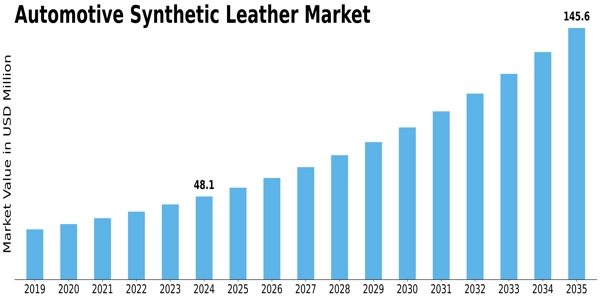

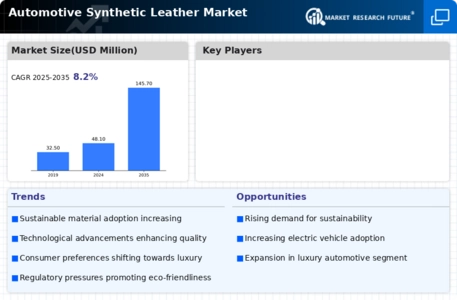

Automotive Synthetic Leather Size

Automotive Synthetic Leather Market Growth Projections and Opportunities

The automotive synthetic leather market is significantly influenced by a multitude of factors that collectively shape its growth and dynamics within the automotive and upholstery industries. Key drivers impacting this market include aesthetic preferences, cost-effectiveness, and environmental considerations. Automotive synthetic leather has emerged as a popular alternative to traditional leather, offering a durable and versatile material for car interiors. Its application spans across upholstery, dashboard covers, and door panels, providing a luxurious appearance and feel at a more affordable price point compared to genuine leather. The demand for visually appealing, cost-effective, and sustainable interior solutions within the automotive sector plays a pivotal role in propelling the growth of the market, aligning with the diverse needs and expectations of car manufacturers and consumers on a global scale.

Economic factors play a vital role in shaping the automotive synthetic leather market. Fluctuations in consumer spending, automotive production rates, and overall economic conditions significantly impact the demand for interior materials in the automotive industry. During periods of economic growth, increased car sales and production contribute to a higher demand for cost-effective yet aesthetically pleasing interior materials like synthetic leather. Conversely, economic downturns may witness a reduction in consumer spending on vehicles and associated components, consequently affecting the market negatively. Therefore, staying attuned to economic trends is crucial for stakeholders in the automotive and upholstery sectors to make informed decisions and navigate market fluctuations effectively.

Technological advancements contribute significantly to the innovation observed in the automotive synthetic leather market. Ongoing improvements in formulations, manufacturing processes, and printing technologies are enhancing the quality, texture, and appearance of synthetic leather materials. Advanced synthetic leathers may boast increased durability, stain resistance, and patterns that convincingly replicate the look of genuine leather. Innovations in eco-friendly and sustainable synthetic leather options, such as those derived from recycled materials or bio-based polymers, are fostering environmentally responsible interior solutions. Manufacturers leveraging cutting-edge technologies gain a competitive edge by offering high-quality and sustainable synthetic leather options that cater to the evolving needs of the automotive industry.

Environmental considerations wield substantial influence over the automotive synthetic leather market. With a growing emphasis on sustainability, there is a heightened demand for interior materials that minimize their environmental impact. Synthetic leathers that adhere to stringent environmental regulations, incorporate eco-friendly manufacturing processes, and offer recyclability are preferred by environmentally conscious consumers and car manufacturers. Furthermore, compliance with safety standards and regulations for automotive interior materials significantly contributes to the market's dynamics. Government initiatives promoting sustainable practices further encourage businesses to invest in compliant and environmentally responsible technologies for automotive synthetic leathers.

Consumer preferences for stylish, comfortable, and easy-to-maintain interiors exert a considerable impact on the automotive synthetic leather market. Car buyers prioritize interior materials that not only enhance the visual appeal of the vehicle but also provide a comfortable and durable seating experience. Synthetic leather's versatility in design, color options, and texture customization caters to the diverse preferences of consumers. Additionally, the easy maintenance and cleaning properties of synthetic leather make it an attractive choice for car owners. The market is further propelled by the increasing demand for customizable and visually appealing interior solutions that contribute to an enhanced driving experience.

Market competition within the automotive synthetic leather industry is influenced by factors such as pricing, quality, and brand reputation. Strategic pricing that considers production costs, material quality, and market demand plays a pivotal role in determining a company's market position. Building a robust reputation for delivering reliable, high-quality, and visually appealing synthetic leather options is essential for attracting and retaining customers. Effective marketing strategies, product differentiation, and collaborations with automotive manufacturers contribute to brand loyalty. Manufacturers and distributors must navigate these competitive factors strategically to establish a strong presence and remain competitive in the dynamic automotive synthetic leather market.

Leave a Comment