Construction Plastics Size

Construction Plastics Market Growth Projections and Opportunities

The Construction Plastics Market is shaped by a variety of factors that collectively influence its trends and growth dynamics. One prominent driver is the increasing use of plastics in the construction industry for various applications, including pipes and fittings, insulation materials, roofing, windows, and doors. The versatility, durability, and cost-effectiveness of construction plastics contribute to their widespread adoption across residential, commercial, and infrastructure projects. As the construction sector continues to expand globally, the demand for innovative plastic solutions for building materials and construction components remains on the rise.

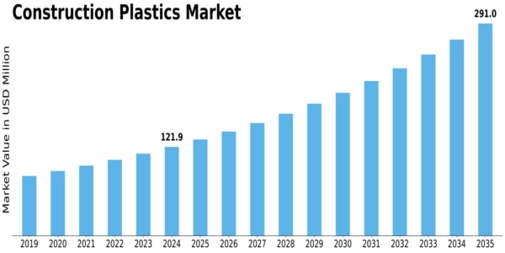

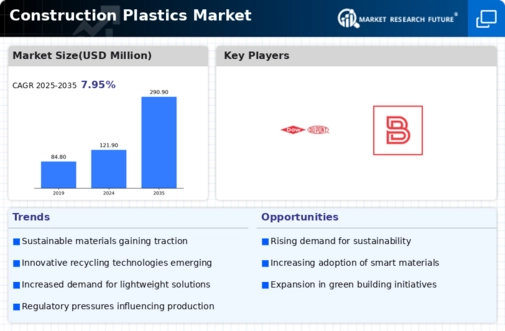

Construction Plastics Market is projected to be worth USD 125.95 Billion by 2027, registering a CAGR of 7.95% during the forecast period (2020 - 2027).

Global economic conditions play a pivotal role in the Construction Plastics Market. Economic growth and urbanization drive the need for construction materials that are lightweight, energy-efficient, and offer design flexibility. Developing economies, undergoing rapid urban development and infrastructure expansion, significantly contribute to the market's growth as construction projects become integral components of their economic progress.

Technological advancements in plastic formulations and manufacturing processes impact the market dynamics. Ongoing research and development efforts lead to innovations in construction plastics, improving their performance characteristics, sustainability, and recyclability. Companies that invest in these technological advancements gain a competitive edge by offering construction plastics with enhanced properties, meeting the evolving demands of builders, architects, and developers.

Environmental considerations are increasingly influencing the Construction Plastics Market. As sustainability becomes a key focus in the construction industry, there is a growing demand for eco-friendly and recyclable plastic materials. Companies aligning their product offerings with green building practices and regulatory standards gain favor in the market. Sustainable construction plastics, designed for energy efficiency and reduced environmental impact, are gaining traction among environmentally conscious builders and developers.

Geopolitical factors and trade dynamics also play a role in shaping the Construction Plastics Market. Fluctuations in trade relations, changes in tariffs, and geopolitical tensions can impact the supply chain and pricing of construction plastics. Companies in the market need to stay informed about global trade developments and adjust their strategies to navigate potential risks and capitalize on emerging opportunities in the global market.

Furthermore, the infrastructure sector significantly contributes to the demand for construction plastics. As governments invest in large-scale infrastructure projects such as highways, bridges, and tunnels, the use of construction plastics for applications like pipes, conduits, and geosynthetics becomes integral. The lightweight and corrosion-resistant properties of plastics make them ideal for infrastructure projects, driving their adoption in the sector.

The residential and commercial construction sectors are key drivers of the Construction Plastics Market. Plastics are used in a variety of building components, including insulation materials, windows, doors, and roofing. The versatility of plastics allows for innovative design solutions and energy-efficient building practices, contributing to their widespread use in modern construction projects.

Raw material prices, particularly those of polymer resins, play a role in shaping the Construction Plastics Market. Fluctuations in the costs of these raw materials impact the production costs and pricing of construction plastics. Companies in the market must implement effective supply chain strategies and cost management practices to navigate these raw material price dynamics.

Leave a Comment