVELOPMENTS: CONTRACTS & AGREEMENTS\r\n14.4.3. KEY DEVELOPMENTS: PARTNERSHIPS & COLLABORATIONS\r\n14.4.4. KEY DEVELOPMENTS: EXPANSIONS\r\n14.4.5. KEY DEVELOPMENTS: PRODUCT DEVELOPMENTS/LAUNCHES\r\n \r\n15. COMPANY PROFILES\r\n15.1. MAHLE GMBH\r\n15.1.1. COMPANY OVERVIEW\r\n15.1.2. FINANCIAL OVERVIEW\r\n15.1.3. PRODUCTS/SOLUTIONS/SERVICES OFFERED\r\n15.1.4. KEY DEVELOPMENTS\r\n15.1.5. SWOT ANALYSIS\r\n15.1.6. KEY STRATEGIES\r\n15.2. MODINE MANUFACTURING COMPANY\r\n15.2.1. COMPANY OVERVIEW\r\n15.2.2. FINANCIAL OVERVIEW\r\n15.2.3. PRODUCTS/SOLUTIONS/SERVICES OFFERED\r\n15.2.4. KEY DEVELOPMENTS\r\n15.2.5. SWOT ANALYSIS\r\n15.2.6. KEY STRATEGIES\r\n15.3. DELPHI TECHNOLOGIES\r\n15.3.1. COMPANY OVERVIEW\r\n15.3.2. FINANCIAL OVERVIEW\r\n15.3.3. PRODUCTS/SOLUTIONS/SERVICES OFFERED\r\n15.3.4. KEY DEVELOPMENTS\r\n15.3.5. SWOT ANALYSIS\r\n15.3.6. KEY STRATEGIES\r\n15.4. DANA LIMITED\r\n15.4.1. COMPANY OVERVIEW\r\n15.4.2. FINANCIAL OVERVIEW\r\n15.4.3. PRODUCTS/SOLUTIONS/SERVICES OFFERED\r\n15.4.4. KEY DEVELOPMENTS\r\n15.4.5. SWOT ANALYSIS\r\n15.4.6. KEY STRATEGIES\r\n15.5. VESTAS AIRCOIL A/S\r\n15.5.1. COMPANY OVERVIEW\r\n15.5.2. FINANCIAL OVERVIEW\r\n15.5.3. PRODUCTS/SOLUTIONS/SERVICES OFFERED\r\n15.5.4. KEY DEVELOPMENTS\r\n15.5.5. SWOT ANALYSIS\r\n15.5.6. KEY STRATEGIES\r\n15.6. BELL INTERCOOLERS\r\n15.6.1. COMPANY OVERVIEW\r\n15.6.2. FINANCIAL OVERVIEW\r\n15.6.3. PRODUCTS/SOLUTIONS/SERVICES OFFERED\r\n15.6.4. KEY DEVELOPMENTS\r\n15.6.5. SWOT ANALYSIS\r\n15.6.6. KEY STRATEGIES\r\n15.7. T. RAD CO. LTD.\r\n15.7.1. COMPANY OVERVIEW\r\n15.7.2. FINANCIAL OVERVIEW\r\n15.7.3. PRODUCTS/SOLUTIONS/SERVICES OFFERED\r\n15.7.4. KEY DEVELOPMENTS\r\n15.7.5. SWOT ANALYSIS\r\n15.7.6. KEY STRATEGIES\r\n15.8. VALEO\r\n15.8.1. COMPANY OVERVIEW\r\n15.8.2. FINANCIAL OVERVIEW\r\n15.8.3. PRODUCTS/SOLUTIONS/SERVICES OFFERED\r\n15.8.4. KEY DEVELOPMENTS\r\n15.8.5. SWOT ANALYSIS\r\n15.8.6. KEY STRATEGIES\r\n15.9. SPECTRA PREMIUM\r\n15.9.1. COMPANY OVERVIEW\r\n15.9.2. FINANCIAL OVERVIEW\r\n15.9.3. PRODUCTS/SOLUTIONS/SERVICES OFFERED\r\n15.9.4. KEY DEVELOPMENTS\r\n15.9.5. SWOT ANALYSIS\r\n15.9.6. KEY STRATEGIES\r\n15.10. CONFLUX TECHNOLOGY\r\n15.10.1. COMPANY OVERVIEW\r\n15.10.2. FINANCIAL OVERVIEW\r\n15.10.3. PRODUCTS/SOLUTIONS/SERVICES OFFERED\r\n15.10.4. KEY DEVELOPMENTS\r\n15.10.5. SWOT ANALYSIS\r\n15.10.6. KEY STRATEGIES\r\n \r\n16.

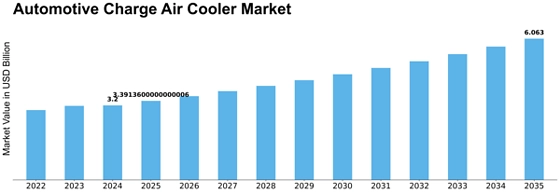

APPENDIX\r\n \r\nLIST OF TABLES\r\nTable 1: Global Automotive Charge Air Cooler Market, by Region, 2024–2030\r\nTable 2: North America: Automotive Charge Air Cooler Market, by Country, 2024–2030\r\nTable 3: North America: Automotive Charge Air Cooler Market, by Type, 2024–2030\r\nTable 4: North America: Automotive Charge Air Cooler Market, by Engine Type, 2024–2030\r\nTable 5: North America: Automotive Charge Air Cooler Market, by Design, 2024–2030\r\nTable 6: North America: Automotive Charge Air Cooler Market, by Vehicle Type, 2024–2030\r\nTable 7: North America: Automotive Charge Air Cooler Market, by Material, 2024–2030\r\nTable 8: North America: Automotive Charge Air Cooler Market, by Sales Channel, 2024–2030\r\n \r\nTable 9: Europe: Automotive Charge Air Cooler Market, by Country, 2024–2030\r\nTable 10: Europe: Automotive Charge Air Cooler Market, by Type, 2024–2030\r\nTable 11: Europe: Automotive Charge Air Cooler Market, by Engine Type, 2024–2030\r\nTable 12: Europe: Automotive Charge Air Cooler Market, by Design, 2024–2030\r\nTable 13: Europe: Automotive Charge Air Cooler Market, by Vehicle Type, 2024–2030\r\nTable 14: Europe: Automotive Charge Air Cooler Market, by Material, 2024–2030\r\nTable 15: Europe: Automotive Charge Air Cooler Market, by Sales Channel, 2024–2030\r\nTable 16: Asia-Pacific: Automotive Charge Air Cooler Market, by Country, 2024–2030\r\nTable 17: Asia-Pacific: Automotive Charge Air Cooler Market, by Type, 2024–2030\r\nTable 18: Asia-Pacific: Automotive Charge Air Cooler Market, by Engine Type, 2024–2030\r\nTable 19: Asia-Pacific: Automotive Charge Air Cooler Market, by Design, 2024–2030\r\nTable 20: Asia-Pacific: Automotive Charge Air Cooler Market, by Vehicle Type, 2024–2030\r\nTable 21: Asia-Pacific: Automotive Charge Air Cooler Market, by Material, 2024–2030\r\nTable 22: Asia-Pacific: Automotive Charge Air Cooler Market, by Sales Channel, 2024–2030\r\nTable 23: MEA: Automotive Charge Air Cooler Market, by Country, 2024–2030\r\nTable 24: MEA: Automotive Charge Air Cooler Market, by Type, 2024–2030\r\nTable 25: MEA: Automotive Charge Air Cooler Market, by Engine Type, 2024–2030\r\nTable 26: MEA: Automotive Charge Air Cooler Market, by Design, 2024–2030\r\nTable 27: MEA: Automotive Charge Air Cooler Market, by Vehicle Type, 2024–2030\r\nTable 28: MEA: Automotive Charge Air Cooler Market, by Material, 2024–2030\r\nTable 29: MEA: Automotive Charge Air Cooler Market, by Sales Channel, 2024–2030\r\nTable 30: South America: Automotive Charge Air Cooler Market, by Country, 2024–2030\r\nTable 31: South America: Automotive Charge Air Cooler Market, by Type, 2024–2030\r\nTable 32: South America: Automotive Charge Air Cooler Market, by Engine Type, 2024–2030\r\nTable 33: South America: Automotive Charge Air Cooler Market, by Design, 2024–2030\r\nTable 34: South America: Automotive Charge Air Cooler Market, by Vehicle Type, 2024–2030\r\nTable 35: South America: Automotive Charge Air Cooler Market, by Material, 2024–2030\r\nTable 36: South America: Automotive Charge Air Cooler Market, by Sales Channel, 2024–2030\r\n \r\n \r\nLIST OF FIGURES\r\n \r\nFIGURE 1 Global Automotive Charge Air Cooler Market Segmentation\r\nFIGURE 2 Forecast Research Methodology\r\nFIGURE 3 Porter’s Five Forces Analysis of Global Automotive Charge Air Cooler Market\r\nFIGURE 4 Value Chain/Supply Chain of Global Automotive Charge Air Cooler Market\r\nFIGURE 5 Share of Global Automotive Charge Air Cooler Market, by Country, 2021 (%)\r\nFIGURE 6 Global Automotive Charge Air Cooler Market, 2024–2030\r\nFIGURE 7 Global Automotive Charge Air Cooler Market Size, by Type, 2024–2030\r\nFIGURE 8 Share of Global Automotive Charge Air Cooler Market, by Type, 2021 (%)\r\nFIGURE 9 Global Automotive Charge Air Cooler Market Size, by Engine Type, 2024–2030\r\nFIGURE 10 Share of Global Automotive Charge Air Cooler Market, by Engine Type, 2021 (%)\r\nFIGURE 11 Global Automotive Charge Air Cooler Market Size, by Design, 2024–2030\r\nFIGURE 12 Share of Global Automotive Charge Air Cooler Market, by Design, 2021 (%)\r\nFIGURE 13 Global Automotive Charge Air Cooler Market Size, by Vehicle Type, 2024–2030\r\nFIGURE 14 Share of Global Automotive Charge Air Cooler Market, by Vehicle Type, 2021 (%)\r\nFIGURE 15 Global Automotive Charge Air Cooler Market Size, by Material, 2024–2030\r\nFIGURE 16 Share of Global Automotive Charge Air Cooler Market, by Material, 2021 (%)\r\nFIGURE 17 Global Automotive Charge Air Cooler Market Size, by Sales Channel, 2024–2030\r\nFIGURE 18 Share of Global Automotive Charge Air Cooler Market, by Sales Channel, 2021 (%)

Leave a Comment