Carrageenan Market Analysis

Carrageenan Market Research Report Information By Type (Kappa, Iota, and Lambda), By Application (Food & beverages, Personal care, Pharmaceuticals, and Others), And By Region (Asia-Pacific, North America, Europe, And The Rest Of The World) – Market Forecast Till 2035

Market Summary

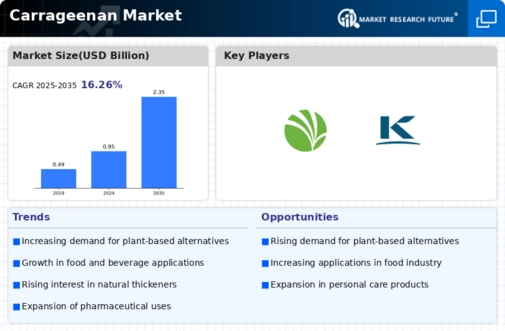

As per Market Research Future Analysis, the Global Carrageenan Market was valued at USD 0.95 billion in 2024 and is projected to reach USD 4.99 billion by 2035, growing at a CAGR of 16.26% from 2025 to 2035. The market is driven by increased applications in food & beverages, pharmaceuticals, and personal care, with kappa carrageenan leading in revenue share. North America dominates the market, particularly the U.S., due to rising health awareness and demand for ingredient-based formulations. The Asia-Pacific region is expected to witness significant growth, driven by populous countries like China and India.

Key Market Trends & Highlights

Key trends driving the Carrageenan market include diverse applications and increasing demand for plant-based ingredients.

- Carrageenan market size in 2024 is projected at USD 0.952 billion. Food & beverages segment accounted for 72.8% of the market share in 2022. Kappa carrageenan held 68.3% of the market revenue in 2022. North America is the largest regional market, driven by ingredient-based food formulations.

Market Size & Forecast

| 2024 Market Size | USD 0.95 Billion |

| 2035 Market Size | USD 4.99 Billion |

| CAGR (2024-2035) | 16.26% |

| Largest Regional Market Share in 2024 | North America |

Major Players

<p>Major players include Ingredion Incorporated, Cargill Incorporated, TBK Manufacturing Corporation, and CP Kelco.</p>

Market Trends

Use of Carrageenan in various industries is driving the market growth.

Market CAGR for carrageenan market is being driven by the use of Carrageenan in a wide range of industries. Carageenan, widely used as an additive, is a natural component of red algae used to emulsify, concentrate and preserve food and beverages. It can be used in various industries like food & beverages, pharmaceutical, cosmetics, and home care industries. It has a rising penetration into dairy and processed meat products as it gives mouth-feel characteristics to emulate fatty feelings.

Carageenan is a plant-based gelatin-like component that is widely used in skincare products as it has a natural ability for water binding that makes it effective in giving a smooth and creamy texture. Carageenan gum has become known among food & drinks due to its emulsifying properties, therefore used in skincare, mainly in moisturizers and lotions. It makes skin care products creamy, luxurious, and smooth, which makes them easy to apply on the face. Carageenan has additional use as toothpaste, shampoos, conditioners, hair masks, and gels, as it does not allow the oil-based and water-based active ingredients to separate.

The increase in demand for plant-based ingredients as an additive for skin care and hair products has fueled the carrageenan market.

Carrageenan has a wide range of pharmaceutical properties that same is stimulating the attention of the pharmaceutical market. The tissue engineering procedures require advanced developmental testing methods; therefore, the pharmaceutical industry is shifting towards carrageenan-derived biomaterials. Carrageenan becomes a strong mass when combined with the salts making them soluble in water and maintaining the elasticity of the product; this property is used by pharmaceutical companies to alter the parasympathetic nerve inhibitors in nasal spray. The carrageenan-based nanomaterials are used to deliver therapeutic agents like small molecule drugs, genetic materials, and peptides.

The kappa carrageenan has a wide range of applications in the food sector; it includes 25-30% of ester sulfate that reacts with locust bean clusters to develop bitter jelly, used as a stabilizer in dairy products. Carrageenan is a popular alternative to gelatin in vegan food products; these are used in chewing gums and other dental confectioneries. Globalization is rising the demand for packaged goods is driving the carrageenan revenue.

<p>The global carrageenan market appears to be experiencing a steady growth trajectory, driven by increasing demand in the food and beverage sector, particularly for its thickening and stabilizing properties.</p>

U.S. Department of Agriculture

Carrageenan Market Market Drivers

Rising Demand in Food Industry

The Global Carrageenan Market Industry experiences substantial growth due to the increasing demand for carrageenan in the food sector. Carrageenan serves as a thickening and gelling agent, enhancing the texture of various food products, including dairy, meat, and plant-based alternatives. As consumers become more health-conscious, the preference for natural additives over synthetic ones is rising. This trend is reflected in the market's projected value of 0.95 USD Billion in 2024, with expectations to reach 2.35 USD Billion by 2035, indicating a robust CAGR of 8.55% from 2025 to 2035. Such growth underscores the essential role of carrageenan in modern food formulations.

Market Segment Insights

Segment Insights

Carrageenan Type Insights

<p>The Carrageenan Industry segmentation, based on type, includes Kappa, Iota, and Lambda. The kappa segment accounted for the largest market revenue of 68.3% in 2022. Kappa is mostly utilized in ice creams, cheese, puddings, and chocolate. Iota is being studied for its anti-viral properties, and lambda held a relatively market revenue share in 2022.</p>

<p>Figure 1: Carrageenan Market, by Types, 2022 & 2032 (USD billion)</p>

<p>Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review</p>

Carrageenan Application Insights

<p>The Carrageenan Market segmentation, based on application, includes Food & beverages, Personal care, Pharmaceuticals, and Others. The food & beverages hold the largest market value of 72.8% in 2022. Carrageenan is used in bakery, dairy, and meat products and beverages as it provides altering viscosity and texture that improves their sensory properties. It also has applications in pharmaceuticals as it acts as excipients, foaming agents, wetting, solubilizing, and stabilizing agents.</p>

Get more detailed insights about Carrageenan Market Research Report - Forecast till 2035

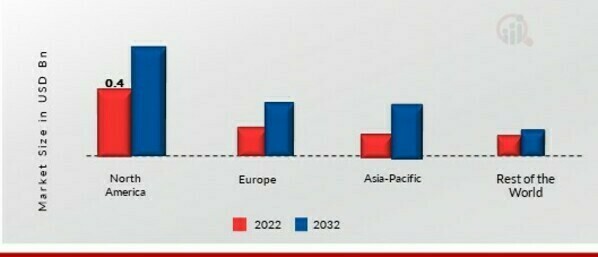

Regional Insights

By region, the study gives market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American carrageenan market area dominates the market owing to the increase in the demand for carrageenan application in the food & beverage industry with the increasing leaning towards ingredient-based food formulation products. The US accounts for the largest market for carrageenan due to the increase in awareness of health benefits and also the research and development in industry fueling the market.

Further, major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: CARRAGEENAN MARKET SHARE BY REGION 2022 (%)

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Europe's Carrageenan market accounts for the second-largest market share owing to the increasing demand for processed food. Further, the German market for carrageenan held the largest market share, and the UK carrageenan industry was the fastest growing market in the European region

The Asia-Pacific Carrageenan Market is expected to grow during the forecast period 2023 to 2032. This is due to the presence of highly populous countries like India and China and expanding awareness of a healthy lifestyle and nutrition and rising per capita disposable income. Moreover, China’s market of carrageenan held the largest market share due to the presence of major food industries, and the Indian carrageenan industry was the rapidly growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Carrageenan Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, carrageenan industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Carrageenan industry to benefit clients and increase the market sector. In recent years, the market for Carrageenan has offered some of the most significant advantages to food & beverage and pharmaceutical industries.

Major players in the Carrageenan market, including Ingredion Incorporated, TBK Manufacturing Corporation, PT Fortuna Cahaya Cemerlang, Cargill Incorporated, LTD, Danlink Ingredients, Caldic B.V., ACCEL Carrageenan Corporation, MCPI Corporation, Scalzo Food Industries, Marcel Trading Corporation, Soriano SA, Gelymar SA, Birmingham Biotech Ltd, Kerry Group, and others, are attempting to increase market demand by investing in research and development operations.

CP Kelco is a nature-based ingredient solutions company of 90 years working with food, beverage, consumer, and industrial product manufacturers globally. They focus on ingredient innovation and problem-solving to develop customized solutions that help their regional insights, meet manufacturers' goals and address consumer needs and preferences. Their key product line consists of gellan gum, pectin, xantham gum, carrageenan, diutan gum, fermentation-derived cellulose, refined locust bean gum, and microparticulate whey protein concentrate. In November 202, CP Kelco US launched a NUTRAVA citrus fiber, that will help in emulsion stabilization, suspension, viscosity, and in providing water holding capacity.

In May 2020, CP Kelco's Cebu was acquired by Marcel, which will help the company in dealing with four carrageenan plants.

The Cargill has helped farmers for more than 150 years to grow more and connect them to the border market. They are developing new products that provide consumers with their requirements, advancing nutrition, food safety, and sustainability. They collaborate with various key markets to innovate and manage risk to provide for the future globally. They have experience with new technologies and insights to be a trusted partner for food, agriculture, financial and industrial customers.

In July 2018, Cargill announced the extension of its seabird portfolio with the invention of the new Satiagel Carrageenan Extract, which is specially designed for texturing solutions for creamy dairy desserts.

Key Companies in the Carrageenan Market market include

Industry Developments

On March 22, 2024, CP Kelco, who have recently expanded their production in a European plant, announced the increase of the output of carrageenan to match the growing demands of beverages and food industry. This advancement will assist CP Kelco serve developing markets of dairy substitutes, sauces and meat substitutes in which carrageenan is the most common gelling agent for thickening and stabilizing.

In January 2024, the FMC Corporation’s launch of a new product containing carrageenan and targeting almond and oat-based milks is expected to improve the result of such products by altering the way they feel and taste. Alvin M Rahm, a spokesperson of FMC Corporation emphasized this plant-based trend is a useful product to have in the portfolio given most consumers are looking for plant-based alternatives.

In December 2023, Genufood, an Indian company, launched a new range of ingredients for the health and wellness industry which are carrageenan based. These new ingredients are being promoted for gut health since they are known to have prebiotic effects, thereby fueling the interest in functional foods.

In November 2023, Ingredion disclosed a collaboration with a top rank European food maker to offer carrageenan-based solutions which enhance the preservation and quality of plant-based meat products. This collaboration is part of the plans of Ingredion in expanding its presence in the ever-emerging market of plant protein.

In October 2023, the Philippines, a major resource of carrageenan, had new guidelines on sustainability aimed at reducing the negative effects of carrageenan production. The undertaking comprises reducing the carbon emissions associated with the harvesting of seaweed the main raw material for production of carrageenan and the promotion of good farming practices within the industry.

In September 2023, a new carrageenan containing offerings have been launched by Du Pont nutrition and biosciences which target the cosmetic and personal care sector. This product is intended to improve the texture and stability of certain skin care products, highlighting the popularity of vegetable skin care products in the personal care market.

Future Outlook

Carrageenan Market Future Outlook

<p>The Global Carrageenan Market is projected to grow at an 16.26% CAGR from 2025 to 2035, driven by rising demand in food, pharmaceuticals, and cosmetics.</p>

New opportunities lie in:

- <p>Develop plant-based carrageenan alternatives to cater to vegan markets. Invest in R&D for enhanced extraction methods to reduce costs. Expand distribution channels in emerging markets to capture new customer bases.</p>

<p>By 2035, the market is expected to exhibit robust growth, positioning itself as a key player in multiple industries.</p>

Market Segmentation

Carrageenan Type Outlook

- Kappa

- Iota

- Lambda

Carrageenan Regional Outlook

- {"North America"=>["US"

- "Canada"]}

- {"Europe"=>["Germany"

- "France"

- "UK"

- "Italy"

- "Spain"

- "Rest of Europe"]}

- {"Asia-Pacific"=>["China"

- "Japan"

- "India"

- "Australia"

- "South Korea"

- "Rest of Asia-Pacific"]}

- {"Rest of the World"=>["Middle East"

- "Africa"

- "Latin America"]}

Carrageenan Application Outlook

- Food & beverages

- Personal care

- Pharmaceuticals

- Others

Report Scope

| Attribute/Metric | Details |

| Market Size 2024 | USD 0.952 billion |

| Market Size 2035 | 4.99 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 16.26% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Application, and Region |

| Geographies Covered | Asia Pacific, Europe, North America, and the Rest of the World |

| Countries Covered | The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Ingredion Incorporated, TBK Manufacturing Corporation, PT Fortuna Cahaya Cemerlang, Cargill Incorporated, LTD, Danlink Ingredients, Caldic B.V., ACCEL Carrageenan Corporation, MCPI Corporation, Scalzo Food Industries, Marcel Trading Corporation, Soriano SA, Gelymar SA, Birmingham Biotech Ltd, Kerry Group. |

| Key Market Opportunities | Rising awareness about the varieties of packaged foods, awareness for health & wellness, and a variety of developments are taking place. |

| Key Market Dynamics | Increasing demand for hydrocolloids as thickeners in the food and beverage industry. |

| Market Size 2025 | 1.11 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Carrageenan market?

The Carrageenan market size valued at USD 0.952 Billion in 2024.

What is the growth rate of the Carrageenan market?

The market is Projected to grow at a CAGR of 5.80% during the forecast period, 2024-2032.

Which region held the largest market share in the Carrageenan market?

North America had the largest share in market.

Who are the key players in the Carrageenan market?

The key players are Ingredion Incorporated, TBK Manufacturing Corporation, PT Fortuna Cahaya Cemerlang, Cargill Incorporated, LTD, Danlink Ingredients, Caldic B.V., ACCEL Carrageenan Corporation, MCPI Corporation, Scalzo Food Industries, Marcel Trading Corporation, Soriano SA, Gelymar SA, Birmingham Biotech Ltd, Kerry Group, in the market.

Which type led the Carrageenan market?

The Kappa Carrageenan Market category dominated the market in 2023.

Which application had largest market share in the Carrageenan market?

Food & beverages had the largest share of the market.

-

Table of Contents

-

1 Executive Summary

-

Market Attractiveness Analysis

- Global Carrageenan Market, by Product Type

- Global Carrageenan Market, by Application

- Global Carrageenan Market, by Region

-

Market Attractiveness Analysis

-

Market Introduction

- Definition

- Scope of the Study

- Market Structure

- Key Buying Criteria

- Macro Factor Indicator Analysis

-

Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Market Size Estimation

- Forecast Model

- List of Assumptions

-

MARKET DYNAMICS

- Introduction

-

Drivers

- Driver 1

- Driver 2

-

Restraints

- Restraint 1

- Restraint 2

-

Opportunities

- Opportunity 1

- Opportunity 2

-

Challenges

- Challenge 1

- Challenge 2

-

MARKET FACTOR ANALYSIS

- Value Chain Analysis

- Supply Chain Analysis

-

Porter’s Five Forces Model

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

GLOBAL CARRAGEENAN MARKET, BY PRODUCT TYPE

- Introduction

-

Kappa

- Kappa: Market Estimates & Forecast, by Region/Country, 2024-2032

-

Iota

- Iota: Market Estimates & Forecast, by Region/Country, 2024-2032

-

Lambda

- Lambda: Market Estimates & Forecast, by Region/Country, 2024-2032

-

GLOBAL CARRAGEENAN MARKET, BY APPLICATION

- Introduction

-

Food & Beverages

- Food & Beverages: Market Estimates & Forecast, by Region/Country, 2024-2032

- Dairy Products

- Meat, Poultry & Seafoods

- Beverages

- Others

-

Pharmaceuticals

- Pharmaceuticals: Market Estimates & Forecast, by Region/Country, 2024-2032

-

Personal Care

- Personal care Market Estimates & Forecast, by Region/Country, 2024-2032

-

Others

- Others: Market Estimates & Forecast, by Region/Country, 2024-2032

-

GLOBAL CARRAGEENAN MARKET, BY REGION

- Introduction

-

North America

- Market Estimates & Forecast, by Product Type, 2024-2032

- Market Estimates & Forecast, by Application, 2024-2032

- Market Estimates & Forecast, by Country, 2024-2032

- US

- Canada

- Mexico

-

Europe

- Market Estimates & Forecast, by Product Type, 2024-2032

- Market Estimates & Forecast, by Application, 2024-2032

- Market Estimates & Forecast, by Country, 2024-2032

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, by Product Type, 2024-2032

- Market Estimates & Forecast, by Application, 2024-2032

- Market Estimates & Forecast, by Country, 2024-2032

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia-Pacific

-

Rest of the World

- Market Estimates & Forecast, by Product Type, 2024-2032

- Market Estimates & Forecast, by Application, 2024-2032

- Market Estimates & Forecast, by Region, 2024-2032

- South America

- Middle East

- Africa

-

Competitive Landscape

- Introduction

- Competitive Benchmarking

- Development Share Analysis

- Key Developments & Growth Strategies

-

COMPANY PROFILES

-

AEP Colloids Inc. (US)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Shemberg Marketing Corp (Phillipines)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Ingredients Solutions Inc. (US)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Gelymar SA (Chile)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Soriano SA (Argentina)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Marcel Trading Corporation (Phillipines)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Scalzo Food Industries (Australia)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

MCPI Corporation (Phillipines)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

ACCEL Carrageenan Corporation (Phillipines)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Caldic B.V. (Netherlands)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Danlink Ingredients (Pty) LTD (South Africa)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Cargill, Incorporated (US)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

PT Fortuna Cahaya Cemerlang (Indonesia)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

TBK Manufacturing Corporation (Phillipines)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Ingredion Incorporated (US)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

AEP Colloids Inc. (US)

-

APPENDIX

- General Sources & References

- List of Abbreviation

-

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 Global Carrageenan Market, by Region, 2024-2032 (USD Million)

- TABLE 2 Global Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 3 Global Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 4 North America: Carrageenan Market, by Country, 2024-2032 (USD Million)

- TABLE 5 North America: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 6 North America: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 7 US: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 8 US: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 9 Canada: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 10 Canada: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 11 Mexico: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 12 Mexico: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 13 Europe: Carrageenan Market, by Country, 2024-2032 (USD Million)

- TABLE 14 Europe: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 15 Europe: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 16 Germany: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 17 Germany: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 18 France: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 19 France: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 20 Italy: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 21 Italy: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 22 Spain: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 23 Spain: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 24 UK: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 25 UK: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 26 Rest of Europe: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 27 Rest of Europe: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 28 Asia-Pacific: Carrageenan Market, by Country, 2024-2032 (USD Million)

- TABLE 29 Asia-Pacific: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 30 Asia-Pacific: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 31 China: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 32 China: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 33 India: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 34 India: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 35 Japan: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 36 Japan: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 37 Australia & New Zealand: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 38 Australia & New Zealand: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 39 Rest of Asia-Pacific: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 40 Rest of Asia-Pacific: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 41 Rest of the World (RoW): Carrageenan Market, by Country, 2024-2032 (USD Million)

- TABLE 42 Rest of the World (RoW): Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 43 Rest of the World (RoW): Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 44 South America: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 45 South America: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 46 Middle East: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 47 Middle East: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 48 Africa: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 49 Africa: Carrageenan Market, by Application, 2024-2032 (USD Million) LIST OF FIGURES

- FIGURE 1 Global Carrageenan Market Segmentation

- FIGURE 2 Forecast Research Methodology

- FIGURE 3 Five Forces Analysis of the Global Carrageenan Market

- FIGURE 4 Value Chain of Global Carrageenan Market

- FIGURE 5 Share of the Global Carrageenan Market in 2020, by Country (%)

- FIGURE 6 Global Carrageenan Market, by Region, 2024-2032,

- FIGURE 7 Global Carrageenan Market Size, by Product Type, 2020

- FIGURE 8 Share of the Global Carrageenan Market, by Product Type, 2024-2032 (%)

- FIGURE 9 Global Carrageenan Market Size, by Application, 2020

- FIGURE 10 Share of the Global Carrageenan Market, by Application, 2024-2032 (%)

- Table of Contents 1. 1 Executive Summary 1.1. Market Attractiveness Analysis 1.1.1. Global Carrageenan Market, by Product Type 1.1.2. Global Carrageenan Market, by Application 1.1.3. Global Carrageenan Market, by Region 2. Market Introduction 2.1. Definition 2.2. Scope of the Study 2.3. Market Structure 2.4. Key Buying Criteria 2.5. Macro Factor Indicator Analysis 3. Research Methodology 3.1. Research Process 3.2. Primary Research 3.3. Secondary Research 3.4. Market Size Estimation 3.5. Forecast Model 3.6. List of Assumptions 4. MARKET DYNAMICS 4.1. Introduction 4.2. Drivers 4.2.1. Driver 1 4.2.2. Driver 2 4.3. Restraints 4.3.1. Restraint 1 4.3.2. Restraint 2 4.4. Opportunities 4.4.1. Opportunity 1 4.4.2. Opportunity 2 4.5. Challenges 4.5.1. Challenge 1 4.5.2. Challenge 2 5. MARKET FACTOR ANALYSIS 5.1. Value Chain Analysis 5.2. Supply Chain Analysis 5.3. Porter’s Five Forces Model 5.3.1. Bargaining Power of Suppliers 5.3.2. Bargaining Power of Buyers 5.3.3. Threat of New Entrants 5.3.4. Threat of Substitutes 5.3.5. Intensity of Rivalry 6. GLOBAL CARRAGEENAN MARKET, BY PRODUCT TYPE 6.1. Introduction 6.2. Kappa 6.2.1. Kappa: Market Estimates & Forecast, by Region/Country, 2024-2032 6.3. Iota 6.3.1. Iota: Market Estimates & Forecast, by Region/Country, 2024-2032 6.4. Lambda 6.4.1. Lambda: Market Estimates & Forecast, by Region/Country, 2024-2032 7. GLOBAL CARRAGEENAN MARKET, BY APPLICATION 7.1. Introduction 7.2. Food & Beverages 7.2.1. Food & Beverages: Market Estimates & Forecast, by Region/Country, 2024-2032 7.2.2. Dairy Products 7.2.2.1. Dairy Products: Market Estimates & Forecast, by Region/Country, 2024-2032 7.2.3. Meat, Poultry & Seafoods 7.2.3.1. Meat, Poultry & Seafoods: Market Estimates & Forecast, by Region/Country, 2024-2032 7.2.4. Beverages 7.2.4.1. Beverages: Market Estimates & Forecast, by Region/Country, 2024-2032 7.2.5. Others 7.2.5.1. Others: Market Estimates & Forecast, by Region/Country, 2024-2032 7.3. Pharmaceuticals 7.3.1. Pharmaceuticals: Market Estimates & Forecast, by Region/Country, 2024-2032 7.4. Personal Care 7.4.1. Personal care Market Estimates & Forecast, by Region/Country, 2024-2032 7.5. Others 7.5.1. Others: Market Estimates & Forecast, by Region/Country, 2024-2032 8. GLOBAL CARRAGEENAN MARKET, BY REGION 8.1. Introduction 8.2. North America 8.2.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.2.2. Market Estimates & Forecast, by Application, 2024-2032 8.2.3. Market Estimates & Forecast, by Country, 2024-2032 8.2.4. US 8.2.4.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.2.4.2. Market Estimates & Forecast, by Application, 2024-2032 8.2.5. Canada 8.2.5.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.2.5.2. Market Estimates & Forecast, by Application, 2024-2032 8.2.6. Mexico 8.2.6.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.2.6.2. Market Estimates & Forecast, by Application, 2024-2032 8.3. Europe 8.3.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.3.2. Market Estimates & Forecast, by Application, 2024-2032 8.3.3. Market Estimates & Forecast, by Country, 2024-2032 8.3.4. Germany 8.3.4.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.3.4.2. Market Estimates & Forecast, by Application, 2024-2032 8.3.5. UK 8.3.5.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.3.5.2. Market Estimates & Forecast, by Application, 2024-2032 8.3.6. France 8.3.6.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.3.6.2. Market Estimates & Forecast, by Application, 2024-2032 8.3.7. Spain 8.3.7.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.3.7.2. Market Estimates & Forecast, by Application, 2024-2032 8.3.8. Italy 8.3.8.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.3.8.2. Market Estimates & Forecast, by Application, 2024-2032 8.3.9. Rest of Europe 8.3.9.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.3.9.2. Market Estimates & Forecast, by Application, 2024-2032 8.4. Asia-Pacific 8.4.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.4.2. Market Estimates & Forecast, by Application, 2024-2032 8.4.3. Market Estimates & Forecast, by Country, 2024-2032 8.4.4. China 8.4.4.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.4.4.2. Market Estimates & Forecast, by Application, 2024-2032 8.4.5. Japan 8.4.5.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.4.5.2. Market Estimates & Forecast, by Application, 2024-2032 8.4.6. India 8.4.6.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.4.6.2. Market Estimates & Forecast, by Application, 2024-2032 8.4.7. Australia & New Zealand 8.4.7.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.4.7.2. Market Estimates & Forecast, by Application, 2024-2032 8.4.8. Rest of Asia-Pacific 8.4.8.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.4.8.2. Market Estimates & Forecast, by Application, 2024-2032 8.5. Rest of the World 8.5.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.5.2. Market Estimates & Forecast, by Application, 2024-2032 8.5.3. Market Estimates & Forecast, by Region, 2024-2032 8.5.4. South America 8.5.4.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.5.4.2. Market Estimates & Forecast, by Application, 2024-2032 8.5.5. Middle East 8.5.5.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.5.5.2. Market Estimates & Forecast, by Application, 2024-2032 8.5.6. Africa 8.5.6.1. Market Estimates & Forecast, by Product Type, 2024-2032 8.5.6.2. Market Estimates & Forecast, by Application, 2024-2032 9. Competitive Landscape 9.1. Introduction 9.2. Competitive Benchmarking 9.3. Development Share Analysis 9.4. Key Developments & Growth Strategies 10. COMPANY PROFILES 10.1. AEP Colloids Inc. (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Products Offered 10.1.4. Key Developments 10.1.5. SWOT Analysis 10.1.6. Key Strategies 10.2. Shemberg Marketing Corp (Phillipines) 10.2.1. Company Overview 10.2.2. Financial Overview 10.2.3. Products Offered 10.2.4. Key Developments 10.2.5. SWOT Analysis 10.2.6. Key Strategies 10.3. Ingredients Solutions Inc. (US) 10.3.1. Company Overview 10.3.2. Financial Overview 10.3.3. Products Offered 10.3.4. Key Developments 10.3.5. SWOT Analysis 10.3.6. Key Strategies 10.4. Gelymar SA (Chile) 10.4.1. Company Overview 10.4.2. Financial Overview 10.4.3. Products Offered 10.4.4. Key Developments 10.4.5. SWOT Analysis 10.4.6. Key Strategies 10.5. Soriano SA (Argentina) 10.5.1. Company Overview 10.5.2. Financial Overview 10.5.3. Products Offered 10.5.4. Key Developments 10.5.5. SWOT Analysis 10.5.6. Key Strategies 10.6. Marcel Trading Corporation (Phillipines) 10.6.1. Company Overview 10.6.2. Financial Overview 10.6.3. Products Offered 10.6.4. Key Developments 10.6.5. SWOT Analysis 10.6.6. Key Strategies 10.7. Scalzo Food Industries (Australia) 10.7.1. Company Overview 10.7.2. Financial Overview 10.7.3. Products Offered 10.7.4. Key Developments 10.7.5. SWOT Analysis 10.7.6. Key Strategies 10.8. MCPI Corporation (Phillipines) 10.8.1. Company Overview 10.8.2. Financial Overview 10.8.3. Products Offered 10.8.4. Key Developments 10.8.5. SWOT Analysis 10.8.6. Key Strategies 10.9. ACCEL Carrageenan Corporation (Phillipines) 10.9.1. Company Overview 10.9.2. Financial Overview 10.9.3. Products Offered 10.9.4. Key Developments 10.9.5. SWOT Analysis 10.9.6. Key Strategies 10.10. Caldic B.V. (Netherlands) 10.10.1. Company Overview 10.10.2. Financial Overview 10.10.3. Products Offered 10.10.4. Key Developments 10.10.5. SWOT Analysis 10.10.6. Key Strategies 10.11. Danlink Ingredients (Pty) LTD (South Africa) 10.11.1. Company Overview 10.11.2. Financial Overview 10.11.3. Products Offered 10.11.4. Key Developments 10.11.5. SWOT Analysis 10.11.6. Key Strategies 10.12. Cargill, Incorporated (US) 10.12.1. Company Overview 10.12.2. Financial Overview 10.12.3. Products Offered 10.12.4. Key Developments 10.12.5. SWOT Analysis 10.12.6. Key Strategies 10.13. PT Fortuna Cahaya Cemerlang (Indonesia) 10.13.1. Company Overview 10.13.2. Financial Overview 10.13.3. Products Offered 10.13.4. Key Developments 10.13.5. SWOT Analysis 10.13.6. Key Strategies 10.14. TBK Manufacturing Corporation (Phillipines) 10.14.1. Company Overview 10.14.2. Financial Overview 10.14.3. Products Offered 10.14.4. Key Developments 10.14.5. SWOT Analysis 10.14.6. Key Strategies 10.15. Ingredion Incorporated (US) 10.15.1. Company Overview 10.15.2. Financial Overview 10.15.3. Products Offered 10.15.4. Key Developments 10.15.5. SWOT Analysis 10.15.6. Key Strategies 11. APPENDIX 11.1. General Sources & References 11.2. List of Abbreviation LIST OF TABLES

- TABLE 1 Global Carrageenan Market, by Region, 2024-2032 (USD Million)

- TABLE 2 Global Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 3 Global Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 4 North America: Carrageenan Market, by Country, 2024-2032 (USD Million)

- TABLE 5 North America: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 6 North America: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 7 US: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 8 US: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 9 Canada: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 10 Canada: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 11 Mexico: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 12 Mexico: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 13 Europe: Carrageenan Market, by Country, 2024-2032 (USD Million)

- TABLE 14 Europe: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 15 Europe: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 16 Germany: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 17 Germany: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 18 France: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 19 France: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 20 Italy: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 21 Italy: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 22 Spain: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 23 Spain: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 24 UK: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 25 UK: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 26 Rest of Europe: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 27 Rest of Europe: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 28 Asia-Pacific: Carrageenan Market, by Country, 2024-2032 (USD Million)

- TABLE 29 Asia-Pacific: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 30 Asia-Pacific: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 31 China: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 32 China: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 33 India: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 34 India: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 35 Japan: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 36 Japan: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 37 Australia & New Zealand: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 38 Australia & New Zealand: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 39 Rest of Asia-Pacific: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 40 Rest of Asia-Pacific: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 41 Rest of the World (RoW): Carrageenan Market, by Country, 2024-2032 (USD Million)

- TABLE 42 Rest of the World (RoW): Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 43 Rest of the World (RoW): Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 44 South America: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 45 South America: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 46 Middle East: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 47 Middle East: Carrageenan Market, by Application, 2024-2032 (USD Million)

- TABLE 48 Africa: Carrageenan Market, by Product Type, 2024-2032 (USD Million)

- TABLE 49 Africa: Carrageenan Market, by Application, 2024-2032 (USD Million) LIST OF FIGURES

- FIGURE 1 Global Carrageenan Market Segmentation

- FIGURE 2 Forecast Research Methodology

- FIGURE 3 Five Forces Analysis of the Global Carrageenan Market

- FIGURE 4 Value Chain of Global Carrageenan Market

- FIGURE 5 Share of the Global Carrageenan Market in 2020, by Country (%)

- FIGURE 6 Global Carrageenan Market, by Region, 2024-2032,

- FIGURE 7 Global Carrageenan Market Size, by Product Type, 2020

- FIGURE 8 Share of the Global Carrageenan Market, by Product Type, 2024-2032 (%)

- FIGURE 9 Global Carrageenan Market Size, by Application, 2020

- FIGURE 10 Share of the Global Carrageenan Market, by Application, 2024-2032 (%)

Carrageenan Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment