Dairy Alternatives Size

dairy alternative products market Size

The Global Dairy Alternative Products Market is projected to grow from 24.90 USD Billion in 2024 to 77.57 USD Billion by 2035.

Dairy Alternative Products Key Trends and Highlights

| 2024 Market Size | 24.90 (USD Billion) |

| 2035 Market Size | 77.57 (USD Billion) |

| CAGR (2025-2035) | 10.88% |

| Largest Regional Market Share in 2024 | latin_america) |

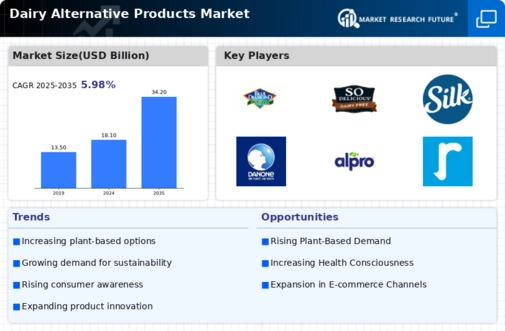

WhiteWave, Blue Diamond Growers, Hälsa, So Delicious, Dean Foods, Silk, Danone, Alpro, Ripple Foods, Elmhurst, Nestle, Nutpods, Oatly, Miyoko's Creamery, Califia Farms

Consumer tastes and changes in lifestyle are driving a number of noteworthy developments in the Dairy Alternative Products Market. Plant-based diets are becoming increasingly popular, and many people are choosing dairy substitutes because of health issues, lactose intolerance, or moral concerns about animal cruelty.Numerous international health organizations, which advocate for the inclusion of plant-based products in diets for improved nutrition and less environmental effect, support this growing awareness of sustainability and health. Additionally, as customers look for more nutrient-dense alternatives, the market is growing due to the growing demand for fortified goods that improve nutritional profiles.

The industry is full of opportunities, especially when new formulations and chemicals that improve the flavor and texture of dairy substitutes appear. Novelties such as using cashews, almonds, and oats as the main ingredients for milk substitutes are becoming more popular.In an effort to increase customer loyalty and engagement, brands are also experimenting with tastes and packaging that appeal to younger audiences. Additionally, the expansion of e-commerce has opened up new avenues for consumer outreach, enabling direct-to-consumer sales and wider distribution networks, which can hasten the launch of new product lines.

The range of dairy substitute products that satisfy a wide range of tastes and preferences has increased recently due to the notable rise in the availability of plant-based cheeses and yogurts. The popularity and use of dairy substitutes are also being aided by the growth of veganism and flexitarian diets in many parts of the world.This market sector is also being driven by the worldwide interest in environmentally friendly goods and sustainable agriculture techniques, which reflects a trend toward healthy eating habits associated with environmental consciousness.

The increasing consumer preference for plant-based diets is reshaping the dairy alternative products market, reflecting a broader trend towards sustainability and health consciousness.

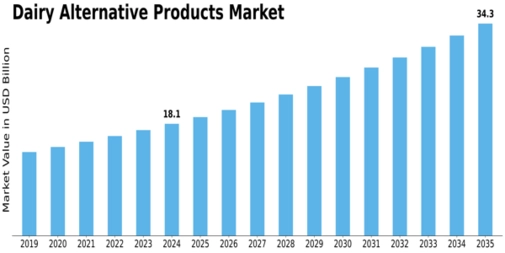

The Global Dairy Alternative Products Market Industry is significantly influenced by changing dietary patterns, particularly the rise of veganism and vegetarianism. As more individuals adopt plant-based diets for ethical, health, or environmental reasons, the demand for dairy alternatives continues to grow. This shift is evident in various regions, where consumers are increasingly substituting traditional dairy products with plant-based options. The market's expansion reflects this trend, with an anticipated increase to 34.2 USD Billion by 2035. This evolving dietary landscape suggests that the Global Dairy Alternative Products Market Industry will continue to thrive as consumer preferences evolve.

Innovation within the Global Dairy Alternative Products Market Industry is a key driver of growth. Companies are continuously developing new and diverse products to cater to varying consumer preferences and dietary needs. For instance, the introduction of fortified plant-based milks, yogurts, and cheeses has expanded the market significantly. These innovations not only enhance the nutritional profile of dairy alternatives but also improve taste and texture, making them more appealing to a broader audience. As a result, the market is poised for substantial growth, with a projected CAGR of 5.98% from 2025 to 2035, indicating a strong trajectory for the industry.

The Global Dairy Alternative Products Market Industry experiences a notable surge in demand driven by increasing health consciousness among consumers. Individuals are becoming more aware of the health implications associated with traditional dairy products, such as lactose intolerance and high cholesterol levels. This shift towards healthier lifestyles has led to a growing preference for plant-based alternatives, which are perceived as more nutritious. In 2024, the market is projected to reach 18.1 USD Billion, reflecting this trend. Consumers are actively seeking products that align with their health goals, thereby propelling the growth of the Global Dairy Alternative Products Market Industry.

Accessibility and availability of dairy alternative products are crucial factors driving the Global Dairy Alternative Products Market Industry. Retailers are expanding their offerings to include a wider range of plant-based options, making these products more accessible to consumers. The proliferation of online shopping platforms further enhances availability, allowing consumers to easily find and purchase dairy alternatives. This trend is likely to contribute to the market's growth, with projections indicating a rise to 18.1 USD Billion in 2024. As more consumers gain access to diverse dairy alternatives, the Global Dairy Alternative Products Market Industry is expected to flourish.

Sustainability plays a pivotal role in shaping the Global Dairy Alternative Products Market Industry. As environmental concerns gain prominence, consumers are increasingly opting for dairy alternatives that have a lower carbon footprint compared to traditional dairy. Plant-based products, such as almond and oat milk, are often viewed as more sustainable options. This trend is supported by various studies indicating that dairy alternatives generally require fewer natural resources for production. The market is expected to grow significantly, with projections indicating a rise to 34.2 USD Billion by 2035, as consumers prioritize eco-friendly choices in their purchasing decisions.

Dairy Alternative Products Market Segment Insights

Dairy Alternative Products Market Product Type Insights

The Dairy Alternative Products Market experienced substantial growth. The segment of Product Type within this industry showcased a varied landscape with notable subsegments, namely Almond Milk, Soy Milk, Oat Milk, Coconut Milk, and Rice Milk all playing essential roles.Almond Milk was prominently leading this segment with a value of 5.4 USD Billion in 2024 and anticipated growth to 10.2 USD Billion by 2035. This dominance can be attributed to its favored taste and perceived health benefits, making it a significant player among consumers seeking non-dairy options.

Following closely, Soy Milk, valued at 4.2 USD Billion in 2024 and expected to surge to 8.1 USD Billion by 2035, was renowned for its protein content and versatility in cooking, further enhancing its appeal to both health-conscious and culinary enthusiasts globally.Oat Milk also presented a compelling segment of the market, boasting a valuation of 3.6 USD Billion in 2024 which is projected to reach 7.2 USD Billion by 2035. Its creamy texture and sustainability factor resonated well with consumers aiming for environmentally friendly choices.

Coconut Milk, valued at 2.8 USD Billion in 2024 with a growth expectation to 5.5 USD Billion by 2035, offered a unique flavor profile appealing to both culinary and nutritional users, making it a favored choice for various recipes such as curries and desserts.Meanwhile, Rice Milk, which held a value of 2.0 USD Billion in 2024 with an anticipated increase to 3.2 USD Billion by 2035, tends to attract consumers with sensitivities to soy and nuts, thus filling a niche in the growing market of dairy alternatives.

The ongoing market trends of increasing health awareness, dietary shifts toward plant-based options, and an overall rise in lactose intolerance among the global population are driving the demand for these dairy alternative products.The Dairy Alternative Products Market is witnessing diverse consumer preferences, making it crucial for producers to adapt and innovate in line with health trends and sustainability practices to capitalize on the growth opportunities present within this sector.

Dairy Alternative Products Market Source Insights

The Dairy Alternative Products Market is experiencing notable growth, driven by increasing consumer demand for plant-based options. The Source segment plays a crucial role in this landscape, encompassing various components such as Nuts, Legumes, Grains, Seeds, and Vegetables, each contributing significantly to market dynamics.

Nuts, for instance, are prevalent in the production of dairy alternatives, providing richness and creaminess that appeal to consumers. Legumes and Grains also hold a major share, being versatile ingredients that cater to diverse dietary preferences.

Seeds contribute to the nutritional profile of dairy substitutes, offering essential fatty acids, while Vegetables add unique flavors and benefits. Both health trends and sustainability concerns are driving this market growth, as consumers increasingly seek dairy alternatives that align with their lifestyle choices.

The Dairy Alternative Products Market data highlights the continued expansion and innovation within these sources, reinforcing their importance in meeting the evolving consumer needs.

Dairy Alternative Products Market Packaging Type Insights

The Dairy Alternative Products Market is evolving in terms of its Packaging Type, showcasing a dynamic shift in consumer preferences and innovative practices. The Packaging Type plays a critical role in this segment, influencing not only the shelf life and freshness of products but also consumer purchasing decisions.

Cartons are known for their sustainability, retaining the freshness of milk-like beverages, while Bottles offer convenience for on-the-go consumption. Pouches have surged in popularity due to their lightweight and space-efficient design, appealing to eco-conscious consumers.

Meanwhile, Cans are recognized for their recyclability and longevity, particularly in markets that emphasize sustainability. As the Dairy Alternative Products Market expands, driven by the rising demand for lactose-free and vegan options, the Packaging Type will continue to be a significant factor in addressing both environmental concerns and consumer preferences.

This segment emphasizes the versatility and adaptability of packaging solutions, presenting growth opportunities for manufacturers in a competitive market landscape.

Dairy Alternative Products Market Distribution Channel Insights

The Dairy Alternative Products Market is poised for significant growth through its diverse Distribution Channels, which play a crucial role in reaching consumers effectively. Supermarkets remain a dominant channel due to their wide reach and variety, attracting health-conscious shoppers seeking convenience in one-stop shopping.

Online Stores have gained traction, particularly with the increased preference for home delivery and the convenience of e-commerce, reflecting a shift in consumer buying behavior. Health Food Stores cater to niche markets by offering specialized products that often emphasize organic and natural alternatives, appealing to health-focused consumers.

Convenience Stores provide essential access points for busy consumers looking for quick and easy options, bolstering the overall market reach. Increased awareness of health benefits and dietary restrictions, alongside a growing trend towards plant-based lifestyles, are driving the demand across these channels.

The Dairy Alternative Products Market segmentation indicates a favorable landscape for retail growth, with each Distribution Channel contributing uniquely to consumer accessibility and market expansion.

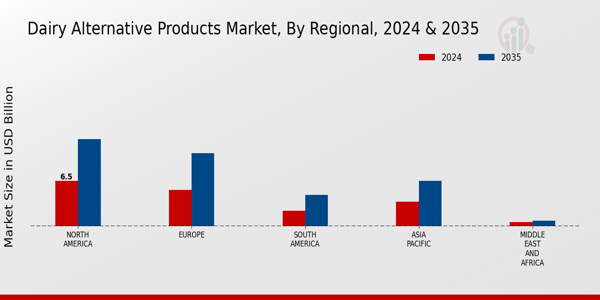

The Dairy Alternative Products Market experienced significant growth across various regions. North America held a majority share, with a valuation of 6.5 USD Billion in the same year, expected to increase to 12.5 USD Billion by 2035, driven by rising demand for plant-based diets and lactose-free options.

In Europe, the market was valued at 5.2 USD Billion in 2024 and is anticipated to expand to 10.5 USD Billion by 2035, reflecting consumers' increasing awareness about health and sustainability.

The South American market, valued at 2.2 USD Billion in 2024, is also poised for growth, supported by a rising inclination towards alternative proteins, while Asia Pacific, with a valuation of 3.5 USD Billion in 2024, showed potential for significant expansion, driven by population growth and changing dietary preferences.

The Middle East and Africa, although the smallest segment with a value of 0.6 USD Billion in 2024, represented an emerging market with untapped potential for dairy alternatives. Overall, the regional dynamics in the Dairy Alternative Products Market were characterized by varied growth patterns influenced by cultural and economic factors, making each region vital for market expansion.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

The Dairy Alternative Products Market has become increasingly competitive, driven by rising consumer preference for plant-based options, concerns regarding lactose intolerance, and a growing awareness of health benefits associated with non-dairy alternatives.

This market includes a variety of products such as almond milk, soy milk, oat milk, rice milk, and other innovative formulations that cater to diverse dietary needs and lifestyles. The competitive landscape is characterized by a blend of established companies and emerging startups, all vying for market share.

Key strategies employed by industry players include product innovation, aggressive marketing campaigns, diversification of product portfolios, and forging strategic partnerships to enhance distribution networks. As consumer trends continue to shift toward sustainable and health-oriented choices, companies must adapt swiftly to maintain relevance in this dynamic market.

WhiteWave has established a formidable presence in the Dairy Alternative Products Market, primarily known for its strong commitment to sustainability and high-quality ingredients. The company focuses on organic and natural products that resonate well with health-conscious consumers.

Its robust product line includes almond milks, soy milks, and other plant-based beverages, showcasing a dedication to variety and quality, which are significant strengths in gaining consumer trust and loyalty. WhiteWave has also developed a reputation for innovation, often leading the market with new product launches that meet evolving dietary preferences.

Its strategic marketing emphasizes not just the functional benefits of dairy alternatives but also aligns with lifestyle choices promoting environmental stewardship, making it a formidable player in the global landscape.

Blue Diamond Growers has carved out a significant niche within the Dairy Alternative Products Market, primarily recognized for its high-quality almond-based products such as almond milk and almond flour. The company benefits from its cooperative structure, which allows it to leverage the collective resources of almond growers to maintain competitive pricing and product availability on a global scale.

Blue Diamond Growers emphasizes its quality assurance processes and sustainability initiatives, enhancing its brand reputation and trust among consumers. Moreover, with successful mergers and acquisitions in the recent past, the company has expanded its product portfolio significantly, allowing it to cater to a diverse consumer base.Its strategic focus on almond-based innovations and expanding distribution channels has solidified Blue Diamond Growers as a crucial player in the marketplace, addressing the rising demand for dairy alternatives.

In order to improve cow digestion using Ajinomoto's AjiPro® L enzyme additive and reduce greenhouse gas emissions in dairy and dairy alternative production, Danone and Ajinomoto announced a partnership in April 2025. The goal is to improve farm-level margins and reduce nitrous oxide emissions by up to 25%.

The industry is getting closer to commercially viable cultured dairy substitutes after Israeli precision fermentation firm Imagindairy was granted regulatory approval in Israel in April 2025 for its animal-free dairy proteins that resemble conventional milk caseins.In order to increase sustainability and customer choice, Oatly and Nestlé intensified their efforts in post-toddler plant-based nutrition in June 2024 by expanding Oatly's "NOT M'LK" oat drink, which is made entirely from locally produced German oats.

A breakthrough in precision-fermentation-derived casein for stretchable plant-based cheese was made in October 2024 by the Israeli biotech company DairyX. This cheese is anticipated to be on the market by 2027 and will save CO₂ emissions by 90% when compared to traditional dairy.

While Q1 sales statistics showed that Danone's Activia kefir and Fage Total yogurt witnessed 4 and 16 percent year-over-year growth, respectively, dairy researchers at SIAL Paris unveiled developments in high-protein lactose-free yogurts targeted at GLP-1 users in June 2024.Traditional dairy brands made a comeback in November 2024, as plant-based milk sales fell 8.4% while dairy milk sales in the US increased 3.5%, indicating a revived customer desire.

The Global Dairy Alternative Products Market is projected to grow at a 5.98% CAGR from 2025 to 2035, driven by rising health consciousness, veganism, and lactose intolerance awareness.

New opportunities lie in:

By 2035, the market is expected to achieve substantial growth, reflecting evolving consumer preferences and increased product diversity.

| Report Attribute/Metric | Details |

| Market Size 2024 | 18.05(USD Billion) |

| Market Size 2035 | 77.57 (USD Billion) |

| Compound Annual Growth Rate (CAGR) | 10.88% (2025 - 2035) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | WhiteWave, Blue Diamond Growers, Hälsa, So Delicious, Dean Foods, Silk, Danone, Alpro, Ripple Foods, Elmhurst, Nestle, Nutpods, Oatly, Miyoko's Creamery, Califia Farms |

| Segments Covered | Product Type, Source, Packaging Type, Distribution Channel, Regional |

| Key Market Opportunities | Growing vegan and lactose-free demand, Expansion in emerging markets, Innovative flavors and formulations, Sustainable packaging solutions, Increasing retail and online availability |

| Key Market Dynamics | health consciousness, lactose intolerance awareness, vegan lifestyle growth, product innovation, environmental sustainability concerns |

| Countries Covered | North America, Europe, APAC, South America, MEA |

| Market Size 2025 | 27.61 (USD Billion) |

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

What was the Market Was at a the Dairy Alternative Products Market in 2024?

The Dairy Alternative Products24.90 Billion USD by 2024

North America Outlook (USD Billion, 2019-2035)

North America Dairy Alternatives Products Market by Product Type

North America Dairy Alternatives Products Market by Source Type

North America Dairy Alternatives Products Market by Packaging Type

North America Dairy Alternatives Products Market by Distribution Channel Type

North America Dairy Alternatives Products Market by Regional Type

US Dairy Alternatives Products Market by Product Type

US Dairy Alternatives Products Market by Source Type

US Dairy Alternatives Products Market by Packaging Type

US Dairy Alternatives Products Market by Distribution Channel Type

CANADA Dairy Alternatives Products Market by Product Type

CANADA Dairy Alternatives Products Market by Source Type

CANADA Dairy Alternatives Products Market by Packaging Type

CANADA Dairy Alternatives Products Market by Distribution Channel Type

Europe Outlook (USD Billion, 2019-2035)

Europe Dairy Alternatives Products Market by Product Type

Europe Dairy Alternatives Products Market by Source Type

Europe Dairy Alternatives Products Market by Packaging Type

Europe Dairy Alternatives Products Market by Distribution Channel Type

Europe Dairy Alternatives Products Market by Regional Type

GERMANY Dairy Alternatives Products Market by Product Type

GERMANY Dairy Alternatives Products Market by Source Type

GERMANY Dairy Alternatives Products Market by Packaging Type

GERMANY Dairy Alternatives Products Market by Distribution Channel Type

UK Dairy Alternatives Products Market by Product Type

UK Dairy Alternatives Products Market by Source Type

UK Dairy Alternatives Products Market by Packaging Type

UK Dairy Alternatives Products Market by Distribution Channel Type

FRANCE Dairy Alternatives Products Market by Product Type

FRANCE Dairy Alternatives Products Market by Source Type

FRANCE Dairy Alternatives Products Market by Packaging Type

FRANCE Dairy Alternatives Products Market by Distribution Channel Type

RUSSIA Dairy Alternatives Products Market by Product Type

RUSSIA Dairy Alternatives Products Market by Source Type

RUSSIA Dairy Alternatives Products Market by Packaging Type

RUSSIA Dairy Alternatives Products Market by Distribution Channel Type

ITALY Dairy Alternatives Products Market by Product Type

ITALY Dairy Alternatives Products Market by Source Type

ITALY Dairy Alternatives Products Market by Packaging Type

ITALY Dairy Alternatives Products Market by Distribution Channel Type

SPAIN Dairy Alternatives Products Market by Product Type

SPAIN Dairy Alternatives Products Market by Source Type

SPAIN Dairy Alternatives Products Market by Packaging Type

SPAIN Dairy Alternatives Products Market by Distribution Channel Type

REST OF EUROPE Dairy Alternatives Products Market by Product Type

REST OF EUROPE Dairy Alternatives Products Market by Source Type

REST OF EUROPE Dairy Alternatives Products Market by Packaging Type

REST OF EUROPE Dairy Alternatives Products Market by Distribution Channel Type

APAC Outlook (USD Billion, 2019-2035)

APAC Dairy Alternatives Products Market by Product Type

APAC Dairy Alternatives Products Market by Source Type

APAC Dairy Alternatives Products Market by Packaging Type

APAC Dairy Alternatives Products Market by Distribution Channel Type

APAC Dairy Alternatives Products Market by Regional Type

CHINA Dairy Alternatives Products Market by Product Type

CHINA Dairy Alternatives Products Market by Source Type

CHINA Dairy Alternatives Products Market by Packaging Type

CHINA Dairy Alternatives Products Market by Distribution Channel Type

INDIA Dairy Alternatives Products Market by Product Type

INDIA Dairy Alternatives Products Market by Source Type

INDIA Dairy Alternatives Products Market by Packaging Type

INDIA Dairy Alternatives Products Market by Distribution Channel Type

JAPAN Dairy Alternatives Products Market by Product Type

JAPAN Dairy Alternatives Products Market by Source Type

JAPAN Dairy Alternatives Products Market by Packaging Type

JAPAN Dairy Alternatives Products Market by Distribution Channel Type

SOUTH KOREA Dairy Alternatives Products Market by Product Type

SOUTH KOREA Dairy Alternatives Products Market by Source Type

SOUTH KOREA Dairy Alternatives Products Market by Packaging Type

SOUTH KOREA Dairy Alternatives Products Market by Distribution Channel Type

MALAYSIA Dairy Alternatives Products Market by Product Type

MALAYSIA Dairy Alternatives Products Market by Source Type

MALAYSIA Dairy Alternatives Products Market by Packaging Type

MALAYSIA Dairy Alternatives Products Market by Distribution Channel Type

THAILAND Dairy Alternatives Products Market by Product Type

THAILAND Dairy Alternatives Products Market by Source Type

THAILAND Dairy Alternatives Products Market by Packaging Type

THAILAND Dairy Alternatives Products Market by Distribution Channel Type

INDONESIA Dairy Alternatives Products Market by Product Type

INDONESIA Dairy Alternatives Products Market by Source Type

INDONESIA Dairy Alternatives Products Market by Packaging Type

INDONESIA Dairy Alternatives Products Market by Distribution Channel Type

REST OF APAC Dairy Alternatives Products Market by Product Type

REST OF APAC Dairy Alternatives Products Market by Source Type

REST OF APAC Dairy Alternatives Products Market by Packaging Type

REST OF APAC Dairy Alternatives Products Market by Distribution Channel Type

South America Outlook (USD Billion, 2019-2035)

South America Dairy Alternatives Products Market by Product Type

South America Dairy Alternatives Products Market by Source Type

South America Dairy Alternatives Products Market by Packaging Type

South America Dairy Alternatives Products Market by Distribution Channel Type

South America Dairy Alternatives Products Market by Regional Type

BRAZIL Dairy Alternatives Products Market by Product Type

BRAZIL Dairy Alternatives Products Market by Source Type

BRAZIL Dairy Alternatives Products Market by Packaging Type

BRAZIL Dairy Alternatives Products Market by Distribution Channel Type

MEXICO Dairy Alternatives Products Market by Product Type

MEXICO Dairy Alternatives Products Market by Source Type

MEXICO Dairy Alternatives Products Market by Packaging Type

MEXICO Dairy Alternatives Products Market by Distribution Channel Type

ARGENTINA Dairy Alternatives Products Market by Product Type

ARGENTINA Dairy Alternatives Products Market by Source Type

ARGENTINA Dairy Alternatives Products Market by Packaging Type

ARGENTINA Dairy Alternatives Products Market by Distribution Channel Type

REST OF SOUTH AMERICA Dairy Alternatives Products Market by Product Type

REST OF SOUTH AMERICA Dairy Alternatives Products Market by Source Type

REST OF SOUTH AMERICA Dairy Alternatives Products Market by Packaging Type

REST OF SOUTH AMERICA Dairy Alternatives Products Market by Distribution Channel Type

MEA Outlook (USD Billion, 2019-2035)

MEA Dairy Alternatives Products Market by Product Type

MEA Dairy Alternatives Products Market by Source Type

MEA Dairy Alternatives Products Market by Packaging Type

MEA Dairy Alternatives Products Market by Distribution Channel Type

MEA Dairy Alternatives Products Market by Regional Type

GCC COUNTRIES Dairy Alternatives Products Market by Product Type

GCC COUNTRIES Dairy Alternatives Products Market by Source Type

GCC COUNTRIES Dairy Alternatives Products Market by Packaging Type

GCC COUNTRIES Dairy Alternatives Products Market by Distribution Channel Type

SOUTH AFRICA Dairy Alternatives Products Market by Product Type

SOUTH AFRICA Dairy Alternatives Products Market by Source Type

SOUTH AFRICA Dairy Alternatives Products Market by Packaging Type

SOUTH AFRICA Dairy Alternatives Products Market by Distribution Channel Type

REST OF MEA Dairy Alternatives Products Market by Product Type

REST OF MEA Dairy Alternatives Products Market by Source Type

REST OF MEA Dairy Alternatives Products Market by Packaging Type

REST OF MEA Dairy Alternatives Products Market by Distribution Channel Type

Kindly complete the form below to receive a free sample of this Report

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment