Market Share

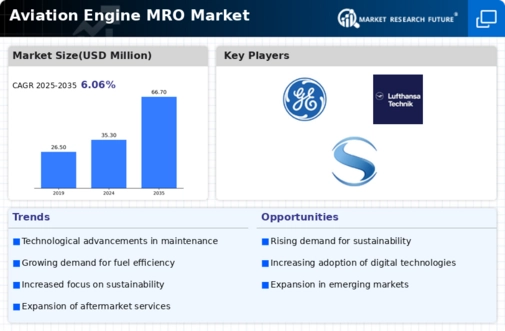

Aviation Engine MRO Market Share Analysis

The aviation engine MRO market plays a vital role in supporting the reliability and performance of aircraft engines to realize safety and efficiency in aviation processes. In the complex and technology-intensive environment of this niche area of engine maintenance and overhaul, companies use various approaches to obtain strong positions in terms of market share. One of the center strategies in aviation engine MRO market is product differentiation. Companies aim to differentiate their services by seeking out state-of-the-art technologies, progressive repair methods, and complete engine overhaul solutions. These companies are looking for optimized and reliable engine performance; therefore, differentiation is important whether it becoming a more fuel efficient or having the ability to operate longer without failing as well as incorporating predictive maintenance capabilities. Another vital strategy used by companies in the aviation engine MRO market is cost leadership. Since engine maintenance is associated with significant costs, companies pay particular attention to optimizing their MRO processes and decreasing the turnaround time as well as providing cost-effective solutions that do not sacrifice quality. This approach is not only cost-effective for budget airlines but also helps companies to have an edge over rivals in an industry where operational efficiency and being able effectively manage costs are important. Market share dynamics in the aviation engine MRO industry are significantly shaped by strategic partnerships and collaborations. Such companies often collaborate with manufacturers of engines, airlines or leasing ones in order to increase their potentials; become equipped and updated regarding the newest technical specifications shall be up-to-date concerning industry standards. These partnerships help in not only advancing the technology but also reaching out to potential markets via established networks. Companies often use market segmentation as a targeted approach to address special needs within the aviation engine MRO. There are different engine types as well as operation needs of various airlines and aircraft operators. To this end, companies modify their MRO services to address the needs of specific sectors. It may include in-depth services for different engine designs or even specialize on certain types of maintenance, such as on wing repairs or complete overhauls.

Leave a Comment