Automotive Lighting Market Analysis

Automotive Lighting Market Research Report By Application (Exterior Lighting, Interior Lighting, Signaling Lighting, Accent Lighting), By Technology (Halogen, LED, Xenon, Laser), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two Wheelers, Buses), By End Use (OEM, Aftermarket) and By Regional (North America, Europe, South America, Asia Pacific, Middle East and Africa) - Forecast to 2035

Market Summary

As per Market Research Future Analysis, the Global Automotive Lighting Market was valued at 34.8 USD Billion in 2023 and is projected to grow to 49.2 USD Billion by 2035, with a CAGR of 2.93% from 2025 to 2035. The market is driven by technological advancements, increasing vehicle production, and rising demand for energy-efficient lighting solutions, particularly LED technology. The shift towards electric vehicles and stringent safety regulations further enhance market growth, while consumer preferences for vehicle personalization and smart lighting systems present new opportunities.

Key Market Trends & Highlights

The Automotive Lighting Market is evolving rapidly, influenced by technology and consumer preferences.

- The market is expected to grow from 35.82 USD Billion in 2024 to 49.2 USD Billion by 2035.

- Exterior Lighting is projected to increase from 15.0 USD Billion in 2024 to 20.0 USD Billion by 2035.

- LED technology's share in automotive applications rose from 20% in 2015 to over 65% in 2022.

- Electric vehicle sales surged from 1.3 million in 2017 to over 10 million in 2022.

Market Size & Forecast

| 2023 Market Size | USD 34.8 Billion |

| 2024 Market Size | USD 35.82 Billion |

| 2035 Market Size | USD 49.2 Billion |

| CAGR (2025-2035) | 2.93% |

| Largest Regional Market Share in 2024 | North America. |

Major Players

Gentex, FederalMogul, Magneti Marelli, Valeo, Philips, Aisin Seiki, LG Innotek, Hella, Koito Manufacturing, Aptiv, Stanley Electric, OSRAM, Lear Corporation, Nippon Seiki, TYC, Brother.

Market Trends

There are substantial trends in the Automotive Lighting Market that are being driven by the increasing demand for advanced vehicle features, increased safety regulations, and technological advancements.

The continuous integration of LED lighting systems in vehicles is a significant market driver, as they provide superior energy efficiency and lengthier lifespans than traditional lighting solutions.

Manufacturers are being encouraged to implement innovative illumination technologies that improve visibility in a variety of driving conditions as a result of global government initiatives that are advocating for enhanced safety standards.

The proliferation of autonomous driving systems and electric vehicles (EVs) is creating opportunities that necessitate sophisticated illumination solutions to guarantee safety and facilitate advanced functionality.

The demand for adaptive illumination systems that can adapt to various driving scenarios and environments is increasing as the global automotive industry transitions to these technologies.

Furthermore, the market opportunity for manufacturers to innovate and provide personalized lighting designs and features is presented by the growing trend of automotive lighting customization among consumers.

In recent years, there has been an increase in the popularity of smart illumination solutions, which include dynamic bending lights and integrated sensors that can adjust to changing road conditions. This is further bolstered by digital advancements, which enable manufacturers to create connected lighting systems that improve the user experience.

The market is also influenced by the increasing emphasis on sustainable practices, which is consistent with the broader global sustainability objectives.

A particular emphasis is placed on eco-friendly materials and procedures in lighting production. The Automotive Lighting Market is poised for sustained growth and innovation in the years ahead due to the convergence of these trends and drivers.

The ongoing evolution of automotive lighting technology appears to enhance vehicle safety and energy efficiency, reflecting a broader trend towards sustainable transportation solutions.

U.S. Department of Transportation

Automotive Lighting Market Market Drivers

Technological Advancements

The Global Automotive Lighting Market Industry is experiencing a surge in technological advancements, particularly with the integration of LED and laser lighting technologies. These innovations not only enhance visibility and safety but also contribute to energy efficiency. For instance, LED lights consume significantly less power compared to traditional halogen bulbs, which aligns with global sustainability goals. The shift towards these advanced lighting solutions is projected to drive the market's growth, with the industry expected to reach 35.8 USD Billion in 2024. This transition reflects a broader trend towards smarter, more efficient automotive technologies.

Market Segment Insights

Automotive Lighting Market Application Insights

The Automotive Lighting Market, with a projected value of 35.82 USD Billion in 2024, demonstrates a comprehensive segmentation across various applications critical to vehicle safety and aesthetics. This market segmentation includes Exterior Lighting, Interior Lighting, Signaling Lighting, and Accent Lighting.

Among these, Exterior Lighting stands out significantly, projected to hold a market value of 14.5 USD Billion in 2024 and grow to 19.7 USD billion by 2035, capturing a major share due to its crucial role in ensuring visibility and safety on the roads.

This application’s dominance can be attributed to the increasing vehicle production and stringent regulations regarding road safety. Interior Lighting follows, representing a noteworthy segment valued at 9.2 USD Billion in 2024, anticipated to rise to 12.4 USD Billion by 2035.

The rising demand for enhanced passenger comfort and vehicle aesthetics drives this segment’s growth, making it prominent in modern automotive design. Signaling Lighting, valued at 7.0 USD billion in 2024 with expectations to reach 9.6 USD billion by 2035, plays a vital role in vehicle communication on the road.

Its growth is greatly linked to ongoing advancements in technology that enhance visibility and response times, meeting the demands for safer driving experiences. On the other hand, Accent Lighting, which holds a market value of 5.12 USD Billion in 2024 and is set to expand to 7.3 USD Billion by 2035, offers customization options for vehicle owners, enabling them to personalize their vehicles further, thus creating a niche market appeal.

Automotive Lighting Market Technology Insights

The Automotive Lighting Market is evolving significantly, particularly in the Technology segment, which encompasses various types of lighting solutions. By 2024, the market is valued at 35.82 USD billion, reflecting the increasing demand for innovative lighting technologies.

The segment includes Halogen, LED, Xenon, and Laser technologies, each with its unique advantages. LED technology is rapidly gaining traction due to its energy efficiency and longevity, contributing to a shift towards more sustainable automotive lighting solutions.

Halogen lights continue to be widely used for their cost-effectiveness, while Xenon lights offer superior brightness, enhancing visibility in challenging driving conditions.

Laser lights represent a cutting-edge advancement, delivering high-intensity illumination and design flexibility. The market growth is propelled by the rising safety standards and consumer preference for advanced lighting systems in vehicles.

However, challenges such as high initial costs and the need for technical expertise in installation may hinder broader adoption. The Automotive Lighting Market segmentation reflects a clear trend towards technologically advanced lighting solutions, aligning with global initiatives aimed at reducing carbon footprints and enhancing road safety.

Automotive Lighting Market Vehicle Type Insights

The Automotive Lighting Market, particularly within the Vehicle Type segment, is projected to be valued at 35.82 USD billion by 2024, reflecting a steady growth trajectory in the industry. This market showcases diverse vehicle categories, such as Passenger Cars, Commercial Vehicles, Two Wheelers, and Buses, each contributing to the overall market dynamics.

Passenger Cars hold a substantial share due to high consumer demand for advanced lighting technology that enhances safety and aesthetic appeal. Commercial Vehicles also play a crucial role, especially with the rising emphasis on efficient transport and logistics.

Two-wheelers are gaining traction, fueled by increasing urbanization and a shift towards more compact, energy-efficient options for mobility. Buses, while representing a smaller segment, are vital for public transportation, benefiting from innovations focused on safety and low energy consumption.

The growing focus on energy-efficient technologies and safety regulations across the globe promotes the impressive growth of the Automotive Lighting Market.

Market growth is also driven by trends toward electrification and sustainability, with global organizations advocating for higher standards in automotive safety and efficiency, thus creating opportunities for innovation in lighting solutions across all vehicle types.

Automotive Lighting Market End Use Insights

The Automotive Lighting Market is projected to reach a valuation of 35.82 USD billion by 2024, highlighting robust demand across various applications. In this market, the end-use segmentation includes Original Equipment Manufacturer (OEM) and Aftermarket categories, both playing crucial roles in its dynamics.

The OEM segment often drives significant revenue due to partnerships with automotive manufacturers, ensuring the integration of innovative lighting solutions in new vehicle models. This collaboration focuses on enhancing vehicle safety and aesthetic appeal, making it a dominant force in the overall market landscape.

Conversely, the Aftermarket segment caters to a diverse range of consumer needs, addressing replacement parts and upgrades for existing vehicles. This segment presents opportunities as vehicle owners increasingly prioritize customization and maintenance over time.

With the global push for energy-efficient technologies and the adoption of LED lighting, both segments stand to gain from emerging trends. The Automotive Lighting Market is influenced by various factors, including regulatory compliance for safer lighting systems and rising consumer expectations, further shaping the competitive landscape.

Understanding these segments provides insights into potential growth areas within the automotive lighting domain.

Get more detailed insights about Automotive Lighting Market Research Report - Global Forecast till 2035

Regional Insights

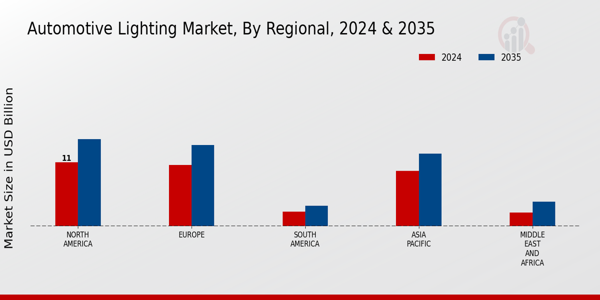

The Automotive Lighting Market revenue showcases diverse regional dynamics, with North America leading significantly, valued at 11.0 USD Billion in 2024 and projected to reach 15.0 USD Billion by 2035, indicating its major dominance in the industry.

Europe closely follows, valued at 10.5 USD Billion in 2024, with expectations of growing to 14.0 USD billion in 2035, reflecting a strong market presence due to stringent regulatory standards and consumer demands for innovative lighting technologies.

The Asia Pacific region, valued at 9.5 USD Billion in 2024 and expected to grow to 12.5 USD billion by 2035, is crucial for introducing advanced automotive technologies, spurred by increasing vehicle production.

South America stands at a valuation of 2.5 USD Billion in 2024, rising to 3.5 USD billion by 2035, but represents a smaller segment overall.

The Middle East and Africa, valued at 2.32 USD billion in 2024 and forecasted to increase to 4.2 USD billion by 2035, are emerging markets presenting opportunities due to increasing automobile ownership and infrastructure improvements.

This regional segmentation of the Automotive Lighting Market data indicates varying growth opportunities and competitive landscapes influenced by local consumer preferences, economic conditions, and regulatory frameworks.

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Key Players and Competitive Insights

The Automotive Lighting Market is characterized by a diverse competitive landscape, driven by innovation and technological advancements. Various companies are vying for market share, focusing on enhancing product capabilities, quality, and design while adapting to changing regulatory standards and consumer preferences.

The increasing demand for energy-efficient lighting solutions, primarily LED technology, has prompted significant investments in research and development, leading to various collaborations, mergers, and product launches.

Companies within the market are recognizing the importance of sustainability, integration of smart technologies, and customization to meet the needs of customers and OEMs alike.

This dynamic environment fosters competition among established players and new entrants, each aiming to capture a larger share of the market through strategic initiatives.

Magneti Marelli has established a formidable presence within the Automotive Lighting Market, attributed to its commitment to innovative designs and advanced technologies.

The company focuses on creating high-quality lighting systems that enhance vehicle safety and aesthetics, thus meeting the evolving demands of automotive manufacturers. One of Magneti Marelli's core strengths lies in its extensive experience in the automotive sector, which equips it with insights to effectively respond to changing trends and customer requirements.

This expertise allows Magneti Marelli to develop reliable, cutting-edge lighting solutions that not only comply with international standards but also enhance the overall driving experience.

The company has seen success through strategic partnerships and alliances, which have bolstered its market reach and product development capabilities, thereby positioning itself as a competitive player in the global landscape.

Hella operates robustly within the Automotive Lighting Market, offering a wide array of products that include innovative light systems, electronics, and accessories aimed at enhancing vehicle functionality and safety. Hella's strength lies in its commitment to research and development, enabling the company to deliver high-performance and stylish lighting solutions tailored to meet diverse consumer preferences.

Furthermore, Hella's global market presence is supported by a strong focus on sustainability and energy efficiency, which aligns with the automotive industry’s shift towards greener technologies.

The company has also made significant strides through strategic mergers and acquisitions that have expanded its capabilities and market footprint, enabling it to leverage unique technologies and insights from acquired firms.

This strategic positioning, combined with an extensive product range and a keen focus on addressing market demands, ensures that Hella remains a key player within the global automotive lighting sector.

Key Companies in the Automotive Lighting Market market include

Industry Developments

- Q4 2024: ams OSRAM and Valeo collaborate to revolutionize vehicle interiors with intelligent RGB LEDs ams OSRAM and Valeo announced a partnership to integrate OSIRE E3731i intelligent RGB LEDs and Open System Protocol (OSP) into automotive ambient lighting, enabling dynamic, personalized visual cues for navigation and driver assistance functions in vehicle interiors.[3]

- Q2 2024: Nichia launches Automotive Innovation Center in Aachen, Germany Nichia, a leading LED manufacturer, opened its Automotive Innovation Center in Germany to accelerate development and support for advanced automotive lighting solutions, focusing on next-generation LED technologies for vehicles.[2]

Future Outlook

Automotive Lighting Market Future Outlook

The Global Automotive Lighting Market is projected to grow at a 2.93% CAGR from 2024 to 2035, driven by advancements in LED technology, increasing vehicle production, and heightened safety regulations.

New opportunities lie in:

- Invest in smart lighting solutions integrating IoT for enhanced vehicle safety.

- Develop energy-efficient lighting systems to meet sustainability goals.

- Explore partnerships with automotive manufacturers for customized lighting designs.

By 2035, the market is expected to achieve robust growth, reflecting evolving consumer preferences and technological advancements.

Market Segmentation

Automotive Lighting End Use Outlook

- OEM

- Aftermarket

Automotive Lighting Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Automotive Lighting Technology Outlook

- Halogen

- LED

- Xenon

- Laser

Automotive Lighting Application Outlook

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

Automotive Lighting Vehicle Type Outlook

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2023 | 34.8 (USD Billion) |

| Market Size 2024 | 35.82 (USD Billion) |

| Market Size 2035 | 49.21 (USD Billion) |

| Compound Annual Growth Rate (CAGR) | 2.93% (2025 - 2035) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | Magneti Marelli, Hella, STMicroelectronics, Osram, Aptiv, Ledvance, Toyota Industries, Ford Motor Company, Fiat Chrysler Automobiles, Valeo, LS Automotive, Robert Bosch, Daimler, Koito Manufacturing, General Motors |

| Segments Covered | Application, Technology, Vehicle Type, End Use, Regional |

| Key Market Opportunities | Innovation in LED technology, Growth in electric vehicles, Expansion in smart lighting systems, Increasing safety regulations, Demand for energy-efficient solutions |

| Key Market Dynamics | Technological advancements, Stringent regulations, rising vehicle production, growing LED adoption, and increased focus on safety |

| Countries Covered | North America, Europe, APAC, South America, MEA |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the projected market size of the Automotive Lighting Market by 2035?

The Automotive Lighting Market is expected to be valued at 49.21 billion USD by the year 2035.

What is the expected CAGR for the Automotive Lighting Market from 2025 to 2035?

The expected compound annual growth rate (CAGR) for the Automotive Lighting Market is 2.93% from 2025 to 2035.

Which application segment holds the largest market share in the Automotive Lighting Market?

The Exterior Lighting application segment is valued at 14.5 billion USD in 2024, making it the largest segment in the market.

What are the market values for Interior Lighting by 2035?

The market value for Interior Lighting in the Automotive Lighting Market is expected to reach 12.4 billion USD by 2035.

Which region is projected to dominate the Automotive Lighting Market by 2035?

North America is projected to dominate the market with a value of 15.0 billion USD by the year 2035.

What will be the market value of North America in 2024 for Automotive Lighting?

In 2024, the market value for Automotive Lighting in North America is expected to be 11.0 billion USD.

How much is the Automotive Lighting Market valued at for Accent Lighting in 2024?

The Accent Lighting application is valued at 5.12 billion USD in 2024 within the Automotive Lighting Market.

Who are the key players in the Automotive Lighting Market?

Major players in the market include Magneti Marelli, Hella, STMicroelectronics, Osram, and Valeo, among others.

What is the projected market value for Signaling Lighting by 2035?

The market value for Signaling Lighting is expected to reach 9.6 billion USD by the year 2035.

What is the market size for the Asia Pacific region's Automotive Lighting in 2024?

The Asia Pacific region's Automotive Lighting market is valued at 9.5 billion USD in 2024.

-

Table of Contents

-

Executive Summary

- Market Overview

- Key Findings

- Market Segmentation

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumption

- Limitations

-

Research Methodology

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value chain Analysis

-

Porter's Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

AUTOMOTIVE LIGHTING MARKET, BY APPLICATION (USD BILLION)

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

-

AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY (USD BILLION)

- Halogen

- LED

- Xenon

- Laser

-

AUTOMOTIVE LIGHTING MARKET, BY VEHICLE TYPE (USD BILLION)

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

-

AUTOMOTIVE LIGHTING MARKET, BY END USE (USD BILLION)

- OEM

- Aftermarket

-

AUTOMOTIVE LIGHTING MARKET, BY REGIONAL (USD BILLION)

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

North America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market share Analysis

- Major Growth Strategy in the Automotive Lighting Market

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Automotive Lighting Market

-

Key developments and growth strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

COMPANY PROFILES

-

Gentex

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

FedralMogul

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Magneti Marelli

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Valeo

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Philips

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Aisin Seiki

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

LG Innotek

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Hella

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Koito Manufacturing

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Aptiv

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Stanley Electric

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

OSRAM

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Lear Corporation

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Nippon Seiki

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

TYC Brother

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Gentex

-

APPENDIX

- References

- Related Reports

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1. LIST OF ASSUMPTIONS

- TABLE 2. NORTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 3. NORTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 4. NORTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 5. NORTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 6. NORTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 7. US AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 8. US AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 9. US AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 10. US AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 11. US AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 12. CANADA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 13. CANADA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 14. CANADA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 15. CANADA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 16. CANADA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 17. EUROPE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 18. EUROPE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 19. EUROPE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 20. EUROPE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 21. EUROPE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 22. GERMANY AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 23. GERMANY AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 24. GERMANY AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 25. GERMANY AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 26. GERMANY AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 27. UK AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 28. UK AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 29. UK AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 30. UK AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 31. UK AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 32. FRANCE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 33. FRANCE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 34. FRANCE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 35. FRANCE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 36. FRANCE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 37. RUSSIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 38. RUSSIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 39. RUSSIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 40. RUSSIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 41. RUSSIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 42. ITALY AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 43. ITALY AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 44. ITALY AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 45. ITALY AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 46. ITALY AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 47. SPAIN AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 48. SPAIN AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 49. SPAIN AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 50. SPAIN AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 51. SPAIN AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 52. REST OF EUROPE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 53. REST OF EUROPE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 54. REST OF EUROPE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 55. REST OF EUROPE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 56. REST OF EUROPE AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 57. APAC AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 58. APAC AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 59. APAC AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 60. APAC AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 61. APAC AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 62. CHINA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 63. CHINA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 64. CHINA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 65. CHINA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 66. CHINA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 67. INDIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 68. INDIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 69. INDIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 70. INDIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 71. INDIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 72. JAPAN AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 73. JAPAN AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 74. JAPAN AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 75. JAPAN AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 76. JAPAN AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 77. SOUTH KOREA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 78. SOUTH KOREA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 79. SOUTH KOREA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 80. SOUTH KOREA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 81. SOUTH KOREA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 82. MALAYSIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 83. MALAYSIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 84. MALAYSIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 85. MALAYSIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 86. MALAYSIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 87. THAILAND AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 88. THAILAND AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 89. THAILAND AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 90. THAILAND AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 91. THAILAND AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 92. INDONESIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 93. INDONESIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 94. INDONESIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 95. INDONESIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 96. INDONESIA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 97. REST OF APAC AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 98. REST OF APAC AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 99. REST OF APAC AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 100. REST OF APAC AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 101. REST OF APAC AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 102. SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 103. SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 104. SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 105. SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 106. SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 107. BRAZIL AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 108. BRAZIL AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 109. BRAZIL AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 110. BRAZIL AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 111. BRAZIL AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 112. MEXICO AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 113. MEXICO AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 114. MEXICO AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 115. MEXICO AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 116. MEXICO AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 117. ARGENTINA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 118. ARGENTINA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 119. ARGENTINA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 120. ARGENTINA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 121. ARGENTINA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 122. REST OF SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 123. REST OF SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 124. REST OF SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 125. REST OF SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 126. REST OF SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 127. MEA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 128. MEA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 129. MEA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 130. MEA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 131. MEA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 132. GCC COUNTRIES AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 133. GCC COUNTRIES AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 134. GCC COUNTRIES AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 135. GCC COUNTRIES AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 136. GCC COUNTRIES AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 137. SOUTH AFRICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 138. SOUTH AFRICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 139. SOUTH AFRICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 140. SOUTH AFRICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 141. SOUTH AFRICA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 142. REST OF MEA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 143. REST OF MEA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 144. REST OF MEA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 145. REST OF MEA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 146. REST OF MEA AUTOMOTIVE LIGHTING MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 147. PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

- TABLE 148. ACQUISITION/PARTNERSHIP LIST OF FIGURES

- FIGURE 1. MARKET SYNOPSIS

- FIGURE 2. NORTH AMERICA AUTOMOTIVE LIGHTING MARKET ANALYSIS

- FIGURE 3. US AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 4. US AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 5. US AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 6. US AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 7. US AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 8. CANADA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 9. CANADA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 10. CANADA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 11. CANADA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 12. CANADA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 13. EUROPE AUTOMOTIVE LIGHTING MARKET ANALYSIS

- FIGURE 14. GERMANY AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 15. GERMANY AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 16. GERMANY AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 17. GERMANY AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 18. GERMANY AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 19. UK AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 20. UK AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 21. UK AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 22. UK AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 23. UK AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 24. FRANCE AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 25. FRANCE AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 26. FRANCE AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 27. FRANCE AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 28. FRANCE AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 29. RUSSIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 30. RUSSIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 31. RUSSIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 32. RUSSIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 33. RUSSIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 34. ITALY AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 35. ITALY AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 36. ITALY AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 37. ITALY AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 38. ITALY AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 39. SPAIN AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 40. SPAIN AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 41. SPAIN AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 42. SPAIN AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 43. SPAIN AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 44. REST OF EUROPE AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 45. REST OF EUROPE AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 46. REST OF EUROPE AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 47. REST OF EUROPE AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 48. REST OF EUROPE AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 49. APAC AUTOMOTIVE LIGHTING MARKET ANALYSIS

- FIGURE 50. CHINA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 51. CHINA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 52. CHINA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 53. CHINA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 54. CHINA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 55. INDIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 56. INDIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 57. INDIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 58. INDIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 59. INDIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 60. JAPAN AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 61. JAPAN AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 62. JAPAN AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 63. JAPAN AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 64. JAPAN AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 65. SOUTH KOREA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 66. SOUTH KOREA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 67. SOUTH KOREA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 68. SOUTH KOREA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 69. SOUTH KOREA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 70. MALAYSIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 71. MALAYSIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 72. MALAYSIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 73. MALAYSIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 74. MALAYSIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 75. THAILAND AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 76. THAILAND AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 77. THAILAND AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 78. THAILAND AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 79. THAILAND AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 80. INDONESIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 81. INDONESIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 82. INDONESIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 83. INDONESIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 84. INDONESIA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 85. REST OF APAC AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 86. REST OF APAC AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 87. REST OF APAC AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 88. REST OF APAC AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 89. REST OF APAC AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 90. SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET ANALYSIS

- FIGURE 91. BRAZIL AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 92. BRAZIL AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 93. BRAZIL AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 94. BRAZIL AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 95. BRAZIL AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 96. MEXICO AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 97. MEXICO AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 98. MEXICO AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 99. MEXICO AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 100. MEXICO AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 101. ARGENTINA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 102. ARGENTINA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 103. ARGENTINA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 104. ARGENTINA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 105. ARGENTINA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 106. REST OF SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 107. REST OF SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 108. REST OF SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 109. REST OF SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY END USE

- FIGURE 110. REST OF SOUTH AMERICA AUTOMOTIVE LIGHTING MARKET ANALYSIS BY REGIONAL

- FIGURE 111. MEA AUTOMOTIVE LIGHTING MARKET ANALYSIS

- FIGURE 112. GCC COUNTRIES AUTOMOTIVE LIGHTING MARKET ANALYSIS BY APPLICATION

- FIGURE 113. GCC COUNTRIES AUTOMOTIVE LIGHTING MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 114. GCC COUNTRIES AUT

Automotive Lighting Market Segmentation

Automotive Lighting Market By Application (USD Billion, 2019-2035)

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

Automotive Lighting Market By Technology (USD Billion, 2019-2035)

- Halogen

- LED

- Xenon

- Laser

Automotive Lighting Market By Vehicle Type (USD Billion, 2019-2035)

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

Automotive Lighting Market By End Use (USD Billion, 2019-2035)

- OEM

- Aftermarket

Automotive Lighting Market By Regional (USD Billion, 2019-2035)

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Automotive Lighting Market Regional Outlook (USD Billion, 2019-2035)

North America Outlook (USD Billion, 2019-2035)

North America Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

North America Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

North America Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

North America Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

North America Automotive Lighting Market by Regional Type

- US

- Canada

- US Outlook (USD Billion, 2019-2035)

US Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

US Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

US Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

US Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- CANADA Outlook (USD Billion, 2019-2035)

CANADA Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

CANADA Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

CANADA Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

CANADA Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

Europe Outlook (USD Billion, 2019-2035)

Europe Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

Europe Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

Europe Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

Europe Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

Europe Automotive Lighting Market by Regional Type

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- GERMANY Outlook (USD Billion, 2019-2035)

GERMANY Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

GERMANY Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

GERMANY Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

GERMANY Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- UK Outlook (USD Billion, 2019-2035)

UK Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

UK Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

UK Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

UK Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- FRANCE Outlook (USD Billion, 2019-2035)

FRANCE Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

FRANCE Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

FRANCE Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

FRANCE Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- RUSSIA Outlook (USD Billion, 2019-2035)

RUSSIA Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

RUSSIA Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

RUSSIA Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

RUSSIA Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- ITALY Outlook (USD Billion, 2019-2035)

ITALY Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

ITALY Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

ITALY Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

ITALY Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- SPAIN Outlook (USD Billion, 2019-2035)

SPAIN Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

SPAIN Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

SPAIN Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

SPAIN Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- REST OF EUROPE Outlook (USD Billion, 2019-2035)

REST OF EUROPE Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

REST OF EUROPE Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

REST OF EUROPE Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

REST OF EUROPE Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

APAC Outlook (USD Billion, 2019-2035)

APAC Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

APAC Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

APAC Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

APAC Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

APAC Automotive Lighting Market by Regional Type

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

- CHINA Outlook (USD Billion, 2019-2035)

CHINA Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

CHINA Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

CHINA Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

CHINA Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- INDIA Outlook (USD Billion, 2019-2035)

INDIA Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

INDIA Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

INDIA Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

INDIA Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- JAPAN Outlook (USD Billion, 2019-2035)

JAPAN Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

JAPAN Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

JAPAN Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

JAPAN Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- SOUTH KOREA Outlook (USD Billion, 2019-2035)

SOUTH KOREA Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

SOUTH KOREA Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

SOUTH KOREA Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

SOUTH KOREA Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- MALAYSIA Outlook (USD Billion, 2019-2035)

MALAYSIA Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

MALAYSIA Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

MALAYSIA Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

MALAYSIA Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- THAILAND Outlook (USD Billion, 2019-2035)

THAILAND Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

THAILAND Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

THAILAND Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

THAILAND Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- INDONESIA Outlook (USD Billion, 2019-2035)

INDONESIA Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

INDONESIA Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

INDONESIA Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

INDONESIA Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- REST OF APAC Outlook (USD Billion, 2019-2035)

REST OF APAC Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

REST OF APAC Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

REST OF APAC Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

REST OF APAC Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

South America Outlook (USD Billion, 2019-2035)

South America Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

South America Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

South America Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

South America Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

South America Automotive Lighting Market by Regional Type

- Brazil

- Mexico

- Argentina

- Rest of South America

- BRAZIL Outlook (USD Billion, 2019-2035)

BRAZIL Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

BRAZIL Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

BRAZIL Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

BRAZIL Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- MEXICO Outlook (USD Billion, 2019-2035)

MEXICO Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

MEXICO Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

MEXICO Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

MEXICO Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- ARGENTINA Outlook (USD Billion, 2019-2035)

ARGENTINA Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

ARGENTINA Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

ARGENTINA Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

ARGENTINA Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2035)

REST OF SOUTH AMERICA Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

REST OF SOUTH AMERICA Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

REST OF SOUTH AMERICA Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

REST OF SOUTH AMERICA Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

MEA Outlook (USD Billion, 2019-2035)

MEA Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

MEA Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

MEA Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

MEA Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

MEA Automotive Lighting Market by Regional Type

- GCC Countries

- South Africa

- Rest of MEA

- GCC COUNTRIES Outlook (USD Billion, 2019-2035)

GCC COUNTRIES Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

GCC COUNTRIES Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

GCC COUNTRIES Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

GCC COUNTRIES Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- SOUTH AFRICA Outlook (USD Billion, 2019-2035)

SOUTH AFRICA Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

SOUTH AFRICA Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

SOUTH AFRICA Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

SOUTH AFRICA Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

- REST OF MEA Outlook (USD Billion, 2019-2035)

REST OF MEA Automotive Lighting Market by Application Type

- Exterior Lighting

- Interior Lighting

- Signaling Lighting

- Accent Lighting

REST OF MEA Automotive Lighting Market by Technology Type

- Halogen

- LED

- Xenon

- Laser

REST OF MEA Automotive Lighting Market by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Buses

REST OF MEA Automotive Lighting Market by End Use Type

- OEM

- Aftermarket

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment