Market Trends

Key Emerging Trends in the Europe Ammunition Market

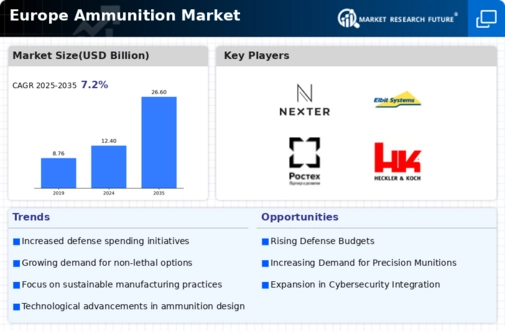

The Europe ammunition market is witnessing notable trends shaped by various factors, including geopolitical dynamics, military modernization efforts, technological advancements, and changing security threats. Ammunition is a critical component of national defense and security strategies, and as such, the market is influenced by evolving military requirements and procurement priorities across European countries. One prominent trend in the market is the emphasis on ammunition modernization and capacity-building initiatives. European nations are investing in the development and acquisition of advanced ammunition systems to enhance their military capabilities, improve operational readiness, and adapt to emerging security challenges.

Moreover, technological advancements are driving market trends in the Europe ammunition sector. Manufacturers are investing in research and development to develop next-generation ammunition solutions that offer improved performance, accuracy, reliability, and lethality. Advanced technologies such as precision-guided munitions, smart ammunition, and enhanced warhead designs are being incorporated into ammunition systems to enhance their effectiveness against a wide range of targets, including armored vehicles, aircraft, and fortified positions. Additionally, advancements in materials science and manufacturing processes enable the production of lighter, more compact, and environmentally friendly ammunition, meeting the evolving needs of modern armed forces.

Furthermore, the demand for ammunition in Europe is influenced by geopolitical dynamics and security threats in the region. With growing tensions and security challenges, European countries are prioritizing defense spending and investing in ammunition stockpiles to ensure deterrence and readiness. Additionally, NATO's emphasis on collective defense and interoperability among member states drives cooperation and collaboration in ammunition procurement and standardization efforts. Furthermore, the proliferation of asymmetric threats, terrorism, and hybrid warfare tactics necessitates versatile and adaptable ammunition solutions that can address a wide range of operational scenarios and threat environments.

Additionally, the Europe ammunition market is experiencing trends related to sustainability and environmental stewardship. As concerns about the environmental impact of conventional ammunition production and disposal grow, there is a growing interest in developing environmentally friendly and lead-free ammunition solutions. Manufacturers are exploring alternative materials, such as composite materials and biodegradable components, to reduce the environmental footprint of ammunition manufacturing and usage. Additionally, efforts to minimize the use of hazardous substances and improve recycling and disposal processes contribute to the development of more sustainable ammunition solutions in the European market.

Moreover, market consolidation and industry partnerships are shaping trends in the Europe ammunition sector. As defense budgets come under pressure and competition intensifies, manufacturers are exploring strategic alliances, mergers, and acquisitions to strengthen their market position, enhance competitiveness, and achieve economies of scale. Additionally, partnerships between defense contractors, government agencies, and research institutions facilitate technology transfer, innovation, and collaboration in ammunition development and production. Furthermore, international cooperation and joint procurement initiatives among European countries contribute to standardization, interoperability, and cost-sharing in ammunition acquisition and logistics.

Leave a Comment