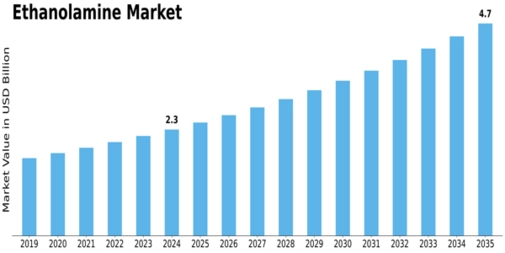

Ethanolamine Size

Ethanolamine Market Growth Projections and Opportunities

Market Factors of Ethanolamine Market:

Industrial Applications: Ethanolamines are widely used in various industrial applications, including chemical intermediates, surfactants, herbicides, and gas treatment agents. The demand for ethanolamines is driven by their versatility and functional properties, making them indispensable in numerous manufacturing processes across different industries.

End-User Industries: The ethanolamine market is closely linked to the performance of end-user industries such as agriculture, pharmaceuticals, personal care, textiles, and construction. For example, in the agriculture sector, ethanolamines are utilized in herbicides and pesticides formulations, while in the pharmaceutical industry, they are used in the synthesis of pharmaceuticals and cosmetics.

Regulatory Compliance: Compliance with regulatory standards and environmental regulations significantly influences the ethanolamine market. Regulations related to product safety, environmental impact, and workplace safety drive manufacturers to develop and adopt sustainable production practices and formulations, shaping market dynamics and product offerings.

Raw Material Availability: The availability and pricing of raw materials such as ethylene oxide and ammonia affect the production costs and profitability of ethanolamines. Fluctuations in raw material prices, supply chain disruptions, and geopolitical factors impact market dynamics, influencing pricing strategies and investment decisions within the industry.

Technological Advancements: Innovations in manufacturing processes and technologies contribute to market growth and product development within the ethanolamine industry. Advanced research and development efforts lead to the development of novel production methods, catalysts, and purification techniques, improving efficiency, quality, and sustainability of ethanolamine production.

Market Competition: The ethanolamine market is characterized by intense competition among key players competing based on factors such as product quality, pricing, brand reputation, and distribution networks. Market players continuously invest in research and development to introduce new and improved ethanolamine formulations, driving market growth and enhancing competitiveness.

Global Economic Conditions: Economic factors such as GDP growth, industrial production, and consumer spending patterns influence the demand for ethanolamines. During periods of economic expansion, increased industrial activities, infrastructure development projects, and consumer spending drive market demand, whereas economic downturns may lead to decreased demand and market volatility.

Emerging Market Opportunities: Growth opportunities in emerging economies present significant prospects for the ethanolamine market. Rapid urbanization, industrialization, and infrastructure development in regions such as Asia-Pacific, Latin America, and the Middle East drive the demand for ethanolamines, fostering market growth and expansion.

Consumer Preferences: Changing consumer preferences and purchasing behavior influence the demand for products containing ethanolamines, such as personal care products and household cleaners. Consumers are increasingly seeking environmentally friendly and sustainable products, driving the demand for ethanolamine-based formulations in various consumer goods.

Environmental Sustainability: Growing awareness of environmental sustainability drives the demand for eco-friendly ethanolamine formulations. Manufacturers are increasingly focusing on developing bio-based, renewable, and low-toxicity ethanolamines to meet sustainability requirements and regulatory standards, influencing market trends and consumer preferences.

Leave a Comment