-

EXECUTIVE SUMMARY

-

OVERVIEW 15

- MARKET SYNOPSIS

-

15

-

2

-

MARKET INTRODUCTION

-

SCOPE OF THE STUDY 16

-

RESEARCH OBJECTIVE 16

-

LIST OF ASSUMPTIONS 17

-

RESEARCH METHODOLOGY

-

OVERVIEW 18

-

DATA MINING

-

18

-

3.3

-

SECONDARY RESEARCH 19

-

PRIMARY RESEARCH 20

- PRIMARY INTERVIEWS AND INFORMATION GATHERING

-

PROCESS 20

-

3.4.2

-

BREAKDOWN OF PRIMARY RESPONDENTS 21

-

FORECASTING TECHNIQUES 21

-

RESEARCH METHODOLOGY FOR

- BOTTOM-UP APPROACH 23

- TOP-DOWN APPROACH 24

-

MARKET SIZE ESTIMATION 22

-

DATA TRIANGULATION 24

-

VALIDATION

-

25

-

4

-

MARKET DYNAMICS

-

4.1

-

OVERVIEW 26

-

4.2

-

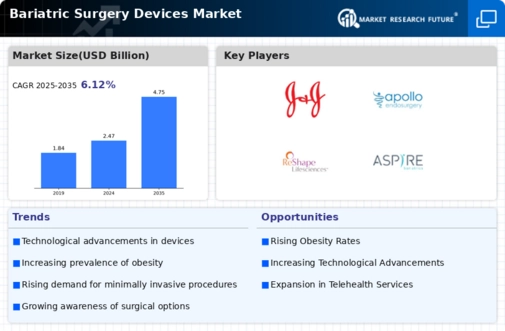

DRIVERS 27

-

4.2.1

-

INCREASING PREVALENCE OF OBESITY 27

-

OF BARIATRIC AND METABOLIC SURGERIES 27

-

BARIATRIC SURGERY DEVICES 27

-

OF BARIATRIC SURGERIES 28

-

RISING TECHNOLOGICAL ADVANCEMENTS 27

-

GROWING NUMBER

-

INCREASING NUMBER OF REGULATORY APPROVALS FOR

-

RESTRAINTS 28

- RISING PRODUCT RECALLS IN THE INDUSTRY 28

- HIGH COST

-

OPPORTUNITIES 29

- EMERGING MARKETS WITH HIGH PREVALENCE OF OBESITY 29

-

MARKET FACTOR

-

ANALYSIS

-

5.1

-

PORTER’S FIVE FORCES MODEL 30

-

31

-

5.1.3

-

THREAT OF SUBSTITUTES 31

-

DESIGNING 33

-

5.2.2

-

MANUFACTURING 33

-

5.2.3

-

DISTRIBUTION 33

-

5.2.4

-

MARKETING & SALES 33

-

THREAT OF NEW ENTRANTS 30

-

BARGAINING POWER OF SUPPLIERS

-

BARGAINING POWER OF BUYERS 31

-

INTENSITY OF RIVALRY 31

-

SUPPLY CHAIN ANALYSIS 32

- R&D AND

- POST-SALES MONITORING 33

-

RECENT FDA APPROVALS 34

-

BARIATRIC SURGERY DEVICES MARKET,

-

BY TYPE

-

6.1

-

OVERVIEW 35

-

6.2

-

MINIMALLY INVASIVE SURGICAL DEVICES 36

-

37

-

6.2.3

-

SUTURING DEVICES 38

-

STAPLING DEVICES 37

-

ENERGY/VESSEL SEALING DEVICES

-

ACCESSORIES 38

-

NON-INVASIVE SURGICAL DEVICES 39

-

BARIATRIC SURGERY DEVICES MARKET,

-

BY PROCEDURE

-

7.1

-

OVERVIEW 40

-

7.2

-

SLEEVE GASTRECTOMY 42

-

GASTRIC BYPASS 42

-

REVISION SURGERY 43

-

ADJUSTABLE GASTRIC BAND 43

-

OTHERS 44

-

BARIATRIC SURGERY DEVICES

-

MARKET, BY END USER

-

OVERVIEW 45

-

HOSPITALS 46

-

SPECIALTY CENTRES 46

-

AMBULATORY SURGICAL CENTERS

-

47

-

8.5

-

OTHERS 47

-

9

-

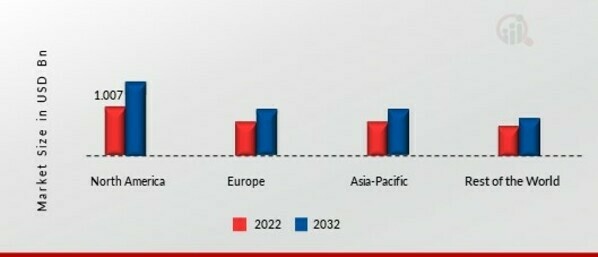

GLOBAL BARIATRIC SURGERY DEVICES MARKET, BY REGION

-

OVERVIEW 48

-

AMERICAS 49

-

BARIATRIC SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY

-

DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET, BY END USER

-

51

-

BARIATRIC

-

NORTH AMERICA

-

SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY

-

DEVICES MARKET, BY END USER

-

US 52

-

BARIATRIC SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY

-

DEVICES MARKET, BY END USER

-

CANADA 54

-

BARIATRIC SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES

-

MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET, BY END USER

-

BARIATRIC SURGERY

-

LATIN AMERICA 55

-

DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET,

-

BY END USER

-

9.3

-

EUROPE 57

-

BARIATRIC

-

SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY

-

DEVICES MARKET, BY END USER

-

WESTERN EUROPE 59

-

BARIATRIC SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY

-

DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET, BY END USER

-

61

-

BARIATRIC

-

GERMANY

-

SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY

-

DEVICES MARKET, BY END USER

-

FRANCE 62

-

BARIATRIC SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES

-

MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET, BY END USER

-

BARIATRIC SURGERY DEVICES

-

UK 63

-

MARKET, BY TYPE

-

BARIATRIC

-

SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET, BY END USER

-

BARIATRIC SURGERY

-

ITALY 65

-

DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET,

-

BY END USER

-

9.3.1.5

-

SPAIN 66

-

BARIATRIC

-

SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY

-

DEVICES MARKET, BY END USER

-

REST OF WESTERN EUROPE 67

-

BARIATRIC SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY

-

DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET, BY END USER

-

69

-

BARIATRIC

-

EASTERN EUROPE

-

SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY

-

DEVICES MARKET, BY END USER

-

ASIA-PACIFIC 71

-

BARIATRIC SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES

-

MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET, BY END USER

-

BARIATRIC SURGERY DEVICES

-

JAPAN 73

-

MARKET, BY TYPE

-

BARIATRIC

-

SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET, BY END USER

-

BARIATRIC SURGERY

-

CHINA 74

-

DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET,

-

BY END USER

-

9.4.3

-

INDIA 76

-

BARIATRIC

-

SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY

-

DEVICES MARKET, BY END USER

-

AUSTRALIA 77

-

BARIATRIC SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES

-

MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET, BY END USER

-

BARIATRIC SURGERY

-

SOUTH KOREA 78

-

DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET,

-

BY END USER

-

9.4.6

-

REST OF ASIA-PACIFIC 80

-

BARIATRIC SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY

-

DEVICES MARKET, BY END USER

-

MIDDLE EAST & AFRICA 82

-

BARIATRIC SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY

-

DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET, BY END USER

-

84

-

BARIATRIC

-

MIDDLE EAST

-

SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

BARIATRIC SURGERY

-

DEVICES MARKET, BY END USER

-

AFRICA 85

-

BARIATRIC SURGERY DEVICES MARKET, BY TYPE

-

BARIATRIC SURGERY DEVICES

-

MARKET, BY PROCEDURE

-

BARIATRIC SURGERY DEVICES MARKET, BY END USER

-

COMPETITIVE LANDSCAPE

-

OVERVIEW 87

-

COMPETITIVE

-

ANALYSIS 87

-

10.3

-

COMPETITOR DASHBOARD 88

-

COMPETITIVE BENCHMARKING 89

-

MAJOR GROWTH STRATEGY IN THE GLOBAL BARIATRIC

-

SURGERY DEVICES MARKET 90

-

LEADING PLAYERS IN TERMS OF NUMBER OF DEVELOPMENTS 90

-

KEY DEVELOPMENTS

- AGREEMENTS 91

- EXPANSIONS 91

- ACQUISITIONS 92

- PRODUCT APPROVALS AND LAUNCHES 92

-

AND GROWTH STRATEGIES 91

-

MAJOR PLAYERS

- SALES & OPERATING PROFIT MARGIN 93

- R&D

- FINANCIAL OVERVIEW 96

- PRODUCTS/SERVICES OFFERED 97

- KEY DEVELOPMENTS

-

FINANCIAL MATRIX & MARKET RATIO 93

-

EXPENDITURE 94

-

11

-

COMPANY PROFILES

-

11.1

-

MEDTRONIC 95

-

11.1.1

-

COMPANY OVERVIEW 95

-

97

-

11.1.5

-

SWOT ANALYSIS 99

-

11.1.6

-

KEY STRATEGIES 99

-

APOLLO ENDOSURGERY, INC. 100

- COMPANY OVERVIEW 100

- FINANCIAL OVERVIEW 100

- PRODUCTS/SERVICES

- SWOT ANALYSIS 102

- KEY STRATEGIES 102

-

OFFERED 101

-

11.2.4

-

KEY DEVELOPMENTS 101

-

INTUITIVE SURGICAL INC.

- FINANCIAL OVERVIEW 103

- PRODUCTS/SERVICES OFFERED 104

- KEY DEVELOPMENTS

- KEY STRATEGIES 106

-

103

-

11.3.1

-

COMPANY OVERVIEW 103

-

104

-

11.3.5

-

SWOT ANALYSIS 106

-

JOHNSON & JOHNSON SERVICES INC. 107

- COMPANY

- PRODUCTS/SERVICES OFFERED 108

- KEY DEVELOPMENTS 108

- SWOT ANALYSIS 109

- KEY STRATEGIES

- COMPANY OVERVIEW 110

- FINANCIAL OVERVIEW 110

- PRODUCTS/SERVICES OFFERED

- SWOT ANALYSIS 111

- KEY STRATEGIES 111

-

OVERVIEW 107

-

11.4.2

-

FINANCIAL OVERVIEW 107

-

109

-

11.5

-

RESHAPE LIFESCIENCES, INC. 110

-

111

-

11.5.4

-

KEY DEVELOPMENTS 111

-

OLYMPUS CORPORATION 112

- COMPANY

- PRODUCTS/SERVICES OFFERED 113

- KEY DEVELOPMENTS 113

- SWOT ANALYSIS 114

- KEY STRATEGIES

- COMPANY OVERVIEW 115

- FINANCIAL OVERVIEW 115

- PRODUCTS/SERVICES OFFERED

- SWOT ANALYSIS 116

- KEY STRATEGIES 116

-

OVERVIEW 112

-

11.6.2

-

FINANCIAL OVERVIEW 112

-

114

-

11.7

-

MEDIFLEX SURGICAL PRODUCTS 115

-

115

-

11.7.4

-

KEY DEVELOPMENTS 115

-

TRANSENTERIX SURGICAL, INC.

- FINANCIAL OVERVIEW 117

- PRODUCTS/SERVICES OFFERED 118

- KEY DEVELOPMENTS

- KEY STRATEGIES 118

-

117

-

11.8.1

-

COMPANY OVERVIEW 117

-

118

-

11.8.5

-

SWOT ANALYSIS 118

-

ASPIRE BARIATRICS 119

- COMPANY OVERVIEW 119

- FINANCIAL

- KEY DEVELOPMENTS 119

- SWOT ANALYSIS 120

- KEY STRATEGIES 120

-

OVERVIEW 119

-

11.9.3

-

PRODUCTS/SERVICES OFFERED 119

-

SPATZ FGIA,

- FINANCIAL OVERVIEW 121

- PRODUCTS/SERVICES OFFERED 121

- KEY DEVELOPMENTS

- KEY STRATEGIES 122

-

INC. 121

-

11.10.1

-

COMPANY OVERVIEW 121

-

121

-

11.10.5

-

SWOT ANALYSIS 122

-

APPENDIX

-

REFERENCES 123

-

RELATED REPORTS 123

-

LIST OF TABLES

-

LIST OF ASSUMPTIONS

-

17

-

TABLE

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET, BY TYPE 2020-2027 (USD MILLION) 36

-

GLOBAL

-

BARIATRIC SURGERY DEVICES MARKET, FOR MINIMALLY INVASIVE SURGICAL DEVICES, BY TYPE

-

(USD

-

MILLION) 36

-

TABLE

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET, FOR MINIMALLY INVASIVE SURGICAL DEVICES,

-

BY REGION 2020-2027

-

(USD MILLION) 36

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET, FOR STAPLING

-

DEVICES, BY TYPE 2020-2027 (USD MILLION) 37

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET,

-

FOR ENERGY/VESSEL SEALING DEVICES, BY TYPE 2020-2027 (USD MILLION) 37

-

GLOBAL

-

BARIATRIC SURGERY DEVICES MARKET, FOR SUTURING DEVICES, BY TYPE 2020-2027 (USD MILLION)

-

38

-

TABLE

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET, FOR ACCESSORIES, BY TYPE 2020-2027 (USD

-

MILLION) 38

-

TABLE

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET, FOR NON-INVASIVE SURGICAL DEVICES, BY

-

REGION 2020-2027 (USD MILLION) 39

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET, FOR SLEEVE GASTRECTOMY,

-

BY REGION 2020-2027 (USD MILLION) 42

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET,

-

FOR GASTRIC BYPASS, BY REGION 2020-2027 (USD MILLION) 42

-

GLOBAL BARIATRIC SURGERY

-

DEVICES MARKET, FOR REVISION SURGERY, BY REGION 2020-2027 (USD MILLION) 43

-

GLOBAL

-

BARIATRIC SURGERY DEVICES MARKET, FOR ADJUSTABLE GASTRIC BAND, BY REGION 2020-2027

-

(USD MILLION) 43

-

TABLE

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET, FOR OTHER PROCEDURES, BY REGION 2020-2027

-

(USD MILLION) 44

-

TABLE

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET, BY END USER 2020-2027 (USD MILLION)

-

46

-

TABLE

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET, FOR HOSPITALS, BY REGION 2020-2027 (USD

-

MILLION) 46

-

TABLE

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET, FOR SPECIALTY CENTRES, BY REGION 2020-2027

-

(USD MILLION) 46

-

TABLE

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET, FOR AMBULATORY SURGICAL CENTERS, BY

-

REGION 2020-2027 (USD MILLION) 47

-

GLOBAL BARIATRIC SURGERY DEVICES MARKET, FOR OTHER

-

END USERS, BY REGION 2020-2027 (USD MILLION) 47

-

GLOBAL: BARIATRIC SURGERY DEVICES MARKET,

-

BY REGION, 2020–2027 (USD MILLION) 48

-

AMERICAS: BARIATRIC SURGERY DEVICES MARKET,

-

BY REGION, 2020–2027 (USD MILLION) 49

-

AMERICAS: BARIATRIC SURGERY DEVICES MARKET,

-

BY TYPE, 2020–2027 (USD MILLION) 49

-

AMERICAS: BARIATRIC SURGERY DEVICES MARKET,

-

FOR MINIMALLY INVASIVE SURGICAL DEVICES, BY TYPE 2020-2027

-

(USD MILLION) 50

-

AMERICAS: BARIATRIC

-

SURGERY DEVICES MARKET, BY PROCEDURE, 2020–2027 (USD MILLION) 50

-

AMERICAS:

-

BARIATRIC SURGERY DEVICES MARKET, BY END USER, 2020–2027 (USD MILLION) 50

-

NORTH

-

AMERICA: BARIATRIC SURGERY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

-

51

Leave a Comment