Automotive Grille Market Share

Automotive Grille Market Research Report Information By Material Type (Aluminum, Stainless Steel, ABS Plastic), By Product Type (Mesh Automotive Grille, CNC Automotive Grille, and Billet Automotive Grille), By Sales Channel (OEM, and Aftermarket), By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), and By Region (North America, Europe, Asia-Pacific, Middle East ...

Market Summary

As per Market Research Future Analysis, the Automotive Grille Market was valued at USD 10,941.22 million in 2023 and is projected to reach USD 16,242.1 million by 2032, growing at a CAGR of 4.48% from 2024 to 2032. The market is driven by the growth of the global automobile industry and the increasing popularity of online marketplaces for aftermarket components. The demand for vehicle modifications, particularly for enhancing aesthetics and performance, is also contributing to market growth.

Key Market Trends & Highlights

Key trends influencing the Automotive Grille Market include:

- ABS Plastic held ~60% market share in 2022, being the most popular material for automotive grilles.

- The Billet Automotive Grille segment dominated in 2022, known for its strength and customization options.

- OEM sales channel led the market in 2022, preferred for compatibility and quality assurance.

- Passenger Cars accounted for the largest share in 2022, driven by increasing sales and demand for advanced features.

Market Size & Forecast

| 2023 Market Size | USD 10,941.22 million |

| 2032 Market Size | USD 16,242.1 million |

| CAGR (2024-2032) | 4.48% |

| Largest Regional Market Share in 2022 | Asia-Pacific. |

Major Players

Key players in the market include T-REX Grille, Westin Automotive Products, Putco, Dorman Products, HBPO GmbH, Faltec, SRG Global, Roush Performance, Toyoda Gosei Co., Ltd., and Magna International.

Market Trends

Growing demand for custom modifications of vehicles

Majority car owners modify the car to enhance the vehicle performance; however, car modification also improves the overall appearance of the vehicle. Furthermore, car modification consists of changing standard car manufacturer setting for new modification which further includes the installation of automotive grilles. Customers’ desire to purchase new cars and sell old ones, as well as car owners’ desire to change their vehicles to keep them appealing, is expected to drive the Automotive Grille Market during the forecast era.

Furthermore, with the rapid urbanization of the world, the market for cars grows as well, resulting in a rise in the demand for car modifications and significantly drive the automotive grille market. Consumers with more disposable income and purchasing power are more likely to modify their vehicles. The trend of vehicle modification is growing in popularity to give vehicle a unique appearance. These are the main factors that are expected to drive the Automotive Grille Market forward in the coming years.

The automotive grille market is poised for transformation, driven by advancements in materials and design that enhance vehicle aerodynamics and aesthetic appeal.

U.S. Department of Transportation

Automotive Grille Market Market Drivers

Market Growth Projections

The Global Automotive Grille Market Industry is poised for substantial growth, with projections indicating an increase from 11.4 USD Billion in 2024 to 18.5 USD Billion by 2035. This growth trajectory suggests a robust demand for automotive grilles, driven by factors such as rising vehicle production, technological advancements, and evolving consumer preferences. The anticipated CAGR of 4.48% from 2025 to 2035 further underscores the market's potential. As manufacturers adapt to changing market dynamics and consumer expectations, the automotive grille sector is likely to evolve, presenting new opportunities for innovation and development.

Rising Vehicle Production

The Global Automotive Grille Market Industry is experiencing growth driven by the increasing production of vehicles worldwide. In 2024, the market is projected to reach 11.4 USD Billion, reflecting the demand for various vehicle types, including passenger cars and commercial vehicles. This surge in production is largely attributed to the growing automotive sector in emerging economies, where manufacturers are ramping up output to meet consumer demand. As vehicle production rises, the need for high-quality grilles that enhance aesthetics and functionality becomes paramount, thereby propelling the market forward.

Consumer Preference for Customization

The Global Automotive Grille Market Industry is witnessing a shift in consumer preferences towards personalized vehicle features. Car buyers increasingly seek customization options that allow them to express their individuality. This trend has led manufacturers to offer a variety of grille designs, finishes, and functionalities. Custom grilles not only enhance the visual appeal of vehicles but also provide opportunities for aftermarket sales. As the demand for unique vehicle aesthetics continues to rise, the market is likely to expand, contributing to the overall growth of the automotive sector.

Sustainability and Eco-Friendly Materials

Sustainability is becoming a crucial factor in the Global Automotive Grille Market Industry. As environmental concerns rise, manufacturers are increasingly adopting eco-friendly materials and production processes. The use of recyclable materials in grille manufacturing not only reduces the carbon footprint but also appeals to environmentally conscious consumers. This trend aligns with the broader automotive industry's shift towards sustainability, as evidenced by the projected market growth from 11.4 USD Billion in 2024 to 18.5 USD Billion by 2035. The emphasis on sustainable practices is likely to drive innovation and investment in the grille market.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are pivotal drivers in the Global Automotive Grille Market Industry. Governments worldwide are implementing stringent regulations regarding vehicle safety and emissions, necessitating the incorporation of advanced grille designs that meet these standards. For instance, grilles must facilitate optimal airflow for engine cooling while adhering to pedestrian safety regulations. As manufacturers strive to comply with these regulations, the demand for innovative grille solutions is expected to increase. This focus on safety and compliance not only enhances vehicle performance but also supports the market's growth trajectory.

Technological Advancements in Grille Design

Innovations in grille design and materials are significantly influencing the Global Automotive Grille Market Industry. Manufacturers are increasingly adopting lightweight materials, such as advanced composites and aluminum, to improve fuel efficiency and reduce emissions. Furthermore, the integration of smart technologies, such as active grille shutters, enhances vehicle aerodynamics and engine cooling. These advancements not only cater to consumer preferences for modern aesthetics but also align with regulatory requirements for sustainability. As a result, the market is expected to grow steadily, with a projected CAGR of 4.48% from 2025 to 2035.

Market Segment Insights

Automotive Grille Market Material Type Segment Insights

Automotive Grille Material Type Insights

Based on Material Type, the Automotive Grille Market segmentation includes Aluminum, Stainless Steel, ABS Plastic. The ABS Plastic material type held the majority share in 2022, contributing around ~60% to the market revenue. ABS is an acronym for acrylonitrile butadiene styrene. This is a strong thermoplastic polymer commonly used on the exterior of vehicles in the form of mud flaps, fender flares, trim, and so on. For reference, “thermoplastic” implies that the material gets soft when heated and hard when cooled. In fact, thermoplastic materials can go through these heating and cooling cycles several times without changing their fundamental makeup.

That is, unless the heat it to its melting point or freeze it to the point of fracture. However, even then, the material isn’t a waste. Unlike ABS, which is a thermoplastic, polyurethane is a thermosetting plastic. That means, it forms strong bonds when heated up—making it great for heat-resistant products. (Think: insulation.) However, that also means it can’t be repeatedly melted down and recast into new parts. That doesn’t mean polyurethane can’t be recycled, just that the process is a little more complex. ABS plastic is considered very strong structurally.

This makes it an ideal choice for various applications that need strong and stiff plastic that is resistant to external strength impacts.

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Automotive Grille Product Type Insights

Based on the Product Type, the Automotive Grille Market segmentation includes Mesh Automotive Grille, CNC Automotive Grille, and Billet Automotive Grille. The Billet Automotive Grille held the majority share in 2022. Billet grilles are custom grille inserts that may be used to cover or to replace the existing or the stock grille insert of a vehicle. As their name implies, billet grills are machined from a single piece of billet.

The most popular billet material used in the manufacturing of billet grilles is billet aluminum, although it is not unusual for one to find billet grilles made from stainless steel or ABS plastic. But from whatever billet material they are made from, they are guaranteed to be stronger than custom grille inserts that have been cast or forged. Using billet to manufacture grilles makes sense from a financial standpoint. The most cost-effective billet grille material available is the ABS Plastic. Widely used across the entire automobile accessories spectrum, ABS Plastic is a lightweight, rigid, and durable thermoplastic material.

While it is not as strong as stainless steel or aluminum, ABS Plastic still makes an excellent medium for building billet grilles because the plastic is impervious to rust and quite durable. For added customization, it can usually be painted to match or accent your stock paint. For high quality ABS billet grilles, turn to RDX, Street Scene and Stull Industries.

Automotive Grille Sales Channel Insights

Based on the Sales Channel, the Automotive Grille Market segmentation is OEM, and Aftermarket. OEM segment dominated the market in 2022. Consumers replacing damaged vehicle components may choose to purchase OEM parts to ensure replacement parts are fully compatible with the vehicle and produced at the same quality standards. As the original suppliers of a vehicle's components, often have their products sold by branded car dealerships and available for order through the automaker directly. OEM products are endorsed by the automaker and are often significantly more expensive than aftermarket parts.

OEM parts usually only offer one or two options for consumers, making the experience of replacing parts rather less complicated.

Automotive Grille Vehicle Type Insights

Based on the Vehicle Type, the Automotive Grille Market segmentation is Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle. Passenger Car segment dominated the market in 2022. Passenger cars hold the largest share in the automotive grille market on account of features and quality- rich exteriors. With the increasing sales of both economical and luxury passenger cars, the preference for advanced and comfortable car design has also increased.

Currently, OEMs are offering convenience features, such as ventilated seats, touchscreen infotainment systems, ambient lighting, and several other features, in mid- variant models, which were earlier available only in the top-end variants. China is currently the largest consumer of vehicles, and it is expected to see the largest demand for automotive grille, as new and innovative features, like head-up displays and navigation systems enter the exteriors market. Also, as developed regions, such as Europe and North America, continue to move toward electric passenger cars, the demand for automotive grille will remain positive even in the long run.

Get more detailed insights about Automotive Grille Market Research Report - Global Forecast till 2032

Regional Insights

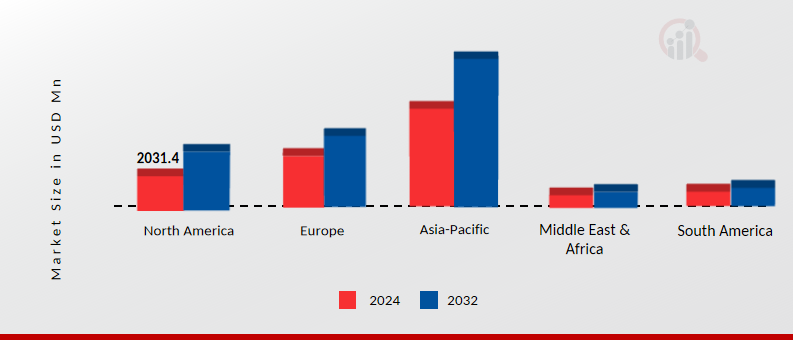

By Region, the study provides market insights into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. The Asia Pacific automotive grille market accounted for ~52% in 2022. The automotive industry is transforming rapidly, and China is one of the main drivers to bring that transformation. The local automakers are innovating with vehicles to fulfil the future demands of roads by developing vehicles for shared mobility. The country is witnessing the exit of some automotive companies to reduce their supply chain dependence in the country, which will likely affect the country’s market soon.

India represents the fourth-largest automobile industry globally, with more than 3.4 million cars sold in 2019. Over the past few years, there has been an increasing demand from consumers for features, like infotainment systems with navigation facilities, convenience, and connectivity. By 2019, car manufacturers, like Maruti Suzuki, Hyundai, Kia, MG, Tata, Mahindra, and Toyota, started offering touchscreen infotainment systems with pre-downloaded maps, and customers have the facility of upgrading the maps whenever there is a new update.

Furthermore, the growing affluent populations, higher consumer spending on luxury goods, and spiked luxury car sales are some of the major factors that are expected to drive the growth of the automotive grille market in India over the forecast period.

Figure2: Automotive Grille Market, by Region, 2024 & 2032 (USD Million)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Europe automotive grille market accounts for the second-largest market share. Germany is a leader in producing passenger cars among all member countries in the European Union. Currently, three major companies - Volkswagen, Daimler AG, and BMW, dominate the German automotive industry. Statistics in country’s automotive sector show that Germany produces over 6 million vehicles annually, including passenger and commercial vehicles. Automakers are constantly upgrading the exteriors, and to provide best exterior experience to customers, major automakers in the market are developing new technologies and materials to stay ahead of their competitors.

Moreover, other countries expected to have good growth prospects for automotive grille are Finland, Belgium, Hungary, Ireland, etc. However, the reimposition of the lockdown in major economies of Europe is expected to hinder the market growth in the short-term, as the countries are facing this turbulence in the smooth operation of facilities and dealerships.

North America automotive grille market is expected to grow at the fastest CAGR between 2022 and 2032. The United States is one of the largest automotive industries in the world. Until 2019, the new vehicle sales across the country had increased significantly. However, during 2019, factors, such as slowdown in the economy, high non-housing debt, diminished retail spending, and rising defaults, led to a decrease in vehicle sales across the country.

Major automakers in the country are investing in the expansion of their facilities and in latest technologies to make the vehicles future-ready and provide the best driving experience to customers. The growing market for premium cars and increased preference toward employing trucks and other commercial vehicles with aftermarket exteriors products may drive the automotive grille market in the country over the forecast period.

Key Players and Competitive Insights

The global automotive grilles market is profitable, both for existing players as well as new entrants. The market is highly competitive with all the players competing to gain a higher market share. Intense competition, rapid advances in solar technology, and regulations are key factors that confront the market growth. A substantial level of rivalry is observed among the existing manufacturers in the market. In recent years, strategic movements by major players included approvals, which have been used as market penetration strategies and a means to reduce competition.

The major players in the market include T-REX Grille, Westin Automotive Products, Putco, Dorman Products, HBPO GmbH, Faltec, SRG Global, Roush Performance, Toyoda Gosei Co, Ltd., Magna International, Kirin Auto Parts Co, Ltd., Zhejiang Ruitai Auto Parts Co., Ltd., and others. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry. Magna International is investing in growing the business, expanding margins, generating solid free cash flow, returning capital to shareholders and accelerating investment in the car of the future.

Its key stakeholders can count on the company for a successful combination of strength, stability, and growth.

Key Companies in the Automotive Grille Market market include

Industry Developments

- In December 2020, Dorman Products has acquired Dayton Parts. Dayton offers a complete line of undercarriage and other related products for commercial vehicles in the United States and Canada, representing one of the most extensive single-source product offerings available in the independent commercial vehicle aftermarket.

- In December 2020, Westin Automotive Products, Inc. has acquired Hint Mounts, a company operating in the public safety vehicle and electronics market. Hint’s products include computers, tablets, keyboards, monitors, specialty mounts, consoles, rear organizers, and electronic products for cars, trucks, and specialty applications.

Future Outlook

Automotive Grille Market Future Outlook

The Automotive Grille Market is projected to grow at a 4.48% CAGR from 2024 to 2035, driven by advancements in materials, design innovation, and increasing demand for electric vehicles.

New opportunities lie in:

- Invest in lightweight composite materials to enhance fuel efficiency and performance.

- Develop smart grilles with integrated sensors for improved vehicle safety and aesthetics.

- Expand into emerging markets with tailored grille designs for local consumer preferences.

By 2035, the Automotive Grille Market is expected to be robust, reflecting dynamic growth and innovation.

Market Segmentation

Automotive Grille Regional Outlook

- US

- Canada

- Mexico

- Germany

- UK

- France

- Italy

- Rest of Europe

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Brazil

- Argentina

- Rest of South America

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

Automotive Grille Product Type Outlook

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

Automotive Grille Vehicle Type Outlook

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Automotive Grille Material Type Outlook

- Aluminum

- Stainless Steel

- ABS Plastic

Automotive Grille Sales Channel Outlook

- OEM

- Aftermarket

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2023 | USD 10941.22 million |

| Market Size 2024 | USD 11433.57 million |

| Market Size 2032 | USD 16242.10 million |

| Compound Annual Growth Rate (CAGR) | 4.48% (2023-2032) |

| Base Year | 2022 |

| Market Forecast Period | 2023-2032 |

| Historical Data | 2019- 2021 |

| Market Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Material Type, Product Type, Sales Channel, Vehicle Type |

| Geographies Covered | Europe, North America, Asia-Pacific, Middle East & Africa, and South America. |

| Countries Covered | The US, Germany, Canada, U.K., Italy, France, Spain, Japan, China, Australia, India, South Korea, and Brazil |

| Key Companies Profiled | T-REX Grille, Westin Automotive Products, Putco, Dorman Products, HBPO GmbH, Faltec, SRG Global, Roush Performance, Toyoda Gosei Co, Ltd., Magna International, Kirin Auto Parts Co, Ltd., Zhejiang Ruitai Auto Parts Co., Ltd. |

| Key Market Opportunities | · Innovative strategies adopted by market player to grab the position in growing automotive sector |

| Key Market Dynamics | · The growth of worldwide automotive industry · Surging adoption of online marketplace selling aftermarket components |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the automotive grille market?

The Automotive Grille Market size is expected to be valued at USD 10523.03 Million in 2022.

What is the growth rate of the automotive grille market?

The global market is projected to grow at a CAGR of 4.48% during the forecast period, 2024-2032.

Which region held the largest market share in the automotive grille market?

Asia Pacific had the largest share of the global market.

Who are the key players in the automotive grille market?

The key players in the market are T-REX Grille, Westin Automotive Products, Putco, Dorman Products, HBPO GmbH, Faltec, SRG Global, Roush Performance, Toyoda Gosei Co, Ltd., Magna International, and Others.

Which Material Type led the automotive grille market?

The ABS Plastic category dominated the market in 2022.

Which vehicle type had the largest market share in the automotive grille market?

Passenger car had the largest market share in the automotive grille market.

-

|-

-

Table of Contents

-

Executive Summary

-

Market Introduction

-

Research Methodology

-

Market Dynamics

-

Market Factor Analysis

-

Global Automotive Grille Market Size Estimation & Forecast, by Material Type

-

Global Automotive Grille Market Size Estimation & Forecast, by Product Type

-

Global Automotive Grille Market Size Estimation & Forecast, by SALES CHANNEL

-

Global Automotive Grille Market Size Estimation & Forecast, by Vehicle Type

-

Global Automotive Grille Market Size Estimation & Forecast, by

-

Asia-Pacific Market Estimates & Forecast, by Region, 2019-2032 Market Estimates & Forecast, by Material Type, 2019-2032 Market Estimates & Forecast, by Product Type, 2019-2032 Market Estimates & Forecast, by Sales Channel, 2019-2032 Market Estimates & Forecast, by Vehicle Type, 2019-2032 China Market Estimates & Forecast, by Material Type, 2019-2032 Market Estimates & Forecast, by Product Type, 2019-2032 Market Estimates & Forecast, by Sales Channel, 2019-2032 Market Estimates & Forecast, by Vehicle Type, 2019-2032 India Market Estimates & Forecast, by Material Type, 2019-2032 Market Estimates & Forecast, by Product Type, 2019-2032 Market Estimates & Forecast, by Sales Channel, 2019-2032 Market Estimates & Forecast, by Vehicle Type, 2019-2032 Japan Market Estimates & Forecast, by Material Type, 2019-2032 Market Estimates & Forecast, by Product Type, 2019-2032 Market Estimates & Forecast, by Sales Channel, 2019-2032 Market Estimates & Forecast, by Vehicle Type, 2019-2032 Rest of Asia-Pacific Market Estimates & Forecast, by Material Type, 2019-2032 Market Estimates & Forecast, by Product Type, 2019-2032 Market Estimates & Forecast, by Sales Channel, 2019-2032 Market Estimates & Forecast, by Vehicle Type, 2019-2032

-

Rest of the World Market Estimates & Forecast, by Region, 2019-2032 Market Estimates & Forecast, by Material Type, 2019-2032 Market Estimates & Forecast, by Product Type, 2019-2032 Market Estimates & Forecast, by Sales Channel, 2019-2032 Market Estimates & Forecast, by Vehicle Type, 2019-2032 Middle East & Africa Market Estimates & Forecast, by Material Type, 2019-2032 Market Estimates & Forecast, by Product Type, 2019-2032 Market Estimates & Forecast, by Sales Channel, 2019-2032 Market Estimates & Forecast, by Vehicle Type, 2019-2032 South America Market Estimates & Forecast, by Material Type, 2019-2032 Market Estimates & Forecast, by Product Type, 2019-2032 Market Estimates & Forecast, by Sales Channel, 2019-2032 Market Estimates & Forecast, by Vehicle Type, 2019-2032

-

Competitive Landscape

-

Company Profiles

-

List of Tables and Figures

- TABLE 1 LIST OF ASSUMPTIONS 31

- TABLE 2 GLOBAL AUTOMOTIVE GRILLES, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 46

- TABLE 3 GLOBAL AUTOMOTIVE GRILLES, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 49

- TABLE 4 GLOBAL AUTOMOTIVE GRILLES, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 51

- TABLE 5 GLOBAL AUTOMOTIVE GRILLES, BY SALES CHANNEL, 2019–2032 (USD MILLION) 53

- TABLE 6 GLOBAL AUTOMOTIVE GRILLES, BY REGION, 2019–2032 (USD MILLION) 55

- TABLE 7 NORTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY COUNTRY, 2019–2032 (USD MILLION) 57

- TABLE 8 NORTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 59

- TABLE 9 NORTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 61

- TABLE 10 NORTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 63

- TABLE 11 NORTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 65

- TABLE 14 US: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 67

- TABLE 15 US: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 69

- TABLE 16 US: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 71

- TABLE 17 US: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 73

- TABLE 18 CANADA: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 75

- TABLE 19 CANADA: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 77

- TABLE 20 CANADA: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 79

- TABLE 21 CANADA: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 81

- TABLE 24 MEXICO: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 83

- TABLE 25 MEXICO: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 85

- TABLE 26 MEXICO: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 87

- TABLE 27 MEXICO: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 89

- TABLE 28 EUROPE: AUTOMOTIVE GRILLES MARKET, BY COUNTRY, 2019–2032 (USD MILLION) 91

- TABLE 29 EUROPE: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 93

- TABLE 30 EUROPE: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 95

- TABLE 31 EUROPE: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 97

- TABLE 32 EUROPE: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 99

- TABLE 33 UK: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 101

- TABLE 34 UK: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 103

- TABLE 35 UK: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 105

- TABLE 36 UK: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 107

- TABLE 39 GERMANY: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 109

- TABLE 40 GERMANY: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 111

- TABLE 41 GERMANY: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 113

- TABLE 42 GERMANY: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 115

- TABLE 45 FRANCE: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 117

- TABLE 46 FRANCE: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 119

- TABLE 47 FRANCE: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 121

- TABLE 48 FRANCE: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 123

- TABLE 51 ITALY: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 125

- TABLE 52 ITALY: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 127

- TABLE 53 ITALY: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 129

- TABLE 54 ITALY: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 131

- TABLE 57 SPAIN: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 133

- TABLE 58 SPAIN: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 135

- TABLE 59 SPAIN: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 137

- TABLE 60 SPAIN: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 139

- TABLE 63 REST OF EUROPE: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 141

- TABLE 64 REST OF EUROPE: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 143

- TABLE 65 REST OF EUROPE: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 145

- TABLE 66 REST OF EUROPE: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 147

- TABLE 69 ASIA-PACIFIC: AUTOMOTIVE GRILLES MARKET, BY COUNTRY, 2019–2032 (USD MILLION) 149

- TABLE 70 ASIA-PACIFIC: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 151

- TABLE 71 ASIA-PACIFIC: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 153

- TABLE 72 ASIA-PACIFIC: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 155

- TABLE 73 ASIA-PACIFIC: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 157

- TABLE 76 CHINA: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 159

- TABLE 77 CHINA: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 161

- TABLE 78 CHINA: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 163

- TABLE 79 CHINA: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 165

- TABLE 82 INDIA: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 167

- TABLE 83 INDIA: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 169

- TABLE 84 INDIA: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 171

- TABLE 85 INDIA: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 173

- TABLE 88 JAPAN: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 175

- TABLE 89 JAPAN: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 177

- TABLE 90 JAPAN: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 179

- TABLE 91 JAPAN: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 181

- TABLE 94 SOUTH KOREA: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 183

- TABLE 95 SOUTH KOREA: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 185

- TABLE 96 SOUTH KOREA: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 187

- TABLE 97 SOUTH KOREA: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 189

- TABLE 100 REST OF ASIA-PACIFIC: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 191

- TABLE 101 REST OF ASIA-PACIFIC: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 193

- TABLE 102 REST OF ASIA-PACIFIC: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 195

- TABLE 103 REST OF ASIA-PACIFIC: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 197

- TABLE 106 MIDDLE EAST & AFRICA: AUTOMOTIVE GRILLES MARKET, BY COUNTRY, 2019–2032 (USD MILLION) 199

- TABLE 107 MIDDLE EAST & AFRICA: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 201

- TABLE 108 MIDDLE EAST & AFRICA: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 203

- TABLE 109 MIDDLE EAST & AFRICA: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 205

- TABLE 110 MIDDLE EAST & AFRICA: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 207

- TABLE 113 UAE: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 209

- TABLE 114 UAE: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 211

- TABLE 115 UAE: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 213

- TABLE 116 UAE: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 215

- TABLE 119 SAUDI ARABIA: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 217

- TABLE 120 SAUDI ARABIA: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 219

- TABLE 121 SAUDI ARABIA: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 221

- TABLE 122 SAUDI ARABIA: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 223

- TABLE 125 SOUTH AFRICA: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 225

- TABLE 126 SOUTH AFRICA: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 227

- TABLE 127 SOUTH AFRICA: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 229

- TABLE 128 SOUTH AFRICA: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 231

- TABLE 131 REST OF MEA: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 233

- TABLE 132 REST OF MEA: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 235

- TABLE 133 REST OF MEA: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 237

- TABLE 134 REST OF MEA: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 239

- TABLE 137 SOUTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY COUNTRY, 2019–2032 (USD MILLION) 241

- TABLE 138 SOUTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 243

- TABLE 139 SOUTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 245

- TABLE 140 SOUTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 247

- TABLE 141 SOUTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 249

- TABLE 144 BRAZIL: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 251

- TABLE 145 BRAZIL: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 253

- TABLE 146 BRAZIL: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 255

- TABLE 147 BRAZIL: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 257

- TABLE 150 ARGENTINA: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 259

- TABLE 151 ARGENTINA: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 261

- TABLE 152 ARGENTINA: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 263

- TABLE 153 ARGENTINA: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 265

- TABLE 156 REST OF SOUTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 267

- TABLE 157 REST OF SOUTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 269

- TABLE 158 REST OF SOUTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 271

- TABLE 159 REST OF SOUTH AMERICA: AUTOMOTIVE GRILLES MARKET, BY SALES CHANNEL, 2019–2032 (USD MILLION) 273

- TABLE 162 KEY DEVELOPMENTS: CONTRACTS & AGREEMENTS 275

- TABLE 163 KEY DEVELOPMENTS: PARTNERSHIPS & COLLABORATIONS 277

- TABLE 164 KEY DEVELOPMENTS: PRODUCT DEVELOPMENTS/LAUNCHES 279

- TABLE 165 T-REX GRILLE: PRODUCTS OFFERED 281

- TABLE 166 T-REX GRILLE: KEY DEVELOPMENTS 283

- TABLE 167 WESTIN AUTOMOTIVE PRODUCTS: PRODUCTS OFFERED 285

- TABLE 168 WESTIN AUTOMOTIVE PRODUCTS: KEY DEVELOPMENTS 287

- TABLE 169 PUTCO: PRODUCTS OFFERED 289

- TABLE 170 PUTCO: KEY DEVELOPMENTS 291

- TABLE 171 DORMAN PRODUCTS: PRODUCTS OFFERED 293

- TABLE 172 DORMAN PRODUCTS: KEY DEVELOPMENTS 295

- TABLE 173 HBPO GMBH: PRODUCTS OFFERED 297

- TABLE 174 HBPO GMBH: KEY DEVELOPMENTS 299

- TABLE 175 FALTEC: PRODUCTS OFFERED 301

- TABLE 176 FALTEC: KEY DEVELOPMENTS 303

- TABLE 177 SRG GLOBAL: PRODUCTS OFFERED 305

- TABLE 178 SRG GLOBAL: KEY DEVELOPMENTS 307

- TABLE 179 ROUSH PERFORMANCE.: PRODUCTS OFFERED 309

- TABLE 180 ROUSH PERFORMANCE.: KEY DEVELOPMENTS 311

- TABLE 181 TOYODA GOSEI CO, LTD.: PRODUCTS OFFERED 313

- TABLE 182 TOYODA GOSEI CO, LTD.: KEY DEVELOPMENTS 315

- TABLE 183 MAGNA INTERNATIONAL: PRODUCTS OFFERED 317

- TABLE 184 MAGNA INTERNATIONAL: KEY DEVELOPMENTS 319

- TABLE 185 MAGNA INTERNATIONAL: PRODUCTS OFFERED 321

- TABLE 186 MAGNA INTERNATIONAL: KEY DEVELOPMENTS 323

- TABLE 187 ZHEJIANG RUITAI AUTO PARTS CO., LTD.: PRODUCTS OFFERED 325

- TABLE 188 ZHEJIANG RUITAI AUTO PARTS CO., LTD.: KEY DEVELOPMENTS 327

- TABLE 189 COMPANY 13: PRODUCTS OFFERED 329

- TABLE 190 COMPANY 13: KEY DEVELOPMENTS 331

- TABLE 191 COMPANY 14: PRODUCTS OFFERED 333

- TABLE 192 COMPANY 14: KEY DEVELOPMENTS 335

- TABLE 193 COMPANY 15: PRODUCTS OFFERED 337

- TABLE 194 COMPANY 15: PRODUCTS OFFERED 339

- FIGURE 1 MARKET SYNOPSIS 20

- FIGURE 2 GLOBAL AUTOMOTIVE GRILLES MARKET ANALYSIS, BY MATERIAL TYPE 21

- FIGURE 3 GLOBAL AUTOMOTIVE GRILLES MARKET ANALYSIS, BY PRODUCT TYPE 22

- FIGURE 4 GLOBAL AUTOMOTIVE GRILLES MARKET ANALYSIS, BY VEHICLE TYPE 23

- FIGURE 5 GLOBAL AUTOMOTIVE GRILLES MARKET ANALYSIS, BY SALES CHANNEL 24

- FIGURE 6 GLOBAL AUTOMOTIVE GRILLES MARKET: STRUCTURE 25

- FIGURE 7 RESEARCH PROCESS 26

- FIGURE 8 TOP-DOWN & BOTTOM-UP APPROACHES 27

- FIGURE 9 MARKET DYNAMICS OVERVIEW 28

- FIGURE 10 DRIVER IMPACT ANALYSIS: GLOBAL AUTOMOTIVE GRILLES MARKET 29

- FIGURE 11 RESTRAINT IMPACT ANALYSIS: GLOBAL AUTOMOTIVE GRILLES MARKET 30

- FIGURE 12 PORTER’S FIVE FORCES ANALYSIS: GLOBAL AUTOMOTIVE GRILLES 31

- FIGURE 13 SUPPLY CHAIN ANALYSIS: GLOBAL AUTOMOTIVE GRILLES 32

- FIGURE 14 GLOBAL AUTOMOTIVE GRILLES, BY MATERIAL TYPE, 2022 (% SHARE) 33

- FIGURE 15 GLOBAL AUTOMOTIVE GRILLES, BY MATERIAL TYPE, 2019–2032 (USD MILLION) 34

- FIGURE 16 GLOBAL AUTOMOTIVE GRILLES, BY PRODUCT TYPE, 2022 (% SHARE) 35

- FIGURE 17 GLOBAL AUTOMOTIVE GRILLES, BY PRODUCT TYPE, 2019–2032 (USD MILLION) 36

- FIGURE 18 GLOBAL AUTOMOTIVE GRILLES, BY VEHICLE TYPE, 2022 (% SHARE) 37

- FIGURE 19 GLOBAL AUTOMOTIVE GRILLES, BY VEHICLE TYPE, 2019–2032 (USD MILLION) 38

- FIGURE 20 GLOBAL AUTOMOTIVE GRILLES, BY SALES CHANNEL, 2022 (% SHARE) 39

- FIGURE 21 GLOBAL AUTOMOTIVE GRILLES, BY SALES CHANNEL, 2019–2032 (USD MILLION) 40

- FIGURE 22 GLOBAL AUTOMOTIVE GRILLES, BY REGION, 2019 TO 2032 (USD MILLION) 41

- FIGURE 23 GLOBAL AUTOMOTIVE GRILLES, BY REGION, 2022 (% SHARE) 42

- FIGURE 24 NORTH AMERICA: AUTOMOTIVE GRILLES MARKET SHARE, BY COUNTRY, 2022 (% SHARE) 43

- FIGURE 25 EUROPE: AUTOMOTIVE GRILLES MARKET SHARE, BY COUNTRY, 2022 (% SHARE) 44

- FIGURE 26 ASIA-PACIFIC: AUTOMOTIVE GRILLES MARKET SHARE, BY COUNTRY, 2022 (% SHARE) 45

- FIGURE 27 MIDDLE EAST & AFRICA: AUTOMOTIVE GRILLES MARKET SHARE, BY COUNTRY, 2022 (% SHARE) 46

- FIGURE 28 SOUTH AMERICA: AUTOMOTIVE GRILLES MARKET SHARE, BY COUNTRY, 2022 (% SHARE) 47

- FIGURE 29 BENCHMARKING OF MAJOR COMPETITORS 48

- FIGURE 30 GLOBAL AUTOMOTIVE GRILLES MARKET SHARE ANALYSIS, 2022 49

- FIGURE 31 T-REX GRILLE: FINANCIAL OVERVIEW SNAPSHOT 50

- FIGURE 32 T-REX GRILLE: SWOT ANALYSIS 51

- FIGURE 33 WESTIN AUTOMOTIVE PRODUCTS: FINANCIAL OVERVIEW SNAPSHOT 52

- FIGURE 34 WESTIN AUTOMOTIVE PRODUCTS: SWOT ANALYSIS 53

- FIGURE 35 PUTCO: FINANCIAL OVERVIEW SNAPSHOT 54

- FIGURE 36 PUTCO: SWOT ANALYSIS 55

- FIGURE 37 DORMAN PRODUCTS: FINANCIAL OVERVIEW SNAPSHOT 56

- FIGURE 38 DORMAN PRODUCTS: SWOT ANALYSIS 57

- FIGURE 39 HBPO GMBH: FINANCIAL OVERVIEW SNAPSHOT 58

- FIGURE 40 HBPO GMBH: SWOT ANALYSIS 59

- FIGURE 41 FALTEC: FINANCIAL OVERVIEW SNAPSHOT 60

- FIGURE 42 FALTEC: SWOT ANALYSIS 61

- FIGURE 43 SRG GLOBAL: FINANCIAL OVERVIEW SNAPSHOT 62

- FIGURE 44 SRG GLOBAL: SWOT ANALYSIS 63

- FIGURE 45 ROUSH PERFORMANCE: FINANCIAL OVERVIEW SNAPSHOT 64

- FIGURE 46 ROUSH PERFORMANCE: SWOT ANALYSIS 65

- FIGURE 47 TOYODA GOSEI CO, LTD.: FINANCIAL OVERVIEW SNAPSHOT 66

- FIGURE 48 TOYODA GOSEI CO, LTD.: SWOT ANALYSIS 67

- FIGURE 49 MAGNA INTERNATIONAL: FINANCIAL OVERVIEW SNAPSHOT 68

- FIGURE 50 MAGNA INTERNATIONAL: SWOT ANALYSIS 69

- FIGURE 51 KIRIN AUTO PARTS CO, LTD.: FINANCIAL OVERVIEW SNAPSHOT 70

- FIGURE 52 KIRIN AUTO PARTS CO, LTD.: SWOT ANALYSIS 71

- FIGURE 53 ZHEJIANG RUITAI AUTO PARTS CO., LTD.: FINANCIAL OVERVIEW SNAPSHOT 72

- FIGURE 54 ZHEJIANG RUITAI AUTO PARTS CO., LTD.: SWOT ANALYSIS 73

- FIGURE 55 COMPANY 13: FINANCIAL OVERVIEW SNAPSHOT 74

- FIGURE 56 COMPANY 13: SWOT ANALYSIS 75

- FIGURE 57 COMPANY 14: FINANCIAL OVERVIEW SNAPSHOT 76

- FIGURE 58 COMPANY 14: SWOT ANALYSIS 77

- FIGURE 59 COMPANY 15: FINANCIAL OVERVIEW SNAPSHOT 78

- FIGURE 60 COMPANY 15: FINANCIAL OVERVIEW SNAPSHOT 79

Automotive Grille Market Segmentation

Automotive Grille Material Type Outlook (USD Million, 2019-2032)

- Aluminum

- Stainless Steel

- ABS Plastic

Automotive Grille Product Type Outlook

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

Automotive Grille Sales Channel Outlook

- OEM

- Aftermarket

Automotive Grille Vehicle Type Outlook

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Automotive Grille Regional Outlook (USD Million, 2019-2032)

- North America Outlook (USD Million, 2019-2032)

- North America Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- North America Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- North America Automotive Grille by Sales Channel

- OEM

- Aftermarket

- North America Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- US Outlook (USD Million, 2019-2032)

- US Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- US Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- US Automotive Grille by Sales Channel

- OEM

- Aftermarket

- US Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- CANADA Outlook (USD Million, 2019-2032)

- CANADA Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- CANADA Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- CANADA Automotive Grille by Sales Channel

- OEM

- Aftermarket

- CANADA Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- MEXICO Outlook (USD Million, 2019-2032)

- MEXICO Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- MEXICO Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- MEXICO Automotive Grille by Sales Channel

- OEM

- Aftermarket

- MEXICO Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Europe Outlook (USD Million, 2019-2032)

- Europe Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- Europe Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- Europe Automotive Grille by Sales Channel

- OEM

- Aftermarket

- Europe Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Germany Outlook (USD Million, 2019-2032)

- Germany Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- Germany Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- Germany Automotive Grille by Sales Channel

- OEM

- Aftermarket

- Germany Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- UK Outlook (USD Million, 2019-2032)

- UK Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- UK Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- UK Automotive Grille by Sales Channel

- OEM

- Aftermarket

- UK Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- France Outlook (USD Million, 2019-2032)

- France Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- France Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- France Automotive Grille by Sales Channel

- OEM

- Aftermarket

- France Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- ITALY Outlook (USD Million, 2019-2032)

- ITALY Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- ITALY Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- ITALY Automotive Grille by Sales Channel

- OEM

- Aftermarket

- ITALY Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Rest Of Europe Outlook (USD Million, 2019-2032)

- REST OF EUROPE Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- REST OF EUROPE Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- REST OF EUROPE Automotive Grille by Sales Channel

- OEM

- Aftermarket

- REST OF EUROPE Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Asia-Pacific Outlook (USD Million, 2019-2032)

- Asia-Pacific Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- Asia-Pacific Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- Asia-Pacific Automotive Grille by Sales Channel

- OEM

- Aftermarket

- Asia-Pacific Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- China Outlook (USD Million, 2019-2032)

- China Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- China Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- China Automotive Grille by Sales Channel

- OEM

- Aftermarket

- China Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Japan Outlook (USD Million, 2019-2032)

- Japan Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- Japan Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- Japan Automotive Grille by Sales Channel

- OEM

- Aftermarket

- Japan Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- India Outlook (USD Million, 2019-2032)

- India Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- India Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- India Automotive Grille by Sales Channel

- OEM

- Aftermarket

- India Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- South Korea Outlook (USD Million, 2019-2032)

- South Korea Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- South Korea Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- South Korea Automotive Grille by Sales Channel

- OEM

- Aftermarket

- Asia-Pacific Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Rest of Asia-Pacific Outlook (USD Million, 2019-2032)

- Rest of Asia-Pacific Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- Rest of Asia-Pacific Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- Rest of Asia-Pacific Automotive Grille by Sales Channel

- OEM

- Aftermarket

- Rest of Asia-Pacific Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Middle East & Africa Outlook (USD Million, 2019-2032)

- Middle East & Africa Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- Middle East & Africa Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- Middle East & Africa Automotive Grille by Sales Channel

- OEM

- Aftermarket

- Middle East & Africa Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- South America Outlook (USD Million, 2019-2032)

- South America Automotive Grille by Material Type

- Aluminum

- Stainless Steel

- ABS Plastic

- South America Automotive Grille by Product Type

- Mesh Automotive Grille

- CNC Automotive Grille

- Billet Automotive Grille

- South America Automotive Grille by Sales Channel

- OEM

- Aftermarket

- South America Automotive Grille by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- South America Automotive Grille by Material Type

- Middle East & Africa Automotive Grille by Material Type

- Asia-Pacific Automotive Grille by Material Type

- Europe Automotive Grille by Material Type

- North America Automotive Grille by Material Type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment