Market Trends

Key Emerging Trends in the Europe Airline Ancillary Services Market

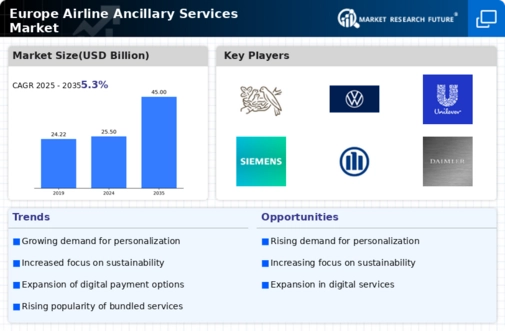

The airline ancillary services market in Europe has been experiencing notable trends and shifts, driven by changing consumer preferences, technological advancements, and evolving airline business models. One prominent trend in this market is the increasing adoption of ancillary services by airlines as a strategy to enhance revenue streams and improve profitability in an increasingly competitive industry. Ancillary services, which encompass a range of optional products and amenities beyond the basic airfare, such as baggage fees, seat selection, onboard meals, and Wi-Fi access, have become a significant source of revenue for airlines. With the pressure to remain competitive and offset operating costs, European airlines are increasingly focusing on optimizing ancillary offerings and leveraging innovative pricing strategies to meet customer demand while maximizing ancillary revenue.

Moreover, technological advancements and digitalization are driving changes in how airlines market and deliver ancillary services to passengers. The widespread adoption of online booking platforms, mobile apps, and self-service kiosks has made it easier for travelers to customize their travel experience and purchase ancillary services at various touchpoints throughout their journey. Airlines are leveraging data analytics and customer insights to personalize ancillary offerings, target specific customer segments, and optimize pricing strategies dynamically. Additionally, partnerships with third-party service providers and digital platforms enable airlines to expand their ancillary product offerings, ranging from hotel accommodations and ground transportation to travel insurance and destination experiences, enhancing the overall customer experience and revenue potential.

Furthermore, the COVID-19 pandemic has reshaped the landscape of airline ancillary services in Europe, leading to changes in traveler behavior, demand patterns, and service offerings. As travel restrictions and health concerns continue to impact passenger confidence and travel demand, airlines have adapted their ancillary strategies to align with evolving customer needs and safety requirements. Enhanced hygiene protocols, flexible booking policies, and travel insurance options have become key ancillary offerings, providing reassurance to travelers and addressing concerns related to travel uncertainty and disruptions. Additionally, contactless payment methods and digital vouchers for ancillary services have gained popularity as airlines prioritize touchless and seamless travel experiences in response to the pandemic.

Moreover, sustainability and environmental consciousness are emerging as important considerations in the airline ancillary services market in Europe. With increasing awareness of the environmental impact of air travel, passengers are seeking eco-friendly options and sustainable travel alternatives, influencing their preferences for ancillary services. Airlines are responding to this trend by offering carbon offset programs, eco-friendly amenities, and sustainable travel products as part of their ancillary offerings. Additionally, initiatives to reduce single-use plastics, minimize food waste, and promote recycling onboard flights are gaining traction, reflecting a broader industry-wide commitment to sustainability and corporate social responsibility.

However, despite the opportunities and advancements in the airline ancillary services market, several challenges remain, including regulatory constraints, competitive pressures, and customer perception issues. Regulatory oversight and consumer protection regulations may limit airlines' ability to implement certain ancillary pricing practices or impose transparency requirements on ancillary fee disclosures. Moreover, intense competition among airlines and online travel agencies can lead to price wars and commoditization of ancillary services, posing challenges for airlines to differentiate their offerings and capture market share effectively. Additionally, negative perceptions of ancillary fees as hidden costs or “nickel-and-diming” tactics by airlines can impact customer satisfaction and brand loyalty, highlighting the importance of transparent pricing practices and clear communication of ancillary value propositions to passengers.

Leave a Comment