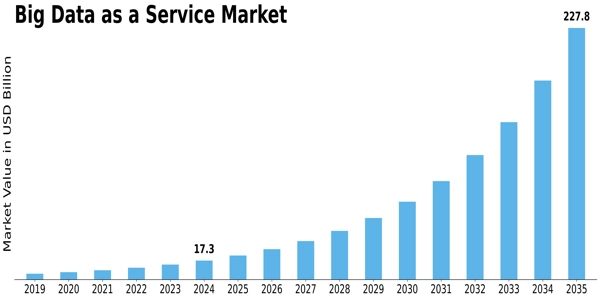

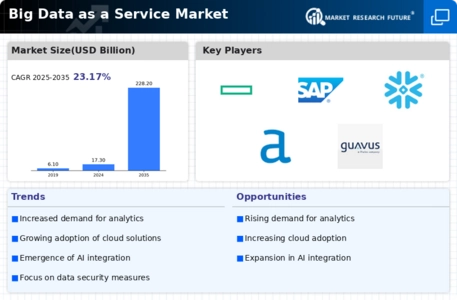

Big Data As A Service Size

Big Data as a Service Market Growth Projections and Opportunities

In the dynamic landscape of the Big Data as a Service (BDaaS) market, companies employ various market share positioning strategies to gain a competitive edge and capitalize on the growing demand for data-driven insights. One prevalent strategy involves differentiation, where providers distinguish their BDaaS offerings through unique features, specialized services, or innovative solutions. This approach allows companies to carve out a niche and attract customers seeking specific functionalities tailored to their business needs. For instance, some BDaaS providers focus on industry-specific analytics, such as healthcare or finance, aligning their services with the unique requirements of those sectors.

Another crucial market share positioning strategy revolves around cost leadership. Some companies aim to dominate the market by offering cost-effective BDaaS solutions without compromising on quality. By optimizing their infrastructure and operational efficiency, these providers can pass on the cost savings to customers, making their services more attractive and accessible. This strategy is particularly effective in appealing to price-sensitive segments of the market and gaining a larger customer base.

Collaboration and partnerships are also integral components of market share positioning in the BDaaS realm. Companies often seek strategic alliances with technology partners, software vendors, or industry leaders to enhance their service portfolios and broaden their market reach. These partnerships can lead to integrated solutions, combining the strengths of different platforms and creating a more comprehensive BDaaS ecosystem. Through collaboration, providers can tap into new customer segments and unlock synergies that propel them ahead of competitors.

Furthermore, customer-centric strategies play a vital role in shaping market share within the BDaaS industry. Providers focus on understanding their customers' pain points and tailoring their services to address specific challenges. This approach involves active engagement with clients, obtaining feedback, and continuously refining offerings based on evolving market demands. Customer satisfaction and loyalty become key differentiators, as companies that consistently deliver value and support stand a better chance of retaining and expanding their market share.

Innovation is a cornerstone strategy for BDaaS providers seeking a competitive advantage. The rapidly evolving nature of technology requires companies to stay ahead of the curve by investing in research and development. By introducing cutting-edge features, adopting emerging technologies like artificial intelligence and machine learning, and staying abreast of industry trends, providers can position themselves as leaders in innovation. This not only attracts forward-thinking customers but also reinforces the perception that a particular BDaaS provider is at the forefront of technological advancements.

Additionally, global expansion and geographic diversification contribute significantly to market share positioning. Companies aim to establish a strong presence in key regions and tap into diverse markets worldwide. This strategy allows providers to mitigate risks associated with regional economic fluctuations and regulatory changes, while also broadening their customer base and revenue streams.

Leave a Comment