-

Prologue

-

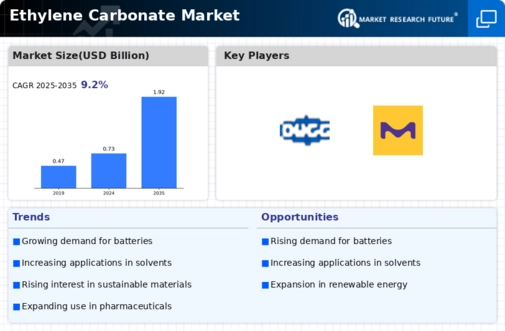

Market Introduction

-

Definition 20

-

Scope

-

Of The Study 20

-

Market Structure 20

-

Market Insights

-

4

-

Research Methodology

-

Research Process 24

-

Primary Research 25

-

Secondary Research 26

-

Market Size Estimation 26

-

Forecast

-

Model 27

-

List Of Assumptions 28

-

Market Dynamics

-

Market Dynamics

-

29

-

Introduction 29

-

Drivers 30

- Use Of Ethylene Carbonate

- Growing Adoption Of Ethylene

-

As An Electrolyte In Lithium-Ion Batteries 30

-

Carbonate In The Gas Separation Process In The Oil & Gas Industry 31

-

5.2.3

-

Increasing Demand For Ethylene Carbonate In The Production Of Vinylene Carbonate

-

And Surface Coatings 33

-

Restraints 34

- Volatile Raw Material

-

Prices 34

-

Opportunity 35

- Introduction Of Lithium-Sulfur Batteries

-

35

-

Trend 36

- Growing Adoption Of Ethylene Carbonate-Modified

-

Dispersants As Additives In Engine Oil 36

-

Challenge 36

- Extensive

-

Research On New Battery Technologies 36

-

Market Factor Analysis

-

Supply

- Raw Materials 38

- Ethylene Carbonate Producers

- Distribution Channel 39

- End-Use Industries 39

- Threat Of New Entrants 40

- Threat Of Substitutes 41

- Bargaining Power

- Bargaining Power Of Buyers 41

-

Chain Analysis 38

-

39

-

6.2

-

Porter’s Five Forces Analysis 40

-

6.2.2

-

Threat Of Rivalry 40

-

Of Suppliers 41

-

Pricing Analysis

-

(2016–2018) 41

-

Global Ethylene Carbonate Market, By Form

-

Introduction

-

43

-

Solid 44

-

Liquid 45

-

Global Ethylene Carbonate Market,

-

By Application

-

Introduction 47

-

Lithium Battery Electrolytes 49

-

Lubricants 50

-

Plasticizers 51

-

Surface Coatings 52

-

8.6

-

Chemical Intermediates 53

-

Fiber Processing Agents 54

-

Dyes 55

-

Others 56

-

Global Ethylene Carbonate Market, By End-Use Industry

-

Introduction 58

-

Automotive 60

-

Oil & Gas 61

-

9.4

-

Textile 63

-

Chemical 64

-

Medical 65

-

Personal Care &

-

Hygiene 66

-

Agriculture 67

-

Others 68

-

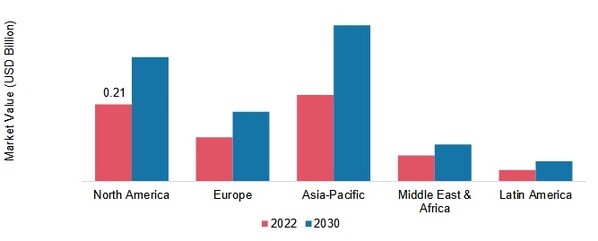

Global Ethylene Carbonate

-

Market, By Region

-

Introduction 69

-

North America 74

- Canada 80

-

10.2.1

-

US 77

-

Europe 83

- Germany 87

- UK 92

- Italy 95

- Russia 98

- The Netherlands 103

- Belgium 106

- Poland

- Rest Of Europe 111

-

10.3.2

-

France 89

-

10.3.6

-

Spain 100

-

109

-

Asia-Pacific 115

- China

- Japan 121

- India 124

- South Korea 127

- Malaysia 132

- Indonesia 135

- Rest Of Asia-Pacific 138

-

118

-

10.4.5

-

Australia And New Zealand 129

-

Latin America 141

- Mexico

- Brazil 147

- Argentina 150

- Rest Of Latin America

-

144

-

152

-

Middle East & Africa 156

- Turkey 159

- UAE

- Saudi Arabia 165

- Israel 168

- Egypt 170

- Rest Of MIDDLE EAST & AFRICA 173

-

162

-

Competitive Landscape

-

11.1

-

Introduction 177

-

Market Strategy Analysis 177

-

Company Profiles

-

BASF SE_x005F_x000B_ 178

- Company Overview 178

- Financial

- Products Offered 179

- Key Developments 179

- SWOT Analysis 179

- Key Strategies 179

-

Overview 178

-

Huntsman International

- Company Overview 180

- Financial Overview

- Products Offered 180

- Key Developments 181

- Key Strategies 181

-

LLC_x005F_x000B_ 180

-

180

-

12.2.5

-

SWOT Analysis 181

-

Mitsubishi Chemical Corporation_x005F_x000B_

- Company Overview 182

- Financial Overview 182

- Key Developments 183

- SWOT Analysis

- Key Strategies 183

-

182

-

12.3.3

-

Products Offered 183

-

183

-

OUCC_x005F_x000B_ 184

- Company

- Financial Overview 184

- Products Offered 185

- Key Developments 185

- SWOT Analysis 185

- Key Strategies

-

Overview 184

-

185

-

Merck KGaA_x005F_x000B_ 186

- Company Overview 186

- Products Offered 187

- Key Developments

- SWOT Analysis 187

- Key Strategies 187

-

12.5.2

-

Financial Overview 186

-

187

-

New Japan

- Company Overview 188

- Products Offered 189

- Key Developments

- SWOT Analysis 189

- Key Strategies 189

-

Chemical Co., Ltd_x005F_x000B_ 188

-

12.6.2

-

Financial Overview 188

-

189

-

TOAGOSEI

- Company Overview 190

- Financial

- Products Offered 190

- Key Developments 191

- SWOT Analysis 191

- Key Strategies 191

-

CO., LTD._x005F_x000B_ 190

-

Overview 190

-

Shandong Senjie

- Company Overview 192

- Products Offered 192

- Key Developments

- SWOT Analysis 192

- Key Strategies 192

-

Cleantech Co., Ltd. _x005F_x000B_ 192

-

12.8.2

-

Financial Overview 192

-

192

-

PANAX

- Company Overview 193

- Products Offered 193

- Key Developments

- SWOT Analysis 193

- Key Strategies 193

-

ETEC_x005F_x000B__x005F_x000B_ 193

-

12.9.2

-

Financial Overview 193

-

193

-

Zibo

- Company Overview 194

- Financial

- Products Offered 194

- Key Developments 194

- SWOT Analysis 194

- Key Strategies 194

-

Donghai Industries Co., Ltd 194

-

Overview 194

-

Tokyo Chemical

- Company Overview 195

- Financial Overview 195

- Products Offered 195

- SWOT Analysis 195

- Key Strategies

-

Industry Co., Ltd _x005F_x000B__x005F_x000B_ 195

-

12.11.4

-

Key Developments 195

-

195

-

Conclusion

-

Key Findings 196

-

Industry Trends 196

-

List Of Tables

-

MARKET SYNOPSIS 19

-

LIST OF ASSUMPTIONS

-

28

-

GLOBAL ETHYLENE CARBONATE MARKET PRICING (USD/TON) (2025-2034) 42

-

GLOBAL ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND) 43

-

GLOBAL ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 44

-

TABLE

-

SOLID: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (USD THOUSAND) 45

-

SOLID: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (TONS) 45

-

LIQUID: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (USD THOUSAND)

-

46

-

LIQUID: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (TONS)

-

46

-

GLOBAL ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD

-

THOUSAND) 48

-

GLOBAL ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034

-

(TONS) 49

-

LITHIUM BATTERY ELECTROLYTES: GLOBAL ETHYLENE CARBONATE

-

MARKET, BY REGION, 2025-2034 (USD THOUSAND) 49

-

LITHIUM BATTERY ELECTROLYTES:

-

GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (TONS) 50

-

LUBRICANTS:

-

GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (USD THOUSAND) 50

-

TABLE

-

LUBRICANTS: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (TONS) 51

-

PLASTICIZERS: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034

-

(USD THOUSAND) 51

-

PLASTICIZERS: GLOBAL ETHYLENE CARBONATE MARKET,

-

BY REGION, 2025-2034 (TONS) 52

-

SURFACE COATINGS: GLOBAL ETHYLENE CARBONATE

-

MARKET, BY REGION, 2025-2034 (USD THOUSAND) 52

-

SURFACE COATINGS: GLOBAL

-

ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (TONS) 53

-

CHEMICAL

-

INTERMEDIATES: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (USD THOUSAND)

-

53

-

CHEMICAL INTERMEDIATES: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION,

-

FIBER PROCESSING AGENTS: GLOBAL ETHYLENE CARBONATE

-

MARKET, BY REGION, 2025-2034 (USD THOUSAND) 54

-

FIBER PROCESSING AGENTS:

-

GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (TONS) 55

-

DYES:

-

GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (USD THOUSAND) 55

-

TABLE

-

DYES: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (TONS) 56

-

TABLE

-

OTHERS: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (USD THOUSAND)

-

56

-

OTHERS: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034

-

(TONS) 57

-

GLOBAL ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034

-

(USD THOUSAND) 59

-

GLOBAL ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY,

-

AUTOMOTIVE: GLOBAL ETHYLENE CARBONATE MARKET,

-

BY REGION, 2025-2034 (USD THOUSAND) 61

-

AUTOMOTIVE: GLOBAL ETHYLENE

-

CARBONATE MARKET, BY REGION, 2025-2034 (TONS) 61

-

OIL & GAS: GLOBAL

-

ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (USD THOUSAND) 62

-

TABLE 33

-

OIL & GAS: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (TONS) 62

-

TEXTILE: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (USD

-

THOUSAND) 63

-

TEXTILE: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION,

-

CHEMICAL: GLOBAL ETHYLENE CARBONATE MARKET, BY

-

REGION, 2025-2034 (USD THOUSAND) 64

-

CHEMICAL: GLOBAL ETHYLENE CARBONATE

-

MARKET, BY REGION, 2025-2034 (TONS) 64

-

MEDICAL: GLOBAL ETHYLENE CARBONATE

-

MARKET, BY REGION, 2025-2034 (USD THOUSAND) 65

-

MEDICAL: GLOBAL ETHYLENE

-

CARBONATE MARKET, BY REGION, 2025-2034 (TONS) 65

-

PERSONAL CARE &

-

HYGIENE: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (USD THOUSAND) 66

-

PERSONAL CARE & HYGIENE: GLOBAL ETHYLENE CARBONATE MARKET, BY REGION,

-

AGRICULTURE: GLOBAL ETHYLENE CARBONATE MARKET,

-

BY REGION, 2025-2034 (USD THOUSAND) 67

-

AGRICULTURE: GLOBAL ETHYLENE

-

CARBONATE MARKET, BY REGION, 2025-2034 (TONS) 67

-

OTHERS: GLOBAL ETHYLENE

-

CARBONATE MARKET, BY REGION, 2025-2034 (USD THOUSAND) 68

-

OTHERS: GLOBAL

-

ETHYLENE CARBONATE MARKET, BY REGION, 2025-2034 (TONS) 68

-

GLOBAL ETHYLENE

-

CARBONATE MARKET, BY REGION, 2025-2034 (USD THOUSAND) 70

-

GLOBAL ETHYLENE

-

CARBONATE MARKET, BY REGION, 2025-2034 (TONS) 71

-

GLOBAL ETHYLENE CARBONATE

-

MARKET, BY FORM, 2025-2034 (USD THOUSAND) 71

-

GLOBAL ETHYLENE CARBONATE

-

MARKET, BY FORM, 2025-2034 (TONS) 71

-

GLOBAL ETHYLENE CARBONATE MARKET,

-

BY APPLICATION, 2025-2034 (USD THOUSAND) 72

-

GLOBAL ETHYLENE CARBONATE

-

MARKET, BY APPLICATION, 2025-2034 (TONS) 72

-

GLOBAL ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 73

-

GLOBAL ETHYLENE

-

CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 73

-

NORTH AMERICA:

-

ETHYLENE CARBONATE MARKET, BY COUNTRY, 2025-2034 (USD THOUSAND) 74

-

TABLE 55

-

NORTH AMERICA: ETHYLENE CARBONATE MARKET, BY COUNTRY, 2025-2034 (TONS) 74

-

TABLE

-

NORTH AMERICA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND) 74

-

NORTH AMERICA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 75

-

NORTH AMERICA: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD

-

THOUSAND) 75

-

NORTH AMERICA: ETHYLENE CARBONATE MARKET, BY APPLICATION,

-

NORTH AMERICA: ETHYLENE CARBONATE MARKET, BY END-USE

-

INDUSTRY, 2025-2034 (USD THOUSAND) 76

-

NORTH AMERICA: ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 77

-

US: ETHYLENE CARBONATE

-

MARKET, BY FORM, 2025-2034 (USD THOUSAND) 77

-

US: ETHYLENE CARBONATE

-

MARKET, BY FORM, 2025-2034 (TONS) 78

-

US: ETHYLENE CARBONATE MARKET,

-

BY APPLICATION, 2025-2034 (USD THOUSAND) 78

-

US: ETHYLENE CARBONATE

-

MARKET, BY APPLICATION, 2025-2034 (TONS) 79

-

US: ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 79

-

US: ETHYLENE

-

CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 80

-

CANADA:

-

ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND) 80

-

CANADA:

-

ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 80

-

CANADA: ETHYLENE

-

CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 81

-

CANADA:

-

ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 81

-

CANADA:

-

ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 82

-

TABLE

-

CANADA: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 82

-

EUROPE: ETHYLENE CARBONATE MARKET, BY COUNTRY, 2025-2034 (USD THOUSAND)

-

83

-

EUROPE: ETHYLENE CARBONATE MARKET, BY COUNTRY, 2025-2034 (TONS)

-

83

-

EUROPE: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND)

-

84

-

EUROPE: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 84

-

EUROPE: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND)

-

85

-

EUROPE: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS)

-

85

-

EUROPE: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034

-

(USD THOUSAND) 86

-

EUROPE: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY,

-

GERMANY: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034

-

(USD THOUSAND) 87

-

GERMANY: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034

-

(TONS) 87

-

GERMANY: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034

-

(USD THOUSAND) 87

-

GERMANY: ETHYLENE CARBONATE MARKET, BY APPLICATION,

-

GERMANY: ETHYLENE CARBONATE MARKET, BY END-USE

-

INDUSTRY, 2025-2034 (USD THOUSAND) 88

-

GERMANY: ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 89

-

FRANCE: ETHYLENE

-

CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND) 89

-

FRANCE: ETHYLENE

-

CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 90

-

FRANCE: ETHYLENE CARBONATE

-

MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 90

-

FRANCE: ETHYLENE

-

CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 91

-

FRANCE: ETHYLENE

-

CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 91

-

TABLE 93

-

FRANCE: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 92

-

TABLE

-

UK: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND) 92

-

TABLE

-

UK: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 92

-

UK:

-

ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 93

-

TABLE

-

UK: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 93

-

TABLE

-

UK: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND)

-

94

-

UK: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS)

-

94

-

ITALY: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND)

-

95

-

ITALY: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 95

-

ITALY: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND)

-

96

-

ITALY: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS)

-

96

-

ITALY: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034

-

(USD THOUSAND) 97

-

ITALY: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY,

-

RUSSIA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034

-

(USD THOUSAND) 98

-

RUSSIA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034

-

(TONS) 98

-

RUSSIA: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034

-

(USD THOUSAND) 98

-

RUSSIA: ETHYLENE CARBONATE MARKET, BY APPLICATION,

-

RUSSIA: ETHYLENE CARBONATE MARKET, BY END-USE

-

INDUSTRY, 2025-2034 (USD THOUSAND) 99

-

RUSSIA: ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 100

-

SPAIN: ETHYLENE

-

CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND) 100

-

SPAIN: ETHYLENE

-

CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 101

-

SPAIN: ETHYLENE CARBONATE

-

MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 101

-

SPAIN: ETHYLENE

-

CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 102

-

SPAIN: ETHYLENE

-

CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 102

-

TABLE 117

-

SPAIN: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 103

-

TABLE

-

THE NETHERLANDS: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND)

-

103

-

THE NETHERLANDS: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034

-

(TONS) 103

-

THE NETHERLANDS: ETHYLENE CARBONATE MARKET, BY APPLICATION,

-

THE NETHERLANDS: ETHYLENE CARBONATE

-

MARKET, BY APPLICATION, 2025-2034 (TONS) 104

-

THE NETHERLANDS: ETHYLENE

-

CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 105

-

TABLE 123

-

THE NETHERLANDS: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS)

-

105

-

BELGIUM: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND)

-

106

-

BELGIUM: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS)

-

106

-

BELGIUM: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034

-

(USD THOUSAND) 107

-

BELGIUM: ETHYLENE CARBONATE MARKET, BY APPLICATION,

-

BELGIUM: ETHYLENE CARBONATE MARKET, BY END-USE

-

INDUSTRY, 2025-2034 (USD THOUSAND) 108

-

BELGIUM: ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 108

-

POLAND: ETHYLENE

-

CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND) 109

-

POLAND: ETHYLENE

-

CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 109

-

POLAND: ETHYLENE

-

CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 109

-

POLAND:

-

ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 110

-

POLAND:

-

ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 110

-

POLAND: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS)

-

111

-

REST OF EUROPE: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034

-

(USD THOUSAND) 111

-

REST OF EUROPE: ETHYLENE CARBONATE MARKET, BY

-

FORM, 2025-2034 (TONS) 112

-

REST OF EUROPE: ETHYLENE CARBONATE MARKET,

-

BY APPLICATION, 2025-2034 (USD THOUSAND) 112

-

REST OF EUROPE: ETHYLENE

-

CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 113

-

REST OF EUROPE:

-

ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 113

-

REST OF EUROPE: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034

-

(TONS) 114

-

ASIA-PACIFIC: ETHYLENE CARBONATE MARKET, BY COUNTRY, 2025-2034

-

(USD THOUSAND) 115

-

ASIA-PACIFIC: ETHYLENE CARBONATE MARKET, BY COUNTRY,

-

ASIA-PACIFIC: ETHYLENE CARBONATE MARKET, BY

-

FORM, 2025-2034 (USD THOUSAND) 116

-

ASIA-PACIFIC: ETHYLENE CARBONATE

-

MARKET, BY FORM, 2025-2034 (TONS) 116

-

ASIA-PACIFIC: ETHYLENE CARBONATE

-

MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 116

-

ASIA-PACIFIC:

-

ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 117

-

ASIA-PACIFIC:

-

ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 117

-

ASIA-PACIFIC: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034

-

(TONS) 118

-

CHINA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD

-

THOUSAND) 118

-

CHINA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034

-

(TONS) 119

-

CHINA: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034

-

(USD THOUSAND) 119

-

CHINA: ETHYLENE CARBONATE MARKET, BY APPLICATION,

-

CHINA: ETHYLENE CARBONATE MARKET, BY END-USE

-

INDUSTRY, 2025-2034 (USD THOUSAND) 120

-

CHINA: ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 121

-

JAPAN: ETHYLENE

-

CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND) 121

-

JAPAN: ETHYLENE

-

CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 121

-

JAPAN: ETHYLENE CARBONATE

-

MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 122

-

JAPAN: ETHYLENE

-

CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 122

-

JAPAN: ETHYLENE

-

CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 123

-

TABLE 161

-

JAPAN: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 123

-

TABLE

-

INDIA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND) 124

-

TABLE

-

INDIA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 124

-

TABLE 164

-

INDIA: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 125

-

INDIA: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 125

-

INDIA: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD

-

THOUSAND) 126

-

INDIA: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY,

-

SOUTH KOREA: ETHYLENE CARBONATE MARKET, BY FORM,

-

SOUTH KOREA: ETHYLENE CARBONATE MARKET,

-

BY FORM, 2025-2034 (TONS) 127

-

SOUTH KOREA: ETHYLENE CARBONATE MARKET,

-

BY APPLICATION, 2025-2034 (USD THOUSAND) 127

-

SOUTH KOREA: ETHYLENE

-

CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 128

-

SOUTH KOREA:

-

ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 128

-

SOUTH KOREA: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034

-

(TONS) 129

-

AUSTRALIA AND NEW ZEALAND: ETHYLENE CARBONATE MARKET,

-

BY FORM, 2025-2034 (USD THOUSAND) 129

-

AUSTRALIA AND NEW ZEALAND:

-

ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 130

-

AUSTRALIA

-

AND NEW ZEALAND: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND)

-

130

-

AUSTRALIA AND NEW ZEALAND: ETHYLENE CARBONATE MARKET, BY APPLICATION,

-

AUSTRALIA AND NEW ZEALAND: ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 131

-

AUSTRALIA

-

AND NEW ZEALAND: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS)

-

132

-

MALAYSIA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD

-

THOUSAND) 132

-

MALAYSIA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034

-

(TONS) 132

-

MALAYSIA: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034

-

(USD THOUSAND) 133

-

MALAYSIA: ETHYLENE CARBONATE MARKET, BY APPLICATION,

-

MALAYSIA: ETHYLENE CARBONATE MARKET, BY END-USE

-

INDUSTRY, 2025-2034 (USD THOUSAND) 134

-

MALAYSIA: ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 134

-

INDONESIA: ETHYLENE

-

CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND) 135

-

INDONESIA:

-

ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 135

-

INDONESIA:

-

ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 136

-

TABLE

-

INDONESIA: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 136

-

INDONESIA: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034

-

(USD THOUSAND) 137

-

INDONESIA: ETHYLENE CARBONATE MARKET, BY END-USE

-

INDUSTRY, 2025-2034 (TONS) 137

-

REST OF ASIA-PACIFIC: ETHYLENE CARBONATE

-

MARKET, BY FORM, 2025-2034 (USD THOUSAND) 138

-

REST OF ASIA-PACIFIC:

-

ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 138

-

REST OF

-

ASIA-PACIFIC: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND)

-

138

-

REST OF ASIA-PACIFIC: ETHYLENE CARBONATE MARKET, BY APPLICATION,

-

REST OF ASIA-PACIFIC: ETHYLENE CARBONATE MARKET,

-

BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 139

-

REST OF ASIA-PACIFIC:

-

ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 140

-

TABLE

-

LATIN AMERICA: ETHYLENE CARBONATE MARKET, BY COUNTRY, 2025-2034 (USD THOUSAND)

-

141

-

LATIN AMERICA: ETHYLENE CARBONATE MARKET, BY COUNTRY, 2025-2034

-

(TONS) 141

-

LATIN AMERICA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034

-

(USD THOUSAND) 141

-

LATIN AMERICA: ETHYLENE CARBONATE MARKET, BY FORM,

-

LATIN AMERICA: ETHYLENE CARBONATE MARKET, BY

-

APPLICATION, 2025-2034 (USD THOUSAND) 142

-

LATIN AMERICA: ETHYLENE

-

CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 143

-

LATIN AMERICA:

-

ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 143

-

LATIN AMERICA: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034

-

(TONS) 144

-

MEXICO: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034

-

(USD THOUSAND) 144

-

MEXICO: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034

-

(TONS) 144

-

MEXICO: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034

-

(USD THOUSAND) 145

-

MEXICO: ETHYLENE CARBONATE MARKET, BY APPLICATION,

-

MEXICO: ETHYLENE CARBONATE MARKET, BY END-USE

-

INDUSTRY, 2025-2034 (USD THOUSAND) 146

-

MEXICO: ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 146

-

BRAZIL: ETHYLENE

-

CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND) 147

-

BRAZIL: ETHYLENE

-

CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 147

-

BRAZIL: ETHYLENE

-

CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 148

-

BRAZIL:

-

ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 148

-

BRAZIL:

-

ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 149

-

BRAZIL: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS)

-

149

-

ARGENTINA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD

-

THOUSAND) 150

-

ARGENTINA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034

-

(TONS) 150

-

ARGENTINA: ETHYLENE CARBONATE MARKET, BY APPLICATION,

-

ARGENTINA: ETHYLENE CARBONATE MARKET,

-

BY APPLICATION, 2025-2034 (TONS) 151

-

ARGENTINA: ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 151

-

ARGENTINA:

-

ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 152

-

TABLE

-

REST OF LATIN AMERICA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND)

-

152

-

REST OF LATIN AMERICA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034

-

(TONS) 153

-

REST OF LATIN AMERICA: ETHYLENE CARBONATE MARKET, BY APPLICATION,

-

REST OF LATIN AMERICA: ETHYLENE CARBONATE

-

MARKET, BY APPLICATION, 2025-2034 (TONS) 154

-

REST OF LATIN AMERICA:

-

ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 154

-

REST OF LATIN AMERICA: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY,

-

MIDDLE EAST & AFRICA: ETHYLENE CARBONATE

-

MARKET, BY COUNTRY, 2025-2034 (USD THOUSAND) 156

-

MIDDLE EAST &

-

AFRICA: ETHYLENE CARBONATE MARKET, BY COUNTRY, 2025-2034 (TONS) 156

-

TABLE 232

-

MIDDLE EAST & AFRICA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND)

-

157

-

MIDDLE EAST & AFRICA: ETHYLENE CARBONATE MARKET, BY FORM,

-

MIDDLE EAST & AFRICA: ETHYLENE CARBONATE

-

MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 157

-

MIDDLE EAST

-

& AFRICA: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 158

-

MIDDLE EAST & AFRICA: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY,

-

MIDDLE EAST & AFRICA: ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 159

-

TURKEY: ETHYLENE

-

CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND) 159

-

TURKEY: ETHYLENE

-

CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 160

-

TURKEY: ETHYLENE

-

CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 160

-

TURKEY:

-

ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 161

-

TURKEY:

-

ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 161

-

TURKEY: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS)

-

162

-

UAE: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND)

-

162

-

UAE: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 162

-

UAE: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND)

-

163

-

UAE: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS)

-

163

-

UAE: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034

-

(USD THOUSAND) 164

-

UAE: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY,

-

SAUDI ARABIA: ETHYLENE CARBONATE MARKET, BY

-

FORM, 2025-2034 (USD THOUSAND) 165

-

SAUDI ARABIA: ETHYLENE CARBONATE

-

MARKET, BY FORM, 2025-2034 (TONS) 165

-

SAUDI ARABIA: ETHYLENE CARBONATE

-

MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 166

-

SAUDI ARABIA:

-

ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 166

-

SAUDI

-

ARABIA: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND)

-

167

-

SAUDI ARABIA: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY,

-

ISRAEL: ETHYLENE CARBONATE MARKET, BY FORM,

-

ISRAEL: ETHYLENE CARBONATE MARKET, BY

-

FORM, 2025-2034 (TONS) 168

-

ISRAEL: ETHYLENE CARBONATE MARKET, BY

-

APPLICATION, 2025-2034 (USD THOUSAND) 168

-

ISRAEL: ETHYLENE CARBONATE

-

MARKET, BY APPLICATION, 2025-2034 (TONS) 169

-

ISRAEL: ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (USD THOUSAND) 169

-

ISRAEL:

-

ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 170

-

TABLE

-

EGYPT: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (USD THOUSAND) 170

-

TABLE

-

EGYPT: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 171

-

TABLE 264

-

EGYPT: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (USD THOUSAND) 171

-

EGYPT: ETHYLENE CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 172

-

EGYPT: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD

-

THOUSAND) 172

-

EGYPT: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY,

-

REST OF MIDDLE EAST & AFRICA: ETHYLENE CARBONATE

-

MARKET, BY FORM, 2025-2034 (USD THOUSAND) 173

-

REST OF MIDDLE EAST

-

& AFRICA: ETHYLENE CARBONATE MARKET, BY FORM, 2025-2034 (TONS) 173

-

TABLE

-

REST OF MIDDLE EAST & AFRICA: ETHYLENE CARBONATE MARKET, BY APPLICATION,

-

REST OF MIDDLE EAST & AFRICA: ETHYLENE

-

CARBONATE MARKET, BY APPLICATION, 2025-2034 (TONS) 174

-

REST OF MIDDLE

-

EAST & AFRICA: ETHYLENE CARBONATE MARKET, BY END-USE INDUSTRY, 2025-2034 (USD

-

THOUSAND) 175

-

REST OF MIDDLE EAST & AFRICA: ETHYLENE CARBONATE

-

MARKET, BY END-USE INDUSTRY, 2025-2034 (TONS) 175

-

KEY DEVELOPMENTS

-

OVERVIEW 177

-

-

List Of Figures

-

GLOBAL ETHYLENE CARBONATE

-

MARKET: MARKET STRUCTURE 20

-

NORTH AMERICA MARKET SIZE & MARKET

-

SHARE BY COUNTRY (2025-2034) 21

-

EUROPE MARKET SIZE & MARKET SHARE

-

BY COUNTRY (2025-2034) 21

-

ASIA-PACIFIC & MARKET SHARE BY COUNTRY

-

(2025-2034) 22

-

LATIN AMERICA MARKET SIZE & MARKET SHARE BY COUNTRY

-

(2025-2034) 22

-

MIDDLE EAST & AFRICA MARKET SIZE & MARKET SHARE

-

BY COUNTRY (2025-2034) 23

-

RESEARCH PROCESS OF MRFR 24

-

FIGURE

-

TOP-DOWN & BOTTOM-UP APPROACH 27

-

MARKET DYNAMICS OVERVIEW 29

-

NUMBER OF ELECTRIC CARS IN CIRCULATION (MILLION) 30

-

ELECTRIC

-

CAR MARKET SHARE, 2020 31

-

PLANNED INVESTMENT IN ENERGY SECTOR BY

-

MIDDLE EAST & AFRICA REGION (2025-2034) 32

-

GLOBAL AUTOMOTIVE

-

PRODUCTION (2025-2034) 33

-

DRIVERS IMPACT ANALYSIS 34

-

FIGURE

-

CRUDE OIL PRICE TRENDS FOR PAST 5 YEARS 35

-

RESTRAINTS IMPACT ANALYSIS

-

35

-

FIGURE 1

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Leave a Comment