Ball Bearing Size

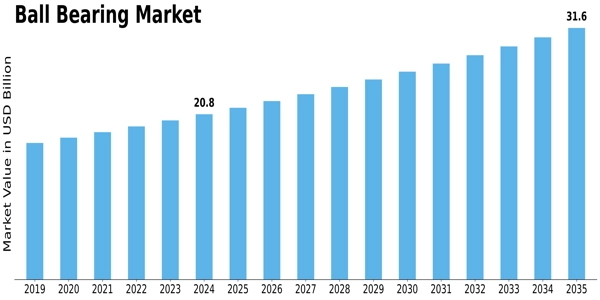

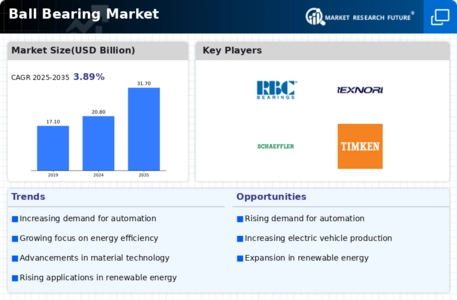

Ball Bearing Market Growth Projections and Opportunities

Bearings that employ balls to maintain racing distance are called ball bearings. These reduce contact between moving components and assist turn parts to move. Cars, airplanes, railroads, and heavy equipment use ball bearings. The market is driven by rising economies including China, Brazil, Mexico, and India building wind turbine frameworks, growing need for high-performance bearings for agricultural gear, and worldwide industrialization.

The ball bearing industry has a complex interchange of variables that affect supply, demand, and growth in various industries. Both macroeconomic and industry-specific forces shape ball bearings, which are essential equipment components. Since ball bearings are closely linked to current workouts, the assembly area's safety is a key motivator. As assembly and production increase, demand for ball-bearing equipment and mechanical frameworks grows, driving market growth.

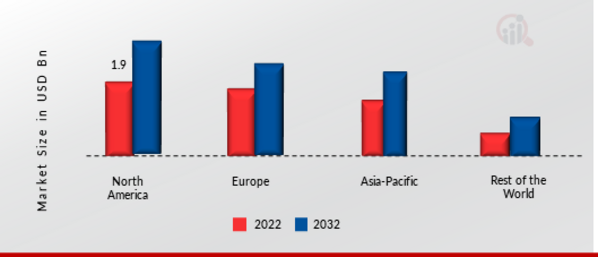

Globalization and trade designs boost the ball bearing business. As companies expand abroad, demand for high-quality ball bearings grows. The inventory network can also be affected by international events, affecting unrefined component availability and assembly procedures. To maintain a manufacturing network and suit the needs of businesses in diverse regions, manufacturers must examine these global factors.

The car industry is changing due to electric vehicle acceptance and autonomous driving innovation, increasing need for particular ball bearings. Electric cars need bearings that can handle challenging situations like quick turns and various load circulations. Market responds by making and selling ball bearings tailored to modern car systems.

Cost and skill drive ball bearing market factors. Enterprises want cost-effective solutions without sacrificing quality or execution. Makers focus on improving production, employing cheaper materials, and increasing ball bearing appeal. This methodology follows industry trends toward functional excellence and cost-effectiveness.

Environmental sustainability influences the ball bearing market. Materials and production methods are being investigated as eco-friendly practises gain popularity. Energy-efficient bearings reduce the natural effect, supporting global efforts to green the contemporary world.

Ball bearing market issues include counterfeit goods and licensed invention insurance. Fake bearings threaten manufacturers and consumers, lowering product confidence and reliability. As a response, manufacturers invest in anti-forging procedures and work with government agencies to protect their licensed technology, ensuring product authenticity.

Leave a Comment