-

Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nNorth America Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nNorth America Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nNorth America Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nNorth America Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nUS Cocoa Chocolate Market SIZE

-

ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nUS Cocoa Chocolate Market SIZE

-

ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nUS Cocoa Chocolate Market SIZE

-

ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nUS Cocoa Chocolate Market SIZE

-

ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nUS Cocoa Chocolate Market SIZE

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nCanada Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nCanada Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nCanada Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nCanada Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nCanada Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nEurope Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nEurope Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nEurope Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nEurope Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nEurope Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nGermany Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nGermany Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nGermany Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nGermany Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nGermany Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nUK Cocoa Chocolate Market SIZE

-

ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nUK Cocoa Chocolate Market SIZE

-

ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nUK Cocoa Chocolate Market SIZE

-

ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nUK Cocoa Chocolate Market SIZE

-

ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nUK Cocoa Chocolate Market SIZE

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nFrance Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nFrance Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nFrance Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nFrance Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nFrance Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRussia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRussia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRussia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRussia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRussia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nItaly Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nItaly Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nItaly Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nItaly Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nItaly Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSpain Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSpain Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSpain Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSpain Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSpain Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of Europe Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of Europe Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of Europe Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of Europe Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of Europe Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nAPAC Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nAPAC Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nAPAC Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nAPAC Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nAPAC Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nChina Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nChina Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nChina Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nChina Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nChina Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nIndia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nIndia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nIndia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nIndia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nIndia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nJapan Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nJapan Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nJapan Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nJapan Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nJapan Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth Korea Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth Korea Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth Korea Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth Korea Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth Korea Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMalaysia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMalaysia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMalaysia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMalaysia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMalaysia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nThailand Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nThailand Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nThailand Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nThailand Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nThailand Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nIndonesia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nIndonesia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nIndonesia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nIndonesia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nIndonesia Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of APAC Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of APAC Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of APAC Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of APAC Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of APAC Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth America Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth America Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth America Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth America Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth America Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nBrazil Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nBrazil Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nBrazil Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nBrazil Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nBrazil Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMexico Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMexico Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMexico Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMexico Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMexico Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nArgentina Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nArgentina Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nArgentina Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nArgentina Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nArgentina Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of South America Cocoa

-

Chocolate Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD

-

Billions)

-

\r\n\r\n\r\nRest of South America Cocoa Chocolate Market SIZE ESTIMATES &

-

FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of South America Cocoa

-

Chocolate Market SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of South America Cocoa

-

Chocolate Market SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035

-

(USD Billions)

-

\r\n\r\n\r\nRest of South America Cocoa Chocolate Market SIZE ESTIMATES

-

& FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMEA Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMEA Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMEA Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMEA Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nMEA Cocoa Chocolate Market

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nGCC Countries Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nGCC Countries Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nGCC Countries Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nGCC Countries Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nGCC Countries Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth Africa Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth Africa Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth Africa Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth Africa Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nSouth Africa Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of MEA Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of MEA Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of MEA Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of MEA Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nRest of MEA Cocoa Chocolate

-

Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

\r\n\r\n\r\nPRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

-

\r\n\r\n\r\nACQUISITION/PARTNERSHIP

-

\r\n\r\n\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\nLIST Of figures

-

\r\n

-

\r\n\r\n\r\nMARKET SYNOPSIS

-

\r\n\r\n\r\nNORTH AMERICA COCOA CHOCOLATE

-

MARKET ANALYSIS

-

\r\n\r\n\r\nUS COCOA CHOCOLATE MARKET ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nUS COCOA CHOCOLATE MARKET ANALYSIS

-

BY END USE

-

\r\n\r\n\r\nUS COCOA CHOCOLATE MARKET ANALYSIS BY FORM

-

\r\n\r\n\r\nUS COCOA CHOCOLATE MARKET ANALYSIS

-

BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nUS COCOA CHOCOLATE MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nCANADA COCOA CHOCOLATE MARKET

-

ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nCANADA COCOA CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nCANADA COCOA CHOCOLATE MARKET

-

ANALYSIS BY FORM

-

\r\n\r\n\r\nCANADA COCOA CHOCOLATE MARKET ANALYSIS BY DISTRIBUTION

-

CHANNEL

-

\r\n\r\n\r\nCANADA COCOA CHOCOLATE MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nEUROPE COCOA CHOCOLATE MARKET

-

ANALYSIS

-

\r\n\r\n\r\nGERMANY COCOA CHOCOLATE MARKET ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nGERMANY COCOA CHOCOLATE MARKET

-

ANALYSIS BY END USE

-

\r\n\r\n\r\nGERMANY COCOA CHOCOLATE MARKET ANALYSIS BY FORM

-

\r\n\r\n\r\nGERMANY COCOA CHOCOLATE MARKET

-

ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nGERMANY COCOA CHOCOLATE MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nUK COCOA CHOCOLATE MARKET ANALYSIS

-

BY PRODUCT TYPE

-

\r\n\r\n\r\nUK COCOA CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nUK COCOA CHOCOLATE MARKET ANALYSIS

-

BY FORM

-

\r\n\r\n\r\nUK COCOA CHOCOLATE MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nUK COCOA CHOCOLATE MARKET ANALYSIS

-

BY REGIONAL

-

\r\n\r\n\r\nFRANCE COCOA CHOCOLATE MARKET ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nFRANCE COCOA CHOCOLATE MARKET

-

ANALYSIS BY END USE

-

\r\n\r\n\r\nFRANCE COCOA CHOCOLATE MARKET ANALYSIS BY FORM

-

\r\n\r\n\r\nFRANCE COCOA CHOCOLATE MARKET

-

ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nFRANCE COCOA CHOCOLATE MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nRUSSIA COCOA CHOCOLATE MARKET

-

ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nRUSSIA COCOA CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nRUSSIA COCOA CHOCOLATE MARKET

-

ANALYSIS BY FORM

-

\r\n\r\n\r\nRUSSIA COCOA CHOCOLATE MARKET ANALYSIS BY DISTRIBUTION

-

CHANNEL

-

\r\n\r\n\r\nRUSSIA COCOA CHOCOLATE MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nITALY COCOA CHOCOLATE MARKET

-

ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nITALY COCOA CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nITALY COCOA CHOCOLATE MARKET

-

ANALYSIS BY FORM

-

\r\n\r\n\r\nITALY COCOA CHOCOLATE MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nITALY COCOA CHOCOLATE MARKET

-

ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nSPAIN COCOA CHOCOLATE MARKET ANALYSIS BY PRODUCT

-

TYPE

-

\r\n\r\n\r\nSPAIN COCOA CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nSPAIN COCOA CHOCOLATE MARKET

-

ANALYSIS BY FORM

-

\r\n\r\n\r\nSPAIN COCOA CHOCOLATE MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nSPAIN COCOA CHOCOLATE MARKET

-

ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nREST OF EUROPE COCOA CHOCOLATE MARKET ANALYSIS BY

-

PRODUCT TYPE

-

\r\n\r\n\r\nREST OF EUROPE COCOA CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nREST OF EUROPE COCOA CHOCOLATE

-

MARKET ANALYSIS BY FORM

-

\r\n\r\n\r\nREST OF EUROPE COCOA CHOCOLATE MARKET ANALYSIS BY

-

DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nREST OF EUROPE COCOA CHOCOLATE MARKET ANALYSIS BY

-

REGIONAL

-

\r\n\r\n\r\nAPAC COCOA CHOCOLATE MARKET ANALYSIS

-

\r\n\r\n\r\nCHINA COCOA CHOCOLATE MARKET

-

ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nCHINA COCOA CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nCHINA COCOA CHOCOLATE MARKET

-

ANALYSIS BY FORM

-

\r\n\r\n\r\nCHINA COCOA CHOCOLATE MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nCHINA COCOA CHOCOLATE MARKET

-

ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nINDIA COCOA CHOCOLATE MARKET ANALYSIS BY PRODUCT

-

TYPE

-

\r\n\r\n\r\nINDIA COCOA CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nINDIA COCOA CHOCOLATE MARKET

-

ANALYSIS BY FORM

-

\r\n\r\n\r\nINDIA COCOA CHOCOLATE MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nINDIA COCOA CHOCOLATE MARKET

-

ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nJAPAN COCOA CHOCOLATE MARKET ANALYSIS BY PRODUCT

-

TYPE

-

\r\n\r\n\r\nJAPAN COCOA CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nJAPAN COCOA CHOCOLATE MARKET

-

ANALYSIS BY FORM

-

\r\n\r\n\r\nJAPAN COCOA CHOCOLATE MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nJAPAN COCOA CHOCOLATE MARKET

-

ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nSOUTH KOREA COCOA CHOCOLATE MARKET ANALYSIS BY PRODUCT

-

TYPE

-

\r\n\r\n\r\nSOUTH KOREA COCOA CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nSOUTH KOREA COCOA CHOCOLATE

-

MARKET ANALYSIS BY FORM

-

\r\n\r\n\r\nSOUTH KOREA COCOA CHOCOLATE MARKET ANALYSIS BY DISTRIBUTION

-

CHANNEL

-

\r\n\r\n\r\nSOUTH KOREA COCOA CHOCOLATE MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nMALAYSIA COCOA CHOCOLATE MARKET

-

ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nMALAYSIA COCOA CHOCOLATE MARKET ANALYSIS BY END

-

USE

-

\r\n\r\n\r\nMALAYSIA COCOA CHOCOLATE MARKET ANALYSIS BY FORM

-

\r\n\r\n\r\nMALAYSIA COCOA CHOCOLATE MARKET

-

ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nMALAYSIA COCOA CHOCOLATE MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nTHAILAND COCOA CHOCOLATE MARKET

-

ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nTHAILAND COCOA CHOCOLATE MARKET ANALYSIS BY END

-

USE

-

\r\n\r\n\r\nTHAILAND COCOA CHOCOLATE MARKET ANALYSIS BY FORM

-

\r\n\r\n\r\nTHAILAND COCOA CHOCOLATE MARKET

-

ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nTHAILAND COCOA CHOCOLATE MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nINDONESIA COCOA CHOCOLATE MARKET

-

ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nINDONESIA COCOA CHOCOLATE MARKET ANALYSIS BY END

-

USE

-

\r\n\r\n\r\nINDONESIA COCOA CHOCOLATE MARKET ANALYSIS BY FORM

-

\r\n\r\n\r\nINDONESIA COCOA CHOCOLATE MARKET

-

ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nINDONESIA COCOA CHOCOLATE MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nREST OF APAC COCOA CHOCOLATE

-

MARKET ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nREST OF APAC COCOA CHOCOLATE MARKET ANALYSIS BY

-

END USE

-

\r\n\r\n\r\nREST OF APAC COCOA CHOCOLATE MARKET ANALYSIS BY FORM

-

\r\n\r\n\r\nREST OF APAC COCOA CHOCOLATE

-

MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nREST OF APAC COCOA CHOCOLATE

-

MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nSOUTH AMERICA COCOA CHOCOLATE MARKET ANALYSIS

-

\r\n\r\n\r\nBRAZIL COCOA CHOCOLATE MARKET

-

ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nBRAZIL COCOA CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nBRAZIL COCOA CHOCOLATE MARKET

-

ANALYSIS BY FORM

-

\r\n\r\n\r\nBRAZIL COCOA CHOCOLATE MARKET ANALYSIS BY DISTRIBUTION

-

CHANNEL

-

\r\n\r\n\r\nBRAZIL COCOA CHOCOLATE MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nMEXICO COCOA CHOCOLATE MARKET

-

ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nMEXICO COCOA CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nMEXICO COCOA CHOCOLATE MARKET

-

ANALYSIS BY FORM

-

\r\n\r\n\r\nMEXICO COCOA CHOCOLATE MARKET ANALYSIS BY DISTRIBUTION

-

CHANNEL

-

\r\n\r\n\r\nMEXICO COCOA CHOCOLATE MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nARGENTINA COCOA CHOCOLATE MARKET

-

ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nARGENTINA COCOA CHOCOLATE MARKET ANALYSIS BY END

-

USE

-

\r\n\r\n\r\nARGENTINA COCOA CHOCOLATE MARKET ANALYSIS BY FORM

-

\r\n\r\n\r\nARGENTINA COCOA CHOCOLATE MARKET

-

ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nARGENTINA COCOA CHOCOLATE MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nREST OF SOUTH AMERICA COCOA

-

CHOCOLATE MARKET ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nREST OF SOUTH AMERICA COCOA

-

CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nREST OF SOUTH AMERICA COCOA CHOCOLATE MARKET ANALYSIS

-

BY FORM

-

\r\n\r\n\r\nREST OF SOUTH AMERICA COCOA CHOCOLATE MARKET ANALYSIS BY DISTRIBUTION

-

CHANNEL

-

\r\n\r\n\r\nREST OF SOUTH AMERICA COCOA CHOCOLATE MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nMEA COCOA CHOCOLATE MARKET

-

ANALYSIS

-

\r\n\r\n\r\nGCC COUNTRIES COCOA CHOCOLATE MARKET ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nGCC COUNTRIES COCOA CHOCOLATE

-

MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nGCC COUNTRIES COCOA CHOCOLATE MARKET ANALYSIS BY

-

FORM

-

\r\n\r\n\r\nGCC COUNTRIES COCOA CHOCOLATE MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nGCC COUNTRIES COCOA CHOCOLATE

-

MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nSOUTH AFRICA COCOA CHOCOLATE MARKET ANALYSIS BY

-

PRODUCT TYPE

-

\r\n\r\n\r\nSOUTH AFRICA COCOA CHOCOLATE MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nSOUTH AFRICA COCOA CHOCOLATE

-

MARKET ANALYSIS BY FORM

-

\r\n\r\n\r\nSOUTH AFRICA COCOA CHOCOLATE MARKET ANALYSIS BY

-

DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nSOUTH AFRICA COCOA CHOCOLATE MARKET ANALYSIS BY

-

REGIONAL

-

\r\n\r\n\r\nREST OF MEA COCOA CHOCOLATE MARKET ANALYSIS BY PRODUCT TYPE

-

\r\n\r\n\r\nREST OF MEA COCOA CHOCOLATE

-

MARKET ANALYSIS BY END USE

-

\r\n\r\n\r\nREST OF MEA COCOA CHOCOLATE MARKET ANALYSIS BY FORM

-

\r\n\r\n\r\nREST OF MEA COCOA CHOCOLATE

-

MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

\r\n\r\n\r\nREST OF MEA COCOA CHOCOLATE

-

MARKET ANALYSIS BY REGIONAL

-

\r\n\r\n\r\nKEY BUYING CRITERIA OF COCOA CHOCOLATE MARKET

-

\r\n\r\n\r\nRESEARCH PROCESS OF MRFR

-

\r\n\r\n\r\nDRO ANALYSIS OF COCOA CHOCOLATE

-

MARKET

-

\r\n\r\n\r\nDRIVERS IMPACT ANALYSIS: COCOA CHOCOLATE MARKET

-

\r\n\r\n\r\nRESTRAINTS IMPACT ANALYSIS:

-

COCOA CHOCOLATE MARKET

-

\r\n\r\n\r\nSUPPLY / VALUE CHAIN: COCOA CHOCOLATE MARKET

-

\r\n\r\n\r\nCOCOA CHOCOLATE MARKET, BY

-

PRODUCT TYPE, 2025 (% SHARE)

-

\r\n\r\n\r\nCOCOA CHOCOLATE MARKET, BY PRODUCT TYPE, 2019 TO

-

\r\n\r\n\r\nCOCOA CHOCOLATE MARKET, BY END USE, 2025 (% SHARE)

-

\r\n\r\n\r\nCOCOA CHOCOLATE MARKET, BY

-

END USE, 2019 TO 2035 (USD Billions)

-

\r\n\r\n\r\nCOCOA CHOCOLATE MARKET, BY FORM, 2025 (% SHARE)

-

\r\n\r\n\r\nCOCOA CHOCOLATE MARKET, BY

-

FORM, 2019 TO 2035 (USD Billions)

-

\r\n\r\n\r\nCOCOA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL,

-

\r\n\r\n\r\nCOCOA CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2019 TO

-

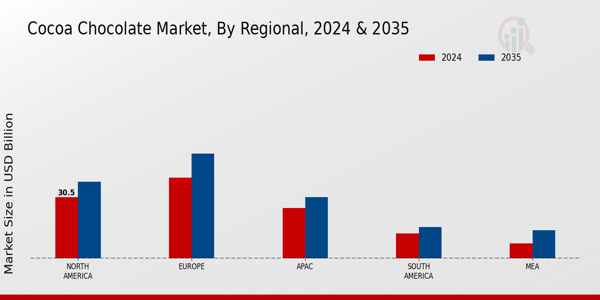

\r\n\r\n\r\nCOCOA CHOCOLATE MARKET, BY REGIONAL, 2025 (% SHARE)

-

\r\n\r\n\r\nCOCOA CHOCOLATE MARKET, BY

-

REGIONAL, 2019 TO 2035 (USD Billions)

-

\r\n\r\n\r\nBENCHMARKING OF MAJOR COMPETITORS

-

\r\n\r\n\r\n

Leave a Comment