-

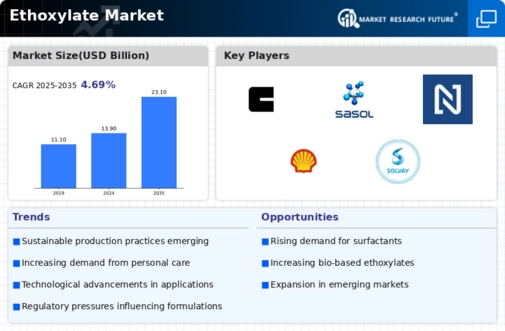

EXECUTIVE SUMMARY

-

MARKET ATTRACTIVENESS

- GLOBAL ETHOXYLATES MARKET, BY TYPE

- GLOBAL ETHOXYLATES

-

ANALYSIS

-

MARKET, BY MOLECULAR WEIGHT

-

GLOBAL ETHOXYLATES MARKET, BY APPLICATION

-

GLOBAL ETHOXYLATES MARKET, BY REGION

-

MARKET INTRODUCTION

-

2.1

-

DEFINITION

-

SCOPE OF THE STUDY

-

RESEARCH OBJECTIVE

-

MARKET

-

STRUCTURE

-

KEY BUYING CRITERIA

-

RESEARCH METHODOLOGY

-

OVERVIEW

-

DATA FLOW

- DATA MINING PROCESS

-

PURCHASED DATABASE:

- SECONDARY RESEARCH DATA FLOW:

-

3.4

-

SECONDARY SOURCES:

-

PRIMARY RESEARCH:

- PRIMARY RESEARCH DATA FLOW:

- PRIMARY RESEARCH: NUMBER OF INTERVIEWS

- PRIMARY RESEARCH: REGIONAL COVERAGE

-

CONDUCTED

-

APPROACHES FOR

- CONSUMPTION & NET TRADE APPROACH

-

MARKET SIZE ESTIMATION:

-

3.6.2

-

REVENUE ANALYSIS APPROACH

-

DATA FORECASTING

- DATA FORECASTING

-

TECHNIQUE

-

DATA MODELING

- MICROECONOMIC FACTOR ANALYSIS:

-

3.8.2

-

DATA MODELING:

-

TEAMS AND ANALYST CONTRIBUTION

-

MARKET DYNAMICS

-

INTRODUCTION

-

DRIVERS

- GROWING DEMAND FOR SURFACTANTS IN

- RISING DEMAND FOR AGROCHEMICALS IN AGRICULTURE

-

PERSONAL CARE PRODUCTS

-

INDUSTRY

-

RESTRAINTS

- STRINGENT ENVIRONMENTAL REGULATIONS ON ETHOXYLATE

- VOLATILITY IN RAW MATERIAL PRICES AFFECTING PRODUCTION

-

PRODUCTION PROCESSES

-

COSTS

-

OPPORTUNITY

- RISING DEMAND FOR BIODEGRADABLE AND ECO-FRIENDLY

- INNOVATION IN LOW-TOXICITY AND SUSTAINABLE ETHOXYLATE FORMULATIONS

-

SURFACTANTS

-

IMPACT ANALYSIS OF COVID - 19

- IMPACT ON SUPPLY

- IMPACT

-

ON DEMAND

-

IMPACT ANALYSIS OF RUSSIA-UKRAINE WAR

-

MARKET FACTOR ANALYSIS

-

SUPPLY/VALUE CHAIN ANALYSIS

- PARTICIPANTS

- VALUE PERCOLATION ACROSS THE CHAIN

- INTEGRATION LEVELS

- KEY ISSUES ADDRESSED (KEY SUCCESS FACTORS)

-

5.1.1.4

-

END-USERS

-

AND CUSTOMIZATION

-

AND CUSTOMER ENGAGEMENT

-

PORTER’S

- THREAT OF NEW ENTRANTS

- BARGAINING POWER

- THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS

- INTENSITY OF RIVALRY

-

FIVE FORCES MODEL

-

OF SUPPLIERS

-

SUPPLY-DEMAND ANALYSIS

-

BROAD LEVEL

- BASED ON TYPE

- BASED

-

GAP ANALYSIS TO UNDERSTAND UNTAPPED AREAS

-

ON APPLICATION

-

TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS

-

REGULATORY

-

FRAMEWORK

-

R&D UPDATE

- CURRENT SCENARIO

- FUTURE

- CHALLENGES

- NOVEL APPLICATIONS

- KEY DEVELOPMENTS

-

ROADMAP

-

CASE STUDIES/USE CASES

- CASE STUDY 1: APPLICATION OF ETHOXYLATES

- CASE STUDY 2: USE OF ETHOXYLATES IN THE

-

IN THE AGROCHEMICAL INDUSTRY

-

TEXTILE INDUSTRY FOR WETTING AND SCOURING

-

PESTEL ANALYSIS

- POLITICAL

- ECONOMIC FACTORS

- SOCIAL FACTORS

- TECHNOLOGICAL

- ENVIRONMENTAL FACTORS

- LEGAL FACTORS

-

FACTORS

-

FACTORS

-

GLOBAL

-

ETHOXYLATES MARKET, BY TYPE

-

INTRODUCTION

-

PHENOXYETHANOL &

-

PHENOXYPROPANOL

-

LAURYL ALCOHOL ETHOXYLATE (1-20 MOLE)

-

TDA ETHOXYLATE

-

(3-12 MOLE)

-

NP ETHOXYLATE (NONYL PHENOL ETHOXYLATE)

-

PEG ALL SERIES

-

TALLOW AMINE ETHOXYLATES

-

STYRENATED PHENOL ETHOXYLATES

-

C-OIL

-

ETHOXYLATES

-

CSA ETHOXYLATES

-

POLYOL (POLYESTER AND POLYETHER)

-

STYRENE BA BINDER

-

TRIMELITIC ANHYDRIDE ETHOXYLATES

-

NONYL

-

PHENOL

-

POLYSORBATES

-

PSEUDOCUMENE ETHOXYLATES

-

CHOLINE

-

CHLORIDE ETHOXYLATES

-

POLYCARBOXYLATE ETHER

-

CETYL ALCOHOL AND

-

STEARYL ALCOHOL ETHOXYLATES

-

OTHERS

-

GLOBAL ETHOXYLATES MARKET, BY

-

MOLECULAR WEIGHT

-

INTRODUCTION

-

1-500

-

500-1000

-

7.4

-

1000-2000

-

2000-4000

-

ABOVE 4000

-

GLOBAL ETHOXYLATES MARKET,

-

BY APPLICATION

-

INTRODUCTION

-

AGROCHEMICALS

-

HOUSEHOLD &

-

PERSONAL CARE

-

PHARMACEUTICALS

-

OILFIELD CHEMICALS

-

INDUSTRIAL

-

& INSTITUTIONAL CLEANING

-

OTHERS

-

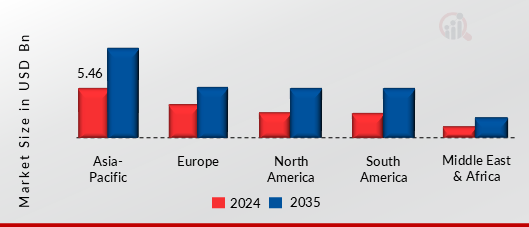

GLOBAL ETHOXYLATES MARKET, BY

-

REGION

-

OVERVIEW

-

NORTH AMERICA

- US

- CANADA

- MEXICO

-

EUROPE

- GERMANY

- FRANCE

- UK

- SPAIN

- ITALY

- REST OF EUROPE

-

ASIA PACIFIC

- CHINA

- INDIA

- JAPAN

- THAILAND

- SOUTH

- REST OF ASIA PACIFIC

-

KOREA

-

SOUTH AMERICA

- BRAZIL

- ARGENTINA

- REST OF SOUTH AMERICA

-

MIDDLE EAST & AFRICA

- SAUDI ARABIA

- UAE

- QATAR

- OMAN

- REST OF MIDDLE EAST & AFRICA

-

9.6.5

-

SOUTH AFRICA

-

COMPETITIVE LANDSCAPE

-

COMPETITIVE OVERVIEW

-

MAJOR PLAYERS IN THE GLOBAL ETHOXYLATES MARKET

-

MAJOR PLAYERS IN TERMS OF MARKET DISRUPTORS & INNOVATORS

-

COMPETITIVE

-

BENCHMARKING

-

STRATEGIES OF MARKET LEADERS IN THE GLOBAL ETHOXYLATES MARKET

- BASF SE

- DOW

- EVONIK INDUSTRIES

- SHELL

- COVESTRO AG

-

LEADING PLAYERS IN TERMS OF THE NUMBER OF DEVELOPMENTS

-

IN GLOBAL ETHOXYLATES MARKET

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

- PRODUCT LAUNCH/PRODUCT DEVELOPMENT

- EXPANSION/ACQUISITION/PARTNERSHIP

-

COMPANY PROFILES

-

COVESTRO AG

- COMPANY OVERVIEW

- PRODUCTS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

11.1.2

-

FINANCIAL OVERVIEW

-

BASF SE

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

11.2.1

-

COMPANY OVERVIEW

-

DOW

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

11.3.3

-

PRODUCTS OFFERED

-

11.3.6

-

KEY STRATEGIES

-

CLARIANT

- COMPANY OVERVIEW

- FINANCIAL

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT

- KEY STRATEGIES

-

OVERVIEW

-

ANALYSIS

-

SASOL

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

HUNTSMAN INTERNATIONAL

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SERVICES

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

LLC

-

OFFERED

-

NOURYON

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

11.7.3

-

PRODUCTS OFFERED

-

11.7.6

-

KEY STRATEGIES

-

SHELL

- COMPANY OVERVIEW

- FINANCIAL

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT

- KEY STRATEGIES

-

OVERVIEW

-

ANALYSIS

-

SOLVAY

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

STEPAN COMPANY

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

11.10.1

-

COMPANY OVERVIEW

-

EVONIK INDUSTRIES

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

\r\n

-

\r\n

-

LIST OF TABLES

-

QFD MODELING FOR MARKET SHARE ASSESSMENT

-

GLOBAL ETHOXYLATES

-

MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

GLOBAL ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (KILO TONS)

-

GLOBAL ETHOXYLATES MARKET, BY MOLECULAR

-

WEIGHT, 2019-2035 (USD BILLION)

-

GLOBAL ETHOXYLATES MARKET, BY MOLECULAR

-

WEIGHT, 2019-2035 (KILO TONS)

-

GLOBAL ETHOXYLATES MARKET, BY APPLICATION,

-

GLOBAL ETHOXYLATES MARKET, BY APPLICATION,

-

GLOBAL ETHOXYLATES MARKET, BY REGION, 2019-2035

-

(USD BILLION)

-

GLOBAL ETHOXYLATES MARKET, BY REGION, 2019-2035 (KILO

-

TONS)

-

NORTH AMERICA ETHOXYLATES MARKET, BY COUNTRY, 2019-2035 (USD

-

BILLION)

-

NORTH AMERICA ETHOXYLATES MARKET, BY COUNTRY, 2019-2035 (KILO

-

TONS)

-

NORTH AMERICA ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

NORTH AMERICA ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

TABLE

-

NORTH AMERICA ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

NORTH AMERICA ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO

-

TONS)

-

NORTH AMERICA ETHOXYLATES MARKET, BY APPLICATION, 2019-2035

-

(USD BILLION)

-

NORTH AMERICA ETHOXYLATES MARKET, BY APPLICATION, 2019-2035

-

(KILO TONS)

-

US ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

US ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

US

-

ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

US

-

ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

US

-

ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

US ETHOXYLATES

-

MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

CANADA ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (USD BILLION)

-

CANADA ETHOXYLATES MARKET, BY TYPE,

-

CANADA ETHOXYLATES MARKET, BY MOLECULAR WEIGHT,

-

CANADA ETHOXYLATES MARKET, BY MOLECULAR WEIGHT,

-

CANADA ETHOXYLATES MARKET, BY APPLICATION, 2019-2035

-

(USD BILLION)

-

CANADA ETHOXYLATES MARKET, BY APPLICATION, 2019-2035

-

(KILO TONS)

-

MEXICO ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

MEXICO ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

TABLE

-

MEXICO ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

TABLE

-

MEXICO ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

TABLE

-

MEXICO ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

TABLE

-

MEXICO ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

TABLE 36

-

EUROPE ETHOXYLATES MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

EUROPE

-

ETHOXYLATES MARKET, BY COUNTRY, 2019-2035 (KILO TONS)

-

EUROPE ETHOXYLATES

-

MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

EUROPE ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (KILO TONS)

-

EUROPE ETHOXYLATES MARKET, BY MOLECULAR

-

WEIGHT, 2019-2035 (USD BILLION)

-

EUROPE ETHOXYLATES MARKET, BY MOLECULAR

-

WEIGHT, 2019-2035 (KILO TONS)

-

EUROPE ETHOXYLATES MARKET, BY APPLICATION,

-

EUROPE ETHOXYLATES MARKET, BY APPLICATION,

-

GERMANY ETHOXYLATES MARKET, BY TYPE, 2019-2035

-

(USD BILLION)

-

GERMANY ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO

-

TONS)

-

GERMANY ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD

-

BILLION)

-

GERMANY ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035

-

(KILO TONS)

-

GERMANY ETHOXYLATES MARKET, BY APPLICATION, 2019-2035

-

(USD BILLION)

-

GERMANY ETHOXYLATES MARKET, BY APPLICATION, 2019-2035

-

(KILO TONS)

-

FRANCE ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

FRANCE ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

TABLE

-

FRANCE ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

TABLE

-

FRANCE ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

TABLE

-

FRANCE ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

TABLE

-

FRANCE ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

TABLE 56

-

UK ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

UK ETHOXYLATES

-

MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

UK ETHOXYLATES MARKET, BY MOLECULAR

-

WEIGHT, 2019-2035 (USD BILLION)

-

UK ETHOXYLATES MARKET, BY MOLECULAR

-

WEIGHT, 2019-2035 (KILO TONS)

-

UK ETHOXYLATES MARKET, BY APPLICATION,

-

UK ETHOXYLATES MARKET, BY APPLICATION, 2019-2035

-

(KILO TONS)

-

SPAIN ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

SPAIN ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

TABLE 64

-

SPAIN ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

TABLE

-

SPAIN ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

TABLE

-

SPAIN ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

TABLE

-

SPAIN ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

TABLE 68

-

ITALY ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

ITALY ETHOXYLATES

-

MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

ITALY ETHOXYLATES MARKET, BY

-

MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

ITALY ETHOXYLATES MARKET,

-

BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

ITALY ETHOXYLATES MARKET,

-

BY APPLICATION, 2019-2035 (USD BILLION)

-

ITALY ETHOXYLATES MARKET,

-

BY APPLICATION, 2019-2035 (KILO TONS)

-

REST OF EUROPE ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (USD BILLION)

-

REST OF EUROPE ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (KILO TONS)

-

REST OF EUROPE ETHOXYLATES MARKET,

-

BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

REST OF EUROPE ETHOXYLATES

-

MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

REST OF EUROPE

-

ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

REST OF

-

EUROPE ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

ASIA

-

PACIFIC ETHOXYLATES MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

ASIA

-

PACIFIC ETHOXYLATES MARKET, BY COUNTRY, 2019-2035 (KILO TONS)

-

ASIA

-

PACIFIC ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

ASIA

-

PACIFIC ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

ASIA PACIFIC

-

ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

ASIA

-

PACIFIC ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

TABLE

-

ASIA PACIFIC ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

TABLE

-

ASIA PACIFIC ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

TABLE

-

CHINA ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

CHINA

-

ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

CHINA ETHOXYLATES

-

MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

CHINA ETHOXYLATES

-

MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

CHINA ETHOXYLATES

-

MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

CHINA ETHOXYLATES

-

MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

INDIA ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (USD BILLION)

-

INDIA ETHOXYLATES MARKET, BY TYPE,

-

INDIA ETHOXYLATES MARKET, BY MOLECULAR WEIGHT,

-

INDIA ETHOXYLATES MARKET, BY MOLECULAR WEIGHT,

-

INDIA ETHOXYLATES MARKET, BY APPLICATION, 2019-2035

-

(USD BILLION)

-

INDIA ETHOXYLATES MARKET, BY APPLICATION, 2019-2035

-

(KILO TONS)

-

JAPAN ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

JAPAN ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

TABLE

-

JAPAN ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

TABLE

-

JAPAN ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

TABLE

-

JAPAN ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

TABLE

-

JAPAN ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

TABLE 106

-

THAILAND ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

THAILAND

-

ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

THAILAND ETHOXYLATES

-

MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

THAILAND ETHOXYLATES

-

MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

THAILAND ETHOXYLATES

-

MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

THAILAND ETHOXYLATES

-

MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

SOUTH KOREA ETHOXYLATES

-

MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

SOUTH KOREA ETHOXYLATES

-

MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

SOUTH KOREA ETHOXYLATES MARKET,

-

BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

SOUTH KOREA ETHOXYLATES

-

MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

SOUTH KOREA ETHOXYLATES

-

MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

SOUTH KOREA ETHOXYLATES

-

MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

REST OF ASIA PACIFIC

-

ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

REST OF ASIA

-

PACIFIC ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

REST OF

-

ASIA PACIFIC ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

REST OF ASIA PACIFIC ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035

-

(KILO TONS)

-

REST OF ASIA PACIFIC ETHOXYLATES MARKET, BY APPLICATION,

-

REST OF ASIA PACIFIC ETHOXYLATES MARKET,

-

BY APPLICATION, 2019-2035 (KILO TONS)

-

SOUTH AMERICA ETHOXYLATES MARKET,

-

BY COUNTRY, 2019-2035 (USD BILLION)

-

SOUTH AMERICA ETHOXYLATES MARKET,

-

BY COUNTRY, 2019-2035 (KILO TONS)

-

SOUTH AMERICA ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (USD BILLION)

-

SOUTH AMERICA ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (KILO TONS)

-

SOUTH AMERICA ETHOXYLATES MARKET,

-

BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

SOUTH AMERICA ETHOXYLATES

-

MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

SOUTH AMERICA

-

ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

SOUTH

-

AMERICA ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

TABLE 132

-

BRAZIL ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

BRAZIL

-

ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

BRAZIL ETHOXYLATES

-

MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

BRAZIL ETHOXYLATES

-

MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

BRAZIL ETHOXYLATES

-

MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

BRAZIL ETHOXYLATES

-

MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

ARGENTINA ETHOXYLATES

-

MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

ARGENTINA ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (KILO TONS)

-

ARGENTINA ETHOXYLATES MARKET, BY MOLECULAR

-

WEIGHT, 2019-2035 (USD BILLION)

-

ARGENTINA ETHOXYLATES MARKET, BY

-

MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

ARGENTINA ETHOXYLATES MARKET,

-

BY APPLICATION, 2019-2035 (USD BILLION)

-

ARGENTINA ETHOXYLATES MARKET,

-

BY APPLICATION, 2019-2035 (KILO TONS)

-

REST OF SOUTH AMERICA ETHOXYLATES

-

MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

REST OF SOUTH AMERICA ETHOXYLATES

-

MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

REST OF SOUTH AMERICA ETHOXYLATES

-

MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

REST OF SOUTH

-

AMERICA ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

TABLE

-

REST OF SOUTH AMERICA ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

REST OF SOUTH AMERICA ETHOXYLATES MARKET, BY APPLICATION, 2019-2035

-

(KILO TONS)

-

MIDDLE EAST & AFRICA ETHOXYLATES MARKET, BY COUNTRY,

-

MIDDLE EAST & AFRICA ETHOXYLATES MARKET,

-

BY COUNTRY, 2019-2035 (KILO TONS)

-

MIDDLE EAST & AFRICA ETHOXYLATES

-

MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

MIDDLE EAST & AFRICA

-

ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

MIDDLE EAST &

-

AFRICA ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

TABLE

-

MIDDLE EAST & AFRICA ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035

-

(KILO TONS)

-

MIDDLE EAST & AFRICA ETHOXYLATES MARKET, BY APPLICATION,

-

MIDDLE EAST & AFRICA ETHOXYLATES MARKET,

-

BY APPLICATION, 2019-2035 (KILO TONS)

-

SAUDI ARABIA ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (USD BILLION)

-

SAUDI ARABIA ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (KILO TONS)

-

SAUDI ARABIA ETHOXYLATES MARKET, BY

-

MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

SAUDI ARABIA ETHOXYLATES

-

MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

SAUDI ARABIA ETHOXYLATES

-

MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

SAUDI ARABIA ETHOXYLATES

-

MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

UAE ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (USD BILLION)

-

UAE ETHOXYLATES MARKET, BY TYPE,

-

UAE ETHOXYLATES MARKET, BY MOLECULAR WEIGHT,

-

UAE ETHOXYLATES MARKET, BY MOLECULAR WEIGHT,

-

UAE ETHOXYLATES MARKET, BY APPLICATION, 2019-2035

-

(USD BILLION)

-

UAE ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (KILO

-

TONS)

-

QATAR ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

QATAR ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

TABLE

-

QATAR ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

TABLE

-

QATAR ETHOXYLATES MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

TABLE

-

QATAR ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

TABLE

-

QATAR ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

TABLE 176

-

OMAN ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

OMAN ETHOXYLATES

-

MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

OMAN ETHOXYLATES MARKET, BY

-

MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

OMAN ETHOXYLATES MARKET,

-

BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

OMAN ETHOXYLATES MARKET,

-

BY APPLICATION, 2019-2035 (USD BILLION)

-

OMAN ETHOXYLATES MARKET,

-

BY APPLICATION, 2019-2035 (KILO TONS)

-

SOUTH AFRICA ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (USD BILLION)

-

SOUTH AFRICA ETHOXYLATES MARKET,

-

BY TYPE, 2019-2035 (KILO TONS)

-

SOUTH AFRICA ETHOXYLATES MARKET, BY

-

MOLECULAR WEIGHT, 2019-2035 (USD BILLION)

-

SOUTH AFRICA ETHOXYLATES

-

MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

SOUTH AFRICA ETHOXYLATES

-

MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

SOUTH AFRICA ETHOXYLATES

-

MARKET, BY APPLICATION, 2019-2035 (KILO TONS)

-

REST OF MIDDLE EAST

-

& AFRICA ETHOXYLATES MARKET, BY TYPE, 2019-2035 (USD BILLION)

-

TABLE 189

-

REST OF MIDDLE EAST & AFRICA ETHOXYLATES MARKET, BY TYPE, 2019-2035 (KILO TONS)

-

REST OF MIDDLE EAST & AFRICA ETHOXYLATES MARKET, BY MOLECULAR WEIGHT,

-

REST OF MIDDLE EAST & AFRICA ETHOXYLATES

-

MARKET, BY MOLECULAR WEIGHT, 2019-2035 (KILO TONS)

-

REST OF MIDDLE

-

EAST & AFRICA ETHOXYLATES MARKET, BY APPLICATION, 2019-2035 (USD BILLION)

-

REST OF MIDDLE EAST & AFRICA ETHOXYLATES MARKET, BY APPLICATION,

-

MAJOR PLAYERS IN TERMS OF MARKET DISRUPTORS

-

& INNOVATORS

-

THE MOST ACTIVE PLAYERS IN THE GLOBAL ETHOXYLATES

-

MARKET

-

PRODUCT LAUNCH/PRODUCT DEVELOPMENT

-

EXPANSION/ACQUISITION/

-

PARTNERSHIP

-

COVESTRO AG: PRODUCTS/SERVICES OFFERED

-

TABLE 199

-

BASF SE: PRODUCTS OFFERED

-

BASF SE: KEY DEVELOPMENTS

-

TABLE 201

-

DOW: PRODUCTS OFFERED

-

CLARIANT: PRODUCTS OFFERED

-

CLARIANT:

-

KEY DEVELOPMENTS

-

SASOL: PRODUCTS OFFERED

-

HUNTSMAN

-

INTERNATIONAL LLC: PRODUCTS/SERVICES OFFERED

-

NOURYON: PRODUCTS OFFERED

-

SHELL: PRODUCTS OFFERED

-

SOLVAY: PRODUCTS OFFERED

-

TABLE

-

STEPAN COMPANY: PRODUCTS OFFERED

-

EVONIK INDUSTRIES: PRODUCTS

-

OFFERED

-

\r\n

-

LIST OF FIGURES

-

MARKET ATTRACTIVENESS

-

ANALYSIS: GLOBAL ETHOXYLATES MARKET

-

GLOBAL ETHOXYLATES MARKET ANALYSIS,

-

BY TYPE, 2024

-

GLOBAL ETHOXYLATES MARKET ANALYSIS, BY MOLECULAR WEIGHT,

-

GLOBAL ETHOXYLATES MARKET ANALYSIS, BY APPLICATION, 2024

-

FIGURE

-

GLOBAL ETHOXYLATES MARKET ANALYSIS, BY REGION, 2024

-

GLOBAL ETHOXYLATES

-

MARKET: STRUCTURE

-

KEY BUYING CRITERIA FOR ETHOXYLATES

-

FIGURE

-

GLOBAL ETHOXYLATES MARKET: MARKET DYNAMICS

-

DRIVER IMPACT ANALYSIS

-

(2019-2035)

-

RESTRAINT IMPACT ANALYSIS (2019-2035)

-

FIGURE 11

-

SUPPLY CHAIN ANALYSIS: GLOBAL ETHOXYLATES MARKET

-

PORTER’S FIVE

-

FORCES MODEL: GLOBAL ETHOXYLATES MARKET

-

GLOBAL ETHOXYLATES MARKET,

-

BY TYPE, 2024 (% SHARE)

-

GLOBAL ETHOXYLATES MARKET, BY MOLECULAR WEIGHT,

-

GLOBAL ETHOXYLATES MARKET, BY APPLICATION, 2024 (%

-

SHARE)

-

GLOBAL MARKET: COMPARATIVE ANALYSIS

-

GLOBAL

-

ETHOXYLATES MARKET, BY REGION, 2024 (% SHARE)

-

NORTH AMERICA MARKET:

-

COMPARATIVE ANALYSIS

-

NORTH AMERICA ETHOXYLATES MARKET, BY COUNTRY,

-

EUROPE MARKET: COMPARATIVE ANALYSIS

-

FIGURE 21

-

EUROPE ETHOXYLATES MARKET, BY COUNTRY, 2024 (% SHARE)

-

ASIA PACIFIC

-

MARKET: COMPARATIVE ANALYSIS

-

ASIA PACIFIC ETHOXYLATES MARKET, BY

-

COUNTRY, 2024 (% SHARE)

-

SOUTH AMERICA MARKET: COMPARATIVE ANALYSIS

-

SOUTH AMERICA ETHOXYLATES MARKET, BY COUNTRY, 2024 (% SHARE)

-

FIGURE

-

MIDDLE EAST & AFRICA MARKET: COMPARATIVE ANALYSIS

-

MIDDLE EAST

-

& AFRICA ETHOXYLATES MARKET, BY COUNTRY, 2024 (% SHARE)

-

MAJOR

-

PLAYERS IN THE GLOBAL ETHOXYLATES MARKET: MARKET SHARE 2024

-

BENCHMARKING

-

OF MAJOR COMPETITORS

-

COVESTRO AG: FINANCIAL OVERVIEW SNAPSHOT

-

COVESTRO AG: SWOT ANALYSIS

-

BASF SE: FINANCIAL OVERVIEW

-

SNAPSHOT

-

BASF SE: SWOT ANALYSIS

-

DOW: FINANCIAL OVERVIEW

-

SNAPSHOT

-

DOW: SWOT ANALYSIS

-

CLARIANT: FINANCIAL OVERVIEW

-

SNAPSHOT

-

CLARIANT: SWOT ANALYSIS

-

SASOL: FINANCIAL

-

OVERVIEW SNAPSHOT

-

SASOL: SWOT ANALYSIS

-

HUNTSMAN INTERNATIONAL

-

LLC: SWOT ANALYSIS

-

NOURYON: SWOT ANALYSIS

-

SHELL: FINANCIAL

-

OVERVIEW SNAPSHOT

-

SHELL: SWOT ANALYSIS

-

SOLVAY: FINANCIAL

-

OVERVIEW SNAPSHOT

-

SOLVAY: SWOT ANALYSIS

-

STEPAN COMPANY:

-

FINANCIAL OVERVIEW SNAPSHOT

-

STEPAN COMPANY: SWOT ANALYSIS

-

FIGURE

-

EVONIK INDUSTRIES: FINANCIAL OVERVIEW SNAPSHOT

-

EVONIK INDUSTRIES:

-

SWOT ANALYSIS

-

\r\n

Leave a Comment