Email Marketing Market Share

Email Market Research Report: By Email Service Type (Transactional Email, Marketing Email, Bulk Email, Automated Email), By Deployment Type (Cloud-Based, On-Premises), By End User (Individuals, Small and Medium Enterprises, Large Enterprises), By Industry Verticals (Retail, Healthcare, Education, Finance) and By Regional (North America, Europe, South America, Asia Pacific, Middle East and Afric...

Market Summary

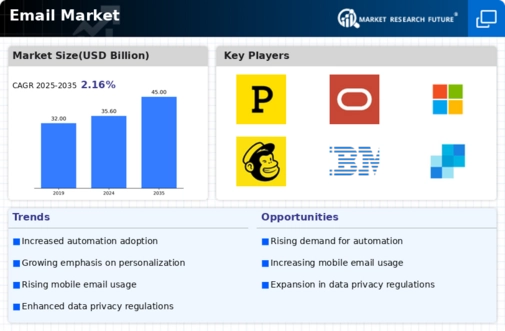

The global email market is projected to grow from 35.6 USD billion in 2024 to 45 USD billion by 2035.

Key Market Trends & Highlights

Email Key Trends and Highlights

- The market is expected to experience a compound annual growth rate of 2.16 percent from 2025 to 2035. By 2035, the global email market is anticipated to reach a valuation of 45 USD billion. In 2024, the market valuation stands at 35.6 USD billion, indicating a robust growth trajectory. Growing adoption of digital communication tools due to increasing remote work trends is a major market driver.

Market Size & Forecast

| 2024 Market Size | 35.6 (USD Billion) |

| 2035 Market Size | 45 (USD Billion) |

| CAGR (2025-2035) | 2.16% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

<p>Postmark, Oracle, Microsoft, Mailchimp, IBM, SendGrid, Mailgun, Google, Constant Contact, AWeber, GetResponse, Salesforce, Zoho, Amazon, HubSpot</p>

Market Trends

There are a number of major developments that are changing the Email Market. One big development is that artificial intelligence and machine learning technologies are becoming more and more integrated, which makes managing email and using it better. These new features make email communication more effective by allowing for smarter filtering, more tailored content, and better spam detection. Another big trend is that cybersecurity is becoming more important as email security concerns keep rising. Companies are spending money on better encryption and security methods to keep private data safe. This is in response to stricter rules on data privacy.

Cloud-based email solutions are also becoming more popular in the industry. They provide organizations of all sizes with the opportunity to grow and change. This change is happening because more and more people want to work from home, and more businesses are choosing cloud-based systems to make sure communication is easy. Also, the rise of mobile devices has made it necessary to create better email apps that work well for those who are always on the move. This has changed the market even more. The worldwide digital revolution is one of the main things that drives the market.

It makes businesses use email as a main way to communicate. The growing use of e-commerce solutions also pushes the demand for good email marketing and customer engagement strategies.

There are chances to grow by entering sectors that aren't well covered and making solutions that are unique to certain fields, including healthcare and finance, where safe and compliant email services are quite important. As privacy becomes more important, businesses that can provide strong security measures together with easy-to-use features are likely to stand out in a crowded global market.

Fig 1: Email Marketing Market Overview

<p>The Global Email Market is poised for continued expansion as organizations increasingly recognize the value of email as a vital communication tool, facilitating both customer engagement and operational efficiency.</p>

U.S. Department of Commerce

Email Marketing Market Market Drivers

Market Growth Projections

Rising Cybersecurity Concerns

As cyber threats become increasingly sophisticated, the demand for secure email solutions is surging within the Global Email Market Industry. Organizations are prioritizing cybersecurity measures to protect sensitive information, leading to the adoption of encrypted email services and advanced authentication protocols. This heightened focus on security is likely to drive market growth, as businesses seek to mitigate risks associated with data breaches. The emphasis on secure communication channels aligns with the overall trend of digital transformation, positioning the email market for sustained expansion in the coming years.

Emergence of Mobile Email Solutions

The rise of mobile email solutions is reshaping the Global Email Market Industry, as consumers increasingly rely on smartphones and tablets for communication. Mobile email applications offer convenience and accessibility, enabling users to manage their emails on the go. This shift towards mobile-first communication is likely to attract a broader audience, particularly among younger demographics. As mobile technology continues to evolve, the demand for user-friendly email applications is expected to grow, further propelling the market. The industry's adaptability to changing consumer preferences positions it well for future growth.

Growing Digital Communication Needs

The increasing reliance on digital communication across various sectors drives the Global Email Market Industry. Businesses and individuals alike are adopting email as a primary mode of communication due to its efficiency and accessibility. In 2024, the market is projected to reach 35.6 USD Billion, reflecting a robust demand for email services. This trend is likely to continue as organizations prioritize digital transformation, enhancing their communication strategies. Furthermore, the rise of remote work and global collaboration necessitates reliable email solutions, further propelling growth in the industry.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning into email services is transforming the Global Email Market Industry. These technologies enhance user experience by providing features like smart sorting, predictive text, and automated responses. As businesses seek to improve productivity and streamline communication, the adoption of these innovations is expected to rise. This technological evolution not only attracts new users but also retains existing customers, contributing to the market's growth. By 2035, the market is anticipated to reach 45 USD Billion, indicating a strong trajectory fueled by technological advancements.

Expansion of E-commerce and Online Services

The rapid expansion of e-commerce and online services is significantly influencing the Global Email Market Industry. As more businesses establish an online presence, email marketing becomes a crucial tool for customer engagement and retention. Companies leverage email campaigns to reach potential customers, promote products, and foster brand loyalty. This trend is expected to contribute to the market's growth, as businesses increasingly recognize the value of email as a marketing channel. The projected CAGR of 2.16% from 2025 to 2035 underscores the potential for sustained growth driven by the e-commerce sector.

Market Segment Insights

Email Market Email Service Type Insights

<p>The Email Market has shown substantial growth trends, particularly in the Email Service Type segment, which encompasses Transactional Email, Marketing Email, Bulk Email, and Automated Email. In 2024, the overall market is projected to reach a valuation of 35.59 USD Billion, driven by various consumer needs and shifting business dynamics. Transactional Email is gaining prominence and is expected to be valued at 10.5 USD Billion in 2024, ultimately growing to 13.0 USD Billion by 2035.</p>

<p>These emails are critical for real-time communications, such as order confirmations and account notifications, which enhance customer experience and retention.Marketing Email is another key area, projected to be valued at 12.0 USD Billion in 2024 and anticipated to reach 15.0 USD Billion by 2035. This segment dominates the revenue generation strategy for businesses looking to engage with customers, showcasing effective promotional and informational outreach.</p>

<p>Meanwhile, Bulk Email, with a valuation of 7.5 USD Billion in 2024 and a forecasted growth to 9.0 USD Billion by 2035, serves as an essential tool in mass communication strategies for businesses looking to maximize reach and market visibility. Lastly, the Automated Email segment, which holds a more niche position, is valued at 5.59 USD Billion in 2024 and expected to reach 7.0 USD Billion in 2035.This service offers significant efficiencies through automated workflows, thus optimizing marketing efforts and customer engagement.</p>

Fig 2: Email Marketing Market Insights

<p>Fig 2: Email Marketing Market Insights</p>

<p>Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review</p>

Email Market Deployment Type Insights

<p>The Email Market revenue is experiencing steady growth, with a projected valuation of 35.59 USD Billion in 2024 and an expected increase to 45.0 USD Billion by 2035. This growth is attributed to various Deployment Type segments, notably Cloud-Based and On-Premises solutions. Cloud-Based email systems have become increasingly popular due to their scalability, ease of access, and cost-effectiveness, allowing businesses to adapt to changing demands swiftly. This segment strengthens the market by facilitating remote collaboration, which has become vital in a globally interconnected environment.Conversely, On-Premises email solutions remain significant for organizations prioritizing data security and customization.</p>

<p>These solutions allow businesses to control and protect their information, making them preferred in various fields, such as finance and healthcare, where privacy is paramount. Overall, the Email Market segmentation reflects a robust landscape driven by evolving technological needs, adherence to data protection regulations, and a push towards operational efficiency, with both deployment types catering to distinct business preferences and operational strategies.The anticipated market growth indicates a favorable environment for both Cloud-Based and On-Premises solutions in the coming years.</p>

Email Market End User Insights

<p>The Email Market, valued at 35.59 USD Billion in 2024, showcases a diverse range of end users, which include Individuals, Small and Medium Enterprises, and Large Enterprises. Individuals represent a significant portion of the user base, relying heavily on email for personal communication and online services. Small and Medium Enterprises are increasingly adopting email solutions to streamline their operations and enhance customer engagement, making them a critical player in the market's growth.</p>

<p>Large Enterprises dominate the landscape due to their extensive communication needs, often utilizing advanced email management systems to optimize workflow and improve productivity.Market trends indicate a rising demand for secure and reliable email solutions across these end users, driven by the growing need for cybersecurity measures and efficient communication tools. The Email Market segmentation reflects the varying needs of these groups, with opportunities for providers to develop tailored solutions that address specific requirements.</p>

<p>Challenges such as data privacy concerns and competition among service providers are prevalent but also pave the way for innovation in email services, ensuring sustained market growth in the coming years.</p>

Email Market Industry Verticals Insights

<p>The Email Market is experiencing notable growth within its Industry Verticals, underscoring the importance of digital communication across various sectors. By 2024, the overall market is expected to be valued at 35.59 USD Billion, enhancing the need for effective email communication tools. Among the diverse sectors, Retail and Healthcare are increasingly relying on email for customer engagement and patient communication, respectively. Retailers utilize email for personalized marketing campaigns, fostering customer loyalty and driving sales.Meanwhile, the Healthcare sector leverages email for appointment reminders and health updates, ensuring seamless communication between patients and providers.</p>

<p>Education also plays a critical role, employing email systems for faculty-student communication and administrative notifications, which streamlines information dissemination. The<a href="https://www.marketresearchfuture.com/reports/banking-finance-sector-market-21861"> Finance industry </a>relies on secure email channels to share sensitive information and comply with regulatory requirements, highlighting its significance in maintaining trust and security. As the Email Market continues to evolve, these Industry Verticals are poised for expansion, driven by the ongoing digital transformation and increasing demand for efficient communication solutions within each sector.This growth reflects the broader trends in digital marketing, customer service enhancement, and operational efficiency, affirming the pivotal role of email in contemporary business communications.</p>

Get more detailed insights about Email Marketing Market Research Report - Global Forecast to 2035

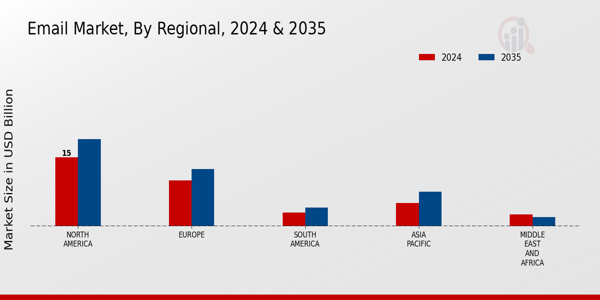

Regional Insights

The Email Market exhibits a diverse distribution across various regions, with North America leading the charge, valued at 15.0 USD Billion in 2024 and projected to grow to 19.0 USD Billion by 2035, signifying its majority holding in the industry. Europe follows as another significant region, starting at 10.0 USD Billion in 2024 and advancing to 12.5 USD Billion by 2035, bolstered by a robust technological infrastructure.

In contrast, South America, while smaller with a valuation of 3.0 USD Billion in 2024 and 4.0 USD Billion in 2035, demonstrates potential for growth due to increased digital adoption.The Asia Pacific region is positioned as an emerging player, with a valuation of 5.0 USD Billion in 2024 expected to reach 7.5 USD Billion in 2035, driven by a rapidly expanding internet user base. The Middle East and Africa reflect a more modest market size of 2.59 USD Billion in 2024, with expectations of decline to 2.0 USD Billion by 2035, indicating challenges in market penetration.

Each region reveals unique opportunities and challenges, influenced by factors such as digital infrastructure, economic conditions, and adoption rates of email services within the Email Market statistics.

Fig 3: Email Marketing Market Regional Insights

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Players and Competitive Insights

The Email Market is characterized by a dynamic landscape shaped by various competitive forces. This market has evolved significantly, driven by technological advancements and changing consumer behaviors. Companies in this space are focusing on enhancing user experiences, ensuring high deliverability rates, and offering security features to safeguard communications.

Competitive insights reveal that firms are increasingly investing in automation and analytics to optimize email marketing efforts, along with integrating capabilities across platforms for better synergy. As email continues to be a primary communication tool for both individuals and businesses, understanding the competitive positioning of major players becomes critically important for stakeholders looking to capitalize on growth opportunities within the sector.Postmark has established itself firmly within the Email Market by focusing on transactional email services.

The company has carved out a niche by providing reliable delivery and excellent customer service, catering primarily to developers and businesses that need fast and efficient email solutions.

This focus allows Postmark to maintain a strong reputation for deliverability and minimal downtime, ensuring that its clients' important emails reach their intended recipients without delay. Additionally, Postmark offers features such as detailed tracking and analytics which further enhances customer satisfaction and engagement. With a user-friendly interface and robust API integrations, Postmark continues to strengthen its market presence while fostering long-term relationships with its customers.Oracle holds a significant position in the Email Market, leveraging its extensive suite of products and services to provide comprehensive email solutions.

The company integrates its marketing cloud offerings with email functionalities, allowing clients to run targeted campaigns and manage customer communications effectively. Key products from Oracle include its Marketing Cloud, which emphasizes automation and analytics, thus enhancing customer engagement through personalized content.

Oracle's strength lies in its ability to offer scalable solutions tailored to meet the diverse needs of businesses, from small enterprises to large corporations. Its ongoing mergers and acquisitions strategy further strengthens its market presence, allowing Oracle to expand its capabilities and product offerings continuously. By investing in innovative technologies and prioritizing customer experience, Oracle positions itself effectively in a competitive environment, enabling brands to drive growth through strategic email marketing initiatives across the global landscape.

Key Companies in the Email Marketing Market market include

Industry Developments

The Email Market has witnessed significant developments recently, with major players like Microsoft, Oracle, and Google investing heavily in enhancing their email service capabilities. In October 2023, Microsoft announced new features for its Outlook platform, focusing on integrated AI tools to improve user experience and engagement.

Additionally, in September 2023, Oracle acquired a smaller company specializing in email deliverability, aiming to strengthen its cloud offerings. Mailchimp has also made headlines with its recent partnerships to broaden its email marketing solutions, adapting to the evolving needs of businesses. The market valuation for email services continues to grow, driven by increased demand for digital communication tools, particularly as remote work persists globally.

Furthermore, in 2022, Salesforce and Zoho reported notable expansions in their email marketing segments, reflecting an overarching trend towards automation and personalization in email marketing strategies. As the industry evolves, companies like IBM, SendGrid, and Mailgun are focusing on innovative solutions to enhance deliverability and analytics for their clients, thus impacting overall market dynamics positively and driving competition among service providers.

Future Outlook

Email Marketing Market Future Outlook

<p>The Global Email Market is projected to grow at a 2.16% CAGR from 2024 to 2035, driven by increased digital communication and automation technologies.</p>

New opportunities lie in:

- <p>Develop AI-driven <a href="https://www.marketresearchfuture.com/reports/ai-email-assistant-market-12206">email personalization tools </a>to enhance user engagement. Expand integration of email marketing with social media platforms for broader reach. Invest in cybersecurity solutions to protect email communications and build trust.</p>

<p>By 2035, the Global Email Market is expected to demonstrate steady growth, reflecting evolving communication needs.</p>

Market Segmentation

Email Market End User Outlook

- Individuals

- Small and Medium Enterprises

- Large Enterprises

Email Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Email Market Deployment Type Outlook

- Cloud-Based

- On-Premises

Email Market Email Service Type Outlook

- Transactional Email

- Marketing Email

- Bulk Email

- Automated Email

Email Market Industry Verticals Outlook

- Retail

- Healthcare

- Education

- Finance

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2023 | 34.84(USD Billion) |

| Market Size 2024 | 35.59(USD Billion) |

| Market Size 2035 | 45.0(USD Billion) |

| Compound Annual Growth Rate (CAGR) | 2.16% (2025 - 2035) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | Postmark, Oracle, Microsoft, Mailchimp, IBM, SendGrid, Mailgun, Google, Constant Contact, AWeber, GetResponse, Salesforce, Zoho, Amazon, HubSpot |

| Segments Covered | Email Service Type, Deployment Type, End User, Industry Verticals, Regional |

| Key Market Opportunities | AI-driven email personalization, Enhanced security features adoption, Marketing automation integration, Cross-platform compatibility improvements, Cloud-based email solutions growth |

| Key Market Dynamics | increasing demand for automation, growing cybersecurity concerns, rise of mobile access, shift towards cloud services, expanding integration with CRM tools |

| Countries Covered | North America, Europe, APAC, South America, MEA |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

Report Attribute/Metric Details Market Size 2023 34.84(USD Billion) Market Size 2024 35.59(USD Billion) Market Size 2035 45.0(USD Billion) Compound Annual Growth Rate (CAGR) 2.16% (2025 - 2035) Report Coverage Revenue Forecast, Competitive Landscape, Growth Factors, and Trends Base Year 2024 Market Forecast Period 2025 - 2035 Historical Data 2019 - 2024 Market Forecast Units USD Billion Key Companies Profiled Postmark, Oracle, Microsoft, Mailchimp, IBM, SendGrid, Mailgun, Google, Constant Contact, AWeber, GetResponse, Salesforce, Zoho, Amazon, HubSpot Segments Covered Email Service Type, Deployment Type, End User, Industry Verticals, Regional Key Market Opportunities AI-driven email personalization, Enhanced security features adoption, Marketing automation integration, Cross-platform compatibility improvements, Cloud-based email solutions growth Key Market Dynamics increasing demand for automation, growing cybersecurity concerns, rise of mobile access, shift towards cloud services, expanding integration with CRM tools Countries Covered North America, Europe, APAC, South America, MEA

The Email Market is expected to be valued at 35.59 USD Billion in 2024.

What is the projected size of the Email Market by 2035?

By 2035, the Email Market is expected to reach a value of 45.0 USD Billion.

What is the estimated compound annual growth rate (CAGR) for the Email Market from 2025 to 2035?

The estimated CAGR for the Email Market from 2025 to 2035 is 2.16%.

Which region is expected to dominate the Email Market in 2024?

North America is expected to dominate the Email Market with a value of 15.0 USD Billion in 2024.

What will be the market size for Transactional Email in 2035?

The market size for Transactional Email is projected to be 13.0 USD Billion in 2035.

What is the expected market size for Marketing Email in 2024?

The market size for Marketing Email is expected to be 12.0 USD Billion in 2024.

Who are the key players in the Email Market?

Major players in the market include Postmark, Oracle, Microsoft, Mailchimp, and IBM, among others.

What is the projected market size for Bulk Email by 2035?

The projected market size for Bulk Email is expected to be 9.0 USD Billion by 2035.

What is the estimated market size for Automated Email in 2024?

The estimated market size for Automated Email is valued at 5.59 USD Billion in 2024.

How much is the South American region expected to contribute to the Email Market by 2035?

By 2035, the South American region is expected to contribute 4.0 USD Billion to the Email Market.

-

Table of Contents

-

Executive Summary

- Market Overview

- Key Findings

- Market Segmentation

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumption

- Limitations

-

Research Methodology

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value chain Analysis

-

Porter''s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

Email Market, BY Email Service Type (USD Billion)

- Transactional Email

- Marketing Email

- Bulk Email

- Automated Email

-

Email Market, BY Deployment Type (USD Billion)

- Cloud-Based

- On-Premises

-

Email Market, BY End User (USD Billion)

- Individuals

- Small and Medium Enterprises

- Large Enterprises

-

Email Market, BY Industry Verticals (USD Billion)

- Retail

- Healthcare

- Education

- Finance

-

Email Market, BY Regional (USD Billion)

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

North America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market share Analysis

- Major Growth Strategy in the Email Market

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Email Market

-

Key developments and growth strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

Company Profiles

-

Amazon

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

IBM

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Hushmail

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

ProtonMail

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

SendGrid

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Rackspace

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Salesforce

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Google

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Fastmail

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Microsoft

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Mailchimp

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Gmx

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Zoho

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Yahoo

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Oracle

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Amazon

-

Appendix

- References

- Related Reports

-

List of Tables and Figures

- LIST Of tables

- Table 1. LIST OF ASSUMPTIONS

- Table 2. North America Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 3. North America Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 4. North America Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 5. North America Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 6. North America Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 7. US Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 8. US Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 9. US Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 10. US Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 11. US Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 12. Canada Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 13. Canada Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 14. Canada Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 15. Canada Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 16. Canada Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 17. Europe Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 18. Europe Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 19. Europe Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 20. Europe Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 21. Europe Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 22. Germany Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 23. Germany Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 24. Germany Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 25. Germany Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 26. Germany Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 27. UK Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 28. UK Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 29. UK Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 30. UK Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 31. UK Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 32. France Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 33. France Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 34. France Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 35. France Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 36. France Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 37. Russia Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 38. Russia Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 39. Russia Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 40. Russia Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 41. Russia Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 42. Italy Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 43. Italy Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 44. Italy Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 45. Italy Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 46. Italy Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 47. Spain Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 48. Spain Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 49. Spain Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 50. Spain Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 51. Spain Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 52. Rest of Europe Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 53. Rest of Europe Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 54. Rest of Europe Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 55. Rest of Europe Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 56. Rest of Europe Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 57. APAC Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 58. APAC Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 59. APAC Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 60. APAC Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 61. APAC Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 62. China Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 63. China Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 64. China Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 65. China Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 66. China Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 67. India Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 68. India Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 69. India Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 70. India Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 71. India Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 72. Japan Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 73. Japan Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 74. Japan Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 75. Japan Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 76. Japan Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 77. South Korea Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 78. South Korea Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 79. South Korea Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 80. South Korea Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 81. South Korea Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 82. Malaysia Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 83. Malaysia Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 84. Malaysia Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 85. Malaysia Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 86. Malaysia Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 87. Thailand Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 88. Thailand Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 89. Thailand Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 90. Thailand Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 91. Thailand Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 92. Indonesia Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 93. Indonesia Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 94. Indonesia Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 95. Indonesia Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 96. Indonesia Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 97. Rest of APAC Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 98. Rest of APAC Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 99. Rest of APAC Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 100. Rest of APAC Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 101. Rest of APAC Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 102. South America Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 103. South America Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 104. South America Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 105. South America Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 106. South America Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 107. Brazil Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 108. Brazil Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 109. Brazil Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 110. Brazil Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 111. Brazil Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 112. Mexico Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 113. Mexico Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 114. Mexico Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 115. Mexico Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 116. Mexico Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 117. Argentina Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 118. Argentina Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 119. Argentina Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 120. Argentina Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 121. Argentina Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 122. Rest of South America Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 123. Rest of South America Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 124. Rest of South America Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 125. Rest of South America Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 126. Rest of South America Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 127. MEA Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 128. MEA Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 129. MEA Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 130. MEA Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 131. MEA Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 132. GCC Countries Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 133. GCC Countries Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 134. GCC Countries Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 135. GCC Countries Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 136. GCC Countries Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 137. South Africa Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 138. South Africa Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 139. South Africa Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 140. South Africa Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 141. South Africa Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 142. Rest of MEA Email Market SIZE ESTIMATES & FORECAST, BY EMAIL SERVICE TYPE, 2019-2035 (USD Billions)

- Table 143. Rest of MEA Email Market SIZE ESTIMATES & FORECAST, BY DEPLOYMENT TYPE, 2019-2035 (USD Billions)

- Table 144. Rest of MEA Email Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Table 145. Rest of MEA Email Market SIZE ESTIMATES & FORECAST, BY INDUSTRY VERTICALS, 2019-2035 (USD Billions)

- Table 146. Rest of MEA Email Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Table 147. PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

- Table 148. ACQUISITION/PARTNERSHIP LIST Of figures

- Figure 1. MARKET SYNOPSIS

- Figure 2. NORTH AMERICA EMAIL MARKET ANALYSIS

- Figure 3. US EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 4. US EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 5. US EMAIL MARKET ANALYSIS BY END USER

- Figure 6. US EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 7. US EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 8. CANADA EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 9. CANADA EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 10. CANADA EMAIL MARKET ANALYSIS BY END USER

- Figure 11. CANADA EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 12. CANADA EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 13. EUROPE EMAIL MARKET ANALYSIS

- Figure 14. GERMANY EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 15. GERMANY EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 16. GERMANY EMAIL MARKET ANALYSIS BY END USER

- Figure 17. GERMANY EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 18. GERMANY EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 19. UK EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 20. UK EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 21. UK EMAIL MARKET ANALYSIS BY END USER

- Figure 22. UK EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 23. UK EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 24. FRANCE EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 25. FRANCE EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 26. FRANCE EMAIL MARKET ANALYSIS BY END USER

- Figure 27. FRANCE EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 28. FRANCE EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 29. RUSSIA EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 30. RUSSIA EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 31. RUSSIA EMAIL MARKET ANALYSIS BY END USER

- Figure 32. RUSSIA EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 33. RUSSIA EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 34. ITALY EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 35. ITALY EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 36. ITALY EMAIL MARKET ANALYSIS BY END USER

- Figure 37. ITALY EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 38. ITALY EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 39. SPAIN EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 40. SPAIN EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 41. SPAIN EMAIL MARKET ANALYSIS BY END USER

- Figure 42. SPAIN EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 43. SPAIN EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 44. REST OF EUROPE EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 45. REST OF EUROPE EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 46. REST OF EUROPE EMAIL MARKET ANALYSIS BY END USER

- Figure 47. REST OF EUROPE EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 48. REST OF EUROPE EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 49. APAC EMAIL MARKET ANALYSIS

- Figure 50. CHINA EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 51. CHINA EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 52. CHINA EMAIL MARKET ANALYSIS BY END USER

- Figure 53. CHINA EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 54. CHINA EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 55. INDIA EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 56. INDIA EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 57. INDIA EMAIL MARKET ANALYSIS BY END USER

- Figure 58. INDIA EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 59. INDIA EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 60. JAPAN EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 61. JAPAN EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 62. JAPAN EMAIL MARKET ANALYSIS BY END USER

- Figure 63. JAPAN EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 64. JAPAN EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 65. SOUTH KOREA EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 66. SOUTH KOREA EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 67. SOUTH KOREA EMAIL MARKET ANALYSIS BY END USER

- Figure 68. SOUTH KOREA EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 69. SOUTH KOREA EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 70. MALAYSIA EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 71. MALAYSIA EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 72. MALAYSIA EMAIL MARKET ANALYSIS BY END USER

- Figure 73. MALAYSIA EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 74. MALAYSIA EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 75. THAILAND EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 76. THAILAND EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 77. THAILAND EMAIL MARKET ANALYSIS BY END USER

- Figure 78. THAILAND EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 79. THAILAND EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 80. INDONESIA EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 81. INDONESIA EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 82. INDONESIA EMAIL MARKET ANALYSIS BY END USER

- Figure 83. INDONESIA EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 84. INDONESIA EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 85. REST OF APAC EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 86. REST OF APAC EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 87. REST OF APAC EMAIL MARKET ANALYSIS BY END USER

- Figure 88. REST OF APAC EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 89. REST OF APAC EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 90. SOUTH AMERICA EMAIL MARKET ANALYSIS

- Figure 91. BRAZIL EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 92. BRAZIL EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 93. BRAZIL EMAIL MARKET ANALYSIS BY END USER

- Figure 94. BRAZIL EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 95. BRAZIL EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 96. MEXICO EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 97. MEXICO EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 98. MEXICO EMAIL MARKET ANALYSIS BY END USER

- Figure 99. MEXICO EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 100. MEXICO EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 101. ARGENTINA EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 102. ARGENTINA EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 103. ARGENTINA EMAIL MARKET ANALYSIS BY END USER

- Figure 104. ARGENTINA EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 105. ARGENTINA EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 106. REST OF SOUTH AMERICA EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 107. REST OF SOUTH AMERICA EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 108. REST OF SOUTH AMERICA EMAIL MARKET ANALYSIS BY END USER

- Figure 109. REST OF SOUTH AMERICA EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 110. REST OF SOUTH AMERICA EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 111. MEA EMAIL MARKET ANALYSIS

- Figure 112. GCC COUNTRIES EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 113. GCC COUNTRIES EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 114. GCC COUNTRIES EMAIL MARKET ANALYSIS BY END USER

- Figure 115. GCC COUNTRIES EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 116. GCC COUNTRIES EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 117. SOUTH AFRICA EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 118. SOUTH AFRICA EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 119. SOUTH AFRICA EMAIL MARKET ANALYSIS BY END USER

- Figure 120. SOUTH AFRICA EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 121. SOUTH AFRICA EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 122. REST OF MEA EMAIL MARKET ANALYSIS BY EMAIL SERVICE TYPE

- Figure 123. REST OF MEA EMAIL MARKET ANALYSIS BY DEPLOYMENT TYPE

- Figure 124. REST OF MEA EMAIL MARKET ANALYSIS BY END USER

- Figure 125. REST OF MEA EMAIL MARKET ANALYSIS BY INDUSTRY VERTICALS

- Figure 126. REST OF MEA EMAIL MARKET ANALYSIS BY REGIONAL

- Figure 127. KEY BUYING CRITERIA OF EMAIL MARKET

- Figure 128. RESEARCH PROCESS OF MRFR

- Figure 129. DRO ANALYSIS OF EMAIL MARKET

- Figure 130. DRIVERS IMPACT ANALYSIS: EMAIL MARKET

- Figure 131. RESTRAINTS IMPACT ANALYSIS: EMAIL MARKET

- Figure 132. SUPPLY / VALUE CHAIN: EMAIL MARKET

- Figure 133. EMAIL MARKET, BY EMAIL SERVICE TYPE, 2025 (% SHARE)

- Figure 134. EMAIL MARKET, BY EMAIL SERVICE TYPE, 2019 TO 2035 (USD Billions)

- Figure 135. EMAIL MARKET, BY DEPLOYMENT TYPE, 2025 (% SHARE)

- Figure 136. EMAIL MARKET, BY DEPLOYMENT TYPE, 2019 TO 2035 (USD Billions)

- Figure 137. EMAIL MARKET, BY END USER, 2025 (% SHARE)

- Figure 138. EMAIL MARKET, BY END USER, 2019 TO 2035 (USD Billions)

- Figure 139. EMAIL MARKET, BY INDUSTRY VERTICALS, 2025 (% SHARE)

- Figure 140. EMAIL MARKET, BY INDUSTRY VERTICALS, 2019 TO 2035 (USD Billions)

- Figure 141. EMAIL MARKET, BY REGIONAL, 2025 (% SHARE)

- Figure 142. EMAIL MARKET, BY REGIONAL, 2019 TO 2035 (USD Billions)

- Figure 143. BENCHMARKING OF MAJOR COMPETITORS

Email Market Segmentation

Email Market By Email Service Type (USD Billion, 2019-2035)

Transactional Email

Marketing Email

Bulk Email

Automated Email

Email Market By Deployment Type (USD Billion, 2019-2035)

Cloud-Based

On-Premises

Email Market By End User (USD Billion, 2019-2035)

Individuals

Small and Medium Enterprises

Large Enterprises

Email Market By Industry Verticals (USD Billion, 2019-2035)

Retail

Healthcare

Education

Finance

Email Market By Regional (USD Billion, 2019-2035)

North America

Europe

South America

Asia Pacific

Middle East and Africa

Email Market Regional Outlook (USD Billion, 2019-2035)

North America Outlook (USD Billion, 2019-2035)

North America Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

North America Email Market by Deployment Type

Cloud-Based

On-Premises

North America Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

North America Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

North America Email Market by Regional Type

US

Canada

US Outlook (USD Billion, 2019-2035)

US Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

US Email Market by Deployment Type

Cloud-Based

On-Premises

US Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

US Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

CANADA Outlook (USD Billion, 2019-2035)

CANADA Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

CANADA Email Market by Deployment Type

Cloud-Based

On-Premises

CANADA Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

CANADA Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

Europe Outlook (USD Billion, 2019-2035)

Europe Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

Europe Email Market by Deployment Type

Cloud-Based

On-Premises

Europe Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

Europe Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

Europe Email Market by Regional Type

Germany

UK

France

Russia

Italy

Spain

Rest of Europe

GERMANY Outlook (USD Billion, 2019-2035)

GERMANY Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

GERMANY Email Market by Deployment Type

Cloud-Based

On-Premises

GERMANY Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

GERMANY Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

UK Outlook (USD Billion, 2019-2035)

UK Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

UK Email Market by Deployment Type

Cloud-Based

On-Premises

UK Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

UK Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

FRANCE Outlook (USD Billion, 2019-2035)

FRANCE Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

FRANCE Email Market by Deployment Type

Cloud-Based

On-Premises

FRANCE Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

FRANCE Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

RUSSIA Outlook (USD Billion, 2019-2035)

RUSSIA Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

RUSSIA Email Market by Deployment Type

Cloud-Based

On-Premises

RUSSIA Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

RUSSIA Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

ITALY Outlook (USD Billion, 2019-2035)

ITALY Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

ITALY Email Market by Deployment Type

Cloud-Based

On-Premises

ITALY Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

ITALY Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

SPAIN Outlook (USD Billion, 2019-2035)

SPAIN Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

SPAIN Email Market by Deployment Type

Cloud-Based

On-Premises

SPAIN Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

SPAIN Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

REST OF EUROPE Outlook (USD Billion, 2019-2035)

REST OF EUROPE Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

REST OF EUROPE Email Market by Deployment Type

Cloud-Based

On-Premises

REST OF EUROPE Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

REST OF EUROPE Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

APAC Outlook (USD Billion, 2019-2035)

APAC Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

APAC Email Market by Deployment Type

Cloud-Based

On-Premises

APAC Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

APAC Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

APAC Email Market by Regional Type

China

India

Japan

South Korea

Malaysia

Thailand

Indonesia

Rest of APAC

CHINA Outlook (USD Billion, 2019-2035)

CHINA Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

CHINA Email Market by Deployment Type

Cloud-Based

On-Premises

CHINA Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

CHINA Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

INDIA Outlook (USD Billion, 2019-2035)

INDIA Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

INDIA Email Market by Deployment Type

Cloud-Based

On-Premises

INDIA Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

INDIA Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

JAPAN Outlook (USD Billion, 2019-2035)

JAPAN Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

JAPAN Email Market by Deployment Type

Cloud-Based

On-Premises

JAPAN Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

JAPAN Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

SOUTH KOREA Outlook (USD Billion, 2019-2035)

SOUTH KOREA Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

SOUTH KOREA Email Market by Deployment Type

Cloud-Based

On-Premises

SOUTH KOREA Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

SOUTH KOREA Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

MALAYSIA Outlook (USD Billion, 2019-2035)

MALAYSIA Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

MALAYSIA Email Market by Deployment Type

Cloud-Based

On-Premises

MALAYSIA Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

MALAYSIA Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

THAILAND Outlook (USD Billion, 2019-2035)

THAILAND Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

THAILAND Email Market by Deployment Type

Cloud-Based

On-Premises

THAILAND Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

THAILAND Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

INDONESIA Outlook (USD Billion, 2019-2035)

INDONESIA Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

INDONESIA Email Market by Deployment Type

Cloud-Based

On-Premises

INDONESIA Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

INDONESIA Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

REST OF APAC Outlook (USD Billion, 2019-2035)

REST OF APAC Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

REST OF APAC Email Market by Deployment Type

Cloud-Based

On-Premises

REST OF APAC Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

REST OF APAC Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

South America Outlook (USD Billion, 2019-2035)

South America Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

South America Email Market by Deployment Type

Cloud-Based

On-Premises

South America Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

South America Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

South America Email Market by Regional Type

Brazil

Mexico

Argentina

Rest of South America

BRAZIL Outlook (USD Billion, 2019-2035)

BRAZIL Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

BRAZIL Email Market by Deployment Type

Cloud-Based

On-Premises

BRAZIL Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

BRAZIL Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

MEXICO Outlook (USD Billion, 2019-2035)

MEXICO Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

MEXICO Email Market by Deployment Type

Cloud-Based

On-Premises

MEXICO Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

MEXICO Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

ARGENTINA Outlook (USD Billion, 2019-2035)

ARGENTINA Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

ARGENTINA Email Market by Deployment Type

Cloud-Based

On-Premises

ARGENTINA Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

ARGENTINA Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2035)

REST OF SOUTH AMERICA Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

REST OF SOUTH AMERICA Email Market by Deployment Type

Cloud-Based

On-Premises

REST OF SOUTH AMERICA Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

REST OF SOUTH AMERICA Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

MEA Outlook (USD Billion, 2019-2035)

MEA Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

MEA Email Market by Deployment Type

Cloud-Based

On-Premises

MEA Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

MEA Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

MEA Email Market by Regional Type

GCC Countries

South Africa

Rest of MEA

GCC COUNTRIES Outlook (USD Billion, 2019-2035)

GCC COUNTRIES Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

GCC COUNTRIES Email Market by Deployment Type

Cloud-Based

On-Premises

GCC COUNTRIES Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

GCC COUNTRIES Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

SOUTH AFRICA Outlook (USD Billion, 2019-2035)

SOUTH AFRICA Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

SOUTH AFRICA Email Market by Deployment Type

Cloud-Based

On-Premises

SOUTH AFRICA Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

SOUTH AFRICA Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

REST OF MEA Outlook (USD Billion, 2019-2035)

REST OF MEA Email Market by Email Service Type

Transactional Email

Marketing Email

Bulk Email

Automated Email

REST OF MEA Email Market by Deployment Type

Cloud-Based

On-Premises

REST OF MEA Email Market by End User Type

Individuals

Small and Medium Enterprises

Large Enterprises

REST OF MEA Email Market by Industry Verticals Type

Retail

Healthcare

Education

Finance

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment