Market Analysis

In-depth Analysis of Building Insulation Material Market Industry Landscape

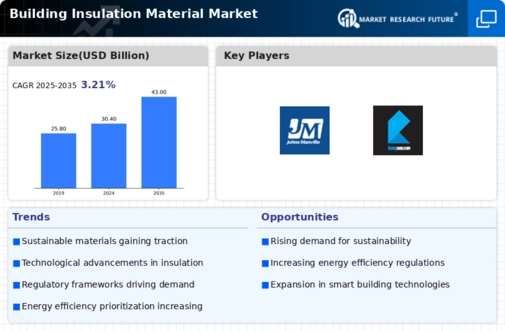

Insulation usage in buildings is regulated by several organizations worldwide. This changed the global building insulation market. Many groups have produced criteria for installing insulation in different parts of a building. Rules may vary per country. More strict requirements are being adopted by governments to promote energy-efficient construction. Because of this, global demand for house insulation products is rising. However, the industry that produces these commodities is struggling owing to a shortage of skilled personnel. There is a scarcity of individuals and leaders with the skills and knowledge to grow the profession. Most companies who make these things are in a few places since they're hard to find. The company may have trouble growing in the future due to a lack of trained staff. Construction companies employ insulation, and organizations and governments worldwide set standards for its usage. These rules are changing the global market for home protection products. These rules govern how insulation should be utilized in different parts of a building, and they may vary by country. Governments are tightening these requirements to promote energy-efficient architecture. This increases demand for warm housing products worldwide. The firm that makes these things has a problem: there aren't enough skilled workers. We've found that the organization lacks skilled and trained personnel and leaders to grow. Scarcity benefits corporations. Most manufacturers of these goods are concentrated in a few areas due to their restricted availability. If the firm doesn't have enough skilled staff, it may struggle to grow. Many building businesses and organizations worldwide have standards or legislation concerning insulation use. These rules are changing the global market for home protection products. Governments are increasing measures to decrease building energy usage. Regulations may vary by country or locale. This increases demand for warm housing products worldwide. However, the business is struggling due to a lack of skilled people. Lack of skilled personnel and leaders makes it hard to grow the sector. Due to space constraints, industrial centers have been localized in a few areas, which may slow industry growth.

Leave a Comment