-

Executive Summary 18

-

Market Introduction 20

-

Definition 20

-

Scope Of The Study 20

-

Research Objective 20

-

Market Structure 21

-

Research Methodology 22

-

Overview 22

-

Data Flow 24

- Data Mining Process 24

-

Purchased Database: 25

-

Secondary Sources: 26

- Secondary Research Data Flow: 27

-

Primary Research: 28

- Primary Research Data Flow: 29

- Primary Research: Number Of Interviews Conducted 30

- Primary Research: Regional Coverage 30

-

Approaches For Market Size Estimation: 31

- Consumption & Net Trade Approach 31

- Revenue Analysis Approach 31

-

Data Forecasting 32

- Data Forecasting Technique 32

-

Data Modeling 33

- Microeconomic Factor Analysis: 33

- Data Modeling: 34

-

Teams And Analyst Contribution 36

-

Market Dynamics 37

-

Introduction 37

-

Drivers 39

- Infrastructure Development And Urbanization 39

- Expansion Of Manufacturing And Industrial Sectors 40

-

Restraints 42

- Challenge From Unorganized Sector 42

-

Opportunity 44

- Technology Integration And Franchise Model 44

- Focus On Green Cleaning Services 45

-

Strategic Insights 46

- Technology Update 46

- Key Geographies To Focus For Expansion 46

-

Impact Analysis Of Covid-19 48

- Impact On Overall Consumer Goods Industry 48

- Impact Of Covid On Cleaning Services 49

- Impact On Supply Chain Of Cleaning Services 50

- Impact On Market Demand Cleaning Services 51

-

Market Factor Analysis 53

-

Value Chain Analysis 53

- Inbound Logistics (20%) 53

- Operations (40%) 54

- Outbound Logistics (15%) 54

- Marketing And Sales (15%) 54

- After Sales Service (10%) 54

-

Porter’s Five Forces Model 56

- Bargaining Power Of Suppliers 56

- Bargaining Power Of Buyers 57

- Threat Of New Entrants 57

- Threat Of Substitute Products 57

- Industry Rivalry 58

-

Global Cleaning Services Market, By Type 60

-

Introduction 60

-

Services 61

- Window Cleaning 62

- Vacuuming 62

- Floor Care 63

- Maid Services 63

- Carpet & Upholstery 63

- Others 63

-

Equipment And Accessories 63

- Mops 65

- Buckets 65

- Pressure Washers 65

- Window Cleaning Tools 65

- Sprayers 66

- Steam Cleaners 66

- Vacuum Cleaners 66

- Litter Removal Kits 66

-

Global Cleaning Services Market, By Mode Of Service 67

-

Introduction 67

-

One-Time 68

-

Contractual 68

-

Global Cleaning Services Market, By End-Use 70

-

Introduction 70

-

Commercial 71

-

Hospitals 72

-

Offices 72

-

Shopping Centers 72

-

Industries 73

-

Others 73

-

Residential 74

-

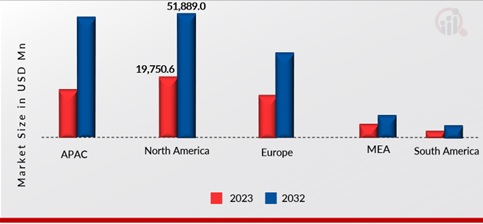

Global Cleaning Services Market, By Region 75

-

Overview 75

-

Europe 76

- Germany 79

- France 80

- Spain 81

- Italy 83

- U.K. 84

- Rest Of Europe 85

-

North America 87

- U.S. 89

- Canada 91

- Mexico 92

-

Asia-Pacific 94

- China 96

- India 98

- Japan 99

- South Korea 100

- Rest Of Asia-Pacific 102

-

Middle East And Africa 103

- Gcc Countries 106

- Turkey 107

- Northern Africa 108

- Southern Africa 110

-

South America 112

- Brazil 114

- Rest Of South America 117

-

Argentina 116

-

Competitive Landscape 120

-

Introduction 120

-

Market Share Analysis, 2022-23 120

-

Competitor Dashboard 122

-

Comparative Analysis: Key Players Financial 123

-

Key Developments & Growth Strategies 123

-

Company Profiles 124

-

Abm Industries 124

- Company Overview 124

- Financial Overview 125

- Services Offered 126

- Key Developments 126

- Swot Analysis 127

- Key Strategy 127

-

Iss Facility Services 128

- Company Overview 128

- Financial Overview 129

- Services Offered 130

- Key Developments 130

- Swot Analysis 130

- Key Strategy 131

-

Compass Group 132

- Company Overview 132

- Financial Overview 133

- Services Offered 134

- Key Developments 134

- Swot Analysis 134

- Key Strategy 135

-

Mitie Group 136

- Company Overview 136

- Financial Overview 137

- Services Offered 138

- Key Developments 138

- Swot Analysis 138

- Key Strategy 139

-

Rentokil Initial 140

- Company Overview 140

- Financial Overview 141

- Services Offered 142

- Key Developments 142

- Swot Analysis 142

- Key Strategy 143

-

Servicemaster 144

- Company Overview 144

- Financial Overview 145

- Services Offered 145

- Key Developments 145

- Swot Analysis 145

- Key Strategy 146

-

Stanley Steemer 147

- Company Overview 147

- Financial Overview 148

- Services Offered 148

- Key Developments 148

- Swot Analysis 148

- Key Strategy 149

-

Jani-King 150

- Company Overview 150

- Financial Overview 150

- Services Offered 151

- Key Developments 151

- Swot Analysis 151

- Key Strategy 152

-

Vanguard Cleaning Systems 153

- Company Overview 153

- Financial Overview 153

- Services Offered 154

- Key Developments 154

- Swot Analysis 154

- Key Strategy 155

-

Anago Cleaning Systems 156

- Company Overview 156

- Financial Overview 156

- Services Offered 157

- Key Developments 157

- Swot Analysis 157

- Key Strategy 158

-

Data Citations 161

-

-

LIST OF TABLES

-

QFD MODELING FOR MARKET SHARE ASSESSMENT 34

-

GLOBAL CLEANING SERVICES MARKET, BY TYPE, 2019-2032 (USD MILLION) 61

-

GLOBAL CLEANING SERVICES MARKET, BY SERVICES TYPE, 2019-2032 (USD MILLION) 62

-

GLOBAL CLEANING SERVICES MARKET, BY SERVICES TYPE, BY REGION, 2019-2032 (USD MILLION) 62

-

GLOBAL EQUIPMENTS AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 64

-

GLOBAL EQUIPMENTS AND ACCESSORIES MARKET FOR CLEANING SERVICES, BY REGION, 2019-2032 (USD MILLION) 65

-

GLOBAL CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 67

-

GLOBAL CLEANING SERVICES MARKET, BY ONE-TIME, BY REGION, 2019-2032 (USD MILLION) 68

-

GLOBAL CLEANING SERVICES MARKET, BY CONTRACTUAL, BY REGION, 2019-2032 (USD MILLION) 69

-

GLOBAL CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 70

-

GLOBAL CLEANING SERVICES MARKET, FOR STATIONARY, BY REGION, 2019-2032 (USD MILLION) 71

-

GLOBAL CLEANING SERVICES MARKET, FOR PORTABLE, BY REGION, 2019-2032 (USD MILLION) 74

-

GLOBAL CLEANING SERVICES MARKET, BY REGION, 2019-2032 (USD MILLION) 75

-

EUROPE: CLEANING SERVICES MARKET, BY COUNTRY, 2019-2032 (USD MILLION) 77

-

EUROPE CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 77

-

EUROPE EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 78

-

EUROPE CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 78

-

EUROPE CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 78

-

GERMANY CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 79

-

GERMANY EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 79

-

GERMANY CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 79

-

GERMANY CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 79

-

FRANCE CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 80

-

FRANCE EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 80

-

FRANCE CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 81

-

FRANCE CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 81

-

SPAIN CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 81

-

SPAIN EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 82

-

SPAIN CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 82

-

SPAIN CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 82

-

ITALY CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 83

-

ITALY EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 83

-

ITALY CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 83

-

ITALY CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 84

-

U.K. CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 84

-

U.K. EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 84

-

U.K. CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 85

-

U.K. CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 85

-

REST OF EUROPE CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 85

-

REST OF EUROPE EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 86

-

REST OF EUROPE CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 86

-

REST OF EUROPE CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 86

-

NORTH AMERICA: CLEANING SERVICES MARKET, BY COUNTRY, 2019-2032 (USD MILLION) 88

-

NORTH AMERICA CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 88

-

NORTH AMERICA EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 88

-

NORTH AMERICA CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 89

-

NORTH AMERICA CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 89

-

U.S. CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 89

-

U.S. EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 90

-

U.S. CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 90

-

U.S. CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 90

-

CANADA CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 91

-

CANADA EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 91

-

CANADA CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 91

-

CANADA CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 92

-

MEXICO CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 92

-

MEXICO EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 92

-

MEXICO CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 93

-

MEXICO CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 93

-

ASIA-PACIFIC: CLEANING SERVICES MARKET, BY COUNTRY, 2019-2032 (USD MILLION) 95

-

ASIA-PACIFIC CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 95

-

ASIA-PACIFIC EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 95

-

ASIA-PACIFIC CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 96

-

ASIA-PACIFIC CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 96

-

CHINA CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 96

-

CHINA EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 97

-

CHINA CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 97

-

CHINA CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 97

-

INDIA CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 98

-

INDIA EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 98

-

INDIA CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 98

-

INDIA CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 99

-

JAPAN CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 99

-

JAPAN EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 99

-

JAPAN CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 100

-

JAPAN CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 100

-

SOUTH KOREA CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 100

-

SOUTH KOREA EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 101

-

SOUTH KOREA CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 101

-

SOUTH KOREA CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 101

-

REST OF ASIA-PACIFIC CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 102

-

REST OF ASIA-PACIFIC EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 102

-

REST OF ASIA-PACIFIC CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 102

-

REST OF ASIA-PACIFIC CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 102

-

MIDDLE EAST AND AFRICA: CLEANING SERVICES MARKET, BY COUNTRY, 2019-2032 (USD MILLION) 104

-

MIDDLE EAST AND AFRICA CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 104

-

MIDDLE EAST AND AFRICA EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 105

-

MIDDLE EAST AND AFRICA CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 105

-

MIDDLE EAST AND AFRICA CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 105

-

GCC COUNTRIES CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 106

-

GCC COUNTRIES EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 106

-

GCC COUNTRIES CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 106

-

GCC COUNTRIES CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 107

-

TURKEY CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 107

-

TURKEY EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 107

-

TURKEY CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 108

-

TURKEY CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 108

-

NORTHERN AFRICA CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 108

-

NORTHERN AFRICA EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 109

-

NORTHERN AFRICA CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 109

-

NORTHERN AFRICA CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 109

-

SOUTHERN AFRICA CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 110

-

SOUTHERN AFRICA EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 110

-

SOUTHERN AFRICA CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 110

-

SOUTHERN AFRICA CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 111

-

SOUTH AMERICA: CLEANING SERVICES MARKET, BY COUNTRY, 2019-2032 (USD MILLION) 113

-

SOUTH AMERICA CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 113

-

SOUTH AMERICA EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 113

-

SOUTH AMERICA CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 114

-

SOUTH AMERICA CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 114

-

BRAZIL CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 114

-

BRAZIL EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 115

-

BRAZIL CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 115

-

BRAZIL CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 115

-

ARGENTINA CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 116

-

ARGENTINA EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 116

-

ARGENTINA CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 116

-

ARGENTINA CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 117

-

REST OF SOUTH AMERICA CLEANING SERVICES MARKET, BY SERVICE TYPE, 2019-2032 (USD MILLION) 117

-

REST OF SOUTH AMERICA EQUIPMENT AND ACCESSORIES FOR CLEANING SERVICES, 2019-2032 (USD MILLION) 118

-

REST OF SOUTH AMERICA CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2019-2032 (USD MILLION) 118

-

REST OF SOUTH AMERICA CLEANING SERVICES MARKET, BY END-USE, 2019-2032 (USD MILLION) 118

-

COMPARATIVE ANALYSIS: KEY PLAYERS FINANCIAL 123

-

KEY DEVELOPMENTS AND KEY STRATEGIES 123

-

ABM INDUSTRIES: SERVICES OFFERED 126

-

ABM INDUSTRIES: KEY DEVELOPMENTS 126

-

ISS FACILITY SERVICES: SERVICES OFFERED 130

-

COMPASS GROUP: SERVICES OFFERED 134

-

MITIE GROUP: SERVICES OFFERED 138

-

RENTOKIL INITIAL: SERVICES OFFERED 142

-

SERVICEMASTER: SERVICES OFFERED 145

-

STANLEY STEEMER: SERVICES OFFERED 148

-

JANI-KING: SERVICES OFFERED 151

-

VANGUARD CLEANING SYSTEMS: SERVICES OFFERED 154

-

ANAGO CLEANING SYSTEMS: SERVICES OFFERED 157

-

-

LIST OF FIGURES

-

GLOBAL CLEANING SERVICES MARKET: STRUCTURE 21

-

GLOBAL CLEANING SERVICES MARKET: MARKET GROWTH FACTOR ANALYSIS (2024-2032) 37

-

VALUE CHAIN ANALYSIS: GLOBAL CLEANING SERVICES MARKET 53

-

PORTER’S FIVE FORCES MODEL: GLOBAL CLEANING SERVICES MARKET 56

-

GLOBAL CLEANING SERVICES MARKET, BY TYPE, SEGMENT ATTRACTIVENESS ANALYSIS 60

-

GLOBAL CLEANING SERVICES MARKET, BY TYPE, 2023 (% SHARE) 61

-

GLOBAL CLEANING SERVICES MARKET, BY MODE OF SERVICE, SEGMENT ATTRACTIVENESS ANALYSIS 67

-

GLOBAL CLEANING SERVICES MARKET, BY MODE OF SERVICE, 2023 (% SHARE) 67

-

GLOBAL CLEANING SERVICES MARKET, BY END-USE, SEGMENT ATTRACTIVENESS ANALYSIS 70

-

GLOBAL CLEANING SERVICES MARKET, BY END-USE, 2023 (% SHARE) 71

-

GLOBAL CLEANING SERVICES MARKET, BY REGION, 2023 (% SHARE) 75

-

EUROPE MARKET: SWOT ANALYSIS 76

-

NORTH AMERICA MARKET: SWOT ANALYSIS 87

-

ASIA-PACIFIC MARKET: SWOT ANALYSIS 94

-

MIDDLE EAST AND AFRICA MARKET: SWOT ANALYSIS 103

-

SOUTH AMERICA MARKET: SWOT ANALYSIS 112

-

GLOBAL CLEANING SERVICES MARKET PLAYERS: COMPETITIVE ANALYSIS, 2022-23 120

-

COMPETITOR DASHBOARD: GLOBAL CLEANING SERVICES 122

-

ABM INDUSTRIES: FINANCIAL OVERVIEW 125

-

ABM INDUSTRIES: SWOT ANALYSIS 127

-

ISS FACILITY SERVICES: FINANCIAL OVERVIEW 129

-

ISS FACILITY SERVICES: SWOT ANALYSIS 130

-

COMPASS GROUP: FINANCIAL OVERVIEW 133

-

COMPASS GROUP: SWOT ANALYSIS 134

-

MITIE GROUP: FINANCIAL OVERVIEW 137

-

MITIE GROUP: SWOT ANALYSIS 138

-

RENTOKIL INITIAL: FINANCIAL OVERVIEW 141

-

RENTOKIL INITIAL: SWOT ANALYSIS 142

-

SERVICEMASTER: SWOT ANALYSIS 145

-

STANLEY STEEMER: SWOT ANALYSIS 148

-

JANI-KING: SWOT ANALYSIS 151

-

VANGUARD CLEANING SYSTEMS: SWOT ANALYSIS 154

-

ANAGO CLEANING SYSTEMS: SWOT ANALYSIS 157

Leave a Comment