Market Share

Introduction: Navigating Competitive Dynamics in the Bone Wax Market

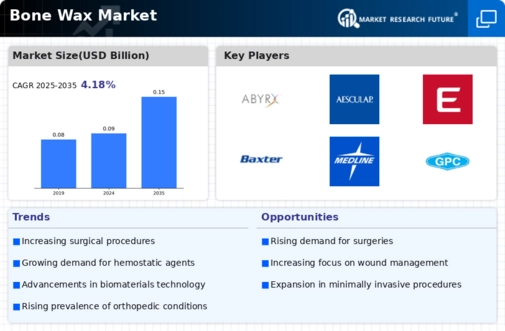

The Bone Wax Market is witnessing a revolutionary change driven by technological advancements and evolving regulatory scenario. This is compelling industry players to rethink their strategies and adapt to the changing preferences of consumers. The leading players, including the original equipment manufacturers, the medical device manufacturers, and the new-age biotechnology companies, are collaborating to establish strategic alliances and differentiate their products. The integration of big data and automation is enabling them to enhance their operational efficiencies and product performance. Moreover, the adoption of sustainable practices is strengthening their market position. However, new entrants, especially those operating in the green building and biomaterials segments, are disrupting the status quo and capturing the niche markets. The regional markets, particularly in North America and Asia Pacific, are slated to grow at a robust CAGR over the forecast period. As a result, the strategic deployment of resources and the implementation of targeted marketing strategies will play a crucial role in capturing the available opportunities in the Bone Wax Market.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions that encompass a wide range of surgical products, including bone wax.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Ethicon, Inc. | Strong brand recognition and trust | Surgical products and wound care | Global |

| Medtronic Plc | Innovative medical technology leader | Surgical and therapeutic solutions | Global |

| Baxter International | Diverse product portfolio in healthcare | Pharmaceuticals and medical devices | Global |

Specialized Technology Vendors

These companies focus on niche technologies and products specifically designed for surgical applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| ABYRX, Inc. | Innovative bone wax formulations | Bone wax products | North America |

| Wound Management Technologies, Inc. | Focus on advanced wound care solutions | Wound management products | North America |

| Futura Surgicare Pvt. Ltd. | Cost-effective surgical solutions | Surgical consumables | Asia |

Infrastructure & Equipment Providers

These vendors supply essential equipment and materials that support surgical procedures, including bone wax.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Aesculap, Inc. | High-quality surgical instruments | Surgical instruments and implants | Global |

| Medline Industries, Inc. | Extensive distribution network | Medical supplies and equipment | North America |

| GPC Medical Ltd. | Wide range of medical products | Healthcare supplies | Asia |

| Bentley Healthcare Pvt. Ltd. | Focus on quality and affordability | Surgical and medical products | Asia |

| WNDW Medical Inc. | Innovative wound care solutions | Wound care products | North America |

| CP Medical Corp. | Specialized in surgical products | Surgical consumables | North America |

Emerging Players & Regional Champions

- Stryker (USA): offers a wide range of bone wax, both synthetic and natural. Has recently obtained contracts with major hospitals for use in orthopedic surgery. Challenges established suppliers with new products and innovations that improve surgical results.

- Medtronic (USA): focuses on developing new bone wax formulations that accelerate healing. Has already introduced them in several clinical trials. Complements existing products with surgical instruments, thereby posing a challenge to traditional bone wax manufacturers.

- B. Braun Melsungen AG (Germany): With its unique biodegradable bone wax, which has been adopted by several European health systems, this company complements the offerings of established companies with an environmentally friendly alternative, while at the same time presenting them with a challenge on the basis of sustainable development.

- ETHICON (Johnson & Johnson) (USA): Known for their advanced hemostatics, Ethicon recently entered the bone wax market, with a focus on surgical efficiency, complementing their existing range and challenging the traditional bone wax suppliers with their brand name.

Regional Trends: In 2024, a significant increase in the use of biodegradable and synthetic bone wax products is observed in North America and Europe, driven by a growing emphasis on safety and on reducing the environmental impact of medicine. Moreover, technological advances in the composition of products are leading to increased healing properties, which are becoming a major differentiating factor in the market. The new players are taking advantage of these trends to establish themselves in the market, especially in countries with the most restrictive regulations.

Collaborations & M&A Movements

- Medtronic and Stryker entered into a partnership to co-develop advanced bone wax formulations aimed at improving surgical outcomes in orthopedic procedures, enhancing their competitive positioning in the orthopedic market.

- Johnson & Johnson acquired a small biotech firm specializing in biodegradable bone wax products to expand its product portfolio and strengthen its market share in the surgical adhesives segment.

- Smith & Nephew and a leading research institution collaborated to innovate new bone wax technologies that reduce infection rates post-surgery, positioning themselves as leaders in surgical safety.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Product Quality | Ethicon, Stryker | It is known for its high-quality bone waxes which are widely used in orthopaedic surgery, and its products are distinguished by their biocompatibility. The company has developed a number of new formulations of bone wax which have improved its effectiveness in preventing bleeding during surgery. |

| Regulatory Compliance | Medtronic, Zimmer Biomet | Medtronic has a strong reputation for meeting stringent regulatory requirements, and its bone wax products are compliant with the U.S. Food and Drug Administration. Zimmer Biomet has successfully completed several regulatory approvals for new bone wax formulations, which demonstrates its commitment to safety and efficacy. |

| Sustainability | B. Braun, Smith & Nephew | In the manufacture of their bone wax, B. Braun has adopted a system of conservation, and the materials used are of an earth-friendly nature. The packaging materials are also being designed to be re-used. |

| Innovation in Formulation | DePuy Synthes, Aesculap | The DePuy Synthes company has developed a bone wax with antimicrobial properties that can reduce the risk of infection after surgery. Aesculap has been known to develop products that are easier to apply and more effective in preventing bleeding. |

| Market Reach | Medtronic, Ethicon | Medtronic has an extensive network of distributors and their products are widely available. Their products are also sold in many hospitals. The reputation of the brand and the strength of the relationship with the hospital staff are assets that the company uses to its advantage. |

Conclusion: Navigating the Bone Wax Market Landscape

The bone wax market is highly fragmented, with a large number of competitors, both established and new. There are regional differences in the trend, but the general picture is one of increasing demand in North America and Europe. This is due to improvements in surgical techniques and a greater emphasis on patient outcomes. Strategic positioning is therefore important. The main strategic issues for the companies are: - Artificial intelligence for product development; - Automation for cost-effective production; - Sustainability to meet regulatory requirements and customer preferences. - The flexibility of product offerings, since hospitals are looking for a tailored solution. These issues are of strategic importance to the companies as the market evolves. They must prioritise in order to be able to take a leading position in the market.

Leave a Comment