Market Share

Burglar Alarm Market Share Analysis

To interest many clients, a few organizations adopt an expense initiative strategy by giving caution frameworks that are both reasonable and reliable. In the savagely cutthroat burglar alarm market, market share techniques are urgent for organizations trying to lay out major areas of strength for an and gain an upper hand. Differentiation through technological innovation is a common strategy. In order to incorporate cutting-edge features like artificial intelligence, machine learning, and smart home integration into their alarm systems, businesses make significant investments in research and development. By offering progressed and special functionalities, organizations mean to draw in educated shoppers who focus on the most recent advancements in their security arrangements. As well as aiding the procurement of piece of the pie, this system positions the brand as a trailblazer at the cutting edge of the business.

This technique is viable in capturing shoppers who actually focus on security. Then again, premium estimating systems center around situating items as top-of-the-line arrangements with extra elements and improved execution. This contributes to the company's market share in the premium segment by appealing to customers who are willing to spend more on comprehensive and high-end security systems.

Vital organizations and joint efforts are progressively used as market share tools in the burglar alarm industry. Organization’s structure unions with different organizations, including savvy home gadget producers, security specialist co-ops, and even insurance agency. Customers can acquire integrated security solutions or receive discounts on insurance premiums through these collaborations, which frequently result in bundled offerings. By making collaborations with reciprocal administrations, organizations can improve their portion of the overall industry by furnishing clients with exhaustive security bundles and added esteem.

Brand notoriety and trust-building systems are basic parts of capturing market share. Laying out a positive and dependable brand picture is critical for drawing in and holding clients. Organizations put resources into promoting efforts, client surveys, and tributes to fabricate believability and grandstand the dependability of their caution frameworks. A solid brand notoriety assists in acquiring with showcasing share as well as makes client steadfastness, as shoppers are bound to pick a brand with a demonstrated history of conveying powerful security arrangements.

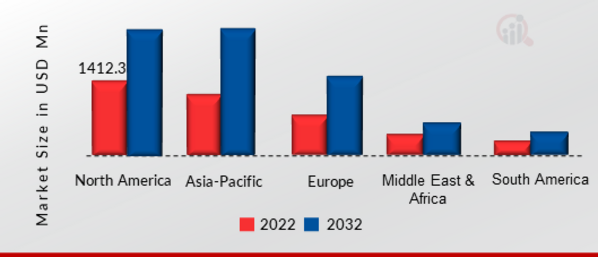

Geological extension is one more system utilized by organizations to improve their portion of the overall industry situating. By entering new business sectors and growing their presence internationally or locally, organizations can take advantage of neglected client bases. Understanding local regulations and preferences and adapting products to meet the specific security requirements of various regions are necessary components of this strategy. Companies can increase their overall market share by diversifying their customer base and mitigating the risks of being reliant on a single market through geographic expansion.

Client driven approaches, for example, extraordinary client care and customized arrangements, are fundamental procedures for market development. Organizations that focus on consumer loyalty and offer responsive help gain an upper hand. Positive customer experiences increase brand advocacy and word-of-mouth recommendations, thereby attracting new customers and keeping current ones. A client centered technique assists in getting with showcasing share as well as makes a feasible plan of action in view of long-haul client connections. Natural manageability drives are arising as a particular system for acquiring piece of the pie in the market. As customers become more mindful of ecological issues, they are bound to buy items that are better for the climate. Associations that combine eco-obliging materials, energy-capable advances, and achievable practices in the gathering and movement of their ready systems can attract earth mindful clients. This procedure positions the brand as socially skilled and lines up with the potential gains of a segment of the market that spotlights practicality.

Leave a Comment