Market Share

Breakfast Cereals Market Share Analysis

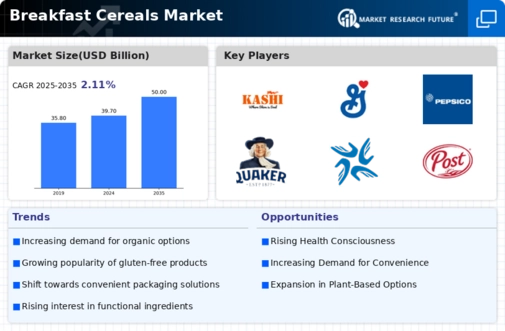

The Breakfast Cereals market is a highly competitive sector where market share positioning strategies play a pivotal role in brand success. One fundamental strategy is product diversification. Companies aim to differentiate their offerings by introducing a wide range of cereals that cater to diverse consumer preferences. This may involve developing products targeting specific dietary needs, such as gluten-free or organic options, or creating cereals with unique flavor combinations to appeal to a broad customer base.

Branding is another crucial element in the Breakfast Cereals market. Successful companies invest in building a strong and memorable brand image that resonates with consumers. Establishing trust through transparent labeling, emphasizing nutritional benefits, and crafting compelling marketing messages contribute to a positive brand perception. Recognizable packaging and brand logos also play a role in attracting and retaining consumers amidst a crowded shelf space.

Pricing strategies are essential in market share positioning within the Breakfast Cereals market. Companies decide whether to position their products as premium, reflecting high-quality ingredients and nutritional value, or as more affordable options to target a wider demographic. Price promotions, bundle deals, and value packs are common tactics to influence consumer purchasing decisions and gain a competitive edge in this price-sensitive market.

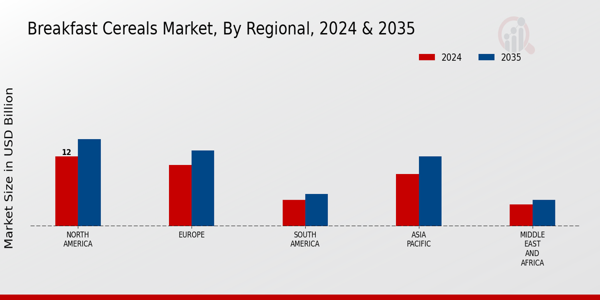

Distribution channels are critical for market penetration in the Breakfast Cereals industry. Companies optimize their distribution networks to ensure widespread availability, partnering with supermarkets, convenience stores, and online platforms. Some may also explore direct-to-consumer channels through e-commerce, subscription services, or branded stores. A well-organized distribution strategy ensures that Breakfast Cereals are accessible to consumers across different regions, contributing to increased market share.

Innovation is a driving force in the Breakfast Cereals market, with companies constantly introducing new and improved products. This could involve incorporating trendy superfoods, developing cereals with unique shapes or textures, or responding to changing dietary trends such as plant-based or protein-enriched options. Staying ahead in terms of innovation allows companies to capture consumer interest, attract new customers, and retain existing ones in this dynamic market.

Collaborations and partnerships are gaining prominence in the Breakfast Cereals market. By teaming up with other food and beverage brands, nutritionists, or influencers, companies can leverage shared expertise to create co-branded products or engage in joint marketing campaigns. Such collaborations not only expand the reach of Breakfast Cereal brands but also enhance their credibility and relevance in the market.

Health and wellness positioning are increasingly important in the Breakfast Cereals market. Companies are responding to the growing demand for nutritious and functional foods by emphasizing the health benefits of their cereals. This includes fortifying products with vitamins and minerals, reducing sugar content, and highlighting whole grain or natural ingredient claims. Brands that successfully communicate a commitment to health-conscious consumers are better positioned to gain market share.

Leave a Comment