Data Acquisition DAQ System Market Share

Data Acquisition System Market Research Report: Information By Type (Hardware, and Software), By Speed (High-speed (>100 KS/S), and Low-speed (<100 KS/S)), By Application (R&D, Field, and Manufacturing), By Vertical (Automotive & Transportation, Aerospace & Defense, Wireless Communications & Infrastructure, Power & Energy, Environmental Monitoring, Healthcare, Food &am...

Market Summary

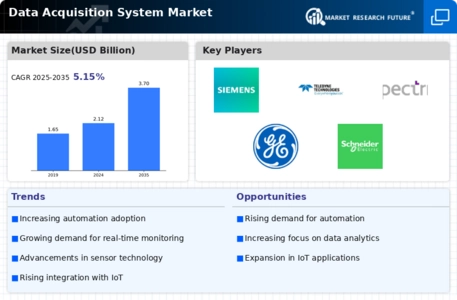

The Global Data Acquisition System Market is projected to grow from 2.12 USD Billion in 2024 to 3.7 USD Billion by 2035, indicating a robust expansion trajectory.

Key Market Trends & Highlights

Data Acquisition System Key Trends and Highlights

- The market is expected to experience a compound annual growth rate (CAGR) of 5.19 percent from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 3.7 USD Billion, reflecting increasing demand for data acquisition solutions.

- In 2024, the market is valued at 2.12 USD Billion, showcasing a solid foundation for future growth.

- Growing adoption of advanced data acquisition technologies due to the increasing need for real-time data analysis is a major market driver.

Market Size & Forecast

| 2024 Market Size | 2.12 (USD Billion) |

| 2035 Market Size | 3.7 (USD Billion) |

| CAGR (2025-2035) | 5.19% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

National Instruments Corp (US), Siemens Digital Industries Software (US), Teledyne Technologies Incorporated (US), Yokogawa Electric Corporation (Japan), Spectris PLC (UK), Emerson Electric Co (US), General Electric (US), Honeywell International Inc (US), Rockwell Automation Corporation (US), Schneider Electric (France), AMETEK, Inc (US), Graphtec Corporation (Japan), Hioki E.E. Corporation (Japan), Curtiss-Wright Corporation (US), Dataforth Corporation (US)

Market Trends

Growing data monitoring is driving the market growth

Market CAGR for data acquisition system is being driven by the rising data monitoring. The data acquisition (DAQ) systems market is expanding due to increased data monitoring requirements globally and increased demand for technology for strategic decision-making in enterprises. Data monitoring improves operational quality and assists in the early detection of faults in the aerospace and defense, government, energy, and automotive industries. Furthermore, data monitoring helps to improve equipment operating efficiency while requiring little human interaction. Integration of control systems with DAQ solutions, which provides real-time control and post-recording data presentation and analysis, also drives industrial growth.

Aside from that, the food and beverage (F&B) industry's widespread use of supervisory control and data acquisition (SCADA) systems for improving food quality management is affecting the need for DAQ systems. Using these technologies in home automation systems with the Internet of Things (IoT) can also be linked to increasing product demand.

5G technology is progressively being adopted by aerospace, wireless communication, automotive, and manufacturing industries. In the automobile industry, for example, existing 4G technology needs to be faster to enable the development and acceptance of self-driving cars.The image recognition, speech detection, and other digital devices utilized in autonomous vehicle development require 5G technology to increase high-speed communication. Similarly, 5G technology is utilized in the aircraft industry to improve avionics equipment dependability by lowering latency and improving communication speed. Furthermore, some nations have already begun investing in 5G technology to improve digital infrastructure and remain competitive in the digital economy.

South Korea, the United States, China, and Germany are among the main countries adopting and deploying 5G wireless infrastructure. These nations will likely present prospects for DAQ systems in various end-user industries, such as wireless communication and infrastructure. Thus, driving the Data Acquisition System market revenue.

The Global Data Acquisition System Market is poised for robust growth, driven by increasing demand for real-time data monitoring and analysis across various sectors, including manufacturing, healthcare, and environmental monitoring.

U.S. Department of Commerce

Data Acquisition DAQ System Market Market Drivers

Market Growth Charts

Market Growth Projections

The Global Data Acquisition System Market Industry is poised for substantial growth, with projections indicating a market value of 2.12 USD Billion in 2024 and an anticipated increase to 3.7 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.19% from 2025 to 2035. Factors contributing to this expansion include technological advancements, increasing automation, and the rising need for regulatory compliance. As industries continue to evolve and embrace data-driven strategies, the demand for data acquisition systems is expected to rise, reflecting the market's robust potential.

Technological Advancements

The Global Data Acquisition System Market Industry is experiencing rapid technological advancements, particularly in sensor technology and data processing capabilities. Innovations such as wireless data acquisition systems and IoT integration are enhancing the efficiency and accuracy of data collection. For instance, the adoption of advanced sensors allows for real-time monitoring and analysis across various sectors, including healthcare and environmental monitoring. This trend is expected to contribute to the market's growth, with projections indicating a market value of 2.12 USD Billion in 2024, reflecting the increasing demand for sophisticated data acquisition solutions.

Growing Demand for Automation

In the Global Data Acquisition System Market Industry, the growing demand for automation across industries is a significant driver. Automation enhances operational efficiency and reduces human error, leading to improved data accuracy. Industries such as manufacturing and energy are increasingly relying on automated data acquisition systems to monitor processes and optimize performance. This trend is likely to propel the market forward, with an anticipated compound annual growth rate of 5.19% from 2025 to 2035. As companies seek to streamline operations, the demand for advanced data acquisition solutions is expected to rise, further solidifying the market's trajectory.

Rising Need for Data Analytics

The increasing emphasis on data analytics within the Global Data Acquisition System Market Industry is driving market expansion. Organizations are recognizing the value of data-driven decision-making, leading to a surge in demand for systems that can efficiently collect and analyze data. The integration of advanced analytics tools with data acquisition systems enables businesses to derive actionable insights from their data. This trend is expected to support the market's growth, with projections indicating a market value of 3.7 USD Billion by 2035. As companies invest in data analytics capabilities, the need for robust data acquisition systems will likely intensify.

Regulatory Compliance and Standards

The Global Data Acquisition System Market Industry is influenced by stringent regulatory compliance and standards across various sectors. Governments and regulatory bodies are enforcing guidelines that necessitate accurate data collection and reporting, particularly in industries such as pharmaceuticals and environmental monitoring. Compliance with these regulations often requires the implementation of sophisticated data acquisition systems that can ensure data integrity and traceability. As organizations strive to meet these requirements, the demand for reliable data acquisition solutions is likely to increase, contributing to the market's growth and stability.

Market Segment Insights

Data Acquisition System Type Insights

The global Data Acquisition System market segmentation, based on type, includes hardware and software. The hardware segment dominated the market, accounting for 66% of market revenue. Information-gathering method hardware is often utilized because of its modular architecture and ability to create diverse combinations to fulfill a broad range of unique experimental settings. Furthermore, Ethernet adoption is growing because of its interoperability and ease of integration, pushing increased demand for DAQ equipment. DAQ hardware is in high demand because of its broad use in industrial applications such as process and discrete, laboratory/R&D, automotive, and aerospace & military.

Data Acquisition System Speed Insights

Based on speed, the global Data Acquisition System market segmentation includes high-speed (>100 KS/S) and low-speed (<100 KS/S). The high-speed (>100 KS/S) segment dominated the market. DAQ software is used to intelligently analyze, standardize, and report massive amounts of data and to test vehicles and components under real-world performance situations. These procedures require high speeds of more than 100 KS/S.

Data Acquisition System Application Insights

Based on application, the global Data Acquisition System market segmentation includes R&D, field, and manufacturing. The R&D segment dominated the market. Committed tests and measurement equipment are necessary for R&D to ensure that the project performs according to calculations and aids in issue resolution. DAQ systems are used in R&D to determine the component parameters and characteristics of prototypes and preproduction models.

Figure 2: Global Data Acquisition System Market, by Application, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Data Acquisition System Vertical Insights

Based on Vertical, the global Data Acquisition System market segmentation includes automotive & transportation, aerospace & defense, wireless communications & infrastructure, power & energy, environmental monitoring, healthcare, food & beverage, and others. The aerospace & defense category generated the most income. The necessity for testing aircraft and their components with real-time monitoring features against numerous metrics and harsh climatic difficulties is driving the growth of the DAQ system market for the aerospace and defense sector. DAQ systems are critical throughout testing methods to ensure that aerospace products and components satisfy functional criteria.

Get more detailed insights about Data Acquisition System Market Research Report - Global Forecast till 2032

Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North American Data Acquisition System market area will dominate this market, The growing demand for DAQ systems in verticals such as automotive and transportation, as well as the growing use of smart solutions in the power, automotive, oil & gas, industrial, and pharmaceutical industries, will drive the market in North America.

Further, the major countries studied in the market report are The US, Canada, German, Japan, India, France, the UK, Italy, Spain, China, Australia, South Korea, and Brazil.

Figure3 : GLOBAL DATA ACQUISITION SYSTEM MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe has the second-largest market share for Data Acquisition Systems. Positive legislative changes, widespread industrial automation, and new clever manufacturing ventures would increase the European Union's market share. Furthermore, the German Data Acquisition System market dominated, while the UK Data Acquisition System market was the fastest expanding in the European area.

The Asia-Pacific Data Acquisition System Market is estimated to expand at the quickest CAGR between 2023 and 2032. The utilization of emerging technology, such as artificial intelligence (AI) and the Internet of Things, increased production capacity, stricter laws governing product testing and measurement, and major government backing for manufacturing. Furthermore, China's Data Acquisition System market had the greatest market share, while India's Data Acquisition System market was the fastest expanding in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market companies are making significant R&D investments to diversify their product offerings, which will drive the Data Acquisition System market's expansion. Important market developments include new product releases, contractual agreements, mergers and acquisitions, greater investments, and collaboration with other organizations. Market participants also engage in several strategic actions to increase their worldwide presence. The market for Data Acquisition System industry is becoming more competitive. Therefore, it needs to offer reasonably priced products to grow and thrive.

Manufacturing locally to reduce operating costs is one of the primary business strategies manufacturers employ in the worldwide Data Acquisition System industry to assist customers and expand the market sector. The market for Data Acquisition System industry has recently provided some of the most important benefits. Major players in the Data Acquisition System market, including Major players in the Data Acquisition System market, including ABB,Explorium' and others, are attempting to increase market demand by investing in research and development operations.

ABB is a technology leader in electrification and automation, paving the path for a more resource-efficient and sustainable future. The company's solutions combine Engineering know-how and software to optimise how objects are created, transported, powered, and operated. ABB's 105,000 workers are dedicated to creating innovations that drive industrial change, building on more than 130 years of excellence. In December 2021, ABB India collaborated with Indore smart city evelopment to implement digital technology that ensures uninterrupted power supply to households and businesses.

Through digitally enabled SCAD solutions, ABB's Compact Secondary Substations (CSS) employed in the project save downtime by ensuring a consistent and stable power supply.

Explorium's External Data Cloud links you to the greatest data sources in the world, all on one platform. It automatically identifies important, impacting data signals and utilises them to provide strong analytical solutions and revolutionary go-to-market activities. In April 2021, Explorium, has released Signal Studio, a data acquisition product for developed analytics and machine learning that allows data and analyst teams quickly recognise and transform the most relevant external information signals into their data analysis pipeline.

Key Companies in the Data Acquisition DAQ System Market market include

Industry Developments

In January 2023, Axiometrix Solutions’ brand, imc Test & Measurement, introduced its modular data collection system, IMC ARGUSfit. Therefore, there is an imc ARGUSfit base unit and extra amplifier and fieldbus interface modules like FD that can be easily docked together quickly to offer high flexibility in automotive and machine testing and monitoring.

In June 2022, Advantech launched the iDAQ line of data collection modules. The company made this announcement about the iDAQ series, which is a new family of modular data acquisition modules and chassis consisting of the iDAQ-900 chassis and a group of DAQ modules that includes the iDAQ-700 and 800.

June 2022 - Advantech announced the launch of a new series of data acquisition modules - the iDAQ series. It contains a range of modular DAQ modules and chassis known as the iDAQ series, including the iDAQ-900 series chassis as well as iDAQ-700 and 800 series DAQ modules.

December 2021 saw a partnership between Indore Smart City Development (which had partnered with ABB India) to provide an uninterrupted supply of electricity for residential areas and businesses through digital technologies. Connected to supervisory control & data acquisition (SCADA) systems powered by Compact Secondary Substations (CSS), it ensures that electricity is constantly supplied without interruption.

In June 2023, imc Test & Measurement finally presented its latest line-up called imc ARGUSfit as a powerful solution for flexible measurement tasks. It is completed by introducing MAY FD options or any other complementary amplifier or fieldbus interface module to these ones. Hence, this modularity allows for easy assembly without having to deal with specific design requirements that are common in both automotive testing scenarios and machinery applications.

FMK INC, a South Korea-based start-up, launched the TSI-T001 tunnel safety inspection system on April 20th, 2024. In addition to this feature, autonomous data acquisition is also provided in the package.

In June 2023, IMC Test & Measurement announced the launch of its new data acquisition system. It is a modular data acquisition system designed to be simple, easily installed, and integrated.

Future Outlook

Data Acquisition DAQ System Market Future Outlook

The Data Acquisition System Market is projected to grow at a 5.19% CAGR from 2024 to 2035, driven by advancements in IoT, automation, and data analytics.

New opportunities lie in:

- Develop AI-integrated data acquisition solutions for real-time analytics.

- Expand into emerging markets with tailored data acquisition systems.

- Leverage cloud technology to enhance data storage and accessibility.

By 2035, the Data Acquisition System Market is expected to be robust, reflecting substantial growth and innovation.

Market Segmentation

Outlook

- R&D

- Field

- Manufacturing

Data Acquisition System Type Outlook

- Hardware

- Software

Data Acquisition System Speed Outlook

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

Data Acquisition System Regional Outlook

- US

- Canada

Data Acquisition System Vertical Outlook

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

Data Acquisition System Application Outlook

- R&D

- Field

- Manufacturing

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2023 | USD 2.01 Billion |

| Market Size 2024 | USD 2.12 Billion |

| Market Size 2032 | USD 3.18 Billion |

| Compound Annual Growth Rate (CAGR) | 5.15% (2023-2032) |

| Base Year | 2023 |

| Market Forecast Period | 2024-2032 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Vertical, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | National Instruments Corp (US), Siemens Digital Industries Software (US), Teledyne Technologies Incorporated (US), Yokogawa Electric Corporation (Japan), Spectris PLC (UK), Emerson Electric Co (US), General Electric (US), Honeywell International Inc (US), Rockwell Automation Corporation (US) , Schneider Electric (France) , AMETEK, Inc (US) , Graphtec Corporation (Japan), Hioki E.E. Corporation (Japan), Curtiss-Wright Corporation (US) , Dataforth Corporation (US) |

| Key Market Opportunities | Growing demand for high-speed connectivity technologies like 5G |

| Key Market Dynamics | Growing emphasis on data monitoring in end user sectors |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Data Acquisition System market?

The global Data Acquisition System market size was valued at USD 2.01 Billion in 2023.

What is the growth rate of the Data Acquisition System market?

The global market is projected to grow at a CAGR of 5.15% during the forecast period, 2024-2032.

Which region held the largest market share in the Data Acquisition System market?

North America had the largest share in the global market

Who are the key players in the Data Acquisition System market?

The key players in the market are National Instruments Corp (US), Siemens Digital Industries Software (US), Teledyne Technologies Incorporated (US), Yokogawa Electric Corporation (Japan).

Which type led the Data Acquisition System market?

The hardware dominated the market in 2022.

Which Vertical had the largest market share in the Data Acquisition System market?

The aerospace and defence had the largest share in the global market.

-

Table of Contents

-

Executive Summary

-

Market Attractiveness Analysis

- Global Data Acquisition (DAQ) System Market, by Type

- Global Data Acquisition (DAQ) System Market, by Speed

- Global Data Acquisition (DAQ) System Market, by Application

- Global Data Acquisition (DAQ) System Market, by Vertical

- Global Data Acquisition (DAQ) System Market, by Region

-

Market Attractiveness Analysis

-

Market Introduction

- Definition

- Scope of the Study

- Market Structure

-

Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Market Size Estimation

- List of Assumptions

-

MARKET DYNAMICS

- Introduction

-

Drivers

- Rising emphasis on data monitoring in end user sectors

- Increasing implementation of Industry 4.0 across aerospace and automotive sectors

- Growing advancements and flexibility of DAQ systems

- Drivers Impact

-

Restraint

- Cost and complexity of DAQ systems

- Restraints Impact

-

Opportunity

- Growing demand for high-speed connectivity technologies like 5G

-

Challenge

- Highly competitive market

-

Impact of COVID-19

- Impact on the overall market

- Impact on the industry verticals

- Impact on the market players

-

MARKET FACTOR ANALYSIS

- Value Chain Analysis/Supply Chain Analysis

-

Porter’s Five Forces Model

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE

- Introduction

- Hardware

- Software

-

GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED

- Introduction

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

-

GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION

- Introduction

- R&D

- Field

- Manufacturing

-

GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL

- Introduction

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

-

GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY REGION

- Overview

-

North America

- Market Size & Estimates, by Country, 2018–2028

- Market Size & Estimates, By Type, 2018–2028

- Market Size & Estimates, by Speed, 2018–2028

- Market Size & Estimates, by Application, 2018–2028

- Market Size & Estimates, by Vertical, 2018–2028

- US

- Canada

- Mexico

-

Europe

- Market Size & Estimates, by Country, 2018–2028

- Market Size & Estimates, By Type, 2018–2028

- Market Size & Estimates, by Speed, 2018–2028

- Market Size & Estimates, by Application, 2018–2028

- Market Size & Estimates, by Vertical, 2018–2028

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- Market Size & Estimates, by Country, 2018–2028

- Market Size & Estimates, By Type, 2018–2028

- Market Size & Estimates, by Speed, 2018–2028

- Market Size & Estimates, by Application, 2018–2028

- Market Size & Estimates, by Vertical, 2018–2028

- China

- Japan

- India

- Rest of Asia-Pacific

-

Middle East & Africa

- Market Size & Estimates, By Type, 2018–2028

- Market Size & Estimates, by Speed, 2018–2028

- Market Size & Estimates, by Application, 2018–2028

- Market Size & Estimates, by Vertical, 2018–2028

-

South America

- Market Size & Estimates, By Type, 2018–2028

- Market Size & Estimates, by Speed, 2018–2028

- Market Size & Estimates, by Application, 2018–2028

- Market Size & Estimates, by Vertical, 2018–2028

-

Competitive Landscape

- Introduction

- Key Players Market Share Analysis, 2020 (%)

- Competitive Benchmarking

- Competitor Dashboard

- Major Growth Strategy in the market

-

Key Developments & Growth Strategies

- New Product Development

- Mergers & Acquisitions

- Contracts & Agreements

-

COMPANY PROFILES

-

National Instruments Corp

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Siemens Digital Industries Software

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Teledyne Technologies Incorporated

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

-

Yokogawa Electric Corporation

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Spectris PLC

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Emerson Electric Co

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

General Electric

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Honeywell International Inc.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Rockwell Automation Corporation

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Schneider Electric

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

AMETEK, Inc

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Graphtec Corporation

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Hioki E.E. Corporation

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Curtiss-Wright Corporation

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Dataforth Corporation

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

National Instruments Corp

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 LIST OF ASSUMPTIONS

- TABLE 2 GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 3 GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 4 GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION

- TABLE 5 GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 6 GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY REGION, 2018–2028 (USD MILLION)

- TABLE 7 NORTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY COUNTRY, 2018–2028 (USD MILLION)

- TABLE 8 NORTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 9 NORTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 10 NORTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 11 NORTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 12 US: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 13 US: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 14 US: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 15 US: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 16 CANADA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 17 CANADA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 18 CANADA DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 19 CANADA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 20 MEXICO: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 21 MEXICO: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 22 MEXICO: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION

- TABLE 23 MEXICO: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 24 EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY COUNTRY, 2018–2028 (USD MILLION)

- TABLE 25 EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 26 EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 27 EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 28 EUROPE DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 29 UK: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 30 UK: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 31 UK: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 32 UK: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 33 GERMANY: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 34 GERMANY: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 35 GERMANY: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 36 GERMANY: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 37 FRANCE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 38 FRANCE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 39 FRANCE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 40 FRANCE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 41 REST OF EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 42 REST OF EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 43 REST OF EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 44 REST OF EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY COUNTRY, 2018–2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 50 CHINA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 51 CHINA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 52 CHINA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 53 CHINA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 54 JAPAN: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 55 JAPAN: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 56 JAPAN: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 57 JAPAN: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 58 INDIA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 59 INDIA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 60 INDIA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 61 INDIA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 63 REST OF ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 64 REST OF ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 65 REST OF ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 66 MIDDLE EAST & AFRICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 67 MIDDLE EAST & AFRICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 68 MIDDLE EAST & AFRICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 69 MIDDLE EAST & AFRICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- TABLE 70 SOUTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- TABLE 71 SOUTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- TABLE 72 SOUTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- TABLE 73 SOUTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION) LIST OF FIGURES

- FIGURE 1 MARKET SYNOPSIS

- FIGURE 2 RESEARCH PROCESS OF MRFR

- FIGURE 3 TOP DOWN & Bottom-up Approach

- FIGURE 4 GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 5 GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 6 GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 7 GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 8 GLOBAL DATA ACQUISITION (DAQ) SYSTEM MARKET, BY REGION, 2018–2028 (USD MILLION)

- FIGURE 9 NORTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY COUNTRY, 2018–2028 (USD MILLION)

- FIGURE 10 NORTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 11 NORTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 12 NORTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 13 NORTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 14 US: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 15 US: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 16 US: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 17 US: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 18 CANADA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 19 CANADA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 20 CANADA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 21 CANADA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 22 MEXICO: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 23 MEXICO: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 24 MEXICO: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION

- FIGURE 25 MEXICO: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 26 EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY COUNTRY, 2018–2028 (USD MILLION)

- FIGURE 27 EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 28 EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 29 EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 30 EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 31 UK: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 32 UK: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 33 UK: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 34 UK: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 35 GERMANY: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 36 GERMANY: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 37 GERMANY: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 38 GERMANY: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 39 FRANCE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 40 FRANCE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 41 FRANCE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 42 FRANCE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 43 REST OF EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 44 REST OF EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 45 REST OF EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 46 REST OF EUROPE: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 47 ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY COUNTRY, 2018–2028 (USD MILLION)

- FIGURE 48 ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 49 ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 50 ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 51 ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 52 CHINA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 53 CHINA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 54 CHINA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 55 CHINA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 56 JAPAN: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 57 JAPAN: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 58 JAPAN: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 59 JAPAN: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 60 INDIA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 61 INDIA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 62 INDIA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 63 INDIA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 64 REST OF ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 65 REST OF ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 66 REST OF ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 67 REST OF ASIA PACIFIC: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 68 MIDDLE EAST & AFRICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 69 MIDDLE EAST & AFRICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 70 MIDDLE EAST & AFRICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 71 MIDDLE EAST & AFRICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

- FIGURE 72 SOUTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY TYPE, 2018–2028 (USD MILLION)

- FIGURE 73 SOUTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY SPEED, 2018–2028 (USD MILLION)

- FIGURE 74 SOUTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY APPLICATION, 2018–2028 (USD MILLION)

- FIGURE 75 SOUTH AMERICA: DATA ACQUISITION (DAQ) SYSTEM MARKET, BY VERTICAL, 2018–2028 (USD MILLION)

Data Acquisition System Market Segmentation

Data Acquisition System Type Outlook (USD Billion, 2018-2032)

- Hardware

- Software

Data Acquisition System Speed Outlook (USD Billion, 2018-2032)

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

Data Acquisition System Application Outlook (USD Billion, 2018-2032)

- R&D

- Field

- Manufacturing

Data Acquisition System Vertical Outlook (USD Billion, 2018-2032)

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

Data Acquisition System Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

- North America Data Acquisition System by Type

- Hardware

- Software

North America Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

North America Data Acquisition System by Application

- R&D

- Field

- Manufacturing

North America Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

US Outlook (USD Billion, 2018-2032)

- US Data Acquisition System by Type

- Hardware

- Software

US Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

US Data Acquisition System by Application

- R&D

- Field

- Manufacturing

US Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

CANADA Outlook (USD Billion, 2018-2032)

- CANADA Data Acquisition System by Type

- Hardware

- Software

- CANADA Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

- CANADA Data Acquisition System by Application

- R&D

- Field

- Manufacturing

- CANADA Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

- North America Data Acquisition System by Type

Europe Outlook (USD Billion, 2018-2032)

- Europe Data Acquisition System by Type

- Hardware

- Software

Europe Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

Europe Data Acquisition System by Application

- R&D

- Field

- Manufacturing

Europe Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

Germany Outlook (USD Billion, 2018-2032)

- Germany Data Acquisition System by Type

- Hardware

- Software

Germany Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

Germany Data Acquisition System by Application

- R&D

- Field

- Manufacturing

Germany Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

France Outlook (USD Billion, 2018-2032)

- France Data Acquisition System by Type

- Hardware

- Software

France Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

France Data Acquisition System by Application

- R&D

- Field

- Manufacturing

France Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

UK Outlook (USD Billion, 2018-2032)

- UK Data Acquisition System by Type

- Hardware

- Software

UK Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

UK Data Acquisition System by Application

- R&D

- Field

- Manufacturing

UK Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

ITALY Outlook (USD Billion, 2018-2032)

- ITALY Data Acquisition System by Type

- Hardware

- Software

ITALY Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

ITALY Data Acquisition System by Application

- R&D

- Field

- Manufacturing

ITALY Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

SPAIN Outlook (USD Billion, 2018-2032)

- Spain Data Acquisition System by Type

- Hardware

- Software

Spain Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

Spain Data Acquisition System by Application

- R&D

- Field

- Manufacturing

Spain Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

Rest Of Europe Outlook (USD Billion, 2018-2032)

- Rest Of Europe Data Acquisition System by Type

- Hardware

- Software

Rest Of Europe Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

Rest Of Europe Data Acquisition System by Application

- R&D

- Field

- Manufacturing

Rest Of Europe Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

- Europe Data Acquisition System by Type

Asia-Pacific Outlook (USD Billion, 2018-2032)

- Asia-Pacific Data Acquisition System by Type

- Hardware

- Software

Asia-Pacific Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

Asia-Pacific Data Acquisition System by Application

- R&D

- Field

- Manufacturing

Asia-Pacific Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

China Outlook (USD Billion, 2018-2032)

- China Data Acquisition System by Type

- Hardware

- Software

China Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

China Data Acquisition System by Application

- R&D

- Field

- Manufacturing

China Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

Japan Outlook (USD Billion, 2018-2032)

- Japan Data Acquisition System by Type

- Hardware

- Software

Japan Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

Japan Data Acquisition System by Application

- R&D

- Field

- Manufacturing

Japan Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

India Outlook (USD Billion, 2018-2032)

- India Data Acquisition System by Type

- Hardware

- Software

India Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

India Data Acquisition System by Application

- R&D

- Field

- Manufacturing

India Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

Australia Outlook (USD Billion, 2018-2032)

- Australia Data Acquisition System by Type

- Hardware

- Software

Australia Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

Australia Data Acquisition System by Application

- R&D

- Field

- Manufacturing

Australia Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

- Rest of Asia-Pacific Data Acquisition System by Type

- Hardware

- Software

Rest of Asia-Pacific Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

Rest of Asia-Pacific Data Acquisition System by Application

- R&D

- Field

- Manufacturing

Rest of Asia-Pacific Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

- Asia-Pacific Data Acquisition System by Type

Rest of the World Outlook (USD Billion, 2018-2032)

- Rest of the World Data Acquisition System by Type

- Hardware

- Software

Rest of the World Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low speed (<100 KS/S)

Rest of the World Data Acquisition System by Application

- R&D

- Field

- Manufacturing

Rest of the World Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

Middle East Outlook (USD Billion, 2018-2032)

- Middle East Data Acquisition System by Type

- Hardware

- Software

Middle East Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

Middle East Data Acquisition System by Application

- R&D

- Field

- Manufacturing

Middle East Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

Africa Outlook (USD Billion, 2018-2032)

- Africa Data Acquisition System by Type

- Hardware

- Software

Africa Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

Africa Data Acquisition System by Application

- R&D

- Field

- Manufacturing

Africa Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

Latin America Outlook (USD Billion, 2018-2032)

- Latin America Data Acquisition System by Type

- Hardware

- Software

- Latin America Data Acquisition System by Speed

- High-speed (>100 KS/S)

- Low-speed (<100 KS/S)

- Latin America Data Acquisition System by Application

- R&D

- Field

- Manufacturing

- Latin America Data Acquisition System by Vertical

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Other

- Rest of the World Data Acquisition System by Type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment