-

Report Prologue

-

Market Definition 18

- Research Objectives 18

- Limitations 19

-

Research Methodology

-

Primary Research 22

-

Market Size Estimation 22

-

Market Dynamics

-

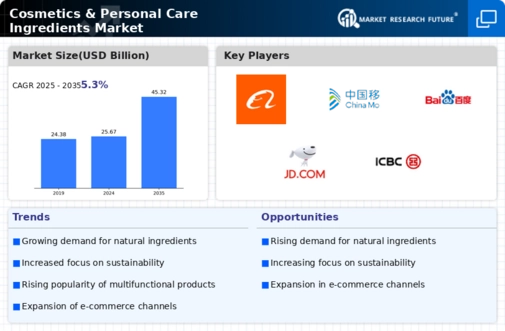

Bolstering Growth Of Personal Care Industry

- Dominance Of Hair

- Substantial

- Increasing Affinity

-

Restraints

- The Overall Market Growth Is Hampered By Increasing

-

Opportunities

- Capacity Expansion And Migration Of Cosmetic

- Increasing

-

Trends 29

- Manufacturers Continue

-

Market Factor Analysis

-

Raw Material Suppliers

- Cosmetics & Personal Care Ingredients Producers

- Formulators 31

-

MENA, G.C.C.,

-

Middle East & North Africa 37

- Tocopherol 39

- Formaldehyde 41

- Glycerol 42

- Tocopherol 44

- Formaldehyde 46

- Tocopherol 50

- Formaldehyde 52

- Glycerols 53

- Tocopherols 55

- Formaldehyde 57

- Glycerols 59

- Tocopherols 61

- Formaldehyde 63

- Glycerols 64

- Introduction 65

- Parabens 67

- Alcohols 69

- Saudi Arabia 71

- Oman 81

- Bahrain 92

-

China 102

-

MENA, G.C.C., China Cosmetic &

-

Introduction

-

MENA 110

- Turkey

- Israel 112

- Rest Of MENA 114

- Saudi Arabia 118

- Oman 121

- Bahrain 125

-

China 128

-

MENA,

-

MENA 131

- Introduction 132

- Introduction 133

-

Production Capacity 135

-

Introduction 136

- Company Overview 136

- Financial

- Key Developments 138

- Company Overview

- Product/Business Segment Overview 139

- Key Developments 139

- Company

- Product/Business Segment Overview

- Financial Updates 140

-

Ittihad International Chemicals

- Company Overview 142

- Financial

- Key Developments 143

- Product/Business Segment

- Financial Updates 144

-

Chemanol 146

- Product/Business Segment

- Financial Updates 148

-

DOGOIDE Group 149

- Product/Business Segment

- Financial Updates 149

-

Conclusion

-

MENA, G.C.C., CHINA COSMETIC & PERSONAL CARE INGREDIENTS MARKET, BY TYPE,

-

MENA, G.C.C., CHINA COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR ALCOHOLS,

-

TURKEY COSMETICS & PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2020-2027(‘000

-

TURKEY COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR TOCOPHEROL, BY TYPE,

-

TURKEY COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR FORMALDEHYDE, BY

-

TURKEY COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR ALCOHOLS, BY TYPE,

-

ISRAEL COSMETICS & PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2020-2027(USD

-

ISRAEL COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR TOCOPHEROLS, BY TYPE,

-

ISRAEL COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR PARABENS, BY TYPE,

-

ISRAEL COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR ALCOHOLS, BY TYPE,

-

ISRAEL COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR GLYCEROLS, BY TYPE,

-

NORTH AFRICA COSMETICS & PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2020-2027(‘000

-

NORTH AFRICA COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR TOCOPHEROLS,

-

NORTH AFRICA COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR FORMALDEHYDE,

-

NORTH AFRICA COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR ALCOHOLS, BY

-

REST OF MENA COSMETICS & PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2020-2027(USD

-

REST OF MENA COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR TOCOPHEROLS,

-

REST OF MENA COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR PARABENS, BY

-

REST OF MENA COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR ALCOHOLS, BY

-

G.C.C. COSMETICS & PERSONAL CARE INGREDIENTS MARKET, BY TYPE, 2020-2027(USD

-

G.C.C. COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR GLYCEROLS, BY TYPE,

-

G.C.C. COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR PARABENS, BY TYPE,

-

G.C.C. COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR ALCOHOLS, BY TYPE,

-

G.C.C. COSMETICS & PERSONAL CARE INGREDIENTS MARKET FOR ALCOHOLS, BY TYPE,

-

SAUDI ARABIA COSMETIC & PERSONAL CARE INGREDIENTS MARKET, BY TYPE, (2020-2027)

-

SAUDI ARABIA COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR PARABENS, BY

-

SAUDI ARABIA COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR ALCOHOLS, BY

-

KUWAIT COSMETIC & PERSONAL CARE INGREDIENTS MARKET, BY TYPE, (2020-2027)

-

KUWAIT COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR TOCOPHEROLS, BY TYPE,

-

KUWAIT COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR PARABENS, BY TYPE,

-

KUWAIT COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR ALCOHOLS, BY TYPE,

-

OMAN COSMETIC & PERSONAL CARE INGREDIENTS MARKET, BY TYPE, (2020-2027) (USD

-

OMAN COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR TOCOPHEROLS, BY TYPE,

-

OMAN COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR PARABENS, BY TYPE,

-

OMAN COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR ALCOHOLS, BY TYPE,

-

OMAN COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR GLYCEROLS, BY TYPE,

-

QATAR COSMETIC & PERSONAL CARE INGREDIENTS MARKET, BY TYPE, (2020-2027)

-

QATAR COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR TOCOPHEROLS, BY TYPE,

-

QATAR COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR FORMALDEHYDE, BY TYPE,

-

QATAR COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR ALCOHOLS, BY TYPE,

-

BAHRAIN COSMETIC & PERSONAL CARE INGREDIENTS MARKET, BY TYPE, (2020-2027)

-

BAHRAIN COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR TOCOPHEROLS, BY

-

BAHRAIN COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR FORMALDEHYDE, BY

-

BAHRAIN COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR GLYCEROLS, BY TYPE,

-

UAE COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR TOCOPHEROLS, BY TYPE,

-

UAE COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR FORMALDEHYDE, BY TYPE,

-

UAE COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR ALCOHOLS, BY TYPE, (2020-2027)

-

UAE COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR GLYCEROLS, BY TYPE,

-

CHINA COSMETIC & PERSONAL CARE INGREDIENTS MARKET, BY TYPE, (2020-2027)

-

CHINA COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR PARABENS, BY TYPE,

-

CHINA COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR FORMALDEHYDE, BY TYPE,

-

CHINA COSMETIC & PERSONAL CARE INGREDIENTS MARKET FOR GLYCEROLS, BY TYPE,

-

MENA, G.C.C., CHINA COSMETIC & PERSONAL INGREDIENTS MARKET, BY APPLICATION,

-

TURKEY COSMETIC & PERSONAL INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

ISRAEL COSMETIC & PERSONAL INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

NORTH AFRICA COSMETIC & PERSONAL INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

REST OF MENA COSMETIC & PERSONAL INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

G.C.C. COSMETIC & PERSONAL INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

SAUDI ARABIA COSMETIC & PERSONAL INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

KUWAIT COSMETIC & PERSONAL INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

OMAN COSMETIC & PERSONAL INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

QATAR COSMETIC & PERSONAL INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

BAHRAIN COSMETIC & PERSONAL INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

UAE COSMETIC & PERSONAL INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

CHINA COSMETIC & PERSONAL INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

MENA, G.C.C., CHINA COSMETIC & PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION,

-

MENA COSMETIC & PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

G.C.C. COSMETIC & PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

CHINA COSMETIC & PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION, (2020-2027)

-

SABIC: KEY DEVELOPMENTS 138

-

ITTIHAD INTERNATIONAL CHEMICALS TRADING LLC: SEGMENT OVERVIEW 142

-

REZA CHEMICAL INDUSTRIES (RCI) (REZA INVESTMENT COMPANY LTD.): SEGMENT OVERVIEW

-

List Of Figures

-

TOP DOWN & BOTTOMUP APPROACH 22

-

TRENDS: IMPACT ANALYSIS 29

-

SABIC: RECENT FINANCIALS 138

Leave a Comment