Market Analysis

In-depth Analysis of Europe low carbon hydrogen market Industry Landscape

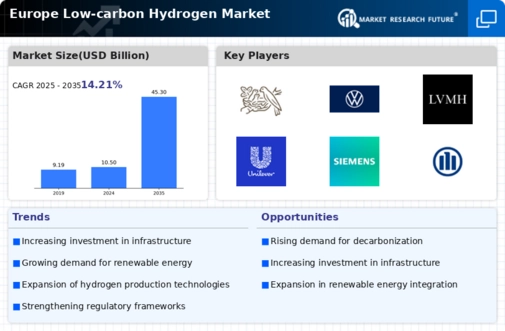

The Europe Low-Carbon Hydrogen Market is influenced by a myriad of market factors that collectively define its dynamics and growth trajectory. At the forefront is the region's commitment to decarbonization and achieving a sustainable energy transition. As part of ambitious climate goals, European countries are actively promoting the production and adoption of low-carbon hydrogen as a clean alternative to conventional hydrogen derived from fossil fuels. This commitment is reinforced by stringent environmental regulations and policy frameworks designed to accelerate the shift towards low-carbon and renewable hydrogen sources, shaping the market landscape.

Economic considerations play a crucial role in the market factors of the Europe Low-Carbon Hydrogen Market. The decreasing costs of renewable energy technologies, coupled with advancements in hydrogen production methods, contribute to the economic viability of low-carbon hydrogen. As the market matures, the competitive pricing of low-carbon hydrogen becomes pivotal in attracting investments, fostering technological innovation, and driving the overall market growth. Economic feasibility is a decisive factor for businesses and industries considering the adoption of low-carbon hydrogen in their operations.

Government policies and regulatory frameworks are instrumental market factors that define the landscape of the Europe Low-Carbon Hydrogen Market. The European Union (EU) and individual member states have established comprehensive hydrogen strategies and roadmaps that include policy instruments such as financial incentives, subsidies, and market mechanisms. These policies are designed to stimulate investment in low-carbon hydrogen projects, incentivize research and development, and create a supportive regulatory environment that fosters the scaling up of low-carbon hydrogen production.

Energy security and independence are critical considerations influencing the adoption of low-carbon hydrogen in Europe. By reducing reliance on imported fossil fuels, particularly natural gas, countries within the region aim to enhance their energy security. The strategic integration of low-carbon hydrogen into the energy mix contributes to a diversified and resilient energy system, aligning with Europe's broader goals of ensuring a secure and self-sufficient energy supply.

Technological advancements and innovation are pivotal market factors shaping the Europe Low-Carbon Hydrogen Market. Ongoing research and development activities focus on improving the efficiency and cost-effectiveness of low-carbon hydrogen production technologies, such as electrolysis powered by renewable energy sources. Innovation also extends to hydrogen storage and transportation methods, influencing market dynamics by enhancing the overall feasibility and competitiveness of low-carbon hydrogen solutions.

Infrastructure development is a key market factor that influences the adoption of low-carbon hydrogen. The successful deployment of low-carbon hydrogen necessitates a robust and interconnected infrastructure, including hydrogen production facilities, storage solutions, and distribution networks. Investments in infrastructure projects contribute to the scalability of low-carbon hydrogen initiatives, shaping market dynamics and supporting the growth of the emerging hydrogen economy.

Public awareness and acceptance are increasingly impactful market factors in the Europe Low-Carbon Hydrogen Market. As awareness of climate change and environmental sustainability grows, there is a heightened demand for cleaner and greener energy solutions. Public support for low-carbon hydrogen projects influences political decisions, regulatory frameworks, and market dynamics, creating a conducive environment for the widespread adoption of low-carbon hydrogen across various sectors.

International collaborations and partnerships are influential market factors in the Europe Low-Carbon Hydrogen Market. European countries actively engage in collaborative efforts with neighboring nations, industry stakeholders, and global organizations to promote the cross-border trade and exchange of low-carbon hydrogen. These collaborations contribute to the development of an integrated and interconnected hydrogen infrastructure, fostering market growth and enhancing the role of low-carbon hydrogen in the broader international energy landscape.

The financial sector and investment trends play a critical role in shaping the Europe Low-Carbon Hydrogen Market. The availability of financing, investments, and favorable lending conditions directly impact the development of low-carbon hydrogen projects. Growing interest from institutional investors and financial institutions in sustainable and green investments contributes to the overall funding landscape, influencing market dynamics and supporting the expansion of low-carbon hydrogen initiatives.

The Europe Low-Carbon Hydrogen Market is defined by a complex interplay of market factors, including environmental commitments, economic considerations, government policies, energy security, technological innovation, infrastructure development, public awareness, international collaborations, and financial trends. As these factors continue to evolve, the market is poised to play a central role in Europe's efforts to achieve a low-carbon and sustainable energy future, contributing to the region's broader climate and energy objectives.

Leave a Comment