Drones for Oil Gas Market Trends

Drones for Oil and Gas Market Research Report Information By Type (Hybrid and Nano, Fixed-Wing, Multi-Rotor, Single Rotor), By Application (Inspection, Security & emergency response, Surveying & mapping), And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) – Market Forecast Till 2032

Market Summary

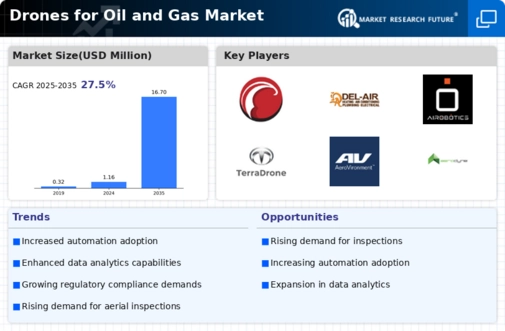

As per Market Research Future Analysis, the Global Drones for Oil and Gas Market was valued at USD 856.65 Million in 2023 and is projected to reach USD 8,048.48 Million by 2032, growing at a CAGR of 27.5% from 2024 to 2032. The market is driven by advancements in drone technology, including AI integration and thermal imaging capabilities, which enhance inspection and maintenance processes in the oil and gas sector. Multi-rotor drones dominate the market due to their affordability and availability, while the Surveying & mapping application leads in revenue generation. North America holds the largest market share, fueled by increased production activities and investments in exploration.

Key Market Trends & Highlights

Key trends driving the Drones for Oil and Gas market include technological advancements and increased adoption.

- Market Size in 2023: USD 856.65 Million

- Projected Market Size by 2032: USD 8,048.48 Million

- CAGR from 2024 to 2032: 27.5%

- North America holds the largest market share due to rising offshore drilling activities.

Market Size & Forecast

| 2023 Market Size | USD 856.65 Million |

| 2024 Market Size | USD 1,155.51 Million |

| 2032 Market Size | USD 8,048.48 Million |

| CAGR (2024-2032) | 27.5% |

| Largest Regional Market Share in 2024 | North America |

Major Players

Key companies include Delair, Airobotics, Airborne Drones, Terra Drone, Intel Corporation, Cyberhawk Innovations Limited, and PrecisionHawk.

Market Trends

Advancements in drone technology to boost the market growth

Drones are now being used by oil and gas operators, which will accelerate market growth. This is due to technology improvements, the incorporation of AI, methane gas detection, and thermal imaging. As a result of advances in artificial intelligence, drones can now be operated without the need for human intervention because sensors with AI integration are now easily capable of moving inside closed structures and will not be susceptible to wall collisions. As a result, this application will likely grow and support the growth of drones for oil and gas market.

The integration of drone technology in the oil and gas sector appears to enhance operational efficiency and safety, while simultaneously reducing costs associated with traditional inspection methods.

U.S. Department of Energy

Drones for Oil Gas Market Market Drivers

Regulatory Support

Regulatory frameworks are increasingly supportive of drone integration within the Global Drones for Oil and Gas Market Industry. Governments worldwide are establishing guidelines that facilitate the safe operation of drones in oil and gas operations. For example, the Federal Aviation Administration in the United States has implemented regulations that streamline the approval process for commercial drone use. This regulatory environment encourages companies to adopt drone technology for tasks such as aerial surveying and monitoring, thereby enhancing operational efficiency and compliance. The anticipated growth in this sector is indicative of a broader acceptance of drone technology in regulated industries.

Enhanced Data Analytics

The integration of advanced data analytics with drone technology is transforming the Global Drones for Oil and Gas Market Industry. Drones equipped with sensors collect vast amounts of data, which can be analyzed to improve decision-making processes. For example, data from drone surveys can be used to create detailed 3D models of oil fields, facilitating better planning and resource allocation. This analytical capability is becoming increasingly vital as companies strive to optimize operations and reduce costs. The synergy between drones and data analytics is likely to propel market growth, reflecting the industry's shift towards data-driven strategies.

Environmental Monitoring

The increasing emphasis on environmental monitoring within the Global Drones for Oil and Gas Market Industry is driving demand for drone technology. Drones are utilized for monitoring emissions, detecting leaks, and assessing environmental impacts, which are crucial for compliance with environmental regulations. For instance, drones can cover vast areas quickly, providing real-time data that helps companies respond to environmental concerns more effectively. This capability not only aids in regulatory compliance but also enhances corporate responsibility, making drones an essential tool in the oil and gas sector's sustainability efforts.

Market Growth Projections

The Global Drones for Oil and Gas Market Industry is poised for substantial growth, with projections indicating an increase from 1.16 USD Billion in 2024 to 16.7 USD Billion by 2035. This remarkable growth trajectory suggests a compound annual growth rate of 27.47% from 2025 to 2035. Such figures highlight the increasing adoption of drone technology across various applications in the oil and gas sector, including exploration, monitoring, and maintenance. The anticipated expansion underscores the industry's recognition of drones as critical tools for enhancing operational efficiency and safety.

Cost Reduction Initiatives

Cost reduction is a primary driver in the Global Drones for Oil and Gas Market Industry, as companies seek to minimize operational expenses. Drones can significantly lower costs associated with inspections, maintenance, and monitoring by reducing the need for manned aircraft and ground crews. For example, using drones for pipeline inspections can decrease costs by up to 80 percent compared to traditional methods. This financial incentive is compelling, especially as the market is expected to grow from 1.16 USD Billion in 2024 to an estimated 16.7 USD Billion by 2035, with a CAGR of 27.47% from 2025 to 2035.

Technological Advancements

The Global Drones for Oil and Gas Market Industry is experiencing rapid technological advancements that enhance operational efficiency and safety. Innovations in drone technology, such as improved battery life, enhanced imaging capabilities, and autonomous flight systems, are driving adoption. For instance, drones equipped with thermal imaging can detect gas leaks and monitor pipeline integrity, reducing the need for manual inspections. As a result, the market is projected to reach 1.16 USD Billion in 2024, reflecting a growing reliance on these technologies to optimize resource management and minimize environmental impact.

Market Segment Insights

Drones for Oil and Gas Type Insights

The market segmentation, based on type, includes Hybrid and nano, Fixed-wing, Multi-rotor, and Single rotor. The Multi-rotor segment holds the majority share in 2021 of the Drones for Oil and Gas revenue. Due to its being readily available in the market and comparatively cheaper.

Drones for Oil and Gas Application Insights

Based on Application, the market segmentation includes Inspection, Security & emergency response, Surveying & mapping. The Surveying & mapping segment dominated the market in 2021. This segment enhances the growth of the market due to the analysis of reservoirs and the developmental growth in the exploration of unconventional and conventional reserves.

Figure 2 Drones for Oil and Gas Market, by Application, 2023 & 2032 (USD Million)

Source Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Get more detailed insights about Drones for Oil and Gas Market Research Report - Global Forecast till 2030

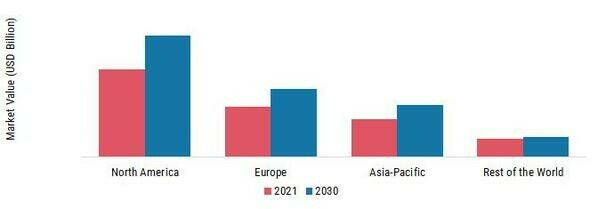

Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American region is holding the dominant position in generating the largest drones for oil and gas market share for the research period due to increasing production activities in oil and gas in this region and rising investments in exploration. Moreover, this region is enhancing the regional growth of drones for the oil and gas market due to the growing usage of drones in the oil and gas industry and the growing offshore drilling activities in the North American region.

Figure 3 Drones For Oil And Gas Market Share By Region 2021 (%)

Source Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Key Players and Competitive Insights

The major market players are investing a lot of money in R&D to expand their product lines, which will spur further market growth. With significant market development like new product releases, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations, market participants are also undertaking various strategic activities to expand their presence. To grow and thrive in a market climate that is becoming more competitive and growing, competitors in the Drones for Oil and Gas industry must offer affordable products.

Manufacturing locally to cut operating costs is one of the main business tactics manufacturers use in the Drones for Oil and Gas industry to benefit customers and expand the market sector. The market has recently given medicine some of the most important advantages. Major market players, including Delair, Airobotics, Airborne Drones, Terra Drone, Intel Corporation, and others, are attempting to increase market demand by funding R&D initiatives.

Delair is a startup that creates visual intelligence solutions to help businesses collect, manage, and evaluate their assets. Its portfolio integrates hardware for unmanned aerial vehicles (UAVs) with the industry's platform for data management and analytics. The mining, construction, agricultural, oil and gas, utilities, and transportation industries are all served by the company.

Also, Airobotics, which was launched in 2014, offers drone automation systems for airborne data collecting. It provides drones for surveying, mapping, inspections, and other purposes. Seaports, industrial facilities, and the mining industry are all served by the firm.

Key Companies in the Drones for Oil Gas Market market include

Industry Developments

- Q2 2025: Terra Drone and MODEC Renew Joint R&D Agreement for FPSO Crude Oil Storage Tanks Inspections Terra Drone Corporation renewed its joint R&D agreement with MODEC to further develop and deploy drone-based non-destructive internal inspection technology for crude oil storage tanks on FPSOs, aiming to enhance safety and operational efficiency in offshore oil and gas operations.

- Q3 2024: Terra Drone and MODEC Sign Joint R&D Contract for Offshore Engineering Drone Technology Terra Drone Corporation and MODEC entered a joint R&D contract to enhance drone technology for the inspection of offshore engineering, specifically focusing on floating production storage offloading (FPSO) systems in the oil and gas sector.

Future Outlook

Drones for Oil Gas Market Future Outlook

The Drones for Oil and Gas Market is projected to grow at a 27.47% CAGR from 2024 to 2035, driven by technological advancements, regulatory support, and increasing operational efficiency demands.

New opportunities lie in:

- Develop AI-driven analytics for real-time data processing and decision-making.

- Expand drone services for pipeline inspections and leak detection.

- Invest in hybrid drone technologies to enhance operational range and efficiency.

By 2035, the market is poised for robust growth, reflecting a dynamic evolution in operational capabilities.

Market Segmentation

Drones for Oil and Gas Type Outlook

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

Drones for Oil and Gas Regional Outlook

- US

- Canada

Drones for Oil and Gas Application Outlook

- Inspection

- Security & emergency response

- Surveying & mapping

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2023 | USD 856.65 Million |

| Market Size 2024 | USD 1,155.51 Million |

| Market Size 2030 | USD 8,048.48 Million |

| Compound Annual Growth Rate (CAGR) | 27.5% (2024-2032) |

| Base Year | 2021 |

| Market Forecast Period | 2024-2032 |

| Historical Data | 2018 & 2020 |

| Market Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Application, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered | The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Cyberhawk Innovations Limited, PrecisionHawk, Delair, Airobotics, Airborne Drones, Terra Drone, Intel Corporation, AeroVironment Inc, Aerodyne Group, Sky-Futures |

| Key Market Opportunities | Amendments in drone regulations |

| Key Market Dynamics | Increasing investment in offshore exploration Rising investment in offshore pipeline infrastructure |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much are the Drones for Oil and Gas market?

The Drones for Oil and Gas market size was valued at USD 856.65 Million in 2023.

What is the growth rate of the Drones for Oil and Gas market?

The market is projected to grow at a CAGR of 27.5% during the forecast period, 2024-2032.

Which region held the largest market share in the Drones for Oil and Gas market?

North America had the largest share of the Drones for Oil and Gas market.

Who are the key players in the Drones for Oil and Gas market?

The key players in the market are Cyberhawk Innovations Limited, PrecisionHawk, Delair, Airobotics, Airborne Drones, Terra Drone, Intel Corporation, AeroVironment Inc, Aerodyne Group, and Sky-Futures.

Which Drones for Oil and Gas type led the Drones for Oil and Gas market?

The Multi-rotor segment Drones for Oil and Gas category dominated the market in 2023.

Which Application had the largest market share in the market?

Inspection for Oil and Gas had the largest share in the market for Drones for Oil and Gas.

-

Market Estimates & Forecast, by Region, 2024-2030

- Multi-Rotor

-

Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Region, 2024-2030

-

Fixed Wing

- Market Estimates & Forecast

- Market Estimates & Forecast, by Region, 2024-2030

-

Hybrid & Nano

- Market Estimates & Forecast, 2024-2030

-

Market Estimates & Forecast, by Region, 2024-2030

-

& Gas Market, by Application

- Introduction

- Inspection

-

Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Region, 2024-2030

-

Surveying & Mapping

- Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Region

-

Security and Emergency Response

- Market Estimates & Forecast, 2024-2030

- Introduction

-

North America

- Market Estimates & Forecast, by Services, 2024-2030

- Market Estimates & Forecast, by Type, 2024-2030

- Market Estimates

-

& Forecast, by Application, 2024-2030

-

Market Estimates & Forecast, by Country, 2024-2030

- US

- Canada

-

Market Estimates & Forecast, by Country, 2024-2030

-

Estimates & Forecast, by Type, 2024-2030

- Market Estimates

-

Forecast, by Plant Type, 2024-2030

-

Mexico

- Market Estimates

-

Mexico

-

& Forecast, by Services, 2024-2030

-

Market Estimates & Forecast, by Type, 2024-2030

- Market Estimates & Forecast, by Application

-

Europe

- Market Estimates & Forecast, by Services

- Market Estimates & Forecast, by Type, 2024-2030

-

Market Estimates & Forecast, by Type, 2024-2030

-

Market Estimates & Forecast, by Application, 2024-2030

- Market Estimates

-

& Forecast, by Country, 2024-2030

-

Norway

- Market Estimates

-

Norway

-

& Forecast, by Services, 2024-2030

-

Market Estimates & Forecast, by Type, 2024-2030

- Market Estimates & Forecast, by Application

- UK

-

Market Estimates & Forecast, by Type, 2024-2030

-

Market Estimates & Forecast, by Application, 2024-2030

-

Denmark

- Market Estimates & Forecast, by Services, 2024-2030

-

Denmark

-

Estimates & Forecast, by Type, 2024-2030

- Market Estimates

-

Forecast, by Application, 2024-2030

-

Rest of Europe

- Market

-

Rest of Europe

-

Estimates & Forecast, by Services, 2024-2030

- Market Estimates

-

Forecast, by Type, 2024-2030

- Market Estimates & Forecast, by Application

-

Asia-Pacific

- Market Estimates & Forecast, by Services

- Market Estimates & Forecast, by Type, 2024-2030

-

Market Estimates & Forecast, by Application, 2024-2030

- Market Estimates

-

& Forecast, by Country, 2024-2030

-

China

- Market Estimates

-

China

-

& Forecast, by Services, 2024-2030

-

Market Estimates & Forecast, by Type, 2024-2030

- Market Estimates & Forecast, by Application

- Japan

-

Market Estimates & Forecast, by Type, 2024-2030

-

Market Estimates & Forecast, by Application, 2024-2030

-

Australia

- Market Estimates & Forecast, by Services, 2024-2030

-

Australia

-

Estimates & Forecast, by Type, 2024-2030

- Market Estimates

-

Forecast, by Application, 2024-2030

-

India

- Market Estimates

-

India

-

& Forecast, by Services, 2024-2030

-

Market Estimates & Forecast, by Type, 2024-2030

- Market Estimates & Forecast, by Application

- Rest of Asia-Pacific

-

Middle East & Africa

- Market Estimates & Forecast, by Services, 2024-2030

- Market Estimates & Forecast, by Type, 2024-2030

- Market Estimates

-

Market Estimates & Forecast, by Type, 2024-2030

-

& Forecast, by Application, 2024-2030

-

Market Estimates & Forecast, by Country, 2024-2030

- Saudi Arabia

-

Market Estimates & Forecast, by Country, 2024-2030

-

Forecast, by Services, 2024-2030

-

Market Estimates & Forecast, by Type, 2024-2030

- Market Estimates & Forecast, by Application, 2024-2030

- UAE

-

Market Estimates & Forecast, by Type, 2024-2030

-

Estimates & Forecast, by Application, 2024-2030

- South Africa

-

Market Estimates & Forecast, by Services, 2024-2030

- Market Estimates

-

& Forecast, by Type, 2024-2030

-

Market Estimates & Forecast, by Application, 2024-2030

- Rest of Middle East & Africa

-

Market Estimates & Forecast, by Application, 2024-2030

-

Market Estimates & Forecast, by Services, 2024-2030

- Market Estimates

-

& Forecast, by Type, 2024-2030

- Market Estimates & Forecast, by Application, 2024-2030

-

South America

- Market Estimates

-

Forecast, by Services, 2024-2030

-

Market Estimates & Forecast, by Type, 2024-2030

- Market Estimates & Forecast, by Application, 2024-2030

- Market Estimates & Forecast, by Country, 2024-2030

- Argentina

-

Market Estimates & Forecast, by Type, 2024-2030

-

Estimates & Forecast, by Type, 2024-2030

- Market Estimates

-

Forecast, by Application, 2024-2030

-

Brazil

- Market Estimates

-

Brazil

-

& Forecast, by Services, 2024-2030

-

Market Estimates & Forecast, by Type, 2024-2030

- Market Estimates & Forecast, by Application

- Rest of South America

- Competitive Scenario

- Competitive Benchmarking of the

-

Market Estimates & Forecast, by Type, 2024-2030

-

Global Drones for Oil & Gas Market

- Major Growth Key Strategies in the

-

Global Drones for Oil & Gas Market

- Market Share Analysis: Global Drones

-

for Oil & Gas Market

- XXXX: The Leading Player in Terms of Number of

-

Developments in Global Drones for Oil & Gas Market

- Product Development

-

in Global Drones for Oil & Gas Market

- Mergers and Acquisitions in Global

-

Drones for Oil & Gas Market

- Contracts and Agreements in Global Drones

-

for Oil & Gas Market

- Expansions and Investments in Global Drones for

-

Oil & Gas Market

-

Cyberhawk Innovations Limited (Scotland)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

PrecisionHawk (US)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Delair (Denmark)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

SkyScape Industries (US)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Airobotics (US)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

- SWOT Analysis

-

Airborne Drones (South Africa)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Sky Futures (UK)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Terra Drone (Japan)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Intel Corporation (US)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

AeroVironment, Inc (US)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Aerodyne Group (Malaysia)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Insitu Pacific Pty Ltd (Australia)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Aerialtronics DV B.V. (the Netherlands)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Flyability (Switzerland)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

ideaForge (India)

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- Key Strategies

- SWOT Analysis

-

Cyberhawk Innovations Limited (Scotland)

-

Gas Market, by Region, 2024-2030 (USD Million)

-

for Oil & Gas Market, by Country, 2024-2030 (USD Million)

-

Drones for Oil & Gas Market, by Country, 2024-2030 (USD Million)

-

2024-2030 (USD Million)

-

by Country, 2024-2030 (USD Million)

-

Market, by Type, 2024-2030 (USD Million)

-

& Gas Market, by Type, 2024-2030 (USD Million)

-

Oil & Gas Market, by Type, 2024-2030 (USD Million)

-

Drones for Oil & Gas Market, by Type, 2024-2030 (USD Million)

-

Middle East & Africa Drones for Oil & Gas Market, by Type, 2024-2030 (USD Million) (USD Million)

-

2024-2030 (USD Million)

-

by Application, 2024-2030 (USD Million)

-

Gas Market, by Application, 2024-2030 (USD Million)

-

for Oil & Gas Market, by Application, 2024-2030 (USD Million)

-

Middle East & Africa Drones for Oil & Gas Market, by Application, 2024-2030 (USD Million)

-

2024-2030 (USD Million)

-

2024-2030 (USD Million)

-

2024-2030 (USD Million)

-

Type, 2024-2030 (USD Million)

-

by Application, 2024-2030 (USD Million)

-

Gas Market, by Type, 2024-2030 (USD Million)

-

& Gas Market, by Application, 2024-2030 (USD Million)

-

for Oil & Gas Market, by Country, 2024-2030 (USD Million)

-

Drones for Oil & Gas Market, by Type, 2024-2030 (USD Million)

-

Europe Drones for Oil & Gas Market, by Application, 2024-2030 (USD Million) Million) Million) (USD Million) (USD Million)

-

2024-2030 (USD Million)

-

by Type, 2024-2030 (USD Million)

-

Gas Market, by Application, 2024-2030 (USD Million)

-

for Oil & Gas Market, by Country, 2024-2030 (USD Million)

-

Drones for Oil & Gas Market, by Type, 2024-2030 (USD Million)

-

Asia-Pacific Drones for Oil & Gas Market, by Application, 2024-2030 (USD Million) Million) (USD Million)

-

2024-2030 (USD Million)

-

by Type, 2024-2030 (USD Million)

-

Market, by Application, 2024-2030 (USD Million)

-

& Gas Market, by Type, 2024-2030 (USD Million)

-

Oil & Gas Market, by Application, 2024-2030 (USD Million)

-

of Asia-Pacific Drones for Oil & Gas Market, by Type, 2024-2030 (USD Million)

-

2024-2030 (USD Million)

-

Gas Market, by Country, 2024-2030 (USD Million)

-

Africa Drones for Oil & Gas Market, by Type, 2024-2030 (USD Million)

-

2024-2030 (USD Million)

-

by Application, 2024-2030 (USD Million)

-

Market, by Type, 2024-2030 (USD Million)

-

Gas Market, by Application, 2024-2030 (USD Million)

-

for Oil & Gas Market, by Type, 2024-2030 (USD Million)

-

Drones for Oil & Gas Market, by Application, 2024-2030 (USD Million)

-

Gas Market, by Application, 2024-2030 (USD Million)

-

Drones for Oil & Gas Market, by Type, 2024-2030 (USD Million)

-

South America Drones for Oil & Gas Market, by Application, 2024-2030 (USD Million) (USD Million) (USD Million)

-

2024-2030 (USD Million)

-

Gas Market, by Type, 2024-2030 (USD Million)

-

Drones for Oil & Gas Market, by Application, 2024-2030 (USD Million) and Bottom-Up Approach Market Drivers Five Forces Analysis

-

for Oil & Gas Market Share, by Type, 2022 (%)

-

Oil & Gas Market, by Type, 2024-2030 (USD Million)

-

for Oil & Gas Market Share, by Application, 2022 (%)

-

for Oil & Gas Market, by Application, 2024-2030 (USD Million)

-

North America Drones for Oil & Gas Market Share (%), 2022

-

America Drones for Oil & Gas Market, by Country, 2024-2030 (USD Million)

-

Europe Drones for Oil & Gas Market, by Country, 2024-2030 (USD Million)

-

Drones for Oil & Gas Market, by Country, 2024-2030 (USD Million)

-

2024-2030 (USD Million)

Market Segmentation

Drones for Oil and Gas Type Outlook (USD Million, 2018-2030)

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

Drones for Oil and Gas Application Outlook (USD Million, 2018-2030)

- Inspection

- Security & emergency response

- Surveying & mapping

Drones for Oil and Gas Regional Outlook (USD Million, 2018-2030)

North America Outlook (USD Million, 2018-2030)

- North America Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- North America Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

US Outlook (USD Million, 2018-2030)

- US Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- US Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

CANADA Outlook (USD Million, 2018-2030)

- CANADA Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- CANADA Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

- North America Drones for Oil and Gas by Drones for Oil and Gas Type

Europe Outlook (USD Million, 2018-2030)

- Europe Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- Europe Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

Germany Outlook (USD Million, 2018-2030)

- Germany Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- Germany Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

France Outlook (USD Million, 2018-2030)

- France Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- France Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

UK Outlook (USD Million, 2018-2030)

- UK Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- UK Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

ITALY Outlook (USD Million, 2018-2030)

- ITALY Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- ITALY Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

SPAIN Outlook (USD Million, 2018-2030)

- Spain Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- Spain Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

Rest Of Europe Outlook (USD Million, 2018-2030)

- REST OF EUROPE Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- REST OF EUROPE Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

- Europe Drones for Oil and Gas by Drones for Oil and Gas Type

Asia-Pacific Outlook (USD Million, 2018-2030)

- Asia-Pacific Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- Asia-Pacific Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

China Outlook (USD Million, 2018-2030)

- China Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- China Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

Japan Outlook (USD Million, 2018-2030)

- Japan Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- Japan Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

India Outlook (USD Million, 2018-2030)

- India Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- India Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

Australia Outlook (USD Million, 2018-2030)

- Australia Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- Australia Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

Rest of Asia-Pacific Outlook (USD Million, 2018-2030)

- Rest of Asia-Pacific Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- Rest of Asia-Pacific Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

- Asia-Pacific Drones for Oil and Gas by Drones for Oil and Gas Type

Rest of the World Outlook (USD Million, 2018-2030)

- Rest of the World Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- Rest of the World Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

Middle East Outlook (USD Million, 2018-2030)

- Middle East Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- Middle East Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

Africa Outlook (USD Million, 2018-2030)

- Africa Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- Africa Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

Latin America Outlook (USD Million, 2018-2030)

- Latin America Drones for Oil and Gas by Drones for Oil and Gas Type

- Hybrid and nano

- Fixed-wing

- Multi-rotor

- Single rotor

- Latin America Drones for Oil and Gas by Application

- Inspection

- Security & emergency response

- Surveying & mapping

- Rest of the World Drones for Oil and Gas by Drones for Oil and Gas Type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment