-

Definition

-

Scope of the Study

- Research Objective

- Assumptions

- Limitations

-

Introduction

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

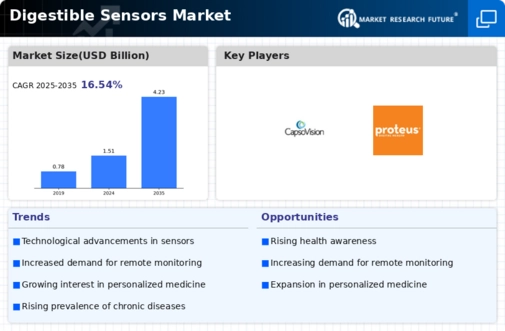

Drivers

-

Restraints

-

Opportunities

-

Challenges

-

Macroeconomic Indicators

-

Technology Trends & Assessment

-

Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

Value Chain Analysis

-

Investment Feasibility Analysis

-

Pricing Analysis

-

Chapter 6. Global Digestible Sensors Market, by Type

-

Introduction

-

Strip Sensors

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Ingestible Sensors

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Invasive Sensors

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Wearable Sensors

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Implantable Sensors

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Chapter 7. Global Digestible Sensors Market, by Application

-

Introduction

-

Diagnostics

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Patient Monitoring

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Therapeutics

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Chapter 8. Global Digestible Sensors Market, by Technology

-

Introduction

-

Image

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Temperature

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Pressure

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Biosensors

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Accelerometer

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Chapter 9. Global Digestible Sensors Market, by End User

-

Introduction

-

Consumer

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Pharmaceutical Companies

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Healthcare Providers

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Sports & Fitness Institutes

-

Market Estimates & Forecast, by region, 2016–2027

-

Market Estimates & Forecast, by Country, 2016–2027

-

Others

-

Chapter 10. Global Digestible Sensors Market, by Region

-

Introduction

-

Americas

- North America

- South America

-

Europe

- Western Europe

- Eastern Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- Republic of Korea

- Rest of Asia Pacific

-

The Middle East & Africa

- The Middle East

- Africa

-

Chapter 11. Company Landscape

-

Introduction

-

Market Share Analysis

-

Key Development & Strategies

-

Chapter 12. Company Profiles

-

Proteus Digital Health

- Company Overview

- Product Overview

- Financials Overview

- Key Developments

- SWOT Analysis

-

Freescale Semiconductor, Inc.

- Company Overview

- Product Overview

- Financial Overview

- Key Developments

- SWOT Analysis

-

Philips Healthcare

- Company Overview

- Product Overview

- Financial Overview

- Key Development

- SWOT Analysis

-

STMicroelectronics

- Company Overview

- Technology/Business Segment Overview

- Financial Overview

- Key Development

- SWOT Analysis

-

Analog Devices, Inc.

- Company Overview

- Product Overview

- Financial overview

- Key Developments

- SWOT Analysis

-

GE Healthcare

- Company Overview

- Product Overview

- Financial Overview

- Key Developments

- SWOT Analysis

-

Honeywell International

- Overview

- Product Overview

- Financial Overview

- Key Developments

- SWOT Analysis

-

Measurements Specialties

- Overview

- Product/ Technology Overview

- Financials

- Key Developments

- SWOT Analysis

-

Medtronic Plc

- Overview

- Product Overview

- Financials

- Key Developments

- SWOT Analysis

-

Sensirion AG

- Overview

- Product Overview

- Financials

- Key Developments

- SWOT Analysis

-

Smiths Medical

- Overview

- Product Overview

- Financials

- Key Developments

- SWOT Analysis

-

Others

-

Chapter 13 MRFR Conclusion

-

Key Findings

- From CEO’s View Point

- Unmet Needs of the Market

-

Key Companies to Watch

-

Prediction of the Arthroscopy Instruments Industry

-

Chapter 14 Appendix

-

LIST OF TABLES

-

Global Digestible Sensors Market Synopsis, 2016–2027

-

Global Digestible Sensors Market Estimates and Forecast, 2016–2027, (USD Million)

-

Global Digestible Sensors Market, by Region, 2016–2027, (USD Million)

-

Global Digestible Sensors Market, by Product, 2016–2027, (USD Million)

-

Global Digestible Sensors Market, by Application, 2016–2027, (USD Million)

-

Global Digestible Sensors Market, by Technology, 2016–2027, (USD Million)

-

Global Digestible Sensors Market, by End-User, 2016–2027, (USD Million)

-

North America Global Digestible Sensors Market, by Product, 2016–2027, (USD Million)

-

North America Global Digestible Sensors Market, by Application, 2016–2027, (USD Million)

-

North America Global Digestible Sensors Market, by Technology, 2016–2027, (USD Million)

-

North America Global Digestible Sensors Market, by End-User, 2016–2027, (USD Million)

-

US Digestible Sensors Market, by Product, 2016–2027, (USD Million)

-

US Digestible Sensors Market, by Application, 2016–2027, (USD Million)

-

US Digestible Sensors Market, by Technology, 2016–2027, (USD Million)

-

US Digestible Sensors Market, by End-User, 2016–2027, (USD Million)

-

Canada Digestible Sensors Market, by Product, 2016–2027, (USD Million)

-

Canada Digestible Sensors Market, by Application, 2016–2027, (USD Million)

-

Canada Digestible Sensors Market, by Technology, 2016–2027, (USD Million)

-

Canada Digestible Sensors Market, by End-User, 2016–2027, (USD Million)

-

South America Digestible Sensors Market, by Product, 2016–2027, (USD Million)

-

South America Digestible Sensors Market, by Application, 2016–2027, (USD Million)

-

South America Digestible Sensors Market, by Technology, 2016–2027, (USD Million)

-

South America Digestible Sensors Market, by End-User, 2016–2027, (USD Million)

-

Europe Digestible Sensors Market, by Product, 2016–2027, (USD Million)

-

Europe Digestible Sensors Market, by Application, 2016–2027, (USD Million)

-

Europe Digestible Sensors Market, by Technology, 2016–2027, (USD Million)

-

Europe Digestible Sensors Market, by End-User, 2016–2027, (USD Million)

-

Western Europe Digestible Sensors Market, by Product, 2016–2027, (USD Million)

-

Western Europe Digestible Sensors Market, by Application, 2016–2027, (USD Million)

-

Western Europe Digestible Sensors Market, by Technology, 2016–2027, (USD Million)

-

Western Europe Digestible Sensors Market, by End-User, 2016–2027, (USD Million)

-

Eastern Europe Digestible Sensors Market, by Product, 2016–2027, (USD Million)

-

Eastern Europe Digestible Sensors Market, by Application, 2016–2027, (USD Million)

-

Eastern Europe Digestible Sensors Market, by Technology, 2016–2027, (USD Million)

-

Eastern Europe Digestible Sensors Market, by End-User, 2016–2027, (USD Million)

-

Asia Pacific Digestible Sensors Market, by Product, 2016–2027, (USD Million)

-

Asia Pacific Digestible Sensors Market, by Application, 2016–2027, (USD Million)

-

Asia Pacific Digestible Sensors Market, by Technology, 2016–2027, (USD Million)

-

Asia Pacific Digestible Sensors Market, by End-User, 2016–2027, (USD Million)

-

Middle East & Africa Digestible Sensors Market, by Product, 2016–2027, (USD Million)

-

Middle East & Africa Digestible Sensors Market, by Application, 2016–2027, (USD Million)

-

Middle East & Africa Digestible Sensors Market, by Technology, 2016–2027, (USD Million)

-

Middle East & Africa Digestible Sensors Market, by End-User, 2016–2027, (USD Million)

-

-

LIST OF FIGURES

-

Research Process

-

Segmentation for Global Digestible Sensors Market

-

Segmentation Market Dynamics for Global Digestible Sensors Market

-

Global Digestible Sensors Market Share, by Product, 2017

-

Global Digestible Sensors Market Share, by Application, 2017

-

Global Digestible Sensors Market Share, by Technology, 2017

-

Global Digestible Sensors Market Share, by End User, 2017

-

Global Digestible Sensors Market Share, by Region, 2017

-

North America Digestible Sensors Market Share, by Country, 2017

-

Europe Digestible Sensors Market Share, by Country, 2017

-

Asia Pacific Digestible Sensors Market Share, by Country, 2017

-

Middle East & Africa Digestible Sensors Market Share, by Country, 2017

-

Global Digestible Sensors Market: Company Share Analysis, 2017 (%)

-

Proteus Digital Health: Key Financials

-

Proteus Digital Health: Segmental Revenue

-

Proteus Digital Health: Geographical Revenue

-

Freescale Semiconductor, Inc.: Key Financials

-

Freescale Semiconductor, Inc.: Segmental Revenue

-

Freescale Semiconductor, Inc.: Geographical Revenue

-

Philips Healthcare:: Key Financials

-

Philips Healthcare: Segmental Revenue

-

Philips Healthcare: Geographical Revenue

-

STMicroelectronics: Key Financials

-

STMicroelectronics: Segmental Revenue

-

STMicroelectronics: Geographical Revenue

-

Analog Devices, Inc.: Key Financials

-

Analog Devices, Inc.: Segmental Revenue

-

Analog Devices, Inc. Geographical Revenue

-

GE Healthcare: Key Financials

-

GE Healthcare: Segmental Revenue

-

GE Healthcare: Geographical Revenue

-

Honeywell International: Key Financials

-

Honeywell International: Segmental Revenue

-

Honeywell International: Geographical Revenue

-

Measurements Specialties: Key Financials

-

Measurements Specialties: Segmental Revenue

-

Measurements Specialties: Geographical Revenue

-

Medtronic Plc: Key Financials

-

Medtronic Plc: Segmental Revenue

-

Medtronic Plc: Geographical Revenue

-

Sensirion AG: Key Financials

-

Sensirion AG: Segmental Revenue

-

Sensirion AG: Geographical Revenue

-

Smiths Medical: Key Financials

-

Smiths Medical: Segmental Revenue

-

Smiths Medical: Geographical Revenue

Leave a Comment