Biodegradable Mulch Films Size

Biodegradable Mulch Films Market Growth Projections and Opportunities

The global biodegradable mulch films markets growth trend is attributed to the multiple market factors that have a strong influence on its functioning. Biodegradable mulch films forming part of the camopile family break down naturally, compared to the main stream plastic mulch which is non sustainable. Not just growth and development of the Mediterranean diet are influenced by several key factors.

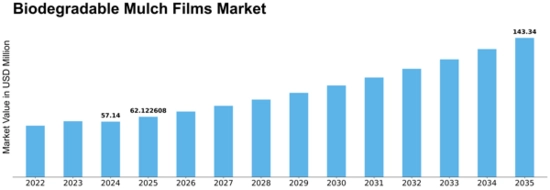

The size of the Biodegradable Mulch Films Market 2021 was USD 24.51 million , which means the product has been generating income for the relevant industry in that time period. Biodegradable Mulch Films manufacturers will engage in a market with a CAGR forecast of 7.90 % over the next 8 years, expanding from USD 26.44 million in 2022 to USD 52.43 million in 2030.

Agroeconomic environment is largely influenced by education and knowledge about sustainable crop cultivation. While global recognition of the havoc wrought by environmentally damaging practices increases, agriculturists along with other agricultural stakeholders are in search of sustainable ways of carrying out day to day farming activities that has minimum negative effects on the environment. The biodegradable mulch films provide an answer to the trend of sustainability since it helps to eliminate plastic pollution in agriculture. Want to reach more investors? Subscribe to our Investment Briefs newsletter now to get advanced insights and exclusive investment opportunities delivered straight to your inbox.

Besides this, strong environmental regulating laws and policies have a profound impact on the overall structure of the worldwide market for biodegradable mulch films. The governments and the other bodies regulating them around the world come up with rules to regulate the use of traditional plastic products meant for mulching such as plastic film mulch. Because of this, the demand for biodegrad capable items that meet the requirements of environmental standards and regulations is on a constant upward trend, and thus the industry market continuously grows.

Another factor triggering the high growth rate of the agrochemicals industry is the increasing importance of preserving the health and fertility of the agricultural sector soils. Biodegradable mulch films comprising of materials like starch, polylactic acid (PLA), and polyhydroxyalkanoates (PHA) act like organic matter and shrink the soil with their break down. Farmers noticed how their covering the fields with mulching plays an important role not only for the weed control and moisture retention but also for their positive impact on soil quality.

The revolution in manufacturing processes and material development, propelled by the technological developments, have created room for the market to expand. Researchers themselves and the company operating already in the industry are constantly in search of new types of materials that support and ensure additional performance features, especially the improved biodegradation, sturdiness and flexibility. This enumeration adds to the emergence of the competitive markets with more entrants of the biodegradable mulch films.

Leave a Comment